Updated July 17, 2023

Definition of Spread Betting

Spread betting is a type of financial derivative product where the trader can speculate on the price of the assets, whether they will rise or decline, without any need to be an owner of the assets.

Explanation

When there is trading in the stock market, the broker proposes two prices for the traders willing to spread bets. The one among them is the price at which the trader can buy or bid price, and the second one at which the trader can sell or ask price, and the discrepancy between these two prices is known as the spread. In such types of derivatives, there is no need to pay broker fees or commissions as the broker makes his profit from a distance between the two prices. The trader will go with these prices according to the market circumstances; if the market grows, the trader will go with a bid price, and if the market declines, the trader will go with the asking price.

Features of Spread Betting

- Appropriate Decision: Spread betting enables the trader to decide whether to keep underlying assets for a little longer or to eliminate them according to the market conditions of rising and declining trends.

- The Use of Leverage: Leverage in spread betting helps the traders fully disclose the market’s underlying costs and a wide variety of markets accessible in it.

- Margins: There are two types of margins in spread betting: deposit and maintenance. The deposit is related to the fund used to get a position, whereas the maintenance margin is the extra fund used to maintain the position.

How to Conduct Spread Betting?

Like any other type of trading, spread betting also requires broad research and knowledge of the market because investors can only predict whether the market will rise or decline. There are three components of the spread betting working procedure. ‘the spread’ is one of them: the fee paid by a trader to open a position; the second is ‘the bet size,’ which is the sum of capital the trader puts in it. The last component is ‘the bet duration,’ which shows how long the position will remain open before it expires.

Example of Spread Betting

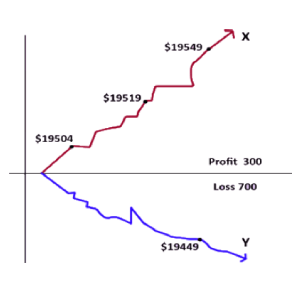

Let us assume XYZ Ltd Company presently has a buy price of $ 195.19, and the corresponding ask price is $195.04. Suppose trader P has expected that the cost of shares of this company will increase soon. So, P buys more shares for $10 per step of the shift to $195.19.

- If, in the future, the company’s share price rises, trader P will decide to close the trade at the point where the asking price touches $195.49. As 30 points increase the market, P will earn a yield of $300.

- However, if there is a downfall in the market, say to an asking price of $194.49then such trader will face a tremendous loss. As the market has a decline of 70, the loss will be $700.

Both these amounts, either profit or loss, will exclude additional charges.

How to Make Money from Spread Betting?

A trader with high research and broad knowledge about the market can make money with spread betting. If the trader’s predictions on the price of the assets are correct, then the trader will profit depending upon the spread; spread refers to the variation between the bid price and the selling price. If there is an increase in this difference, the trader will get a higher profit. Whereas there is a risk involved in it, too. If the difference in the spread is declining or the bid price is lower than the selling price, then the trader would suffer a loss on the bid. It is a kind of speculation process.

Leverage in Spread Betting

There is leverage in the spread betting, which is a beautiful component as it enables the trader to attain an excellent profit level with their capital which could be less if there is no leverage. Leveraged trading can also be called marginal trading. The leverage is very effective in getting a high-profit level with less capital; it magnifies the profit and the loss, if any. So the trader must use leveraged trading carefully.

Advantages

- Use of Leverage: Less capital can be used to get a high profit in the spread betting as leverage helps the trader maximize their wealth.

- Helpful in Making a Decision: It helps the trader decide whether to go long or short; if the market shows growth, then the trader would go long or vice-versa.

- No Need to Pay Commission: Spread betting saves the trader from paying high fees or commissions to the broker as the broker makes a profit from the spread, so there is no need to pay.

Disadvantages

- Risk: As the profit in the spread betting magnifies, magnified losses are possible. Suppose the asking price declines more than the bid price; the trader would bear a loss on the bet.

- Margin Calls: In spread betting, the traders may get a position far more significant than their accounts which could cause margin calls.

Conclusion

Spread betting was initiated to organize an active market for both aspects of the competition. It is a type of wagering by which merchandisers could attain acknowledgment of different kinds of markets just by depositing a minimal percentage of the available amount of trade. Traders can gain proceeds if the market runs as per the expectation. Traders need not expense additional charges like a commission for trading, capital gain, or stamp duties.

Recommended Articles

This is a guide to Spread Betting. Here we also discuss the definition, how to conduct spread betting, and its advantages and disadvantages. You may also have a look at the following articles to learn more –