Updated July 18, 2023

Difference Between Shareholder Fund vs Net Worth

Shareholders’ fund includes equity share capital, preference share capital, retained earnings, etc., whereas net worth refers to the difference between assets and liabilities i.e. what is left over after paying off all the liabilities, and the word shareholders equity is used only in companies whereas the word Net worth can be used everywhere as it includes individual net worth also. in this topic, we are going to learn about shareholder funds vs net worth.

For example, if the organization has $ 5,000 as equity share capital, $ 2,000 as preference share capital, and $ 1,000 as retained earnings, then shareholders’ equity will be $ 8,000. The assets of Mr. A are $ 5,000, and the liabilities of Mr. A are $ 3500. So, the Networth of Mr. A will be $ 1500.

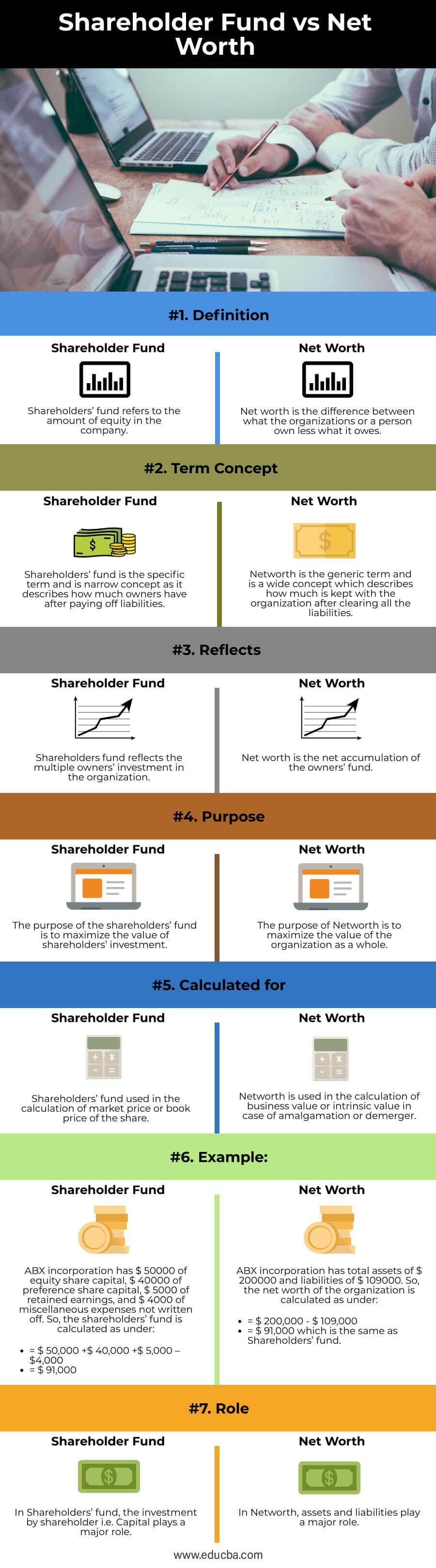

Head To Head Comparison Between Shareholder Fund vs Net Worth (Infographics)

Below are the top 7 differences between Shareholder Fund vs Net Worth:

Key Differences Between Shareholder Fund vs Net Worth

Following are the key differences between Shareholder Fund vs Net Worth:

- Meaning

Shareholders’ fund represents the direct investment by the investors in the organization, whereas net worth represents accumulated income left over after paying off all the liabilities.

- Equation for Calculation: Equation for calculation for shareholders’ funds is

- Equity Share Capital + Preference Share Capital + Retained Earnings – Miscellaneous Expenses Not Written Off

- Whereas, Equation for the calculation of Networth is ( Total Assets – Total Liabilities)

- Purpose: The purpose of the calculation of Shareholders’ funds is to know how much the owners’ invested in the company, whereas the purpose of the calculation of net worth is to determine what the organization or individual has left with after paying off the liabilities.

- Determination: Shareholders’ fund is used to determine the company’s performance over a period of time. If there is an increase in shareholders’ funds, then it indicates consistent profitability and effective management of the company, whereas Networth is used to determine the amount which the organization or individual can re-invest in the business.

- Basis: Shareholders’ fund is based on the amount invested by the shareholders, whereas Networth is based on the amount left over for the investors.

- Importance: Shareholders’ fund is important to calculate to attract investors and to measure the effectiveness of the performance of the organization. The net worth calculation is important to know how much the organization has actually earned from the business.

- Inclusion: When we talk about Shareholders’ funds, it’s always about a group of people i.e. firm or organization, whereas when we talk about net worth, it is about the individual or company.

- Relationship with Market Value: Shareholders’ fund has a direct relationship with the market value of the shares, whereas Networth has a direct relationship with the market value of the organization i.e. business.

- Relationship Between Both: Shareholders’ fund and Networth are directly related i.e. higher the Networth higher the shareholders’ fund and vice versa.

Shareholder Fund vs Net Worth Comparison Table

Let us look at the comparison table of Shareholder funds vs Net Worth.

| Heading | Shareholders’ fund | Networth |

| Definition | Shareholders’ fund refers to the amount of equity in the company. | Net worth is the difference between what the organization or a person owns less what it owes. |

| Term Concept | Shareholders’ fund is the specific term and is a narrow concept as it describes how much owners have after paying off liabilities. | Networth is a generic term and is a wide concept that describes how much is kept with the organization after clearing all the liabilities. |

| Reflects | Shareholders’ fund reflects the multiple owners’ investment in the organization. | Net worth is the net accumulation of the owners’ fund. |

| Purpose | The purpose of the shareholders’ fund is to maximize the value of shareholders’ investments. | The purpose of Networth is to maximize the value of the organization as a whole. |

| Calculated for | Shareholders’ funds are used in the calculation of the market price or book price of the share. | Networth is used in the calculation of business value or intrinsic value in case of amalgamation or demerger. |

| Example | ABX incorporation has $ 50000 of equity share capital, $ 40000 of preference share capital, $ 5000 of retained earnings, and $ 4000 of miscellaneous expenses not written off. So, the shareholders’ fund is calculated as under:

|

ABX incorporation has total assets of $ 200000 and liabilities of $ 109000.

|

| Role | In Shareholders’ funds, the investment by shareholders i.e. Capital, plays a major role. | In Networth, assets and liabilities play a major role. |

Recommended Articles

This is a guide to Shareholder Fund vs Net Worth. Here we also discuss the shareholder fund vs net worth key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –