Definition of Statement of Income Example

Preparing the statement of income is crucial for the organization as it helps assess the performance and financial position. It is considered one of the three primary financial statements used for this purpose.

Examples of Statement of Income

We shall see some of the basic statements of Comprehensive income examples followed by the different companies at different levels:

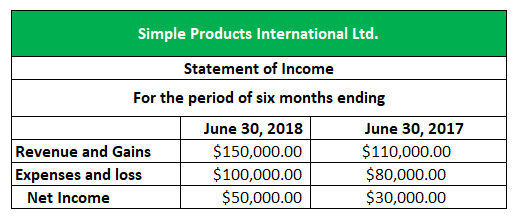

Example #1

Simple Products International Ltd wants to know the net income change for the 6 months ending June 30, 2017, and June 30, 2018. The total revenue and gains generated during the period are $ 110,000 and $ 150,000, respectively, and the total expenses and losses incurred are $80,000 and 100,000. Therefore, prepare the income statement for the six months ending June 30, 2018.

The format used is the single-step format, one of the two most commonly used income statement formats.

The example compares the company’s net incomes during the two periods. This will help the company in analyzing its performance. As in the present case, the company’s revenue increased from $30,000 to $50,000.

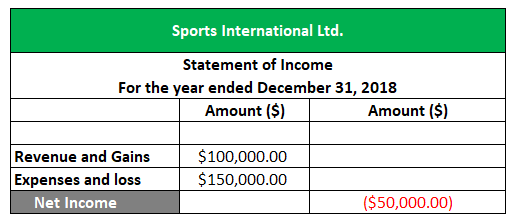

Example #2

Sports Ltd wanted to know the net income/ loss on December 30, 2018. The total revenue and gains generated during the period are $ 100,000, and the total expenses and losses are $150,000. Therefore, prepare the income statement for the period ending on December 31, 2018.

This example shows that during the period under consideration, the company incurred a loss of $ 50,000. Using the income statement, management will know that the company’s expenses and losses are more than the revenue and gains, which is not a good indication. So they can analyze the same and make decisions to correct the company’s financial position.

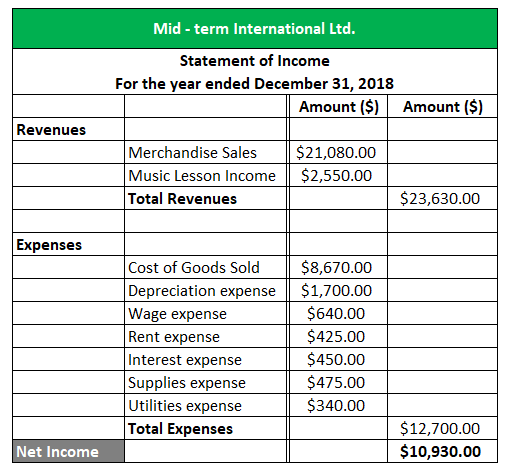

Example #3

Mid-term international ltd started the business one year back, and during the year ended December 31, 2018, it generated revenue by selling merchandise of $ 21080. The cost of goods sold was $ 8670. It has also generated income from other sources by providing a music lesson for $ 2550. The annual depreciation charge comes to $ 1700. In addition, the company paid wages of $ 640, rent of $ 425, interest on a loan of $ 450, supplies expense of $ 475, and utility expense of $ 340.

The management of Mid-term International Ltd wants to know the Net Income position of the company. Therefore, prepare the Statement of income for the year ended December 31, 2018.

It is a Single-step statement of income approach reason being has listed its expenses in a significantly broad category. A single-step statement of Income only shows a single category of all income and all expenses. Moreover, this statement might not be helpful for stakeholders who need detailed information, but it accurately calculates the net income for the year.

In the present case, it can be seen that the company has generated a Net Income of $ 10,930 during the period under consideration.

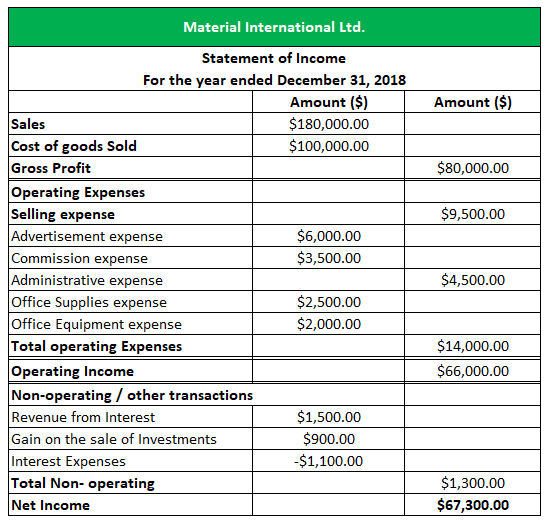

Example #4

Multi-step statement of income.

Material International Ltd started its business on 1st January 2018. The company has generated revenue of $ 180,000 by selling materials. The cost of goods sold of the material is $ 100,000. It has done selling expenses in the advertisement of $ 6,000 and paid commission to sales agents of $ 3,500. The office supplies expense was $ 2,500, and the office equipment expense was $ 2,000. It has made a gain of $ 900 on selling an investment. The interest earned on the loan given was $ 1,500, and the interest paid on the loan taken was $ 1,100. The CFO of Material International Ltd wants to know the Net Income position of the company to analyze it in detail. Prepare the Statement of income for the year ended December 31, 2018.

It is a Multi-step statement of income approach because it separates the expenses account into the more usable and relevant accounts based on their function.

In the present case, it is evident that the company has generated a Net Income of $67,300 during the period under consideration. Separating all the expense accounts into more usable and relevant accounts, it will assist the management and stakeholders review the company’s performance in detail. Consequently, they can make better decisions based on the information provided.

Conclusion

It is noted that the statement of income can be prepared to know the company’s net income by following any of the commonly used discussed methods depending on the management’s demand. For example, they can follow a single-step income statement if they simply want to know the net income. On the other hand, if they want to analyze the net position in-depth, they should prepare it following a multi-step income statement approach. One thing which can be concluded is that net income will be the same in either of the methods. The only difference is the presentation and availability of the data to present the same.

Recommended Articles

This is a guide to the Statement of Income Example. Here we discussed the introduction and how the Income Statement can be calculated together with the Multi-step statement. You can also go through our other suggested articles to learn more –