Updated August 30, 2023

What is the Simple Interest Formula?

The Simple Interest formula helps you to calculate the extra money you will need to pay back when you borrow money from someone or a bank. We treat this extra money as interest. This formula can also help you calculate the total cost of borrowing or the interest you can earn on an investment.

It can be beneficial when comparing different loan or investment options. For example, you can use the formula to compare the total cost of borrowing between different lenders or the interest earned on other savings accounts. A simple interest formula is a valuable tool for making wise financial decisions.

How to Calculate Simple Interest Formula?

The formula for calculating simple interest is as follows;

Where:

- The Principal is the amount of money you originally borrowed or invested. For example, if you borrow $1,000 from a bank, the principal is $1,000.

- The interest rate is how much money you’ll need to pay back on top of the Principal. We usually express it as a percentage of the Principal. For example, if the interest rate is 5%, you’ll need to pay back an extra 5% of the Principal in interest.

- The time is how long you’ll need to borrow or invest the money. We usually express it in years. For example, if you borrow money for 3 years, the time is 3 years.

By understanding the concepts of simple interest, compound interest, and interest rate, you can accurately calculate the amount of interest you will need to pay back on a loan or the amount of money you will earn on an investment over time.

For example, if you decide to invest $5,000 in a savings account with an annual interest rate of 4%, you can calculate the simple interest you will earn in one year.

Using the formula, we have:

Simple Interest = (Principal x Rate x Time)

= ($5,000 x 4% x 1)

= $200

So, in one year, you will earn a simple interest of $200 on your investment of $5,000.

Simple Interest Formula Example (With Excel Template)

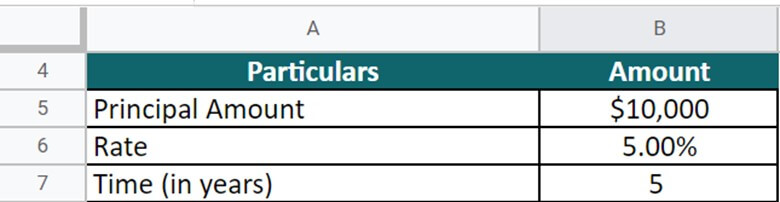

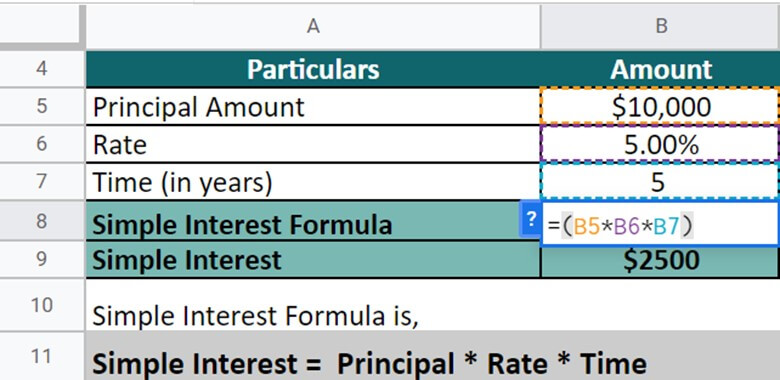

Example #1

In this scenario, Steve has borrowed $10,000 from a bank at an interest rate of 5% annually for five years. We can use the simple interest formula to calculate the total interest that he will need to pay. Additionally, we can determine the outstanding amount due after five years by adding the Principal amount to the total interest accrued.

Given,

Solution:

Implementing the formula, let’s calculate the simple interest for Steve;

Here, Simple Interest = P x R x T

= $10,000 x 5% x 5

= $2,500

Thus, the simple interest that Steve has to pay for five years is $2,500. Also, the amount due after five years is;

=Principal+Simple Interest

=$10,000+$2,500

=$12,500

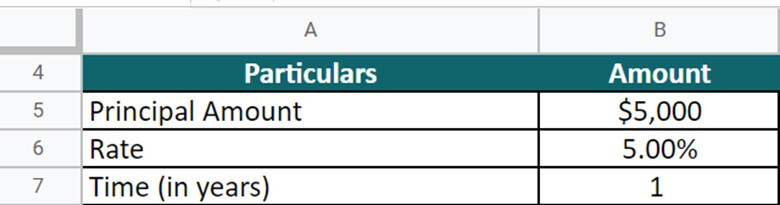

Example #2

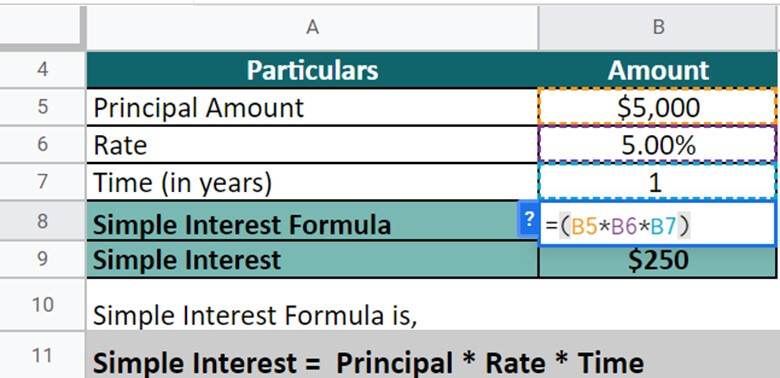

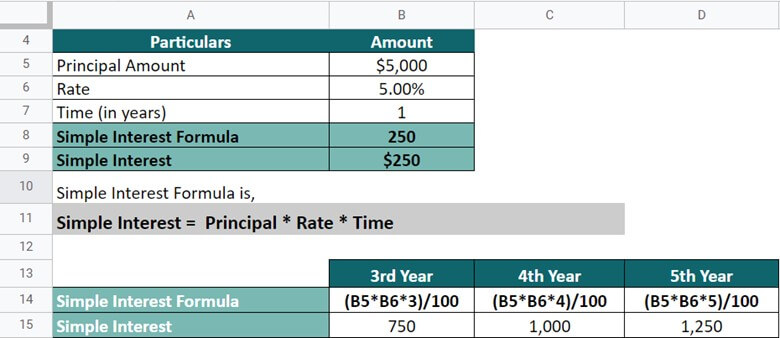

Bigsun Pvt. Ltd. borrowed $5,000 from the bank at an interest rate of 5% to purchase assets. Let’s calculate the simple interest for a tenure of 1 year as well as for 3, 4, and 5 years.

Given,

Solution:

Implementing the formula, let’s calculate the simple interest for Bigsun Pvt. Ltd.

Here, Simple Interest = P x R x T

= $5,000 x 5% x 5

= $250

Thus, the simple Interest that Bigsun Pvt. Ltd. has to pay for one year is $250. Similarly, we will find the simple Interest for 3, 4, and 5 years respectively.

Simple Interest =P x R x T

=>5,000 x 5% x 3=750

=>5,000 x 5% x 4=1,000

=>5,000 x 5% x 5=1,250

Thus, the simple interest for the three years will be 750, 4th year will be 1,000, and 5th year will be 1,250.

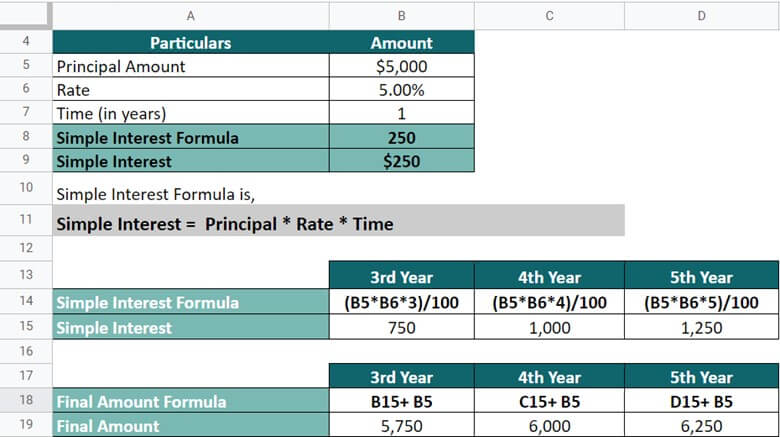

Now, let’s find out the amount that they will return after that tenure;

Final Amount =Principal + Simple Interest

=5,000+750=5,750(After 3rd year)

=5,000+1000=6,000(After 4th year)

=5,000+1,250=6,250(After 5th year)

As a result of the application of compound interest, Bigsun Pvt. Ltd will need to repay $5,750 after three years, $6,000 after the fourth year, and $6,250 after the fifth year.

Example #3

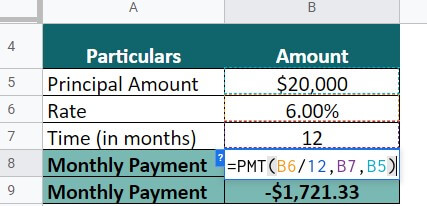

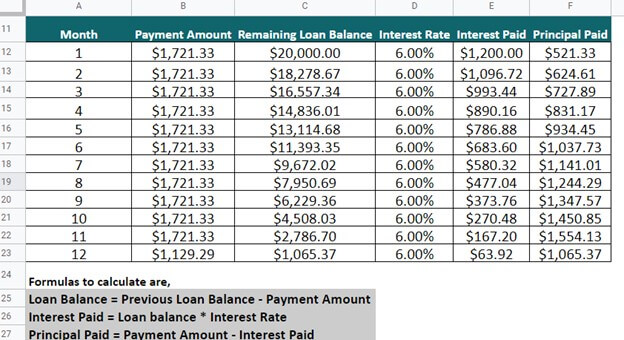

Given that Sam has applied for a home loan of $20,000 with an interest rate of 6% for 12 months, and is required to make monthly installments to repay the loan, we can use the amortization method to calculate the simple interest that Sam will need to pay.

Solution:

Step #1: Calculate the monthly payment amount using Excel’s PMT function,

Monthly payment = PMT (G5/12,12, F5) = -$1,721.33.

Step #2: Create an amortization table,

- First, we calculate the interest paid for the first month,

= $20,000 x 6.00% = $1,200.00

- Next, calculate the principal paid by subtracting the payment amount and interest paid.

= $1,721.33 – $1,200.00 = $521.33

- Follow these steps till the 11th month.

For the 12th month, as the remaining loan balance is less than the monthly payment amount, we calculate the last payment as follows,

Payment for the 12th month = Loan balance + (Loan balance * Interest Rate)

= $1,605.37 + ($1,605.37 * 6%) = $1,605.37 + $63.92

= $1,129.29

Thus, Sam will pay $1,605.37 for 11 months and $1,129.29 for the 12th month.

Simple Interest Alternate Formula

Alternatively, we have another interpretation for finding the simple interest. The formula for the same is

Where,

- A is the loaner’s total value to the lender, Principal amount + S.I.

- P is the Principal amount the borrower has to pay to the lender.

- r is the predetermined rate of interest that the borrower pays as a sign of goodwill.

- t is the tenure or period of the loan.

Example:

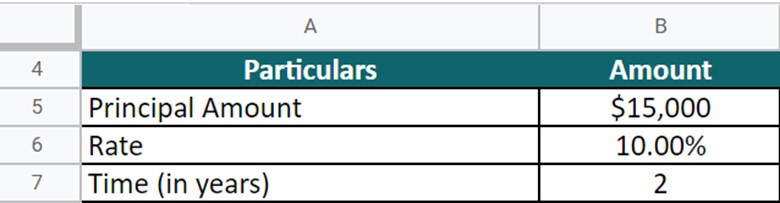

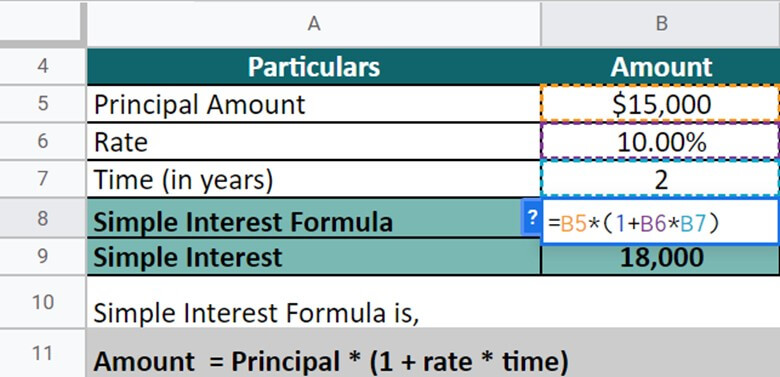

Given that Maryland Industries Ltd. borrowed $15,000 long-term from a corporate bank with an annual interest rate of 10%, we can calculate the total amount (including simple interest) that they must pay at the end of the tenure. To solve this problem, we need to use the standard simple interest formula.

Given,

Solution:

Implementing the formula, let’s calculate the simple interest for Maryland Industries;

Here, Simple Interest = A = P x ( 1 + R x T)

= $15,000 x (1 + 10% x 2)

= $18,000

Thus, the total amount, including the simple interest that Maryland Industries has to pay for two years, is $18,000.

Future Value Simple Interest Formula

The future value simple interest formula is a mathematical equation used to calculate the value of an investment at a future point in time, assuming a fixed interest rate.

The Future Value Simple Interest Formula is:

Here,

P = Principal amount

I = Interest

r = Rate

t = Time

For example, assume you invest $1,000 at a 5% annual interest rate for three years. Using the formula, you can calculate the future value of your investment:

FV=1,000 * (1 + 0.05 * 3)

FV=1,000 * 1.15

FV=1,150

Therefore, at the end of the 3-year investment term, your investment will be worth $1,150.

It’s important to note that this formula assumes that the interest rate remains constant over the entire investment term and that we will not compound the interest.

Types of Simple Interest Formula

There are two types of simple interest formulas: standard simple interest formula and exact simple interest formula.

The standard simple interest formula uses 360 days as the value of a year, while the exact simple interest formula uses the precise number of days in a year (365 or 366 for leap years).

For example, let’s say Sophia takes a loan of $20,000 from a bank on 1st March 2023, with a repayment date of 10th May 2023 and an interest rate of 5%. To find the simple interest using the standard simple interest formula, we can use the following calculation:

P = $20,000

R = 5%

T = 70 days (from 1st March to 10th May)

To convert the days into years, we can use the formula:

Time (in years) = T / 360

1. Using the standard simple interest formula

Simple Interest = (P × R × T) / 100

= ( 20,000 × 5 × 70/360) / 100

= $194

Therefore, Sophia needs to pay $194 in total interest.

2. Using the exact simple interest formula

P = $20,000

R = 5%

T = 70 / 365 years

Simple Interest = (P × R × T) / 100

= ( 20,000 × 5 × 70/365) / 100

= $198

Therefore, Sophia needs to pay $198 in total interest.

In summary, the type of simple interest formula used can affect the interest we calculate, so it’s essential to choose the appropriate procedure based on the situation.

Applications of Simple Interest

People use simple interest in various financial transactions, such as personal loans, business loans, savings accounts, and bonds.

- In the case of personal loans, simple interest is used to calculate the interest paid over a shorter period, typically ranging from one to five years.

- In the case of business loans, simple interest is used to calculate the interest charged on short-term expenses such as inventory or payroll.

- Savings accounts also use simple interest to calculate the amount of interest earned by an account holder based on their account balance and the interest rate paid out regularly.

- When it comes to bonds, a fixed interest is calculated using simple interest and is paid over a certain period of time.

Simple Interest Formula Calculator

Use the following calculator for Simple Interest formula calculations.

| Principal | |

| Rate of Interest | |

| Time | |

| Simple Interest = | |

| Simple Interest = | Principal x Rate of Interest * Time |

| = | 0 x 0 x 0 = 0 |

Simple Interest vs. Compound Interest

Here are the top differences between both formulas:

| Simple Interest | Compound Interest | |

| Meaning | We calculate simple interest based on the principal amount of a deposit or loan. | We calculate compound interest based on the principal amount and the added interest in every period. |

| Formula | P x r x t

p = principle r = rate of interest t = time |

A = P +

A = final amount P = initial principle balance r = rate of interest n = the number of times interest is applied for a time. nt = the number of times elapsed.

|

| Interest Applicable on | Applicable only on the principal amount. | Applicable on the principal amount and the outstanding interest. |

| Growth | Its wealth grows at a steady rate. | Its wealth grows at an exponential rate due to compounding. |

| Returns | It gives lesser returns. | It gives higher returns. |

| Principal Amount | The principal amount remains the same for the entire time. | The principal amount of a loan or investment increases as the interest is compounded and added to the principal. |

Frequently Asked Questions(FAQs)

Q1. How do you calculate Simple Interest?

Answer. One can calculate simple Interest using its formula:

Simple Interest = P*R*T

Where

- P is the Principal amount of the loan

- R is the rate of Interest

- T is the tenure of the loan

Q2. What is Simple Interest with an example?

Answer. Simple interest is a commonly used term that refers to the extra amount a borrower agrees to pay the lender in addition to the borrowed amount.

For example, John borrows $10,000 from a bank for two years, with an annual interest rate of 6%. To calculate the simple Interest charged on a loan, we can use the formula:

I = P x R x T

= $10,000 x 0.06 x 2

= $1,200

Therefore, the total Interest charged on John’s loan would be $1,200. At the end of the two years, John would be required to repay a total of $11,200, including the principal amount of $10,000 and the accrued interest of $1,200.

Q3. Are there two formulas for Simple Interest?

Answer. No, there is only one formula for calculating simple Interest. However, we use ordinary and exact methods to calculate simple Interest using the same formula. The only difference between them is the value of time. In the standard method, we consider a year as 360 days, while in the exact process, it is either 365 or 366 days (for leap years).

Recommended Articles

It was an EDUCBA synopsis of Simple Interest. However, to gain a more comprehensive understanding of this topic, it is highly recommended to read the suggested articles for further learning,