Updated July 21, 2023

Definition of Statutory Liquidity Ratio

Statutory liquidity ratio is defined as the percentage which the federal bank on in this case, for example, let us consider Reserve Bank of India compulsorily instructs other banks in operation to keep their net demand and time liabilities in the form of liquid assets like cash reserves and gold by every end of day’s business.

The specified ratio of these liquid assets to net demand and time liabilities is defined as a statutory liquidity ratio. The federal bank or RBI has the power to increase the percentage of ratio and thus whenever this happens flow of money into the economy is hampered. The statutory liquidity ratio can also be used as a monetary measure to bring about regulation in the flow of money in the economy and bring about stability in the price of commodities.

Objectives of Statutory Liquidity Ratio

The following can be considered as the various objectives of the statutory liquidity ratio:

To Prevent Over the Liquidation of Banks

RBI or the federal bank employs a statutory liquidity ratio to bring about a check on the bank credit. In the absence of a statutory liquidity ratio, a bank can experience the problem of over liquidity with cash reserve ratio going up making the bank in extreme need of additional funds. The statutory liquidity ratio makes sure the bank remains solvent and also banks invest in government securities which are always considered to be a safer option.

To Tune the Flow of Credit

The statutory liquidity ratio is also used to bring about a rise and dip in the flow of the bank’s credit. During periods of inflation, the federal bank or RBI increases the statutory liquidity ratio whereas during phases of recession it decreases statutory liquidity ratio to allow banks to give the number of credits.

To Ensure Banks Invest in Government Securities

In developing our fast-paced economy banks would like to invest in aggressive markets like the stock markets where returns are more lucrative but at times of volatility in economy government securities and bonds are a better option because they offer a lot more security to the investments.

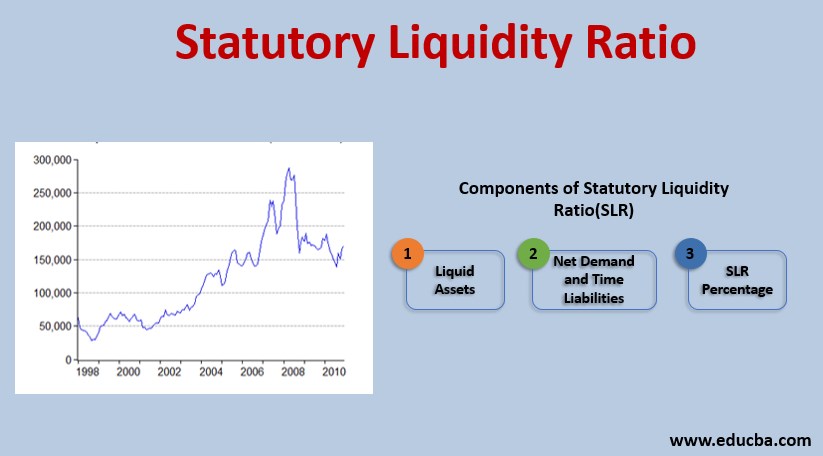

Components of Statutory Liquidity Ratio

The components of the statutory liquidity ratio are as follows:

- Liquid Assets: Liquid assets are the ones that provide the highest level of liquidity and can be easily converted into cash. These can be gold, treasury bills, government-backed securities, government-issued bonds, and cash reserves. Securities can also be part of this provided they belong to market stabilization scheme or they fall under the category of market borrowing schemes.

- Net Demand and Time Liabilities: This is defined as the net demand and time-based liabilities that are held one bank with other banks in business. Demand deposits can be considered as the deposits which on-demand the bank is bound to pay like demand draft, current deposit, overdue FD’s, etc. Time-based deposits are the ones that are only paid back by the bank at the time of maturity. There is maturity or a lock-in period before which the depositor cannot claim back his/her fund. Here one typical example of time-based deposits is fixed deposits. Lastly, time-based liabilities can be considered as the certificate of deposits and investments made in other banks.

- SLR Percentage: The federal bank or RBI fixes this percentage which every bank on a compulsory basis has to follow. Generally, the percentage revolves with an upper band of 40% to a lower band of 23%.

How Does Statutory Liquidity Ratio Work?

Besides maintaining the cash reserve ration banks are instructed to maintain a certain percentage of their net demand and time liabilities in the form of extreme liquid assets like cash reserves or gold with the federal bank or RBI. Treasury bills and securities under market borrowing schemes and market stabilization schemes also form a part of SLR. Every alternate Friday banks are required to report their SLR rate to RBI, failing to which they may be also subjected for penalties. At present, the current rate of SLR as prescribed by RBI is set to be 19%. This means out of total net demand and time liabilities every bank must maintain 19% of it in the form of liquid assets like cash reserves or gold with the RBI.

Difference Between SLR vs CRR

The following are the differences between SLR and CRR:

- SLR demands the bank to maintain reserves in the form of liquid assets which can be both cash and gold whereas in the case of CRR banks have to maintain only cash reserves with RBI.

- Banks can earn money or interest on the deposits they maintain with RBI in cases of SLR whereas in the case of CRR banks earn no interest in maintaining the cash reserve.

- SLR is used to bring about a check on the bank’s leverage option to monitor its credit growth whereas CRR is purely used by RBI to control the liquidity in the banking system.

- In the case of SLR, the securities are maintained by the bank themselves in the form of liquid assets whereas in the case of CRR the cash reserves have to be stored with RBI only.

Impact of Statutory Liquidity Ratio

SLR plays an instrumental role in deciding the base rate of India’s economy. This is the minimum rate beyond which a bank is not allowed to lend money. This base rate is generally fixed by RBI. As SLR plays such an important role to help RBI determine the base rate, RBI has to make sure that the SLR rate is justified and a balanced one. Previously banks were not compelled to maintain anything as such and branches used to have at times no funds for lending and during sudden requirement of credit would fail as a lender.

This is why RBI pitched in and made sure they have some form of reserves always available so that as a lender they never fail and thus came the concept of SLR. SLR plays a significant role of injecting more money into the nation’s economy and participates in the same process towards the development of the country.

Conclusion

SLR has always been a significant number to drive the economy or inject liquidity in it. It also makes sure that banks don’t fail to perform the business of lending. Since it is controlled by RBI, all banks are forced to maintain this without any exception, failing to attract penalties.

Recommended Articles

This is a guide to the Statutory Liquidity Ratio. Here we discuss the introduction and objectives of the statutory liquidity ratio along with how the statutory liquidity ratio works. You may also look at the following articles to learn more –