Updated July 31, 2023

Difference Between Short Sale vs Foreclosure

The following article provides an outline for Short Sale vs Foreclosure. A short sale is an investment method where an investor sells the borrowed security with the anticipation that the security price may fall and requires to return of an equal number of shares in the future. Whereas the legal authority convicts foreclosure. The lender takes control of a property, expels the homeowner, and sells the home when a homeowner cannot pay the full principal and the interest amount on his or her mortgage as stipulated during the contract.

What is a Short Sale?

A short sale is when the homeowner cannot repay the mortgage amount they owe on it. The lender must agree to sell the property for less than the mortgage amount, and the lender or bank has to bear the loss or short. The lender has to either forgive the difference amount or need to settle down based on mutual consent, where the borrower must pay the whole or part of the difference between the sale price and the original value of the mortgage. No short sale may occur without lender approval. The difference between the mortgage and paid amounts is known as a deficiency. However, it is quite a tedious process and takes a lot of time-consuming and paperwork. Its execution requires so many approvals.

Even Though a short sale impacts less on the credit score than a foreclosure, it negatively marks the credit history. Any property sale credit company considers it “not paid as agreed,” impacting a credit score. Short sales, foreclosures, and deeds-in-lieu of foreclosure negate the person’s credit.

What is Foreclosure?

Foreclosure is a civil lawsuit in which the mortgagee has a right to terminate the mortgagor’s interest in the property through a court order. In this process, the court fixes the deadline for the borrower to pay the debt and the foreclosure expenses and redeem the property.

Foreclosure is quite a tedious and complex process. The lender must have complete and accurate paperwork and other supporting documents that help him claim the title even though homeowners put their best efforts into winning loan modifications and other help to rescue from this situation and stay in their homes. But other factors add more complicacy, such as financial and legal problems, bankruptcy, etc.

There are three types based on which the property lies in the foreclosure process; those are elaborate in the three stages are as follows:

- Pre-Foreclosures

- Foreclosure Stage

- Post- Foreclosure

Major causes of Foreclosure:

- Laid off fired, or quit the job

- Inability to continue working due to medical conditions

- Maintenance issues they can longer afford

- Job transfer to another state

- Squabbles with co-owner, divorce

Excessive debt and mounting bill obligations.

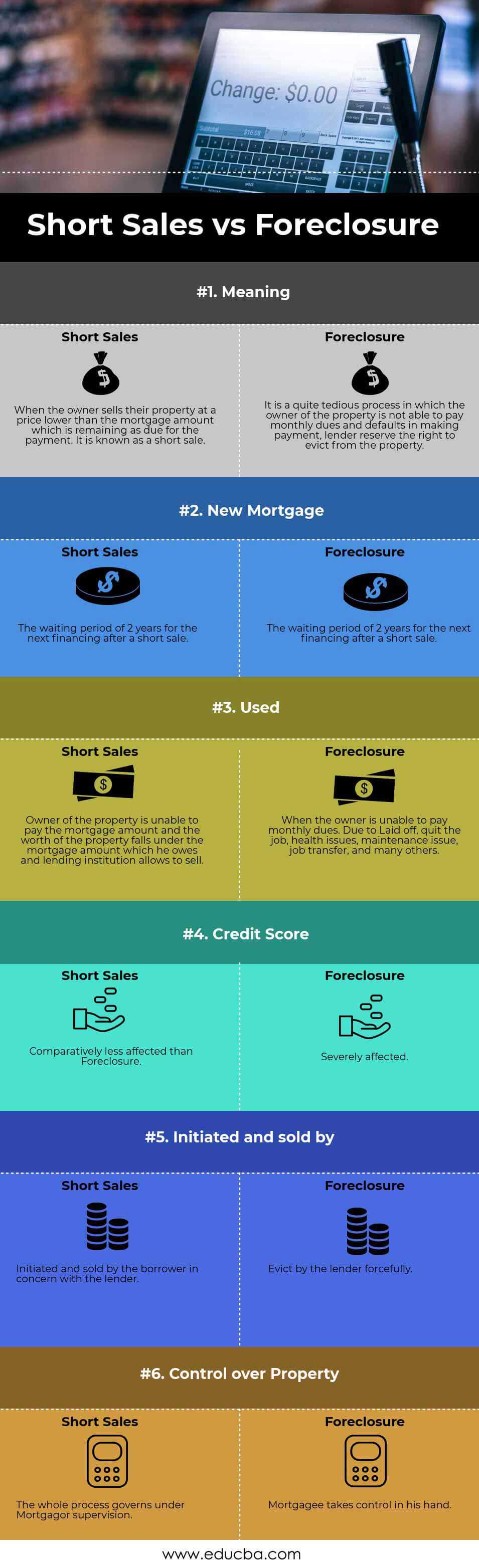

Head To Head Comparison Between Short Sale vs Foreclosure (Infographics)

Below is the top 6 difference between Short Sale vs Foreclosure

Key Differences Between Short Sale vs Foreclosure

The most significant differences between Short Sale vs Foreclosure are given below:

- The lender seizes the property of the borrower when he/she defaults in making monthly payments in foreclosure. In reverse, Short sales are the process in which the owner sells the property for less than the remaining mortgage balance.

- FHA has lenient the conventional mortgage borrowers nationwide; now, they can re-apply for a new loan just two years after the bankruptcy, short sale, or pre-foreclosure.

- Foreclosure happens when an owner cannot pay their monthly payment due to being Laid off, quitting the job, health issues, maintenance issues, job transfer, and many other circumstances. As opposed to the short sale, the owner defaults in payment when the property’s value falls below the value of the mortgage he owes, and the lender allows him/ her for sale.

- The foreclosure severely impacts the credit history of the borrower. While in a short sale, the borrower is comparatively less impacted.

- In the foreclosure process, the lender takes the initiative and sale of the property. While the short sale is initiated by the borrower with the lender’s consent.

The lender takes possession of the mortgaged property in the foreclosure. while in a short sale, the mortgagor has control over it.

Short Sale vs Foreclosure Comparison Table

Let’s look at the top 6 Comparisons between Short Sales vs Foreclosure:

| Basis of Comparison |

Short Sale |

Foreclosure |

| Meaning | When the owner sells their property at a price lower than the mortgage amount remaining due for the payment, it is known as a short sale. | It is a quite tedious process in which the property owner cannot pay monthly dues and defaults in making payments; the lender reserves the right to evict from the property. |

| New Mortgage | The waiting period of 2 years for the next financing after a short sale. | FHA has reduced the mandatory waiting period to make a mortgage application and can reapply for a loan 2 years from bankruptcy, Short sale, or pre-foreclosure. |

| Used | The property owner cannot pay the mortgage amount, and the worth of the property falls under the mortgage amount he owes, and the lending institution allows for selling. | When the owner cannot pay monthly dues due to being Laid off, quitting the job, health issues, maintenance issues, job transfer, and many others. |

| Credit Score | Comparatively less affected than Foreclosure. | Severely affected. |

| Initiated and Sold By | Initiated and sold by the borrower in concern with the lender. | Evict by the lender forcefully. |

| Control Over Property | The whole process governs under Mortgagor’s supervision. | The mortgagee takes control in his hand. |

Conclusion

The most remarkable thing between these processes is that foreclosure is convicted under legal clauses, possibly leading to the forced sale conveyed earlier in the mortgage’s preliminary process. But the short sale is voluntary with the consent of the lender. Each process has its characteristics; neither can we say good or bad. However, the preferable one is better with the short sale, which requires ample time and paperwork but is more convenient for both the lender and owner.

Recommended Articles

This has been a guide to the top difference between Short Sale vs Foreclosure. Here, we discuss the Short Sale vs Foreclosure key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –