Updated July 29, 2023

Difference Between Shares vs Debentures

A debenture is a medium to long-term debt instrument for a company, which is used to raise capital from investors at a fixed interest rate. These are mostly repayable on a fixed date.

When the company raises a portion of the capital through the general public in a primary capital market, it becomes its share capital. A share is an indivisible unit of capital, thereby giving ownership to the shareholder and creating an ownership relationship between the company and the shareholder.

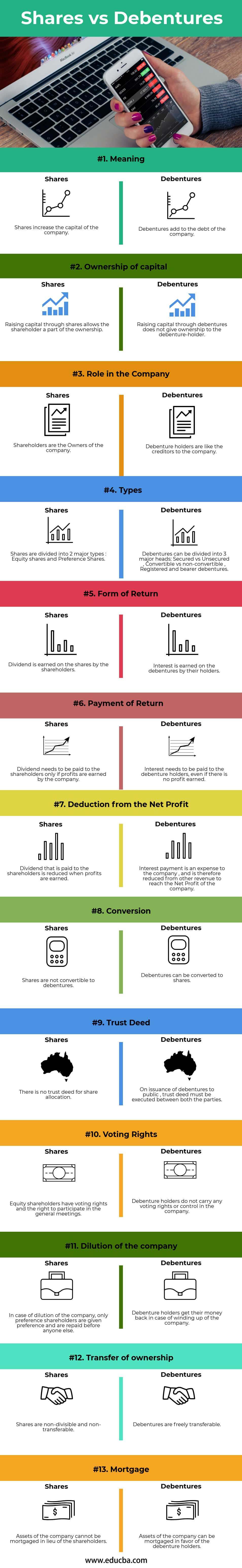

Head To Head Comparison Between Shares vs Debentures (Infographics)

Below is the top 13 difference between Shares vs Debentures:

Key Differences Between Shares vs Debentures

Both Shares vs Debentures are popular choices in the market. Let us discuss some of the major Difference Between Shares vs Debentures:

- The shares are the owned capital of the company, whereas debentures are instruments to raise debt for the company. There is no need to do any backing or underlying asset to raise debentures, but a sheer reputation in the market. Investors would be more interested in how well a company can repay the interest regularly. The company raises the share capital through stocks and shares from the market. Before putting their money into the company shares, investors need to read through their books of accounts, prospective growth areas, and peer comparison and only then invest money in a business.

- The risk involved: Many investors buy debentures of a company as they carry lesser market-driven risk and promise a fixed income regularly in the form of interest payment. On the other hand, shares attract investors who not only foresee the value or growth of the company but are ready to take a risk. Return on shares is, therefore, higher than the interest received on debentures. The interest percentage also remains fixed over the period of time it has been taken for. However, shares can only give you higher profits, subject to market risks.

- A ratio between Debt and Share Capital of the company: In a normal business operation, debt should be capable of covering the Equity. It just signifies that a company has good cash management and debt-handling capacity. It signifies how much of the share capital can be leveraged to raise debt from the market.

- Companies and the government float debentures to raise money for their financial and other long-term requirements. Their interest remains fixed for the period the money is lent. On the other hand, Shares can be issued by a company only if it is a public company, i.e. it is listed on the national stock exchanges of the country. A company can raise money only when there are more buyers in the market for its stock than the sellers.

Shares vs Debentures Comparison Table

Below is the topmost comparison between Shares vs Debentures:

| Basis Of Comparison |

Shares |

Debentures |

| Meaning | Shares increase in the capital of the company. | Debentures add to the debt of the company. |

| Ownership of capital | Raising capital through shares allows the shareholder a part of the ownership. | Raising capital through debentures does not give ownership to the debenture-holder. |

| Role in the Company | Shareholders are the Owners of the company. | Debenture holders are like creditors to the company. |

| Types | Shares are divided into 2 major types: Equity Shares and Preference Shares. | Debentures can be divided into 3 major heads: Secured vs Unsecured, Convertible vs non-convertible, and Registered and bearer debentures. |

| Form of return | Shareholders earn a dividend on the shares. | Interest is earned on the debentures by their holders. |

| Payment of return | Dividends must only be paid to the shareholders if the company earns profits. | The company must pay interest to the debenture holders, even if no profit is earned. |

| Deduction from the Net Profit | The dividend paid to the shareholders is reduced when profits are earned. | The interest payment is an expense to the company and is therefore reduced from other revenue to reach the company’s Net Profit. |

| Conversion | Shares are not convertible to debentures. | Debentures can be converted to shares. |

| Trust Deed | There is no trust deed for share allocation. | Both parties must execute the trust deed to issue debentures to the public. |

| Voting Rights | Equity shareholders have voting rights and the right to participate in general meetings. | Debenture holders do not carry any voting rights or control in the company. |

| Dilution of the company | In the case of dilution of the company, preference shareholders are given preference and are repaid before anyone else. | Debenture holders get their money back in case the company is winding up. |

| Transfer of ownership | Shares are non-divisible and non-transferable. | Debentures are freely transferable, |

| Mortgage | The company cannot mortgage its assets in lieu of the shareholders. | The company can mortgage its assets in favor of the debenture holders. |

Conclusion

Both forms of capital have their own merits and demerits. Investors and stakeholders should do their research well and arrive not just in deciding their own risk appetite but also the financial capacity and growth of the business they want to invest in. Shares vs debentures both form an integral part of a company’s capital. It is worth studying how different types of companies and industries function to increase or reduce the ratio between these depending on their requirements.

Recommended Articles

This has been a guide to the top difference between Shares vs Debentures. Here we also discuss the Shares vs Debentures key differences with infographics, and comparison table. You may also have a look at the following articles to learn more –