Updated November 2, 2023

Difference Between Simple Interest Rate vs Compound Interest Rate

An income for the person who lends money and an expense for the person who borrows money, interest, may be defined as the charge or fee for using the borrowed money. It is a good thing because you will let institutions borrow your money, and then they use it for issuing loans. It is the incentive that individual institutions use. Most financial institutions, such as banks and credit unions, only offered interest on savings accounts and some high-end checking accounts earlier.

The federal funds rate typically informs us about changes in interest rates when raised or lowered. As the interest rates go high, it will cause inflation to fall as the demand for goods and services will drop.

In the financial world, compounding growth is used extensively to transform small savings into a big corpus over time. It is also an underlying idea behind the ‘time value of money’ and ‘discounted cash flow valuation’.

There are two ways of calculating interest rates: Simple Interest Rate vs Compound Interest Rate. On the one hand, we calculate the simple interest rate as a percentage of the principal. On the other hand, we calculate the compound interest rate as a percentage of both the principal and interest rate.

Formulas for both are given below:

For example, let’s say that a bank has a 5% Interest Rate, and you borrow $1000 for 10 years. After 10 years, you will owe the bank $500 in simple interest terms. If you deposit $1000 in a five-year fixed deposit at a 4% interest rate, compounded monthly, the calculated interest using the above formula amounts to $221.

Banks levy Simple Interest Rates to the principal part only. Compound Interest Rate includes calculation on both principal and interest rate. In this, the interest can be compounded at any interval, and the most common compounding intervals are daily (365 times a year), weekly (52 times a year), monthly (12 times a year), quarterly (four times a year), and annually (once a year).

The person who borrows the money and the moneylender i.e. any bank/financial institution, mutually decide the interest rates.

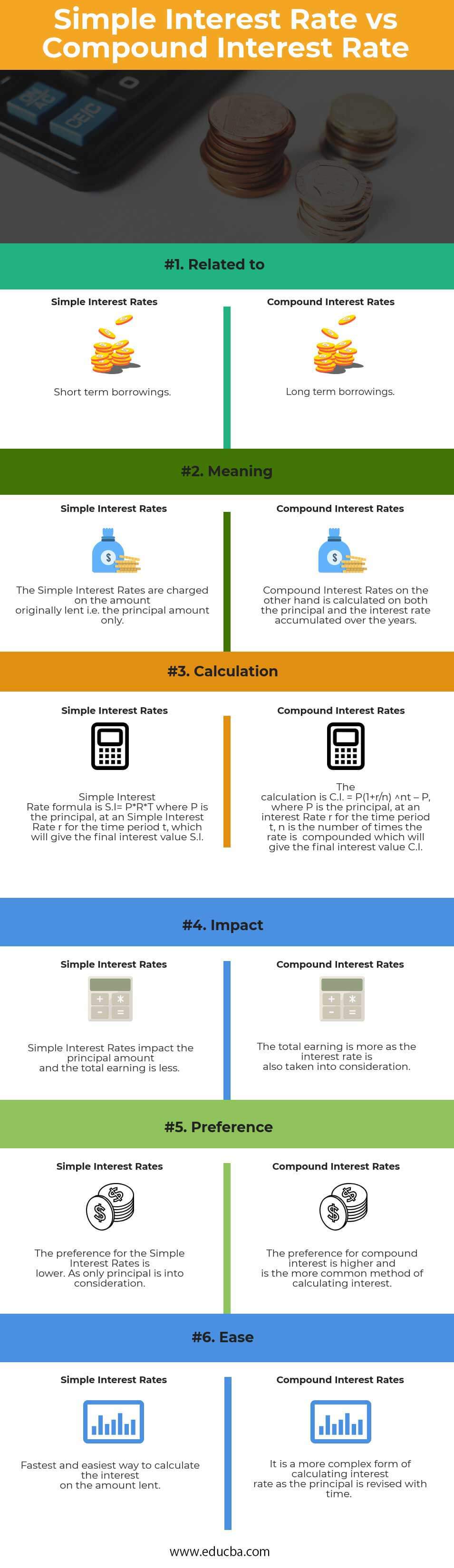

Simple Interest Rate vs Compound Interest Rate Infographics

Below is the top 6 difference between Simple Interest Rate vs Compound Interest Rate

Key Differences Between Simple Interest Rate vs Compound Interest Rate

Both Simple Interest Rate vs Compound Interest Rate are popular choices in the market; let us discuss some of the major differences: –

- Simple Interest Rates – This method does not charge interest on any accumulated interest and usually charges interest on short-term borrowings. In contrast, compound interest rates charge interest on both the principal amount and the accumulated interest. The interest rate for the next period is calculated by adding the principal amount to the interest amount, which is reinvested to earn more interest.

- Compound interest calculates the interest computed on the principal amount and the accumulated interest rate, making it greater than simple interest.

- Since the calculation is only on the principal amount, it is easier for simple interest than compounded interest. Compound interest should be used if the priority is to avoid letting the value of your money fade away, as it accounts for the changes in money over time. The value of a dollar today is more than that of a dollar that will be received one year from now.

- Understanding the principal amount is important as it represents the original money borrowed from an individual or a financial institution. Simple interest uses the principal amount, while compound interest also adds interest.

- Growth in the simple interest calculation remains uniform, while in the compound interest formula, it increases rapidly.

Head To Head Differences Between Simple Interest Rate vs Compound Interest Rate

| The basis Of Comparison | Simple Interest Rate | Compound Interest Rate |

| Related to | Short-term borrowings | Long-term borrowings |

| Meaning | Lenders charge Simple Interest Rates on the principal amount only. | Compound interest rates calculate the accumulated interest on both the principal and the interest rate over the years. |

| Calculation | The simple Interest Rate formula is S.I= P*R*T where P is the principal, at a Simple Interest Rate r for the time period t, giving the final interest value S.I. | The calculation is C.I. = P(1+r/n) ^nt – P, where P is the principal, at an interest rate r for the time period t, n is the number of times the rate is compounded, which will give the final interest value C.I. |

| Impact | Simple Interest Rates impact the principal amount, and the total earning is less. | The total earning is more as the interest rate is also considered. |

| Preference | The preference for Simple Interest Rates is lower as the only principal is considered. | The preference for compound interest is higher and is the more common method of calculating interest. |

| Ease | The fastest and easiest way to calculate the interest on the amount lent | Calculating interest rates becomes more complex as the principal is revised with time. |

Conclusion

Many borrowers are unaware that both Simple Interest Rate vs Compound Interest Rate calculates the interest to be charged. The difference between Simple Interest Rate vs Compound Interest Rate is very important as one can get hundreds of dollars less for a deposit.

Compound interest is a more detailed borrowing measure, including the Simple Interest Rates and the principal amount. The more often the interest is compounded, the more is the interest earned or paid as the amount is accumulated with every time period, and the calculation is done on the revised amount.

Recommended Articles

This has guided the top differences between Simple Interest Rate vs Compound Interest Rate. Here, we discuss the Simple Interest Rate vs Compound Interest Rate key differences with infographics and a comparison table. You may also have a look at the following articles –