Updated July 25, 2023

Difference Between Sole Proprietorship vs LLC

The following article outlines the differences between Sole Proprietorship vs LLC. A sole proprietorship refers to a business owned and operated by a single individual, with no legal distinction between the owner and the business. This type of business structure does not involve many legal complexities. On the other hand, an LLC (Limited Liability Company) is a type of private limited company in the US that provides limited liability to its owners. Both sole proprietorships and LLCs are common forms of small businesses. Before choosing either of these structures, it’s important to analyze both options’ financial and legal requirements.

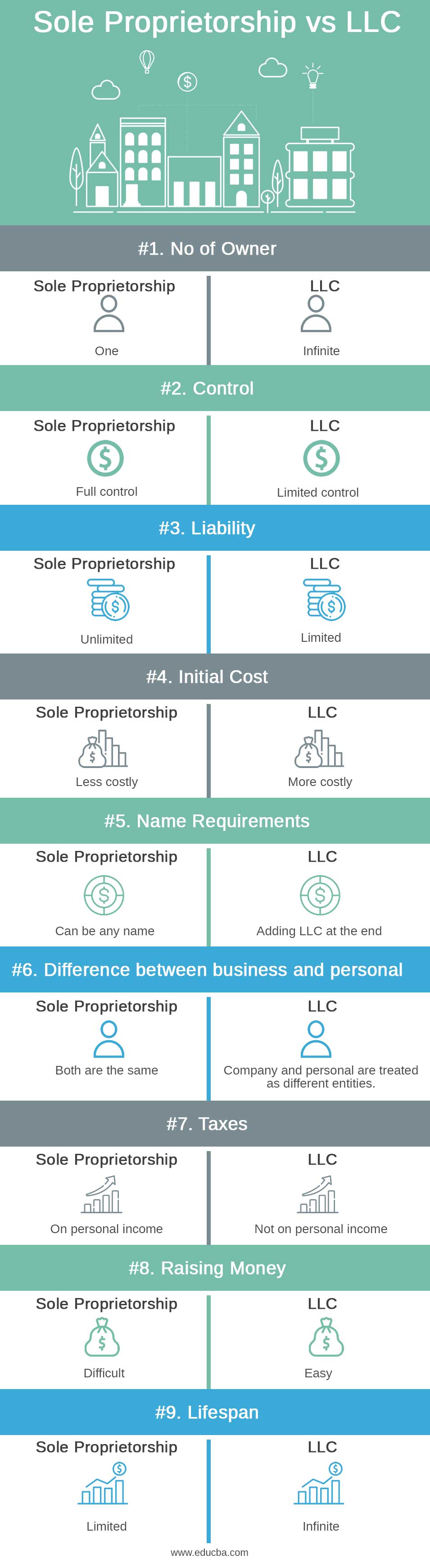

Sole Proprietorship vs LLC: Head-to-Head Comparison (Infographics)

Below are the top 9 differences between Sole Proprietorship vs LLC:

Sole Proprietorship vs LLC: Key Differences

- In a sole proprietorship, only one owner and no other person or business can be involved. In contrast, an LLC can have infinite owners, who may be individuals, corporations, or foreign entities. One can structure LLCs as a hybrid of incorporation and business and hire managers to run the company. An LLC is an extension of a sole proprietorship where no member has greater ownership than any other.

- With a sole proprietorship, the owner has full control over the business and can make decisions independently without following rules or regulations. The owner also has a complete will over how to use the company’s assets and resources. In an LLC, decisions must be made considering the multiple owners and the company can hire third-party managers to assist with operations. Resource management in an LLC is a collective responsibility.

- As the name suggests, an LLC is a Limited Liability Company, meaning owners have limited liability. In contrast, a sole proprietorship has unlimited liability, as the owner is solely responsible for the company’s debts and liabilities. Creditors can legally seize the owner’s personal assets, including their home and car, to meet the company’s debts in a sole proprietorship. This cannot happen with an LLC, which provides protection from creditors and lawsuits related to the company. In a sole proprietorship, the owner is wholly responsible for debt repayments, liabilities, and lawsuits.

- Setting up a sole proprietorship is relatively inexpensive compared to an LLC, as it only requires an initial license and some fees. On the other hand, an LLC must register its name with the state and pay annual fees, which can cost around $1000 to set up.

- Naming a company as an LLC requires adding “LLC” at the end of the company’s name. In a sole proprietorship, there are no name-related compulsions, and there is no need to add any suffix at the end of the name. Also, an LLC cannot use the same name as another company.

- When running a sole proprietorship, there is no need to differentiate between personal assets and liabilities and those of the business. They are the same in the eyes of the law, as the business belongs to the individual. In an LLC, there is a clear separation between personal and company funds and liabilities. Personal assets will not be at risk even if the company fails to meet its debts. However, it is important to maintain detailed and separate records for both to avoid any future legal issues.

- In a sole proprietorship, income generated by the individual is considered personal income and is taxed accordingly. In an LLC, taxes can vary, as the company can be treated as a sole proprietorship, a partnership, or a corporation. This confusion between LLCs and sole proprietorships often arises because they can and cannot pay taxes similarly. An election can determine this, with the format receiving the most votes being used. In an LLC, the members and the company are treated separately, and taxes are based on company income, not personal income.

- Raising money in a sole proprietorship is difficult, as the business’s credibility is low, and personal and company funds are treated the same. In an LLC, raising funds from other companies or individuals for business expansion is easy.

- A sole proprietorship’s lifespan depends entirely on the owner’s life or if the owner decides to sell or merge the business. On the other hand, an LLC can have an infinite lifespan. This is because a particular individual or corporation does not own an LLC, so the company’s existence is lifelong. When establishing an LLC, legal documents can include contracts that stipulate the continuation of the business even if one of the members dies, retires, or experiences some other event.

Comparison Table of Sole Proprietorship vs LLC

|

Basis of Comparison |

Sole Proprietorship |

LLC |

| No. of Owner(s) | One | Infinite |

| Control | Full control | Limited control |

| Liability | Unlimited | Limited |

| Initial Cost | Less costly | More costly |

| Name Requirements | Can be any name | Adding LLC at the end |

| Difference between Business and Personal | Both are the same | Company and personal are treated as different entities. |

| Taxes | On personal income | Not on personal income |

| Raising Money | Difficult | Easy |

| Lifespan | Limited | Infinite |

Conclusion

Choosing between a sole proprietorship and an LLC depends on various factors, such as the number of owners, liability protection, tax implications, and the company’s lifespan. A sole proprietorship provides complete control over the business but offers no liability protection. On the other hand, an LLC offers limited liability protection and allows for multiple owners and a potentially infinite lifespan. As a result, it is important to carefully consider these factors before deciding which business structure is the most suitable for one’s needs.

Recommended Articles

Here are some further related articles for expanding understanding: