Understanding How Stock Results Impact Stock Markets

Getting the nuances of financial markets might be demanding, but it is essential for investors and traders. The release of financial stock results impact market movements, influencing investment decisions and market sentiment. These announcements provide a snapshot of a company’s performance and prospects, offering critical data for stakeholders.

When companies announce their financial performance, it affects the dynamics, reflecting investor reactions to the results. Analysts and investors closely scrutinize these results to adjust their strategies accordingly. Analyzing the impact of stock results today provides valuable insights into current market movements and future investment opportunities.

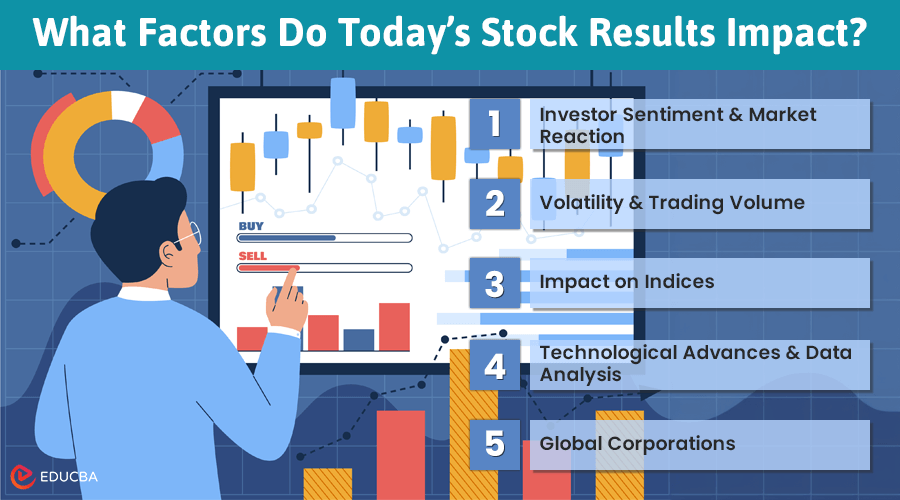

Which Factors are Impacted by Stock Results?

Here are the factors that stock results can impact:

#1. Investor Sentiment and Market Reaction

Financial outcomes play a critical role in shaping investor sentiment. Positive results often increase investor confidence, driving up demand and prices. Conversely, disappointing outcomes can lead to selling pressure and declining prices.

Reaction to financial performance does not come solely from numbers but also from how they compare to market expectations. Surpassing expectations can lead to a bullish trend while falling short can result in bearish movements. Therefore, understanding its sentiment is crucial for predicting subsequent movements.

#2. Volatility and Trading Volume

Financial announcements can lead to significant market volatility. Traders often anticipate these announcements and position themselves accordingly, increasing trading activity.

The impact of stock results can cause sharp price movements, creating opportunities for traders to capitalize on short-term fluctuations. We can observe high trading volumes during such periods, reflecting heightened activity. This increased activity underscores the dynamic nature of market responses to financial news.

#3. Impact on Indices

The performance of major companies influences stock market indices, which are benchmarks for overall market performance. Positive or negative financial announcements by large-cap companies can lead to movements in indices, affecting investor sentiment. Indices represent a broad range of stocks, so significant changes in a few major stocks can sway the overall index direction. As a result, these indices serve as a barometer for broader market health.

#4. Technological Advances and Data Analysis

Technology integration in financial analysis has revolutionized how investors and analysts interpret stock results. Advanced data analytics tools provide deeper insights and more accurate predictions of market movements. These technologies enable faster, more efficient processing of financial data, helping investors react swiftly to new information. Technological advancements ensure a competitive edge in understanding and responding to stock results. As technology evolves, its role in financial analysis will become even more significant.

#5. Sector-Wide Implications

The performance of a single company can have ripple effects across its sector. When a leading company in a sector announces strong results, it often boosts the sentiment for other companies in the same sector. Investors may interpret this as a sign of overall sector health, leading to increased investment. Conversely, poor performance by a major player can dampen enthusiasm for the entire sector, causing broader implications. This sector-wide impact highlights the interconnected nature of market participants.

#6. Global Corporations

The financial performance of major companies can have global implications. Multinational corporations with significant global operations can influence markets beyond their home countries. Strong results from such companies can boost investor confidence worldwide, while weak performance can lead to a global downturn. Consequently, global investors must stay informed about these influential results.

Future Outlook

While past performance is crucial, forward-looking statements and guidance companies provide during financial announcements are equally important. Investors pay close attention to the future outlook as it provides insights into potential growth and challenges. Positive guidance can lead to optimistic market reactions, while cautious or negative outlooks can temper investor enthusiasm. This forward-looking information is critical for shaping long-term investment strategies.

Final Thoughts

The impact of stock results today on market movements is profound and multifaceted. Knowing these dynamics helps investors and traders make informed decisions, navigating the complexities of financial markets with greater confidence. By staying informed and adapting to new information, market participants can better position themselves for success.

Recommended Articles

We hope this article on “Stock Results Impact” was helpful to you. For similar articles, check these links.