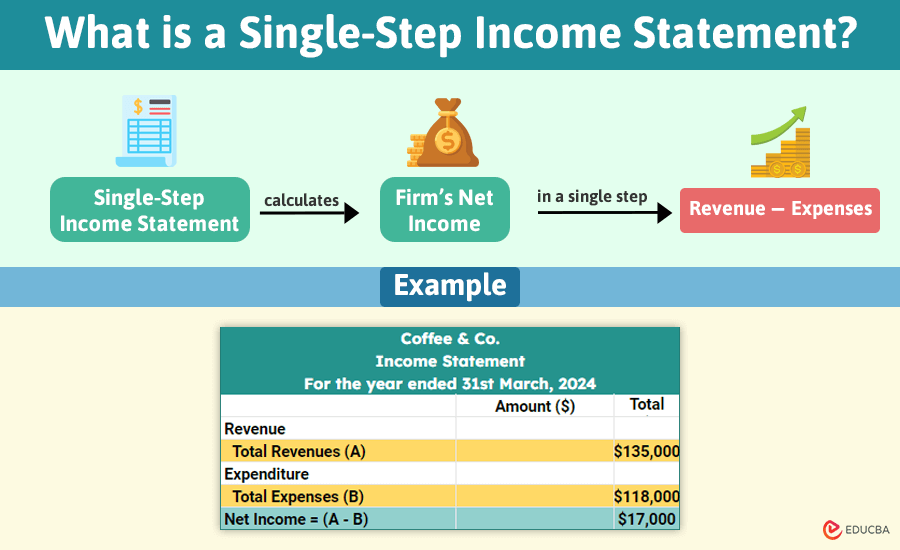

What is a Single-Step Income Statement?

A single-step income statement groups all types of revenue together as “Total Revenue” and all types of expenses together as “Total Expenses.” This format is simpler than a multi-step income statement, which breaks down revenues and expenses into categories like operating and non-operating.

The statement ends with the net profit or loss, which the company calculates by finding the difference between total revenues and total expenses.

The accounting equation to compute net income in a single-step income statement is:

Table of Contents

Format

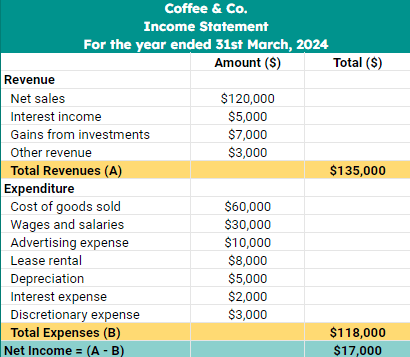

Imagine you run a small coffee shop. You can prepare your single-step income statement as per the below format:

How to Prepare a Single-Step Income Statement? (With Example)

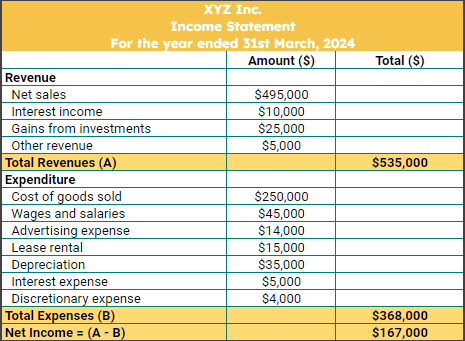

Suppose XYZ Inc. manufactures soft drinks for the US market. Below are the figures from the company’s accounts. Use the given data to prepare a single-step income statement.

Given:

For FY2024, the company reports:

- Net sales: $495,000

- Interest income: $10,000

- Other revenue: $5,000

- Gain from investments: $25,000

- Cost of goods sold: $250,000

- Wages and salaries: $45,000

- Advertising expense: $14,000

- Rent: $15,000

- Depreciation: $35,000

- Interest expense: $5,000

- Discretionary expense: $4,000

Solution:

Step 1: Calculate Total Revenue

Add all the revenue:

- Net sales: $495,000

- Interest income: $10,000

- Other revenue: $5,000

- Gain from investments: $25,000

Total Revenue = $495,000 + $10,000 + $5,000 + $25,000 = $535,000

Step 2: Calculate Total Expenses

Add all the expenses:

- Cost of goods sold: $250,000

- Wages and salaries: $45,000

- Advertising expense: $14,000

- Rent: $15,000

- Depreciation: $35,000

- Interest expense: $5,000

- Discretionary expense: $4,000

Total Expenses = $250,000 + $45,000 + $14,000 + $15,000 + $35,000 + $5,000 + $4,000 = $368,000

Step 3: Calculate Net Income

Net Income = Total Revenue – Total Expenses

Net Income = $535,000 – $368,000 = $167,000

Result:

The single-step income statement for XYZ Inc. is as follows:

Who Uses Single-Step Income Statements and Why?

This format clearly shows total revenue, total expenses, and net income without the complexity of multiple steps. Hence, entities with simpler financial structures prefer a single-step income statement, including:

- Small businesses

- Sole proprietors

- Service-based companies

- Freelancers.

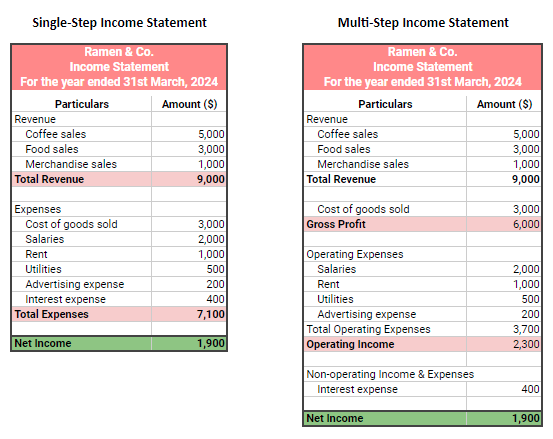

Single-Step Vs. Multi-Step Income Statement

Key differences between a single-step and a multi-step income statement are as follows:

1. Single-Step Income Statement:

- Sums all revenues and gains together.

- Sums all expenses and losses together.

- Calculates net income in a single step: Total Revenue – Total Expenses.

- Suitable for small businesses.

2. Multi-Step Income Statement:

- Separates operating and non-operating activities.

- Calculates Gross Profit (Revenue – Cost of Goods Sold).

- Includes non-operating items like interest expense, depreciation, etc., after Operating Income to arrive at Net Income.

- Suitable for larger businesses.

Advantages and Disadvantages

The various advantages and disadvantages of the single-step income statement are as follows:

Advantages:

1. Simple Representation

The single-step income statement is straightforward. It lists revenues and expenses separately and then calculates net income in one simple step.

Suppose a small coffee shop owner wants to understand their business’s performance. The single-step income statement shows them total sales, expenses, and profit. The owner doesn’t need to be a financial expert to see that their sales were $10,000, expenses were $8,000, and net income was $2,000.

2. Reduces Accountants’ Workload

This simplified approach helps reduce the workload of accountants as it makes record-keeping and financial analysis easier.

3. Suitable for Small Businesses

Small businesses typically have simpler financial transactions, and the single-step statement covers all necessary financial data without the need for deep analysis.

Disadvantages:

1. Not Suitable for Making Investment Decisions

Suppose an investor is looking to invest in a technology company. They might find a single-step income statement lacking because it does not break down revenue sources, such as software sales, consulting services, etc. Without the breakup, it is difficult to understand the business’s growth potential.

2. Important Financial Metrics are Missing

It fails to capture important financial metrics, such as gross and operating margins. For example, a company using a single-step income statement won’t separately report the operating margin. Hence, investors cannot easily see how much profit the company makes from its core business operations, excluding interest and taxes.

3. Difficult to Identify the Source of Expenses

Suppose a restaurant uses a single-step income statement and lists total expenses as a single figure without breaking them down into categories like food costs, labor, utilities, and rent. It makes it challenging for managers to pinpoint areas where they can reduce costs.

4. No Differentiation Between Core and Non-core Activities

Suppose a software company has significant income from selling softwares (core activity) and also earns interest from investments (non-core activity). In that case, the single-step format will combine these figures, which can be misleading.

Final Thoughts

A single-step income statement is a useful approach that many businesses use for preparing their financial accounts. Larger organizations can use this method for internal reporting where they do not require a deep analysis of the company’s performance. On the other hand, some companies can choose to use single-step income statements along with detailed ones to cater to the needs of a different set of audiences.

Frequently Asked Questions (FAQs)

Q1. What is the use of a single-step income statement?

Answer: It offers a straightforward and simplified version of a company’s financial accounts, which merely conveys its revenue, expenses, and net income.

Q2. Which is better for detailed analysis: a single-step income statement or a multi-step income statement?

Answer: A multi-step income statement is better for detailed financial analysis as it separates operating and non-operating activities.

Q3. Does GAAP allow for a single-step income statement?

Answer: Yes, GAAP allows both single-step and multi-step income statements.

Q4. What does not show on a single-step income statement?

Answer: A single-step income statement does not show Gross Profit and Operating Income.

Recommended Articles

We hope this article on ‘Single-Step Income Statement’ was helpful. For accounting-related concepts, you can refer to the below posts: