Updated July 31, 2023

Difference Between Standard Deviation vs Mean

Standard Deviation

Standard deviation and mean are both terms used in statistics. It measures the distance from the mean and is calculated as the square root of the variance by determining the difference between each data point and the mean. The standard deviation plays a crucial role in the world of finance. In finance, analysts use the standard deviation as a statistical measure to evaluate an investment’s annual rate of return. It sheds the volatility of historical volatility of that investment. The greater the standard deviation greater the volatility of an investment. Standard deviation is the best tool for measuring volatility, which helps you know the better and larger price range. The volatile stock has a very high standard deviation, and the blue-chip stock has a very low standard deviation due to low volatility.

Mean

Mean is a simple mathematical average of the set of two or more numbers. There are different types of mean calculation, including the arithmetic mean method, which uses sums of all numbers in the series, and the geometric mean method. The simple method of the mean is to make the total of all data and divide it by the number of data. Then we reach to mean. The mean is nothing but the simple average of data. Investors use the mean as a statistical indicator to evaluate a stock’s performance over time by assessing its fundamentals, such as the P/E ratio, balance sheet, and portfolio. They estimate the stock’s average rate of return over time by calculating the mean. Similarly, in statistics, the term “standard deviation” is used to calculate and analyze data.

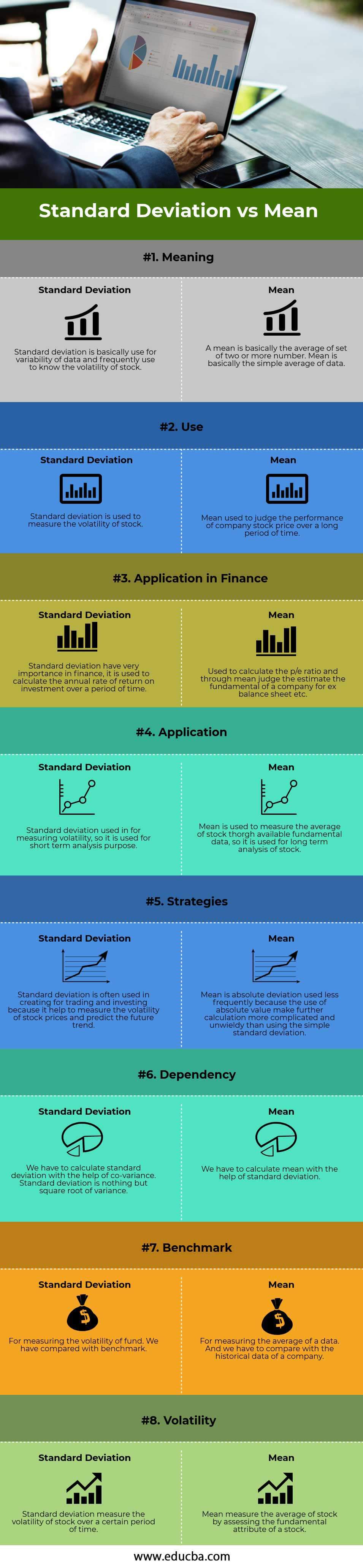

Head To Head Comparison Between Standard Deviation vs Mean (Infographics)

Below is the top 8 difference between Standard Deviation vs Mean

Key Differences Between Standard Deviation vs Mean

- In statistics, the standard deviation measures the dispersion of a dataset relative to its mean, calculated by taking the square root of the variance. It determines the variation between each data point and the mean.

- Mean is a mathematical average of the set of two or more numbers. The mean for the given number can be computed in more than one way.

- In calculating the annual rate of return in finance, one utilizes the standard deviation, while historical data calculates the average through the mean.

- The standard deviation is used to measure the volatility of a stock. The higher the standard deviation higher the volatility of a stock. The blue-chip stock has a low standard deviation, so that has low volatility.

- It is the simplest form. The mean is an average of all data points. Standard deviation is one of the key fundamental risk measures that analytics, portfolio managers, wealth management, and financial planner use.

- The standard deviation is calculated based on the mean. In the stock market, both the tool play a very important role in measuring the stock price and future performance of the stock price and large price range.

- The formula of standard deviations:

- The formula of mean -:

x¯¯¯=∑xN

Standard Deviation vs Mean Comparison Table

| The Basis of Comparision |

Standard Deviation |

Mean |

| Meaning | People use standard deviation to measure the variability of data and frequently employ it to determine the volatility of stocks. | A mean is the average of a set of two or more numbers. Mean is the simple average of data. |

| Use | Investors use standard deviation to measure the volatility of a stock. | The mean is used to judge the performance of a company’s stock price over a long period. |

| Application in Finance | The standard deviation has very important in finance. It is used to calculate the annual rate of return on investment over a period of time. | Used to calculate the p/e ratio and through mean judge the estimate the fundamental of a company forex balance sheet etc. |

| Application | The standard deviation measures volatility and is used for short-term analysis purposes. | Investors use the mean to measure the average of a stock’s available fundamental data, making it a useful tool for long-term stock analysis. |

| Strategies | Traders and investors often use standard deviation to measure the volatility of stock prices and predict future trends. | People use the mean absolute deviation less frequently because the use of absolute value complicates and makes the further calculation more unwieldy than the sample standard deviation. |

| Dependency | We have to calculate the standard deviation with the help of covariance. Standard deviation is nothing but the square root of the variance. | We have to calculate the mean with the help of standard deviation. |

| Benchmark | For measuring the volatility of the fund. We have compared it with the benchmark. | For measuring the average of data. And we have to compare with the historical data of a company. |

| Volatility | Standard deviation measures the volatility of the stock over a certain period of time. | Mean measures the average of stock by assessing the fundamental attribute of a stock. |

Conclusion

Standard deviation vs mean, both tools used for statistical stock price valuation, have their own importance in finance. Big investors and companies apply these terms to evaluate stock prices and future prospectus. Standard deviation is the deviation from the mean, and a standard deviation is nothing but the square root of the variance. Mean is an average of all data sets from an investor or company. Standard deviation plays a vital role in finance as it is used to measure the volatility of a stock. The mean and standard deviation are essential in trading and investment activities, with standard deviation being easier to visualize and apply.

Recommended Articles

This has guided the top difference between Standard Deviation vs Mean. Here we also discuss the standard Deviation vs Mean key differences with infographics and comparison table. You may also have a look at the following articles to learn more.