Updated November 3, 2023

What is Sovereign Debt?

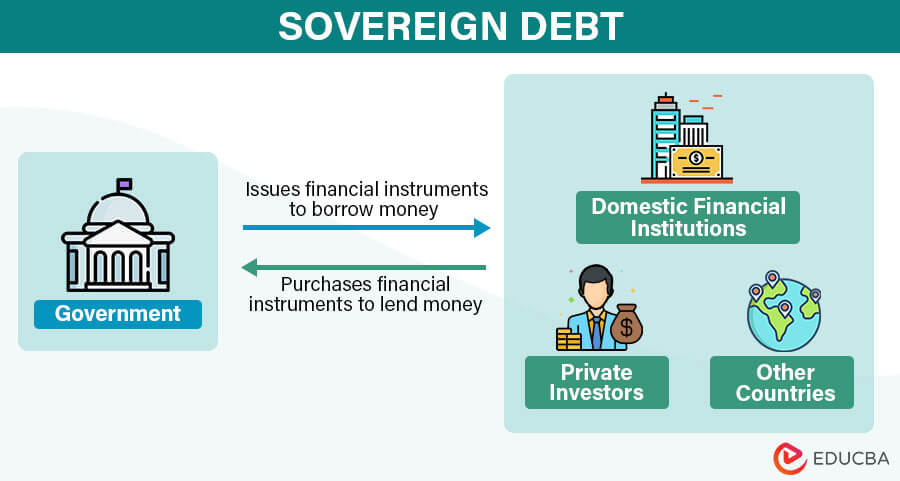

Sovereign debt, or government debt, refers to money that a country borrows from domestic financial institutions, private investors, or other countries by issuing debt securities, like bonds, loans, etc.

The government borrows this money to finance activities, such as infrastructure projects, social programs, etc., to stimulate economic growth. However, when a government fails to repay its debt obligation, it can lead to defaults, financial crises, or a need for debt restructuring.

Investors and creditors determine the risk of lending money by assessing a country’s creditworthiness or debt credit rating. Therefore, sustainable debt management is essential to balance borrowing, expenditure, and revenue generation to maintain a nation’s financial and economic stability.

Table of Content

- What is Sovereign Debt?

- How Does it Work?

- Who Owns it?

- Features

- Debt Crisis

- Real-World Examples

- Sovereign Debt Vs. Economic Growth

How Does it Work?

Let’s understand how sovereign debt works in simple terms. Consider country A needs funds to finance its infrastructure development programs.

In this scenario,

- The government raises funds by issuing debt securities, such as government bonds, treasury bills, etc., depending on their requirements.

- Investors, including domestic or foreign government organizations, purchase these debt securities and lend money to the government with terms and conditions.

- The government then makes periodic payments to investors who hold these securities, repaying the principal and interest payments till the debt’s maturity date. The maturity period can vary from short-term (like a few years) to long-term (over a decade or more).

- If the government fails to repay the money, the country will face the risk of defaulting. It means it will be difficult for them to get new loans. It can also lead to economic instability. Therefore, governments must carefully manage their debt to ensure it remains sustainable.

Who Owns Sovereign Debt?

The following are the types of entities that own this debt.

1. Domestic Investors

Local investors, like individuals, commercial or central banks, and other financial institutions within that country purchase the debt instruments. This usually happens during monetary policy implementations to manage interest rates and money supply.

2. Foreign Investors

Foreign governments, including private investors and banks, lend countries money by buying debt securities. It depends on the currency exchange rate, interest rates, investment strategy, and the country’s economic and political situation.

3. Other Sovereigns

International financial institutions like the International Monetary Fund (IMF) and the World Bank may hold or purchase debt instruments. It is to support economic stability and development in member countries.

Features

The key features that distinguish sovereign debt from other debt are as follows:

- Governments obtain this debt from various sources, including domestic and foreign lenders. They can borrow money in their own currency or in foreign currencies.

- When governments cannot pay their debts, creditors cannot seize their assets as repayment for the debt as they are legally protected.

- If a country faces economic or political disputes with other countries, it could become riskier for investors to lend money.

- They can collect money from their citizens through taxes or print more money.

Sovereign Debt Crisis

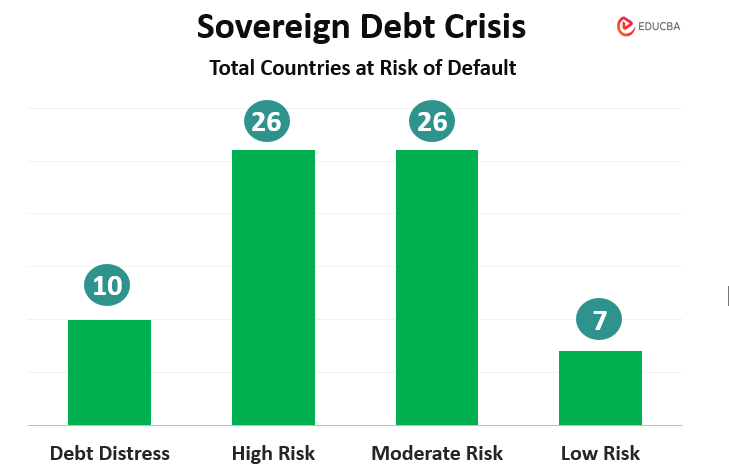

A sovereign debt crisis refers to a situation in which a country is unable to repay its creditors. According to a recent report by the IMF, 70 countries are at risk of defaulting on their loans. According to the data, 10 countries are in debt distress, 26 are at high risk, 26 are at moderate risk, and 7 are at low risk of debt default. A common example of a debt crisis is the European debt crisis.

Real-World Example of Greece’s Debt Crisis

Here is a real-life example of Greece’s sovereign debt crisis.

In the late 2000s and early 2010s, Greece faced a severe sovereign debt crisis that caught global attention. Its economic troubles threatened the stability of the Eurozone and led to international debates about financial measures.

Situation:

⇒ 2009: Financial crisis

Greece faced a financial crisis due to high budget deficit and debt levels, exceeding the EU’s 3% of GDP limit. This increased Greece’s borrowing costs and made it harder to manage its growing debt.

⇒ 2010: First Bailout

Greece received a 110 billion euros ($146 billion) bailout from the European Union ( EU ) and the International Monetary Fund (IMF).

⇒ 2012: Second Bailout

The EU-IMF granted a second bailout of 130 billion euros ($172 billion), involving a 53.5% debt reduction for private bondholders.

⇒ 2013: Austerity Measures

Greece’s Parliament approved unpopular austerity measures, like cuts in public spending, tax increases, and economic reforms.

⇒ 2015: Third Bailout

Greece received a new financial rescue package from the EU worth 86 billion euros in installments up to 2018. This was to help Greece meet its financial obligations, such as paying off its debts and covering its budget deficits.

⇒ 2018: Exit from Bailout

Greece completed its third bailout program, owing approximately 290 billion euros ($330 billion) to the EU and IMF.

Conclusion:

The austerity measures led to widespread protests and political problems in Greece. In 2018, Greece exited its eight-year bailout program. Although the economy is getting better, high unemployment and caution with money are still an issue. Greece’s situation remains a case study in managing a sovereign debt crisis within a monetary union like the Eurozone.

Differentiate Between Sovereign Debt and Economic Growth

The following are the differences between sovereign debt vs. economic growth.

| Feature | Sovereign Debt | Economic Growth |

| Definition | Amount a country owes to lenders by issuing bonds. | Increase in a country’s production of goods and services over time. |

| Measures | Total outstanding debt as a percentage of GDP. | Percentage change in GDP from one period to another. |

| Impacts | High debt leads to higher borrowing costs, interest payments, and economic instability. | Sustained growth improves living standards and creates jobs, reducing the debt burden. |

| Management Institutions | Managed by a country’s treasury or finance department and central bank. | Managed by governmental policies, like monetary, fiscal, and regulatory measures. |

| Potential Risks | Risks include default, high interest rates, and restricted access to capital markets. | Risks include inflation, income inequality, and environmental degradation. |

Frequently Asked Questions (FAQs)

Q1. What is a sovereign credit rating?

Answer: A sovereign credit rating is a debt rating that credit rating agencies give to evaluate the creditworthiness of a national government or sovereign entity. This rating shows how good a country or entity is at paying back its loans. The most common rating agencies are Moody’s Services, Fitch Ratings, and Standard & Poor’s. It helps investors assess the risk associated with investing in a country’s debt securities. A higher rating indicates lower risk, and a low rating means more risk.

Q2. What was the European sovereign debt crisis?

Answer: The European Sovereign Debt Crisis or Eurozone Crisis was a global financial crisis that began in the late 2000s and continued till 2012. It primarily affected Eurozone countries that adopted the euro as their common currency. Some factors that caused this include the global financial crisis of 2007 and the Great Recession of 2008.

Additionally, high debt levels in countries like Greece, Ireland, etc., worsen the situation. Consequently, the crisis triggered austerity measures, unemployment, economic disturbance, and political turmoil. As a result, the European Stability Mechanism (ESM) was established as a permanent bailout fund to stabilize financial markets.

Recommended Articles

We hope this article providing a detailed explanation of sovereign debt was informative. For further guidance on related topics, we recommend the following articles: