Updated July 17, 2023

Difference Between Shares vs Mutual Funds

Companies raise funds from the public in the nature of capital and issue shares to them as a token of their investment. Sometimes these shares are issued only to select individuals who invest their money in the business. The investors of the shares are referred to as shareholders, and the proportion of the shares held by the investors represent their proportionate ownership in the company’s net assets. The shareholders get entitled to many benefits including that of dividends, voting rights, and shares in net assets.

A mutual fund is a professionally managed scheme that collects funds from investors having a common investment objective. The collected investments are then invested in bonds, stocks, and other securities. Such investment schemes are run by an asset management company for which they charge fees. The mutual fund issues units or shares to its investors, representing their ownership in the mutual fund. The fund distributes the returns generated on the fund to its investors based on the type of mutual fund.

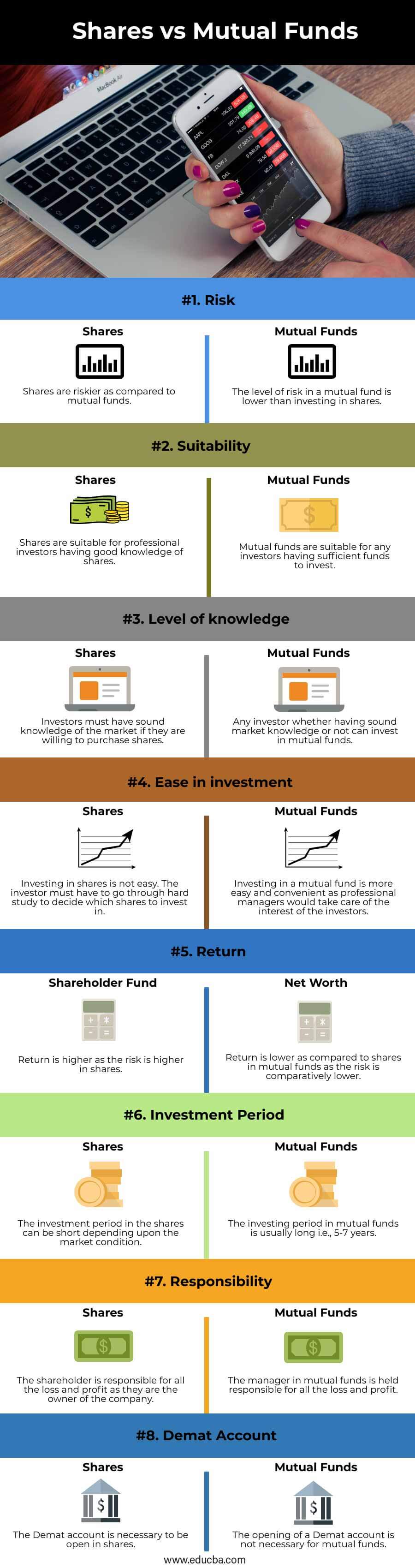

Head To Head Comparison Between Shares vs Mutual Funds (Infographics)

Below are the top 8 differences between Shares vs Mutual Funds:

Key Differences Between Shares vs Mutual Funds

- The investor who purchases the shares becomes the shareholder as well as the owner of the company. The risk factor is high in shares as the profit and loss depend upon the company’s performance.

- In a mutual fund, a professional manager collects funds from the general public and invests them in different stocks, bonds, and securities as a result of which, if any of the asset classes in mutual funds face loss, it would be covered up with the profit of others so there is comparatively lower risk.

- Investing in shares is not easy, as one must do a lot of research on the market and shares; only then the investor shall purchase or sell a share.

- In a mutual fund, an investor can invest without knowing much about the investment world since professional managers will look after the best possible outcomes for their investors.

- The investor willing to invest in the shares must open a Demat account first. Without a Demat account, one cannot purchase shares.

- The Demat account is useful in mutual funds as it lets investors buy mutual funds digitally. Still, opening such an account in mutual funds is unnecessary.

- Investors can purchase the shares by themselves if they know the conditions prevailing in the market. Thus, there is no need to pay the managers or advisors any fees.

- Professional managers in mutual funds work on behalf of the investor in investing the funds in bonds, stock, or other securities for which they charge some fees from the fund, which reduces the returns for the investors.

- The shares can be sold in a short period if there is a profit in selling them according to the condition of the market.

- Mutual funds show growth mainly after a long period, most likely in 5-7 years from the day of purchase.

Shares vs Mutual Funds Budget Comparison Table

Let us look at the comparison table of Shares vs Mutual Funds.

|

Criteria |

Shares |

Mutual funds |

| Risk | Shares are riskier as compared to mutual funds. | A mutual fund’s risk level is lower than investing in shares. |

| Suitability | Shares are suitable for professional investors having good knowledge of shares. | Mutual funds are suitable for any investors having sufficient funds to invest. |

| Level of knowledge | Investors must have sound market knowledge if they are willing to purchase shares. | Any investor, whether having sound market knowledge or not, can invest in mutual funds. |

| Ease in investment | Investing in shares is not easy. The investor must study hard to decide which shares to invest in. | Investing in a mutual fund is more easy and more convenient as professional managers would take care of the interest of the investors. |

| Return | Return is higher as the risk is higher in shares. | Return is lower than shares in mutual funds as the risk is comparatively lower. |

| Investment Period | The investment period in the shares can be short, depending upon the market condition. | The investing period in mutual funds is usually long, i.e., 5-7 years. |

| Responsibility | The shareholder is responsible for all the loss and profit as they own the company. | The manager in mutual funds is held responsible for all the loss and profit. |

| Demat account | The Demat account is necessary to be open in shares. | The opening of a Demat account is not necessary for mutual funds. |

Conclusion

There are several differences between shares and mutual funds. But shares and mutual funds are equally important and have their place in the investment market. None of them should be looked like both of the investment schemes attracts investors according to their nature it holds. High returns in a short time attract risk-loving investors, making shares the preferred pool for investing their funds. In contrast, low risk accompanied by average return attracts pessimists, leading them to prefer mutual funds.

Recommended Articles

This is a guide to Shares vs Mutual Funds. Here we also discuss the shares vs mutual funds key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –