Updated July 11, 2023

Definition of Spot Price

The price at which commodities or securities can be bought or sold handily in the current time and place is known as the spot price (SP). The number of buyers and sellers seeking to purchase and sell defines its value.

Explanation

The SP is the current price of the commodities or assets at which the traders or investors transact. The value of SP depends upon the number of traders seeking to buy and sell it. When there are more buyers than sellers, the spot price gains similarly; if the sellers are more than buyers, the spot price drops. It is usually based on the demand and supply of assets or commodities. The spot price helps in ascertaining the future price of the commodity; if the trader is looking for a commodity that the trader needs in nearby future, but the spot price of it is expected to be lower than its future price, then the trader will purchase it on the spot price.

How to Calculate the Spot Price?

The SP is more economical than a mathematical value as there is no formula to calculate the spot price. Its demand and supply can only calculate the SP. When there is more demand than supply, the value of SP will increase, whereas when the supply is more than the demand, its value declines. In other words, when there are more buyers than sellers, the spot price will increase because of the high demand for the commodity. Similarly, if there are more sellers than buyers, the spot price will decline due to less need for the commodity.

Example

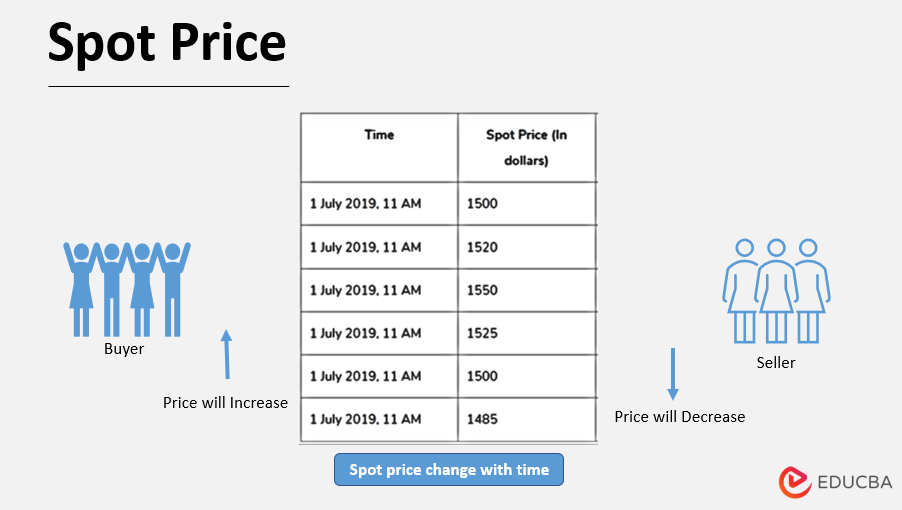

Let us consider that XYZ Company’s share’s SP is $1500. So, buyers have to pay $1500 to get these shares immediately. Buyers can also purchase futures contracts to acquire these shares at the expiry of the agreement. When the buyer receives the shares instantly, the price is known as the SP, and when the buyer purchases a futures contract, the price is known as the future price.

|

Time |

Spot Price (In dollars) | Buyers |

Sellers |

| 1 July 2019, 11 AM | 1500 | 1100 | 1100 |

| 1 July 2019, 11 AM | 1520 | 1400 | 1000 |

| 1 July 2019, 11 AM | 1550 | 1600 | 900 |

| 1 July 2019, 11 AM | 1525 | 1300 | 1000 |

| 1 July 2019, 11 AM | 1500 | 1100 | 1200 |

| 1 July 2019, 11 AM | 1485 | 1000 | 1500 |

From the above study, we can say that the market price changes with time and entirely depends upon the number of buyers and sellers. When the buyers are more than the sellers, the SP will rise; when the sellers are more than the buyers, the SP will decline. So, we can say that the SP depends on market participants’ behavior.

The Spot Price in Option

The option’s spot price is the price at which options can be sold and purchased immediately without further delay. The SP means the current market price of its underlying securities or that of options and the price at which buying and selling only options are done, not the underlying securities. They are called the “option’s SP” instead of “spot price.”

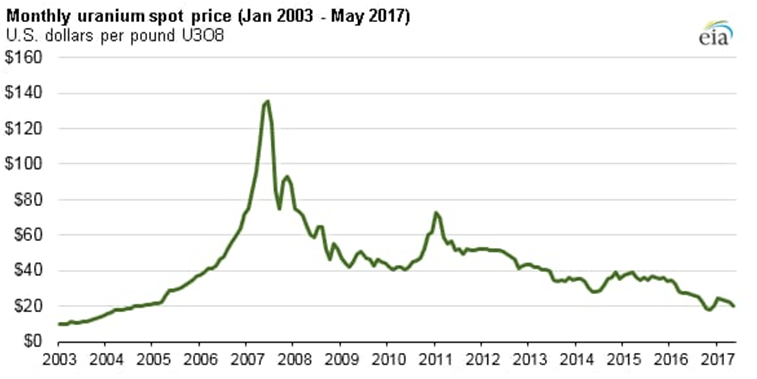

Source: Researchgate

Above is the graph of the SP of Uranium from the year Jan 2003-May 2017. It is based on the monthly SP. The SP of uranium gradually increased from 2003 to 2007 to approximately $140.But after this, it shows a slight decline between 2007 and 2008. It keeps fluctuating due to buyers’ and sellers’ demand and supply. The SP showed ups and downs numerous times between 2008-2017. Further, the spot price in 2017 was lower than before due to less demand for uranium, and it went as low as $20 near May 2017.

Advantages and disadvantages of Spot Price

Some of the advantages and disadvantages are mentioned below:

Advantages

- Ascertainment of the future price: With the help of the SP, the commodity’s future price can be ascertained. If the buyer is getting a commodity at a lower price than is expected in the future, the buyer will purchase it at the spot price.

- Helps in getting profit: The SP is usually lower than the future price, so the trader or buyer who purchases it right now would earn a good amount of profit in the future.

- Ownership of the commodity: The trader or investor will get ownership of the commodity or security when they pay the SP.

Disadvantages

- Holding of the commodity: The trader or investor in the SP gets the commodity as soon as they pay the SP, so they have to keep the commodity themselves, which sometimes causes wear and tear, and their value could decline.

- Dependency on the buyers and sellers: The SP depends on the buyers and sellers as it will increase when there are more buyers than sellers and decline when the sellers are more than buyers.

Conclusion

The SP of any commodity or security is the price at which one can buy and sell it instantly. Its rise and decline depend upon the number of buyers or sellers in it. It helps investors and analysts ascertain the future prices of the underlying commodities and securities.

Recommended Articles

This is a guide to Spot Price. Here we also discuss the definition, how to calculate the spot price, and advantages and disadvantages. You may also have a look at the following articles to learn more –