Updated July 17, 2023

Definition of Short Term Loan

Short-term loans can be defined as temporary or short-term unsecured borrowings undertaken to fulfill short-term business, personal or working capital requirements that will be repaid over a period no longer than one year and are usually presented under the current liability section of the balance sheet.

Explanation

A short-term loan is a form of short-term finance that enables the user to gain instant liquidity to meet his short-term business or personal requirements. Short-term loans can be undertaken by financial institutions (FI) like banks and NBFCs. Institution granting loans charges interest and processing fees in the form of consideration against funds granted. These are attractive funding sources for startups and small businesses as they may be unable to avail of long-term loans from banks and FIs. The value of a loan sanctioned is generally low, ranging from $100 to $1,00,000. Short-term loans are beneficial not only for businesses but also for individuals to meet their sudden or temporary financial requirements.

Short-term loans are generally utilized to supplement day-to-day business operations and meet our working capital requirements. For example, to pay suppliers where accounts receivables are yet to be realized. Quantum of the short-term loan availed helps understand and analyze the company’s working capital management efficiency level. A high short-term loan indicates liquidity issues for the entity. If the short-term borrowings are more than the cash and cash equivalents, this might suggest that the company is in poor financial condition and doesn’t have sufficient cash to pay off its obligations.

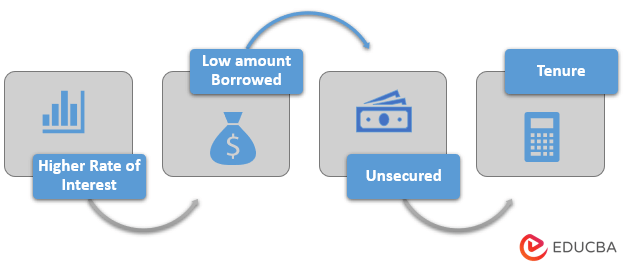

Characteristics of Short Term Loan

- Higher Rate of Interest: These loans are pretty expensive as banks and FIs charge high-interest rates on such loans and advances.

- Low amount Borrowed: The Amount of loan sanctioned in these loans is always lower than other types of loans.

- Unsecured: These loans are generally unsecured, as the borrowing amount and the repayment time are less; therefore, collateral security may not be asked for. However, some banks and FIs may ask for collateral security.

- Tenure: Short-term loans may include one month, a quarter, or a year assignments. The real interest and principal need to be repaid within this time limit.

How to Apply for Short-Term Loan Online

To apply for a short-term loan, one has to follow the following steps –

Step #1 – Register on the platform: To avail of a short-term loan, one must find a suitable credit lending agency and understand its terms and conditions. If it suits the entity’s requirements, then one must register on its portal online.

Step #2 – Fulfil KYC details as per the government requirement: The next step is to submit basic borrower details along with the necessary documents by which KYC can be done, like a passport. The submitted document must mention the borrower’s points, name, address, etc.

Step #3 – Submit the income documents and bank statements for the last six months: To determine the maximum amount that can be granted, banks and FI require a potential borrower to submit income details to determine the person’s repayment capacity. Accordingly, documents like tax returns and bank statements must be uploaded to the portal.

Step #4 – Credit assessment: In the next step, the lending agencies undergo credit assessment by reviewing all the documents uploaded by the borrower.

Step #5 – Sanctioning: Banks sanction loans to eligible clients if a person is found appropriate.

Step# 6 – Disbursement: Disbursement is the next step after sanctioning the loan. At this stage, money gets transferred to the borrower’s bank A/c.

Types and Examples of Short Term Loan

- Line of Credit: Line of credit is a financing term used by a bank or any financial institution which determines the maximum amount of loan or advance that can be granted to a borrower based on his creditworthiness. It is up to the borrower to withdraw the loan amount at once or in installments according to his needs. Charges will incur only on the loan amount withdrawn and not on the sanctioned amount. His credit is refilled with the approved amount when the borrowed amount is repaid. For example, Sam, who has a high credit score, is eligible to have $50,000, whereas Tom, who has a low credit score, will have only $30,000 eligibility.

- Bank Overdraft: It is a line of credit provided by banks to their customers. The bank prefixes the overdraft limit. If, in any case, the borrower’s funds are falling short of covering a payment made, the bank will cover the deficit amount by extending its overdraft facility. For example, when a company has an account balance of $1,000 and writes a cheque of $2000. The account will be overdrawn by $1000 when the cheque is cleared. In this case, the company has an agreement with the bank for an overdraft limit (short-term loan), so due to this facility, the company’s cheque will get cleared; otherwise, it would have been bounced due to the unavailability of sufficient balance.

- Merchant Cash Advances: This funding facility is best applicable for businesses with large credit /debit card transactions instead of cash transactions. In this case, the bank or financial institution agrees to provide the borrower with a lump sum amount in advance. The bank gradually recovers this amount as a percentage of the borrower’s sales. For example, when the borrower makes a sale, a fixed percentage, say the bank, will directly recover 2% from the payment initiator.

- Payday Loans: This is suitable for event-based businesses or individuals under which the amount of loan granted is recovered from the next credited salary or other income as agreed by the lender and borrower.

Short Term Loan Periods

The period of short-term loans may vary depending upon the type of loan granted. Some may fall due by next week, month, quarter, or year. However, there is no hard stone-based time limit of one year. Some banks and FI may even consider loan periods of 2 or 3 years as short-term loans.

Advantages of Short Term Loan

Some of the advantages are:

- Easily Accessible: These are easily available to small businesses and individuals without many complications. These act as lifesavers for small companies that have lower credit scores.

- Instant Approvals: The approval process is quite simple and does not require lengthy processes compared to long-term loans. The risk here is low compared to other risky loans as the duration is short.

- Low-Interest Cost: The repayment period is shorter here; therefore, the interest cost is lower.

- Increases Credit Score: Borrowing such loans and repaying them on time will increase the credit score and creditworthiness of the borrower.

- Unsecured: There is no collateral required to borrow these loans.

Disadvantages of Short Term Loan

Some of the disadvantages are:

- The strain on Small-Time Borrowers: Small business owners may default on debt servicing due to any hike in interest rates or penalties. This will, in turn, also lower their credit score.

- Lower Borrowing Amount: Short-term loans can supplement only small funding requirements, i.e., the number of funds that can be procured using short-term debts is minimal.

- Not Suitable For Long-Term Projects: Taking such loans for long-term projects will not be feasible and can add substantial interest costs, which may prove costly for an entity. These loans may not be adequate to meet any capital expenditure or large-scale fund requirement.

Conclusion

Short-term loans are borrowings undertaken by any business entity or individual to meet their short-term fund requirements. These loans must be repaid within a short period, usually a year. Availing of such loans has its benefits and drawbacks. One of the most crucial advantages is the ease of sanctioning. However, banks and FIs charge higher interest rates on such loans, which might increase the cost of borrowed funds.

Recommended Articles

This is a guide to Short Term Loan. Here we also discuss the definition and how to apply for a short-term loan online with advantages and disadvantages. You may also have a look at the following articles to learn more –