Updated July 11, 2023

What is Stock Beta?

The term “Stock Beta” refers to the statistical measure that helps assess the volatility in the prices of a stock concerning a benchmark or the entire market as a whole. This is an important Capital Asset Pricing Model (CAPM) component.

The tool uses the risk-free rate, market risk premium, and beta to calculate the expected return of a security or an asset.

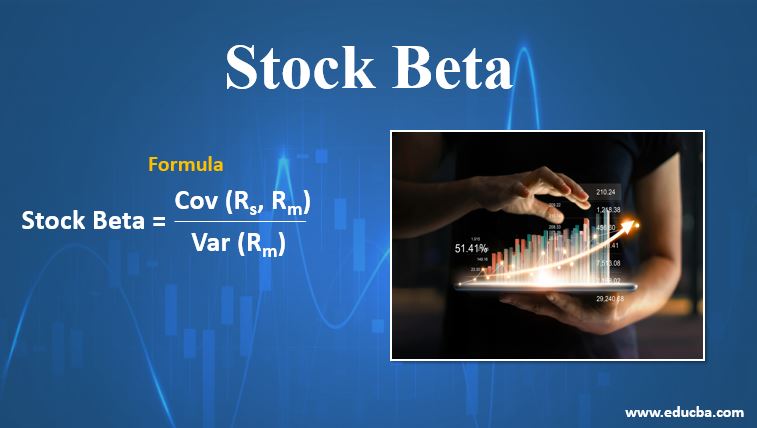

Formula

The formula for it can be expressed by dividing the covariance between a stock’s and the market’s returns by the variance of the market’s returns over a given period. Mathematically, it is represented as,

Where,

- Rs: Returns of the Stock

- Rm: Returns of the Underlying Market

- Cov (Rs, Rm): Covariance Between the Stock Returns and the Market Returns

- Var (Rm): Variance of the Market Returns

Explanation

It helps assess the direction of the price movement of the subject stock concerning the direction of the movement of the benchmark index. Further, it indicates the sensitivity of the stock’s price movement regarding the benchmark or the market. For example, it tells you that if the market has gone up today, then how much is the price of a particular stock going to go up or down based on the value of the same? This can have one of the following three values:

- Beta < 0 or negative beta means an inverse relationship between the stock price movement and the underlying market, i.e., stock price and the market will always move in the opposite direction.

- Beta = 0 means that there is no significant relationship between the stock price movement and the underlying market, i.e., movement in the market is unlikely to impact the stock price.

- Beta > 0 or positive beta means a direct relationship between the stock price movement and the underlying market, i.e., both stock price and the market will always move in the same direction.

Examples of Stock Beta (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

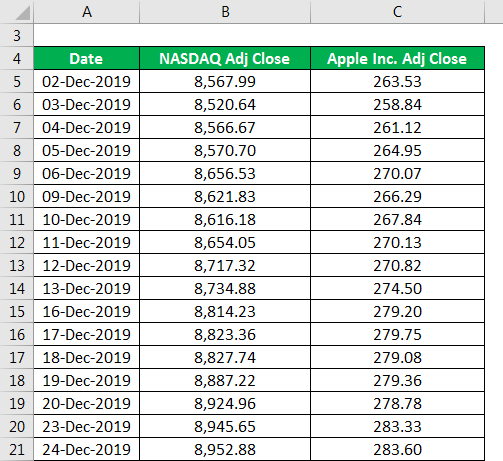

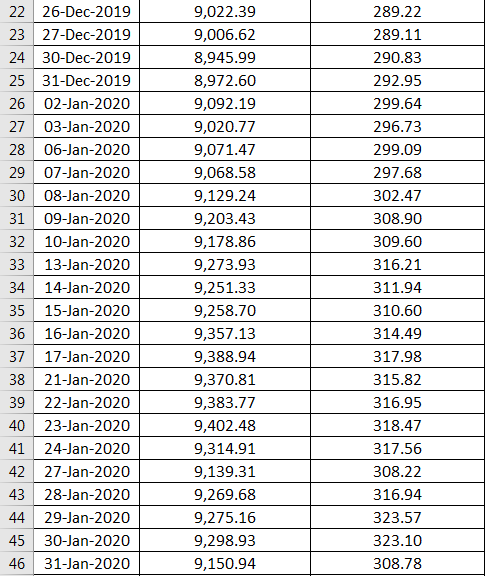

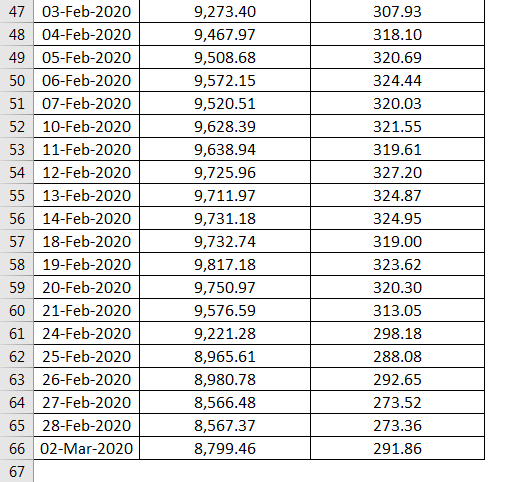

Let us take the example of Apple Inc.’s stock to Calculate the calculation of stock beta. In this case, the NASDAQ composite index is the benchmark, and the price data has been collected for the last three months.

Solution:

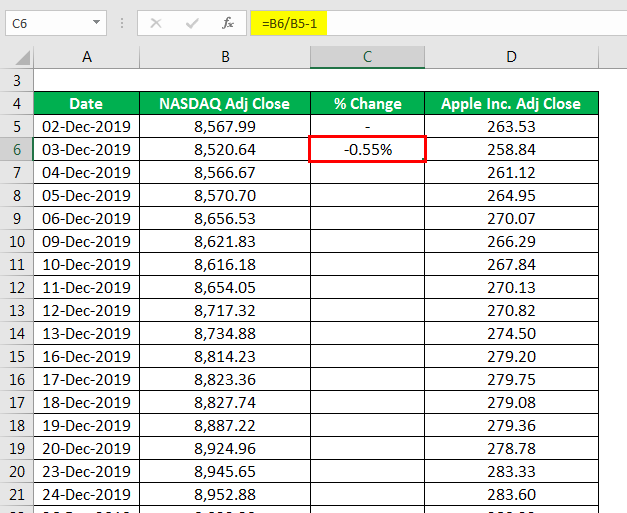

% Change for NASDAQ is Calculated as

Similarly, Calculated below. Also, the same calculation is for % Change Apple Inc.

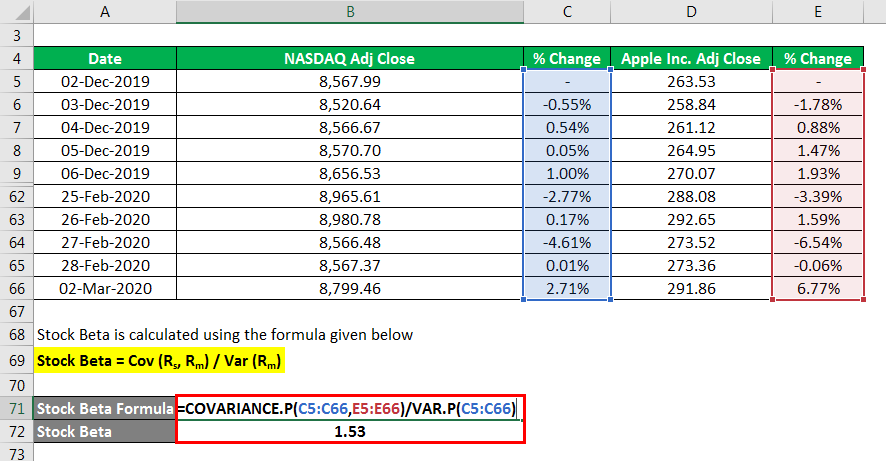

It is calculated using the formula given below

Stock Beta = Cov (Rs, Rm) / Var (Rm)

- Stock Beta = 1.53

In this case, we can see that based on three months of price data Apple Inc.’s stock beta can be calculated as 1.53

Beta Values of Stock

Examples of beta values of stocks of some famous companies are:

- The Boeing Company = 31

- Walmart Inc. = 40

- The Home Depot, Inc. = 97

- The Coca-Cola Company = 39

- The Walt Disney Company = 94

Stock Beta and Volatility

- It measures the stock’s returns concerning a benchmark or market, while volatility measures the stock price movement alone. In other words, It measures relative movement, while volatility measures absolute movement.

- On the other hand, a higher beta value (either positive or negative) corresponds to higher volatility, while a beta value close to zero corresponds to lower volatility.

Advantages and Disadvantages

Below are the points that explain the advantages and disadvantages of the same:

Advantages

Some of the major advantages are:

- First, it can assess an asset’s volatility concerning the overall stock market.

- It is a straightforward and easily quantifiable risk measure.

Disadvantages

Some of the major disadvantages are:

- It is based on historical data, so the output may not accurately indicate future volatility.

- It fails to incorporate any new information.

Conclusion

So, It finds widespread application in the stock market as investors use this statistical tool to determine their portfolio risk (qualitative and quantitative) and associated rewards.

Recommended Articles

This is a guide to the Stock Beta. Here we discuss how to calculate, along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –