Updated November 15, 2023

Definition of Sole Proprietorship and Partnership

A successful commercial organization must comply with two registration requirements in all nations. The first would be Business Registration, while the second is Tax Registration. Commercial organizations must acquire various business registrations under their respective national statutory frameworks. The popular registrations are Sole Proprietorship, Company, Partnership, Limited Liability Partnership, etc. The business must take tax registration after attaining business registration but before commencing operations.

- Sole Proprietorship: This is a Business form in which one person retains the business’s complete ownership, managerial control, and operational dynamics. The concerned person who runs such a business is legally termed a Sole Proprietor or Sole Trader.

- Partnership: Any business where two or more individuals converge and agree on a specific agreement (legally called Partnership Deed) that specifies the nature of the business, contribution, and role of the partner, and sharing or profit and losses are called a Partnership. Members of a partnership business are called Partners; usually, there are two types of partners – Active (Active role in management/operations) and Passive (Only profit sharing) partners. The collective of such Partners forming a business is called a Firm.

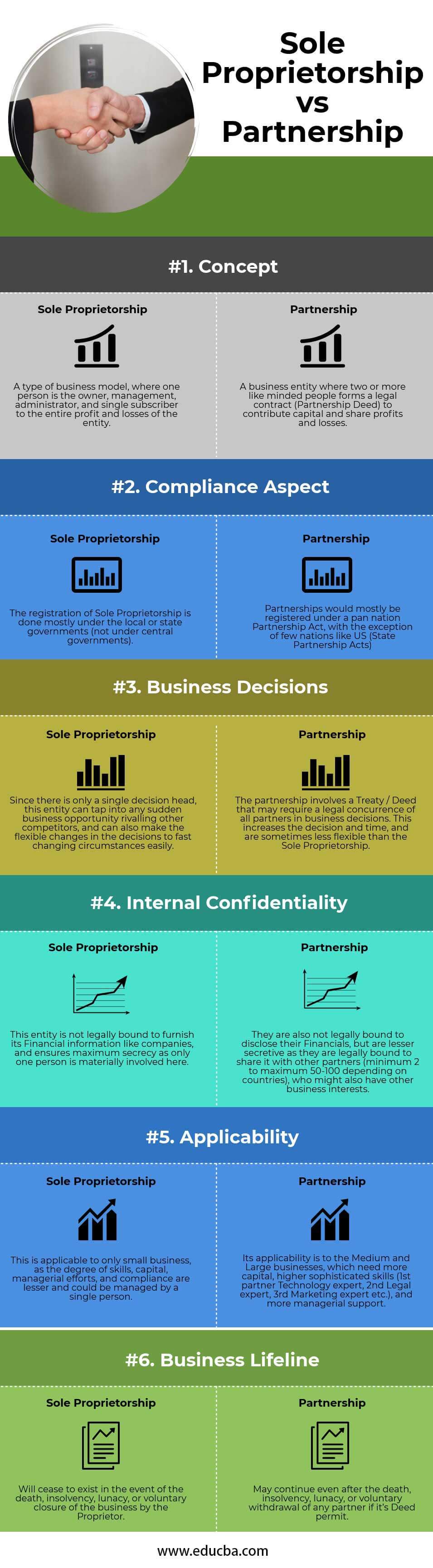

Sole Proprietorship and Partnership Infographics

Below is the top 6 difference between Sole Proprietorship vs Partnership

Key Differences Between Sole Proprietorship and Partnership

Both Sole Proprietorships and Partnership are popular choices in the market; let us discuss some of the major points

1. Fundamental Concept

The basic premise of a Sole Proprietorship is a one-man-owned, controlled, and directed entity with lesser regulatory burden and ease of operation. Whereas in a Partnership, there is a Contract between interested Partners (two or more) called a Partnership Deed \ Treaty who share Ownership, Profit, and Control.

2. Incentive Model

A sole proprietor has the ultimate and undivided claim on the profit generated by the business; moreover, it creates more satisfaction and accomplishment for being one’s boss. On the other hand, in a Partnership, the profits of the business are shared as per the Deed between the partners and provide more security to them as the risks are also shared by them rather than completely owned by a single person.

3. Operational Aspect

The sole proprietorship is easier to operate and offers quick flexibility in decisions. The proprietor’s unavailability can negatively impact the entire business. While the Partnership goes by mutual consensus of decisions, it is difficult to make complicated decisions when partners are high (like 35 or 50). However, other partners can support business operations without one partner.

4. Confidentiality Edge

A sole proprietorship will offer maximum confidentiality, as there is no regulatory requirement to furnish the financials; hence, the Competitor would be less likely to attain your details likewise in Companies. There is no safer person to trust than the self. Hence, there is no room for ambiguity in this entity. However, in Partnership, the partners are mandatorily provided with the financials, and the trust factor among them plays a crucial role in the future of the business. In Firms (Partnership Businesses) where there are 15 or 30 partners with mutual faith and integrity, they demonstrate an impeccable role as one partner may also be a partner to a Competitive Firm that may leak their confidential details.

5. Liability Clause

A proprietor bears unlimited liability to their business, which implies that their assets can be seized to repay obligations in the event of a default by the business. In a partnership, the partners are individually and collectively responsible for addressing any defaults made by the business. In certain cases, if the partners fail to meet the liabilities fully, the partner’s assets possessing additional properties would also be liquidated.

6. Challenge

The Sole Proprietor must possess all the relevant skills, knowledge, capital, connections, technology, and managerial talent to spearhead his business. This works well if the size of the business is small. But Partnership is a solution to all of the aforesaid flaws of the Single Proprietorship since the Firm can admit any Fresh talent, high net worth individuals with connections and capital, and the scope of growth is higher in Partnership than in Proprietorship.

7. Free Entry and Exit

The sole proprietorship is easy, with fewer formalities & discussions. In the event of an opportunity or adverse consequence, and can quickly start or close this business. However, in Partnership, since each of these significant decisions (opening and closing) needs everyone’s concurrence, it has a lower degree of easiness for Entry and Exit when compared to Proprietorship.

Sole Proprietorship vs Partnership Comparison Table

Below is the topmost comparison between Sole Proprietorship vs Partnership

|

The Basis of Comparison |

Sole Proprietorship |

Partnership |

| Concept | A type of business model where one person is the owner, management, administrator, and single subscriber to the entire profit and losses of the entity. | A business entity where two or more like-minded people form a legal contract (Partnership Deed) to contribute capital and share profits and losses. |

| Compliance Aspect | Local or state governments primarily handle the registration of Sole Proprietorship, not the central government. | Partnerships would mostly be registered under a pan-nation Partnership Act, except for a few nations like the US (State Partnership Acts) |

| Business Decisions | Since there is only a single decision head, this entity can tap into any sudden business opportunity rivaling competitors. It can also make flexible changes in decisions to fast-changing circumstances easily. | The partnership involves a Treaty / Deed that may require a legal concurrence of all partners in business decisions. This increases the decision and time and is sometimes less flexible than the Sole Proprietorship. |

| Internal Confidentiality | Only one person is materially involved here, ensuring maximum secrecy, and this entity is not legally bound to furnish its financial information like companies. | They are not legally obligated to disclose their financials, but they demonstrate less secrecy as they are legally obligated to share them with partners (ranging from a minimum of 2 to a maximum of 50-100 depending on countries) who may also have other business interests. |

| Applicability | This applies to only small businesses, as the degree of skills, capital, managerial efforts, and compliance are lesser and could be managed by a single person. | Its applicability is to Medium and Large businesses, which need more capital, higher sophisticated skills (1st partner Technology expert, 2nd Legal expert, 3rd Marketing expert, etc.), and more managerial support. |

| Business Lifeline | The business ends if the Proprietor dies, goes bankrupt, becomes insane, or closes voluntarily. | May continue even after the death, insolvency, lunacy, or voluntary withdrawal of any partner if its Deed permits. |

Conclusion

Businesses prefer certain registration modes for fewer regulatory hurdles and confidentiality. However, an entrepreneur needs to carefully assess the external and internal factors before choosing either of these models.

A small business that is comparatively riskier and is more vulnerable to some external factor (such as foreign exchange, etc.) can choose the Sole Proprietorship model. This model is recommended because it allows for easy and quick entry and exit from the business in the event of unavailability. The proprietor can assume any unilateral decision about his business without concurrence with anyone. However, in the case of a partnership, any significant decision concerning the business (especially its closure or withdrawal of any partner) needs to be accepted by all partners. This consensus becomes even more difficult when the number of partners is greater. Moreover, conflicts often arise between partners when there are differences in the future course of the business or pivotal decisions.

However, the Partnership can maximize the success chance of the business because several entrepreneurial talents exert a unidirectional convergence of their efforts and their technological, managerial, and networking skills. Moreover, the partnership form is prudent for medium/large business growth due to its sophistication. This should be why if we take out of the lists of renowned successful business houses, your chances of finding a partnership are higher than that of a Sole Proprietorship (for example, Ernst & Young, KPMG, and so on..)

Recommended Articles

This has guided the top difference between Sole Proprietorship vs Partnership. However, we also discuss the key differences between infographics and comparison tables. Therefore, you may also look at the following articles to learn more.