Why Do We Need Small Business Accounting Best Practices?

Running a small business can be challenging with limited funds. Moreover, when customers delay payments, the business may find itself short on cash and under financial pressure. Therefore, learning how to manage accounting for small businesses is a must to navigate these challenges. They can use techniques like small business invoice factoring and financing to access cash quickly, even when waiting for payments. However, they must look into small business accounting best practices to keep their cash flow steady and maintain financial stability.

So, without delays, here’s how to maintain your accounts for sustainable growth.

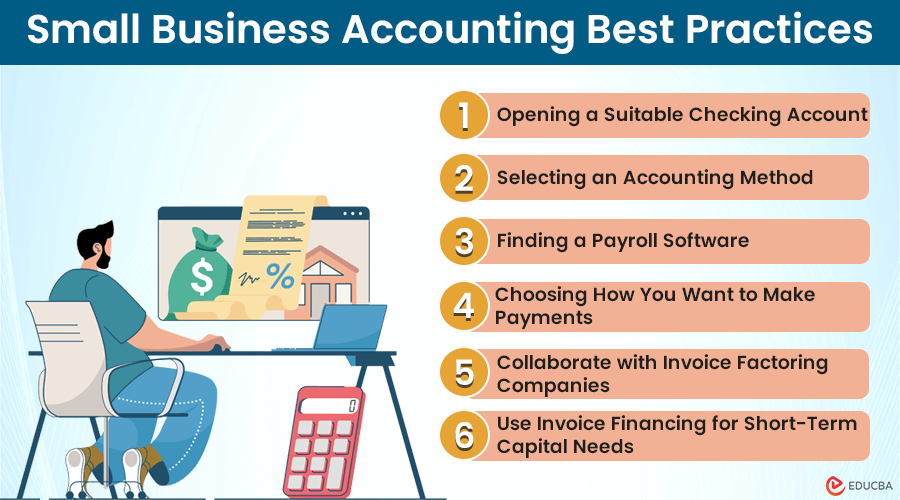

6 Small Business Accounting Best Practices

Following are the top small business accounting best practices:

1. Opening a Suitable Checking Account

To keep personal and professional accounts separate, choosing a business checking account must be a priority. This helps you manage your business finances without mixing them with personal investments, which is especially important for startup owners.

Benefits:

- Customers can pay directly into your business account, keeping all business transactions in one place.

- A dedicated business account can help you secure higher credit limits from banks, allowing you to grow your business.

- A business account lends credibility to your business and simplifies tax preparation.

Key features to look for:

- No or low monthly maintenance fee.

- No deposit limits.

- No foreign transaction fees.

- Direct payments within 24-48 hours.

- Auto-save feature for auditing and taxes.

- Unlimited transactions.

- App integrations for smart business decisions.

- Automated bill payments with consent.

2. Selecting an Accounting Method

When deciding on an accounting method for your startup, you can choose between cash-based or accrual-based accounting.

If you use cash-based accounting, you only record transactions when you receive cash. This means you don’t give credit to your clients or customers and realize profits when you make a cash sale. However, this method does not provide a complete picture of your financial health.

Accrual-based accounting, however, records transactions when they occur, even if the cash hasn’t been received yet. You recognize revenue after completing a transaction and record expenses when they happen, regardless of when the cash is received. This method gives a better estimate of your company’s financial health but can be more challenging to maintain and track.

3. Finding a Payroll Software

Choose a payroll software that can track all your business earnings, expenses, deductions, fees, charges, and other remunerations. This is essential regardless of the accounting method you use. Consider getting a demo or trial, as a Small Business HQ guide advises, before determining which accounting software to commit to. You need real-time data to make strong, reliable, and forward-thinking financial decisions.

Your future business plans may fail without understanding your current operational and financial efficiency. Knowing the exact status of your financial aspects allows you to make informed decisions about where to invest next.

4. Choosing How You Want to Make Payments

Choose how you want to make payments by setting up a payment gateway system. Ensure you have all the necessary documents ready and integrate the gateway with your current invoicing, payroll, and income software. This streamlines your workflow and eliminates the need for additional tools or software.

Also, make sure the payment gateway accepts all types of payments from various other gateways or portals and has stringent safety protocols to protect your client’s data.

5. Collaborate with Invoice Factoring Companies

Invoice factoring for small businesses is the best practice to manage cash flow for your business activity. In this, you sell your unpaid invoices to a factoring company, receive an advance payment within a few days, and the factoring company then collects the payment from your client. This way, you can focus on running your business without waiting for customers to pay. Here’s how to do it:

- Set up an account with an invoice factoring company with relevant business documents.

- Use free invoice receipt templates to ensure your invoices are professional and error-free before submitting them.

- Connect your accounting software and submit your invoices.

- The factoring company will assess your and your client’s eligibility.

- Your client agrees to transfer the invoice to the factoring company by signing a Notice of Agreement.

- You receive funds in your business account within a few days.

- Your customer pays the factoring company directly, eliminating your need to collect payment.

6. Use Invoice Financing for Short-Term Capital Needs

Small business invoice financing is a common practice to improve bookkeeping efficiency and maintain urgent cash flow needs. This approach allows you to get instant cash as a loan for a short period until your client fully pays the invoice. Although it will increase your liabilities on the balance sheet, one key benefit is that you don’t need to involve your client or customer in the financing process.

Invoice financing offers faster approvals and cash flows compared to invoice factoring. You can easily finance large amounts of invoices to meet your working capital requirements at a minimal rate.

Additionally, you can repay the financed cash in installments, reducing the need to pay back the full amount at once.

Final Thoughts

The above-mentioned small business accounting best practices will help you learn how to manage accounting for your small business and make financially sound decisions. It will help you grow your business to its maximum potential. You must consider investing in reliable software solutions, tools, features, etc., as well as using smart funding options like factoring and financing etc. With the right tools, proactive measures, and new solutions, you can ensure the success and growth of your business.

Recommended Articles

We hope you found the article on ‘Small Business Accounting Best Practices’ helpful. To learn more about managing your business finances, visit our recommended list below.