Updated July 11, 2023

What is Spot Rate?

The term “spot rate” (SR) refers to the current market value of a security, commodity, or currency available for purchase/ sale in an immediate settlement.

The determination of the SR (selling price) of an asset involves considering the price the buyer is willing to pay and the price the seller is prepared to accept in exchange. In other words, the SR is the price at which both buyer and seller are willing to execute the transaction.

Explanation of Spot Rate

Typically, the calculation of SR depends on various factors, such as the asset’s market value in the market right now and shortly. The movement in an asset’s SR indicates its demand and supply in the market. As such, the spot rate of an asset varies frequently, and at times, it may also witness drastic change owing to some significant event or news about it.

How Does Spot Rate Work?

SR is usually helpful in the context of forwarding and futures contracts. Under certain circumstances, the buyers and sellers in the market are apprehensive about the prices of the commodities. Hence, they wish to lock in the desired strike price of an item at some future date by using forward and future contracts. In this way, the buyers and sellers limit their downside risk in a market where the commodity price frequently fluctuates due to supply and demand mismatch. On the day of the transaction, the buyers and sellers will execute the sale and purchase of commodities at the strike price, regardless of the spot price on that date. The market situation is contango if the contract’s strike price exceeds the expected spot price. Conversely, if the expected spot price is higher than the strike price, it is backwardation.

Examples of Spot Rate

Example #1

Let us take the example of John Doe, a wholesaler of rice who wants to purchase 10MT of rice in October 2020.

In this case, he can pay the spot price of rice to the seller and take the physical delivery of 10MT rice within three days.

Example #2

In the above example, let us assume that John Doe needs the rice at his warehouse at the start of January 2021 as he believes the demand will surge then; hence, rice as a commodity will be more expensive.

In this case, he would avoid buying the rice now and store it till January 2021, as the risk of spoilage is very high. Given that the commodity won’t be needed until January 2021, he should opt for a forward contract. So, John Doe can enter into a forward contract for the 10MT rice and lock in the price today based on the expected spot price and current market scenario. He will have to take the physical delivery in January 2021 and pay the strike price, irrespective of the spot price.

How to Find Expected Spot Rate?

Although the SR has applications in various fields, let us take the case of spot interest rate to explain how to find the expected SR. The spot interest rate for the maturity of N years is analogous to the yield to maturity (YTM) of a zero coupon bond with N years until maturity. So, the expected spot interest rate can be calculated using the face value of the bond, the current market value of the bond (or spot rate), and the number of years till maturity. The formula for YTM of the zero coupon bond or expected SR can be expressed as,

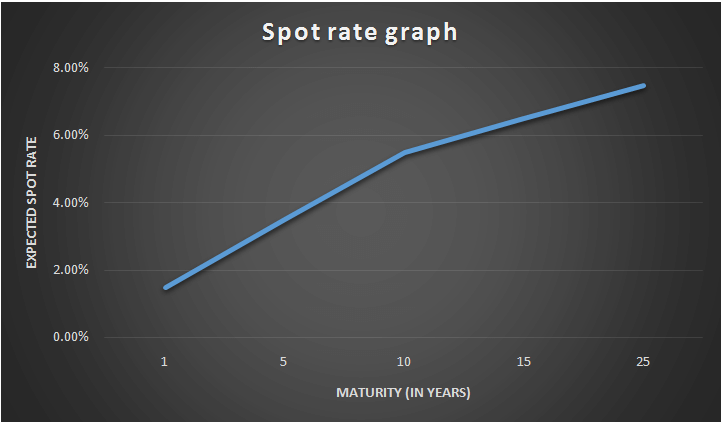

Spot Rate Graph

The SR curve is created by plotting the spot rates against the respective maturity period on a graph. Again, in this section, we will take the example of a spot interest rate to explain the SR graph. Under normal circumstances, the SR increase as the maturity term increases, which indicates that bonds with longer maturities offer higher yields. However, this trend changes in the case of stressed economic conditions. As such, the shape of the spot rate graph indicates the current and expected market scenario.

Advantages

- Both parties (buyer and seller)agree on the asset’s value under consideration.

- It helps in understanding the actual movement of the market.

- There is none to the limited scope of speculation involved in its calculation.

- Analysis of a particular commodity’s SR across periods can help understand its demand and supply dynamics.

Disadvantages

- In a bearish market, the buyer may incur losses as the spot rate will likely decline shortly, which means the expected spot rate will be lower than the current spot rate.

- The fluctuation of the SR can be a tricky business in a fluctuating market scenario.

- SR exposes the stakeholders to market vagaries, which can be mitigated to some extent by using forward and future contracts. Nevertheless, some portion of the risk continues to remain.

Conclusion

So, it can be seen that the spot rates are one of the most critical metrics that reflect the expected market movement in the future. The trend witnessed in the SR captures the market view of the investors. Additionally, it plays an essential role in the case of forwarding and future contracts. Hence, sellers and buyers must analyze all transaction components using SR optimally.

Recommended Articles

This is a guide to Spot Rate. Here we also discuss the introduction, how to find an expected spot rate, and advantages and disadvantages. You may also have a look at the following articles to learn more –