Difference Between Spin off vs Split off

In the corporate world, you will usually come across various transactions wherein companies change or transfer ownership through acquisitions or the creation of new entities. In some cases, the companies seek to relinquish their ownership in a subsidiary because in that way either the parent grows in value or the subsidiary gains more market traction as a separate company. Now, the process of separation from the parent company can be spin off, split off, split up, carve out or sale of the subsidiary. In this article we will focus on spin off and split off and how they are different from each other.

What is Spin off?

In the case of a spin off, the parent company chooses to distribute the equity stocks of the subsidiary to its existing shareholders on a pro rata basis, mostly in the form of dividend payout. In this type of deal, no cash transaction is involved between the parent company and the subsidiary. Essentially, the shareholders of the parent company are now offered shareholding in the new entity and so effectively they now become shareholders of two separate companies instead of one. Usually, the spun-off entities have their own management as they are recognized as a distinctly separate entity. Spin off is also known as spin out, but it is less frequently used.

In the year 2015, Baxter International Inc. decided to spin off its biopharmaceuticals business, Baxalta Inc. The announcement of the separation came in the month of March and was finally completed in the month of July. As per the definitive agreement, the shareholders in the parent company were offered 1 Baxalta share for each Baxter share they held. Post spin off, Baxter retained a 19.5% stake in Baxalta, while the remaining 80.5% stake was distributed through a special dividend.

What is Split off?

Split off is quite similar to spin off but with a catch. In the case of a split off, the shareholders of the parent company are given the option of either becoming the shareholders in the newly formed subsidiary in exchange for that of the parent company or continue to remain the shareholders of the parent company only. Basically, they can’t have a shareholding in both the parent company and subsidiary. Given that all the shareholders of the parent company might not choose to participate in the split off, the distribution of the subsidiary shares, in this case, can’t be pro-rata as in the case of a spin off. However, in order to complete the split off successfully with the exchange offer is made more attractive so that shareholders participate. Usually, the exchange ratio is more favorable for the investors who choose to participate in the split off.

In the year 2009, Bristol-Myers Squibb Company made the announcement to split off its holdings in Mead Johnson Nutrition Company. This transaction was intended to offer enhanced shareholder value in a tax-advantaged way. As per the definitive agreement, each Bristol-Myers share was offered 1.11 Mead Johnson share in exchange, which was subject to a certain upper limit on the exchange ratio.

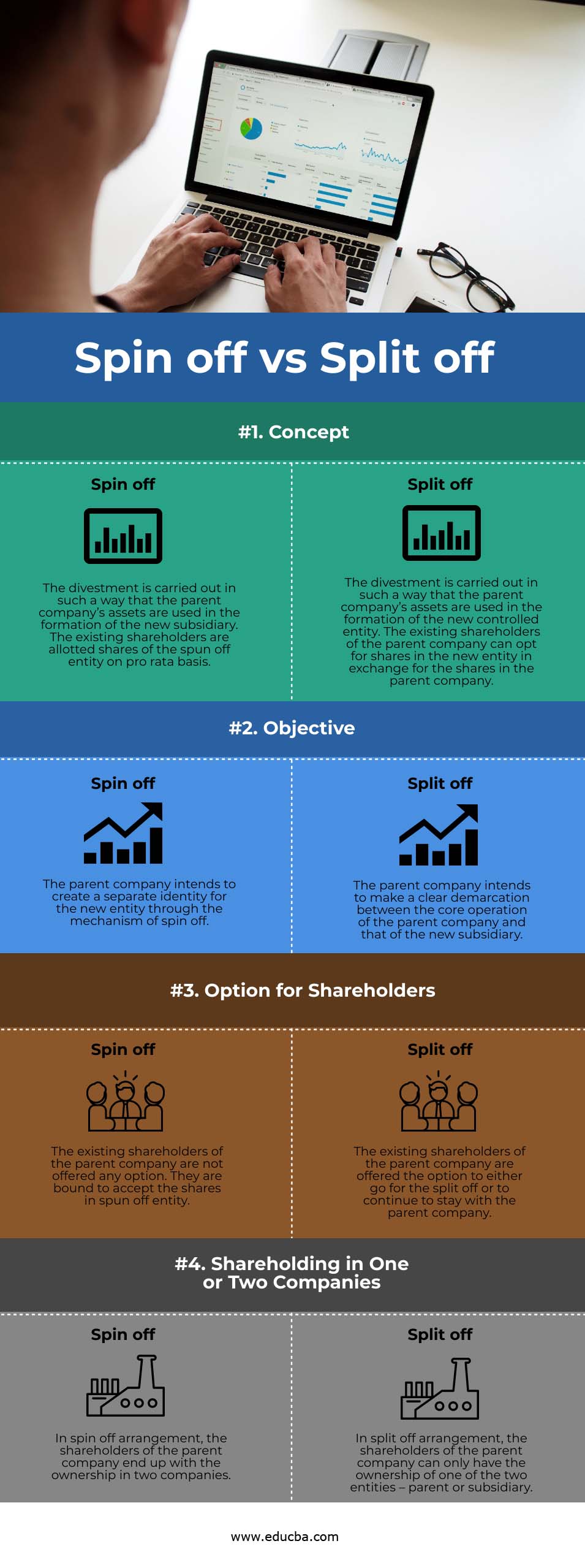

Head to Head Comparison Between Spin off and Split off (Infographics)

Below is the Top 4 Comparison between Spin off vs Split off.

Key Differences Between Spin off vs Split off

Some of the key differences between spin off and split off are as discussed below:

- Allotment of Shares: In case of spin off, the shareholders in the parent company are offered the share of the spun off entity on pro rata basis, whereas in case of split off, the shareholders in the parent company are offered the shares of split off entity only in exchange of that of the parent company.

- Right of Shareholding: In case of spin off, the existing shareholders enjoy the advantage of becoming shareholders of two separate entities, whereas, in the case of split off, the existing shareholder either have to accept shares of the new subsidiary in exchange for the parent company or continue with the parent company – effectively they have a shareholding in only one company.

- Business Objective: In the case of spin off, the parent company intends to create a separate identity for the spun off entity, whereas, in case of split off, the parent company seeks to separate its core business from that of the new subsidiary.

Spin off vs Split off Comparison Table

The comparison between spin off vs split are given below:

|

Basis of Comparison |

Spin off |

Split off |

| Concept | The divestment is carried out in such a way that the parent company’s assets are used in the formation of the new subsidiary. The existing shareholders are allotted shares of the spun off entity on pro-rata basis. | The divestment is carried out in such a way that the parent company’s assets are used in the formation of the new controlled entity. The existing shareholders of the parent company can opt for shares in the new entity in exchange for the shares in the parent company. |

| Objective | The parent company intends to create a separate identity for the new entity through the mechanism of spin off. | The parent company intends to make a clear demarcation between the core operation of the parent company and that of the new subsidiary. |

| Option for Shareholders | The existing shareholders of the parent company are not offered any option. They are bound to accept the shares in spun off entity. | The existing shareholders of the parent company are offered the option to either go for the split off or to continue to stay with the parent company. |

| Shareholding in One or Two Companies | In spin off arrangement, the shareholders of the parent company end up with the ownership in two companies. | In split off arrangement, the shareholders of the parent company can only have the ownership of one of the two entities – parent or subsidiary. |

Conclusion

So, it can be seen that both spin off and split off are recognized as one of the best tools for corporate divestment. Both the arrangements help companies build a more efficient and effective corporate structure. Companies go for spin offs when they intend to create a separate identity for the spun off entity, while they go for split offs when they want separate their core business from the subsidiary.

Recommended Articles

This is a guide to the top difference between Spin off vs Split off. Here we also discuss the key differences with infographics and comparison tables. You may also have a look at the following articles to learn more-