Updated July 13, 2023

Introduction of Short-Term Investments on Balance Sheet

Short-term investments (also known as marketable securities) are ready to encash (i.e., liquid) assets that are invested for a temporary period by an organization to sell the same & realize quick returns in a short span of the next 3-12 months from the date of closing books of accounts (but with original period of investment of 3 to 5 years).

It includes treasury bills, money market securities, savings accounts, certificates of deposits, etc. This topic will teach us about Short Term Investments on Balance Sheet.

Explanation

- Short-term investments are disclosed on the assets side of the balance sheet. These are typically held with the intent to gain quick returns. Hence, these are generally sold within 3-12 months of closing.

- Short-term investments go in hand with the short-term goal of an individual or an organization.

- For individuals, the short-term goals could be starting a new venture, savings for marriage, buying a car or house, child education, or any other personal or professional goal. For organizations, the short-term goals could be maintaining emergency cash, savings excess funds, managing working capital payments, etc.

- Since the goal for returns is short-term, the risk horizon changes accordingly. If the investor is aggressive in returns, he will invest in riskier short-term investments. If the investor wants assured returns, he will go for less-riskier short-term investments.

- Examples of short-term investment include certificates of deposits, money market instruments, savings accounts yielding higher interest rates, treasury bills & many more.

Example of Short-Term Investments on Balance Sheet

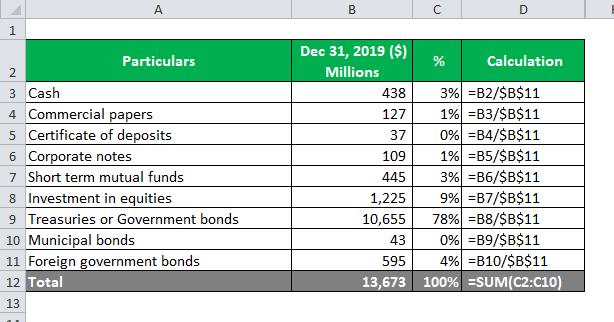

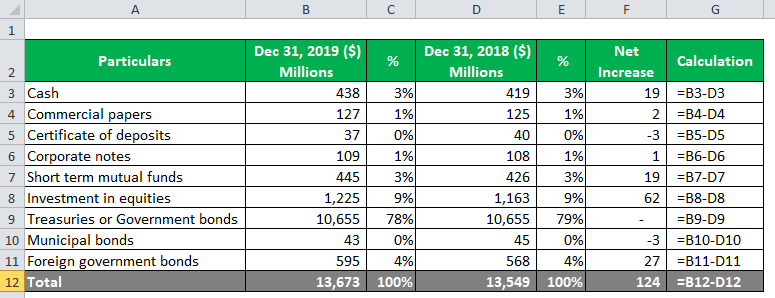

Let’s have a look at the short-term investment schedule of a corporation:

| Particulars | Dec 31, 2019 ($) Millions | % | Dec 31, 2018 ($) Millions | % | Net Increase |

| Cash | 438 | 3% | 419 | 3% | 19 |

| Commercial papers | 127 | 1% | 125 | 1% | 2 |

| Certificate of deposits | 37 | 0% | 40 | 0% | -3 |

| Corporate notes | 109 | 1% | 108 | 1% | 1 |

| Short-term mutual funds | 445 | 3% | 426 | 3% | 19 |

| Investment in equities | 1,225 | 9% | 1,163 | 9% | 62 |

| Treasuries or Government bonds | 10,655 | 78% | 10,655 | 79% | – |

| Municipal bonds | 43 | 0% | 45 | 0% | -3 |

| Foreign government bonds | 595 | 4% | 568 | 4% | 27 |

| Total | 13,673 | 100% | 13,549 | 100% |

Calculation of the short-term investment schedule of a corporation is given below:

for Dec 31, 2019

similarly, on Dec 31, 2019,

Net Increase is calculated as

Explanations: As you can observe, as of December 31, 2018, the organization has increased its short-term investments by $ 124 Million compared to December 31, 2018. However, out of all the investments, the company has its biggest chunk with “Treasuries or Government bonds”, which relates to the domestic government bonds & is 78% of the total investments. This represents that the company’s main objective is not to earn higher profits but to divest the funds for a short-term period of time with lower risks. Therefore, let us carry the explanation for each investment one by one:

- Commercial Papers: These are issued by private corporate bodies for their funding requirements. We cannot invest in equities of private companies as we do for public companies. The rate of interest is higher than domestic government bonds. Also, the risk ratio is lower in the case of short-term commercial papers. Since the back end is a private body, the total percentage of investment is lower.

- Certificate of deposits: These are commonly called CDs or FDs. The backend here is banks of the country that pay a higher interest rate than on the savings bank accounts. The higher interest is linked with a higher amount of funds invested and the periodicity of investment. CDs’ periodicity (i.e., maturity) can range from days to years.

- Corporate notes: Corporate notes are investments incorporation that pays no dividends. The company also earns no interest. The attractive feature is that they get paid according to the company’s growth. As a result, corporate notes rank higher than equity investments.

- Short-term mutual funds: We invest a short amount in a mutual fund. The mutual fund, in turn, invests further in various sectors & earns higher returns. That said, the return is shared between the fund’s investors in the proportion of the units held by each investor. Mutual funds which can be redeemed in the short term are treated as short-term mutual funds. These are normally open-ended funds. This enables easy selling of the units whenever required.

- Investment in equities: Risk & return go hand-in-hand. Higher risk equates with higher returns. Investment in equities is subject to a higher quantum of risk. The company here has invested $ 1225 million into equities. The first return the company gets is a dividend from the company. The second return it gets is capital gains (i.e., selling at a higher price than the purchase price).

- Treasuries or Government bonds: The company has made the biggest investment here, populating $ 10,655 million. This defines the risk appetite of the company. The domestic government issues these. This is the safest investment around the globe. The default risk is minimal here, with a lower amount of return. The various types of treasuries include notes, bills of securities, inflation-protected securities, etc.

- Municipal bonds: These bonds are issued by the municipal or local government & these are non-federal agencies. The return here is higher & there can be tax exemptions in many cases.

- Foreign Government Bonds: The foreign state’s government offers these. The rate of interest depends on the GDP growth of the said country. The risk depends on the state affairs going around within a foreign government’s territory.

Advantages of Short-Term Investments on Balance Sheet

Some of the advantages of short-term investments in the balance sheet are:

- Flexibility is the biggest advantage of short-term investments. The reason is we do not have to wait for the security to mature. The investments are readily saleable & have ready-market for sale. This can be compared with long-term investments, wherein you can get the same encashed a little early with the pinch of lower returns.

- Short-term investments enable making substantial profits in a short period of time.

- The risk & returns go hand-in-hand. Thus, your return perspective depends on the type of risk you are ready to bear. However, short-term investments have lower risk per transaction wise.

- The liquidity is higher since locking up the profits is done in the short term. You can easily reinvest the proceeds into other investments for further gains. This way, the money keeps revolving to generate returns.

- Short-term investments also involve few investments with fewer than 3 years. These little higher periods of short-term investments enable generating higher profits since maturity & returns go hand-in-hand.

- The results of the investment strategy are visible in the short run. This encourages further investments.

Conclusion

Higher the risk, the higher the return. This applies to the short period of investments. This can check with the results appearing in no time. Cash earns zero interest rates since it is kept idle & no one would give you returns unless you let some other utility that cash. Thus, short-term investments are better than keeping the funds idle since something is better than nothing. Even if the short-term investments have returned, it has to bear part of the inflation, risk of default by the third party, and other relevant risks. But everything is compensated by the rate of return.

Recommended Articles

This is a guide to Short-Term Investments on Balance Sheet. Here we also discuss the introduction, examples of short-term investments, and advantages. You may also have a look at the following articles to learn more –