Updated July 4, 2023

What is the Statement of Financial Position?

A financial position or balance sheet statement gives a broad overview of a company’s financial position considering its assets and liabilities, for example, as per the 2021 annual report of Amazon. The company’s balance sheet shows that it holds assets worth $420,549 and liabilities worth $142,266.

Here, the assets are higher than the liabilities, which means the company is in a good financial position.

It is best known as the balance sheet and represents an undertaking’s financial position on a particular day, the last day of the reporting period. It portrays the unfiltered financial position of a company wherein one can identify whether the company is making a profit or loss.

Key Highlights

- A statement of financial position or balance sheet gives a complete overview of the company’s financial health by evaluating its assets and liabilities.

- It calculates yearly and should be balanced, which means both assets and liabilities or shareholders’ equity value should be the same.

- It helps to evaluate and analyze the business’s liquidity, performance, and cash flow.

- Its primary purpose is to represent accurate and vital financial information about any company’s Equity, assets, and liabilities.

- It can also be useful for the Management of the company to review and track the financial stability of the company and find the scope for improvement.

Formula

The statement of financial position formula is:

Here,

- Assets are what the firm owns.

- Liabilities are how much the firm owes.

- Equity is the value that can return to the investors if the business is to be liquidated.

Real-World Examples

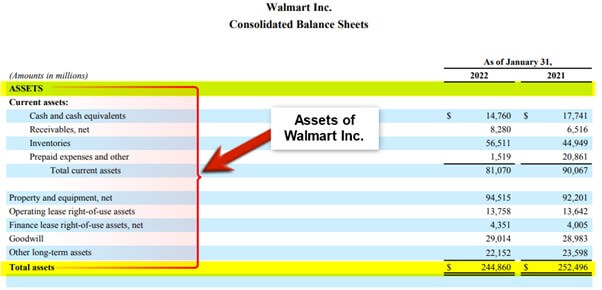

#1 Walmart

Let’s take the example of Walmart Inc. The company’s balance sheet can evaluate as the statement of financial position for the financial year ending on December 31, 2022.

(Image Source: Walmart’s Annual Report 2022)

We can draw the following conclusion from the above balance sheet:

- The company’s assets worth $244,860 are what the company owns.

- The total liabilities and equity worth $244,860 are the sources of income that the company has used to fund its assets.

Thus, with the above information, we can conclude that the company’s balance sheet is balanced as both the factors, such as assets and liabilities or shareholder’s equity, are the same.

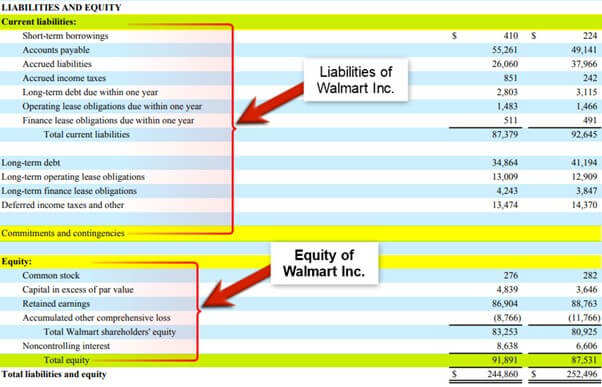

#2 McDonald’s

Let’s take the example of McDonald’s. The company’s balance sheet can evaluate as the statement of financial position for the financial year ending on December 31, 2021.

(Image Source: McDonald’s Annual Report 2021)

We can draw the following conclusion from the above balance sheet:

- The company’s assets worth $53,854 are what the company owns.

- The total liabilities and equity worth $53,854 are the sources of income that the company has used to fund its assets.

Thus, with the above information, we can conclude that the company’s balance sheet is balanced as both the factors, such as assets and liabilities or shareholder’s equity, are the same.

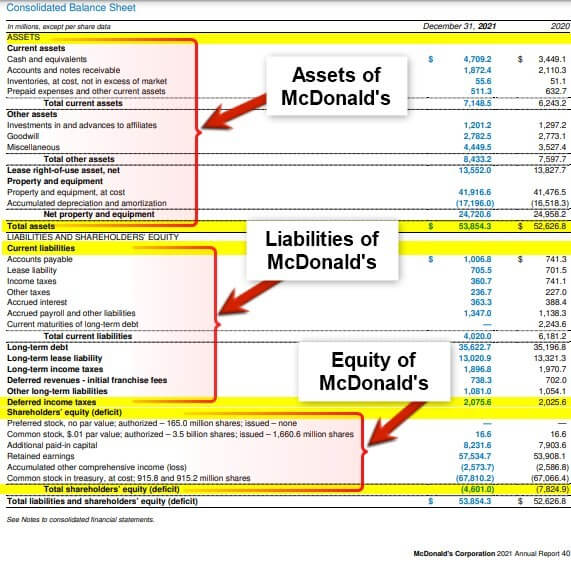

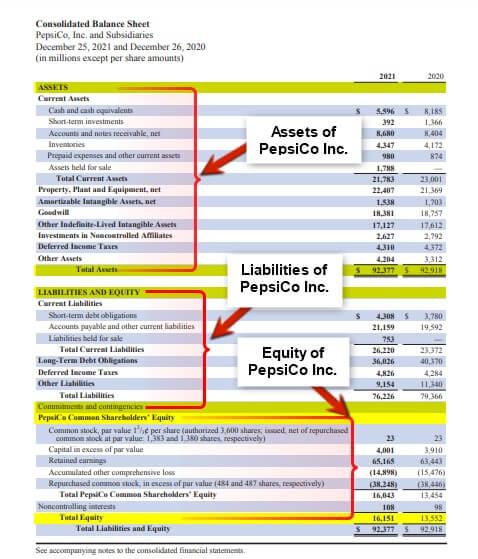

#3 PepsiCo.Inc

Let’s take the example of PepsiCo. The company’s balance sheet can evaluate as the statement of financial position for the financial year ending on December 31, 2021.

(Image Source: PepsiCo’s Annual Report 2021)

We can draw the following conclusion from the above balance sheet:

- The company’s assets worth $92,377 are what the company owns.

- The total liabilities and equity worth $92,377 are the sources of income that the company has used to fund its assets.

Thus, with the above information, we can conclude that the company’s balance sheet is balanced as both the factors, such as assets and liabilities or shareholder’s equity, are the same.

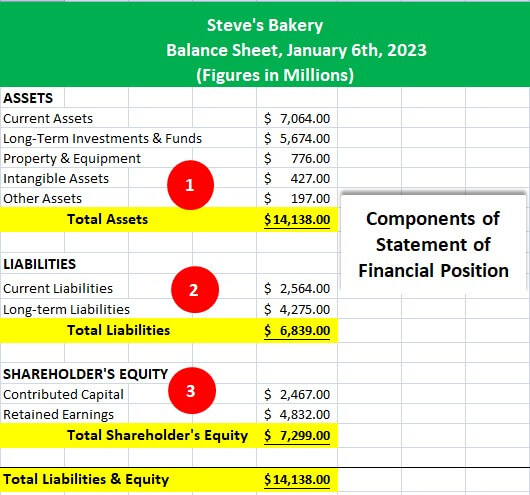

Components

#1 Asset

- These are the resources owned by the company and acquired or generated with equity funds or outside borrowings.

- They are further divided into current and non-current assets based on whether they are expected to be realized within twelve months of the reporting period.

- Examples of assets include inventory, property, trade receivables, financial assets, deferred tax assets, etc.

#2 Liabilities

- Liabilities refer to the amounts owed by the company towards outside parties (i.e., amounts owed to parties other than shareholders in their capacity as a shareholder).

- The liabilities are also sub-classified as current and non-current liabilities based on whether they are expected to be settled within twelve months of the reporting period.

- Some most commonly represented line items for liabilities include borrowings, provisions, trade payables, deferred tax liability, etc.

#3 Equity

- Equity represents the amount belonging to the company’s shareholders.

- This indicates the amount invested by the company’s shareholders and the amount it owes to them.

- There are different equity components, such as paid-up share capital, revenue reserves, capital reserves, etc.

How to Prepare a Statement of Financial Position?

Preparing the statement of any company’s financial position involves aggregating the accounting information into a standard set of financials. Further ahead, the complete financial statements are distributed to the lenders, Management, investors, and creditors.

These statements help them evaluate and analyze the business’s liquidity, performance, and cash flow. So below are the steps involved in the process of preparing the statement of financial position:

Step 1: Verify the receipts of the supplier’s invoices by comparing the logs from your account statements and the received invoices.

Step 2: Verify and ensure that the customer’s invoices have been shared with them about the items being shipped to them.

Step 3: Analyze if there are any kind of expenses for which the wages have been earned but have yet to be paid.

Step 4: Calculate the depreciation value for all the company’s fixed assets.

Step 5: Calculate the value of the inventory balance.

Step 6: Crate journal entries to record all the adjustments to the accounting records of the business’s bank statement.

Step 7: Post all the account balances into the company’s general ledger.

Step 8: Print the preliminary balance sheets and all other financial statements and review them to avoid errors.

Step 9: Review the income tax expenses.

Step 10: After review, close the ledgers of that period. And then print the final version of the statement of the company’s financial position.

What is a Consolidated Statement of Financial Position?

- A consolidated financial statement is a financial statement of any parent company and its subsidiaries or divisions.

- They consist of a complete income statement, cash flow statement, and balance sheet that provides a 360-degree view of the company’s financial health and its subsidiaries.

- Simply put, a consolidated financial statement shows you insights into the overall financial health of any company and its subsidiaries.

What is a Classified Statement of Financial Position?

- A classified financial statement is a financial report that shows all the expenses, profits, and revenues of the company; further, that has various expense and revenue classifications too.

- This classified format is mainly used for complex financial statements to make them easier to read and understand for users.

- A typical classified statement of financial position contains three sections: the operating expense section, the non-operating expense section, and the gross margin section.

What is the Purpose of the Statement of Financial Position & Explanation?

- The primary purpose of the balance sheet is to represent accurate and vital financial information about any company’s Equity, assets, and liabilities.

- The main reason behind this representation is to reveal the exact financial position of the company at any point in time as and when required.

- The financial information and position shown typically help the investors or other stakeholders to understand and decide upon their investment analysis in that company.

- If any investor asks, it can also provide for the past years to help them understand the company’s deviation and profit analysis.

- Apart from this, it can also be useful for the Management of the company to review and track the financial stability and expenditure going in the company and take respective measures for any improvement if required.

Importance

- It is very important from the investors’ and management’s perspectives as it helps investors analyze the information in the statement to identify the company’s financial health.

- Stakeholders like investors and lending institutions also carry out ratio analysis using the statement of financial position to determine various financial parameters.

- Management uses the statement to identify and track the company’s financial position over a period of time.

- The current period statement can be compared with last year’s statement to track the company’s performance.

- Investors get information about the company’s financial health; based on this statement, they can make investment decisions.

- It also helps determine the company’s liquidity by providing data about the current assets available with the company for settling its current liabilities.

Statement of Financial Position vs. Balance Sheet

- The terms statement of financial position and balance sheet are used interchangeably.

- Both statements present the financial position of an entity at the end of the reporting period by presenting the position of assets, liabilities, and equity.

- International Financial Reporting Standards use the term Statement of Financial Position, while the US GAAP uses the terminology Balance Sheet.

- There are some differences with respect to the presentation of line items as well in both statements.

- Non-profit organizations produce statements of financial position, whereas for-profit companies produce balance sheets.

- Moreover, the assets presented in the balance sheet and the statement of financial position differ significantly.

Final Thoughts

It forms part of an organization’s financial statements and provides useful insight to the users about the company’s financial health. The statement is to be prepared as per the accounting standards applicable to the company based on their jurisdiction.

Frequently Asked Questions (FAQs)

Q.1 What does the statement of financial position show?

Answer: The statement of financial position displays a business’s overall value as of a particular date or year. We can evaluate its current financial position as it presents information on how much the company owns and owes.

Q.2 Is the statement of financial position a balance sheet?

Answer: Yes, the statement of financial position is also known as the balance sheet. An organization’s assets, liabilities, and equity as of the reported date are listed in the statement. As a result, it offers a snapshot of a company’s financial situation as of a particular date.

Q.3 Which financial statement shows the company’s financial position?

Answer: A balance sheet or a statement of financial position records a company’s financial position. It enlists the company’s assets, liabilities, profit, loss, and other financial metrics.

Q.4 Is the statement of financial position a non-profit?

Answer: A balance sheet, often a nonprofit statement of financial condition, is a report that provides a quick overview of your company’s financial situation. In a single document, it winds up your nonprofit’s assets, liabilities, and net assets.

Q.5 Is the statement of financial position for partnership?

Answer: For partnership purposes, each partner has a capital account and a current account in the statement of financial position. The raw contribution and the partners’ equity accounts are combined or divided.

Q.6 How to read a statement of financial position?

Answer: The balance sheet table is primarily read from top to bottom, while the asset and liability columns are read from left to right. The assets are organized from most liquid to permanent from top to bottom. Liabilities are also organized according to maturity, starting with short-term debt and moving to long-term debt.

Q.7 What are the 3 statements of financial position?

Answer: The three statements of financial position that must be provided are the income statement, balance sheet, and statement of cash flows. Traders can use these three statements as learning resources to assess a company’s financial health and quickly determine its underlying value.

Recommended Articles

This is a guide to the Statement of Financial Position. Here we also discuss the definition and components of a statement of financial position, format, and examples. You may also have a look at the following articles to learn more –