Updated July 12, 2023

Definition of Stock Dividend

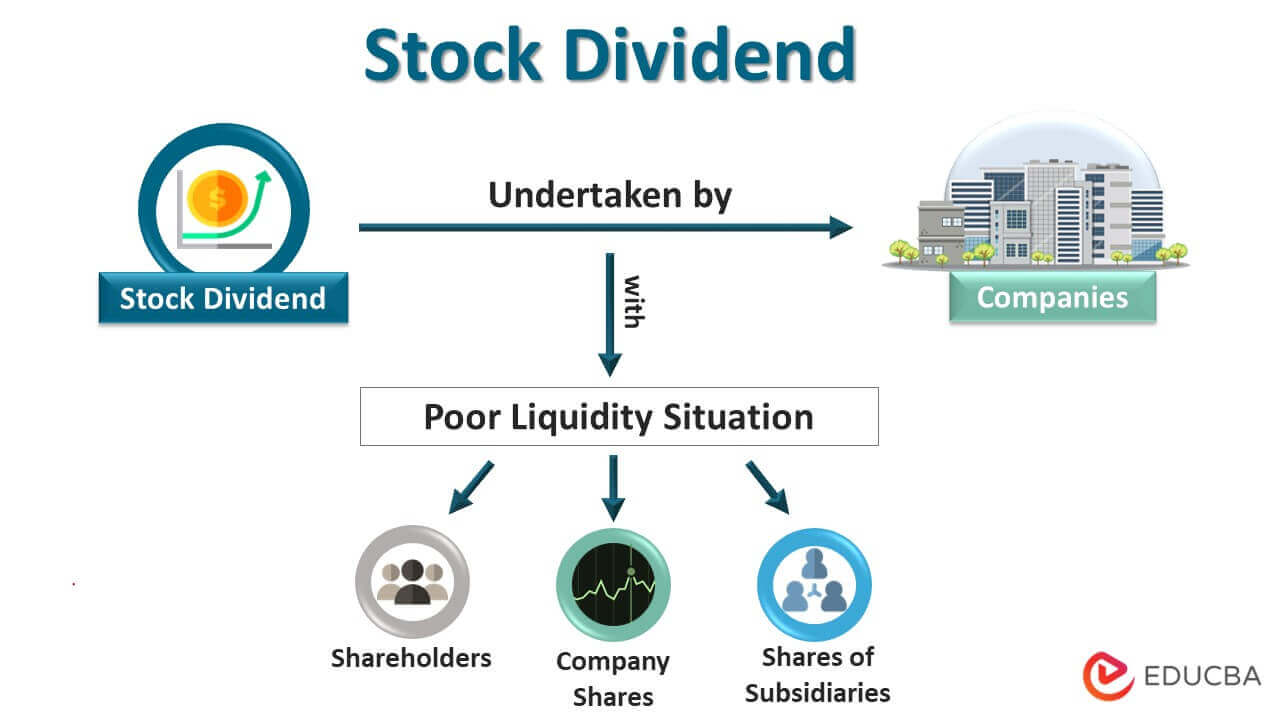

A stock dividend can be defined as a form of dividend distribution undertaken by companies that may have a poor liquidity situation. Under this distribution, existing shareholders are allotted additional company shares or shares of any of its subsidiaries based on the number of shares they own instead of distributing profits in cash.

Explanation

Stock dividends are dividends paid in stock rather than paying cash. It is a method of rewarding shareholders without affecting the company’s cash balance. Issuing additional shares will dilute earnings per share (EPS) and market price per share (MPS). These dividends are generally paid for infractions as a percentage of existing shares. Such dividends are not taxed until the owner sells the shares. Unlike cash dividends, stock dividends do not increase the shareholder’s wealth but only increase the number of shares held, which may lower the market price per share. Simply put, stock dividends are dividends where companies distribute profits to investors by allotting additional company shares instead of cash dividends. Accordingly, an investor can receive a healthy return from the company, and the company also doesn’t lose its cash balance.

How Does it Work?

Stock dividend is simply the distribution of shares instead of cash dividends. It occurs when the company wants to reward its shareholders and investors but does not have a cash surplus or needs the cash for future investments. Stock dividends are also advantageous for investors from a tax point of view, as taxes are levied only when the investor sells the shares or until the company offers the holder the option to take the share or redeem it for cash. Companies may restrict trading for a certain period after issuing such shares. The holding period of stock dividends starts from the date of purchase. Therefore, it is necessary to understand the holding period to determine the qualified tax treatment of dividends. If the stock dividend comes with a cash dividend option, it will be liable to taxation even if it is unsold.

It is essential to understand how stock dividends function. A stock dividend will not impact the shareholders’ funds or the cash balance. Since there is no cash distribution, the cash balance remains unaffected. But why don’t shareholders’ values change?

To answer the above question, one must understand that declaring and distributing stock dividends involves the conversion of retained earnings or any other reserves into share capital. A journal entry will be passed with a debit to Reserves and Surplus and a credit to Share Capital A/c. Since both reserves and surplus and share capital are components of shareholders’ funds, a debit and equivalent credit will result in the shareholders’ funds remaining unchanged.

Example of Stock Dividend

James is a shareholder of Walmart Inc. and holds 2,000 shares. Due to the company’s poor profits, it declared a 20% stock dividend. Currently, the stock price is $20, and are 200,000 shares outstanding. What will be the effect of this dividend on James’ holdings?

Calculate the new MPS and determine the effect on shareholders’ funds.

Solution:

- The market capitalization of Walmart Inc. before dividend declaration:

2,00,000 * $20 = $40,00,000

- The total increase in outstanding shares:

2,00,000 shares * 20% = 40,000 shares

- Total shares outstanding after a 20% increase:

2,00,000 + 40,000 = 2,40,000

- James’s new ownership:

2,000 shares + 20% = 2,400 shares

- Price per share of Walmart Inc. after stock dividend:

Market capitalization / Total outstanding shares (Since market capitalization remains unaffected)

$40,00,000 / 2,40,000 = $16.66

Hence, declaring a stock dividend does not affect market capitalization but increases the number of shares.

Impact of Stock Dividends

When a stock dividend is declared, there is no actual increase in the value of shareholders’ funds. Instead, what gets affected is the price of the stock, similar to cash dividends. When stock dividends are declared, the stock price often increases. However, as the stock dividend increases the number of outstanding shares, the company’s total value remains the same, diluting the market value per share. Since the overall market capitalization remains unchanged, the stock dividend does not impact the shareholders’ net worth. However, it can generate liquidity for shareholders. Due to the increase in the number of shares, shareholders can sell some while retaining the balance.

Journal Entries for Stock Dividends

Genius Inc. has 10,000 common shares outstanding and has declared a 10% stock dividend. A stock’s par value is $10, and the market value is $100. Write down its journal entries accordingly:

Solution:

The number of new shares to be issued:

10000 * 10% = 1000 shares

Journal entry on the date of declaration

| Date | Particulars | L/f | Debit | Credit |

| —- | Retained Earnings A/c Dr. | 1,00,000 | ||

| To Dividend Payable A/c | 1,00,000 | |||

| (Being Stock dividend announced by the company) | ||||

| —- | Dividend Payable A/c Dr. | 1,00,000 | ||

| To Common Stock A/c | 10,000 | |||

| To Paid in Capital in excess of Par A/c | 90,000 | |||

| (Being Stock dividend distributed by the company) | ||||

Advantages

Some of the advantages are as follows:

- A stock dividend proves advantageous for the company as it honors its commitment to dividend distribution without affecting its working capital. Providing stock dividends helps save cash outflows and does not affect the company’s liquidity. During hard times when the company doesn’t have sufficient cash to pay dividends, stock dividends are helpful in such a situation. The net cost to the company of a stock dividend is negligible.

- Cash dividends are considered income in the year of receipt and are liable for tax, whereas stock dividends are not taxed in the hands of shareholders unless sold.

- By issuing stock dividends, a company can increase the liquidity of its shares as it increases the number of shares in the market.

Disadvantages

Some of the disadvantages are as follows:

- The market may observe the declaration of stock dividends as a liquidity shortage. The market participants might feel that the company is in a distressed position and is facing a liquidity crunch, which in turn may negatively impact the company’s share market price.

- As the stock dividend does not increase shareholders’ wealth immediately, some might feel dissatisfied as the company didn’t pay anything in cash.

- The stock dividend will always lead to a falling share market price, which confident investors might not understand. This, in turn, creates selling pressure on the stock.

Conclusion

A stock dividend can reward shareholders with additional company shares instead of paying them in cash. The stock dividend does not impact a shareholder’s net worth. However, it increases the number of shares in the market, generating additional liquidity for shareholders. Declaring stock dividends instead of cash dividends may be perceived positively and negatively by different stakeholders. While some may see it as a sign of a company facing liquidity crunch issues, others may view it as a means of saving for reinvestments in future business development and growth.

Recommended Articles

Here are some further related articles for expanding understanding: