Are Short-Term Investment Plans a Good Choice for You?

In the dynamic financial landscape, short-term mutual funds in India have emerged as a smart investment avenue for those seeking a balance between liquidity, safety, and moderate returns. These funds cater to short investment horizons, making them a popular option for investors who want temporary parking for their funds without locking them in for years.

This guide breaks down the features, benefits, types, and best short-term investment options available as of March 2025.

What Are Short-Term Mutual Funds?

Short-term mutual funds, or duration funds, typically invest in financial instruments with a maturity period ranging from 6 months to 3 years. The portfolio usually includes:

- Money market instruments.

- Certificates of Deposit (CDs).

- Short-term government and corporate bonds.

By focusing on short maturities, these funds reduce interest rate risk and are less volatile than long-term options. Short-term mutual funds in India are ideal for conservative investors who value liquidity and capital preservation over high returns.

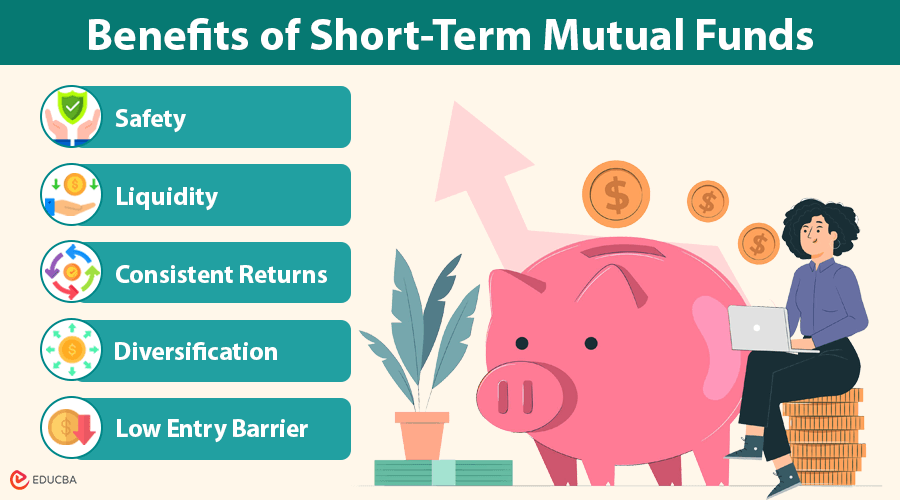

Why Choose Short-Term Mutual Funds in India?

These funds offer a range of benefits tailored to short-term financial needs:

1. Safety

Short-term funds typically invest in high-credit-rated instruments, making them relatively low-risk. They are suitable for those prioritizing capital protection.

2. Liquidity

These funds are easy to redeem, making them more liquid than many traditional fixed-income options. Due to occasional exit loads, they are perfect for short-term needs but not ideal for emergency funds.

3. Consistent Returns

While returns are not sky-high, they tend to be steady and more predictable than equity funds. This makes them ideal for investors seeking low volatility.

4. Diversification

Investments are spread across different instruments, reducing the risk of putting all the money in one asset.

5. Low Entry Barrier

Most short-term mutual funds in India have low minimum investment amounts, making them accessible to retail investors.

How Do Short-Term Mutual Funds Work?

Short-term mutual funds in India aim to provide stable returns while ensuring liquidity. They operate through a well-structured investment strategy focusing on low-risk, short-duration instruments. Here is how they work:

1. Diversified Investment Portfolio

These funds put money into a mix of short-term options like money market securities, certificates of deposit (CDs), and short-term government or corporate bonds. This mix helps lower the risk linked to any one type of investment.

2. Short Maturity Period

The securities in the fund typically mature within 6 months to 3 years. This shorter duration reduces sensitivity to interest rate fluctuations, resulting in lower volatility than long-term funds.

3. Risk Management

By focusing on short-tenure assets, these funds effectively limit interest rate risk. They offer a more stable and predictable investment plan, making them ideal for conservative investors.

4. Stability with Moderate Returns

It strikes a balance between the safety of fixed deposits and the return potential of longer-term investments. They are well-suited for investors with a moderate risk appetite looking for consistent returns.

5. Flexible Portfolio Management

Fund managers actively handle their portfolios and can quickly adjust to changes in monetary policy, especially those made by the Reserve Bank of India (RBI). This adaptability allows them to navigate market shifts and optimize returns.

Types of Short-Term Mutual Funds in India

Different types of funds cater to various investor needs and risk appetites:

1. Liquid Funds

- Invest in easily accessible assets like Treasury Bills and Commercial Papers.

- Very low risk, suitable for extremely short-term goals.

2. Ultra Short-Term Funds

- Slightly longer duration than Liquid Funds.

- Offer better returns with similar risk levels.

3. Money Market Funds

- Invest in short-term loans provided to governments, banks, or companies.

- Prioritize safety and stability.

4. Short-Term Debt Funds

- Invest in corporate bonds and debentures.

- Higher returns than Liquid or Ultra Short-Term Funds with moderate risk.

5. Fixed Maturity Plans (FMPs)

- Closed-ended funds with a fixed maturity period.

- Good for investors with a clear investment horizon who want predictable returns.

Best Short-Term Investment Options – March 2025

Besides short-term mutual funds in India, here are some top short-term investment instruments to consider in 2025:

1. High-Yield Savings Accounts

- FDIC-insured, higher interest than regular savings.

- Perfect for risk-averse investors.

2. Cash Management Accounts

- Offered by brokers or robo-advisors.

- Flexible and offers competitive interest.

3. Money Market Accounts

- Bank products offer slightly better rates than savings accounts.

- Good for easy access with minimal penalties.

4. Short-Term Corporate Bond Funds

- Invest in high-grade corporate bonds.

- Ideal for moderate-risk investors seeking higher returns.

5. U.S. Government Bond Funds (For international investors)

- Invest in government-backed T-bills and T-notes.

- Extremely safe and suitable for global diversification.

6. Money Market Mutual Funds

- Invest in safe, short-term debt.

- Offers a balance between liquidity and return.

7. No-Penalty Certificates of Deposit (CDs)

- Allow early withdrawals without penalties.

- Useful in a rising interest rate environment.

8. Treasury Securities

- Government-backed instruments with varying tenures.

- Virtually risk-free.

Final Thoughts

Short-term mutual funds in India are a powerful tool for investors looking to park funds temporarily, achieve short-term goals, or balance risk in a larger portfolio. With their ability to offer safety, liquidity, and steady returns, these funds are an excellent alternative to traditional savings methods or fixed deposits.

To optimize your short-term finances, consider exploring the variety of short-term mutual funds available in India. These funds cater to all investors—from cautious savers to those looking for higher returns.

Recommended Articles

We hope you found this guide helpful. Explore these recommended articles to learn more about debt mutual funds, low-risk investment strategies, and personal finance planning in India.