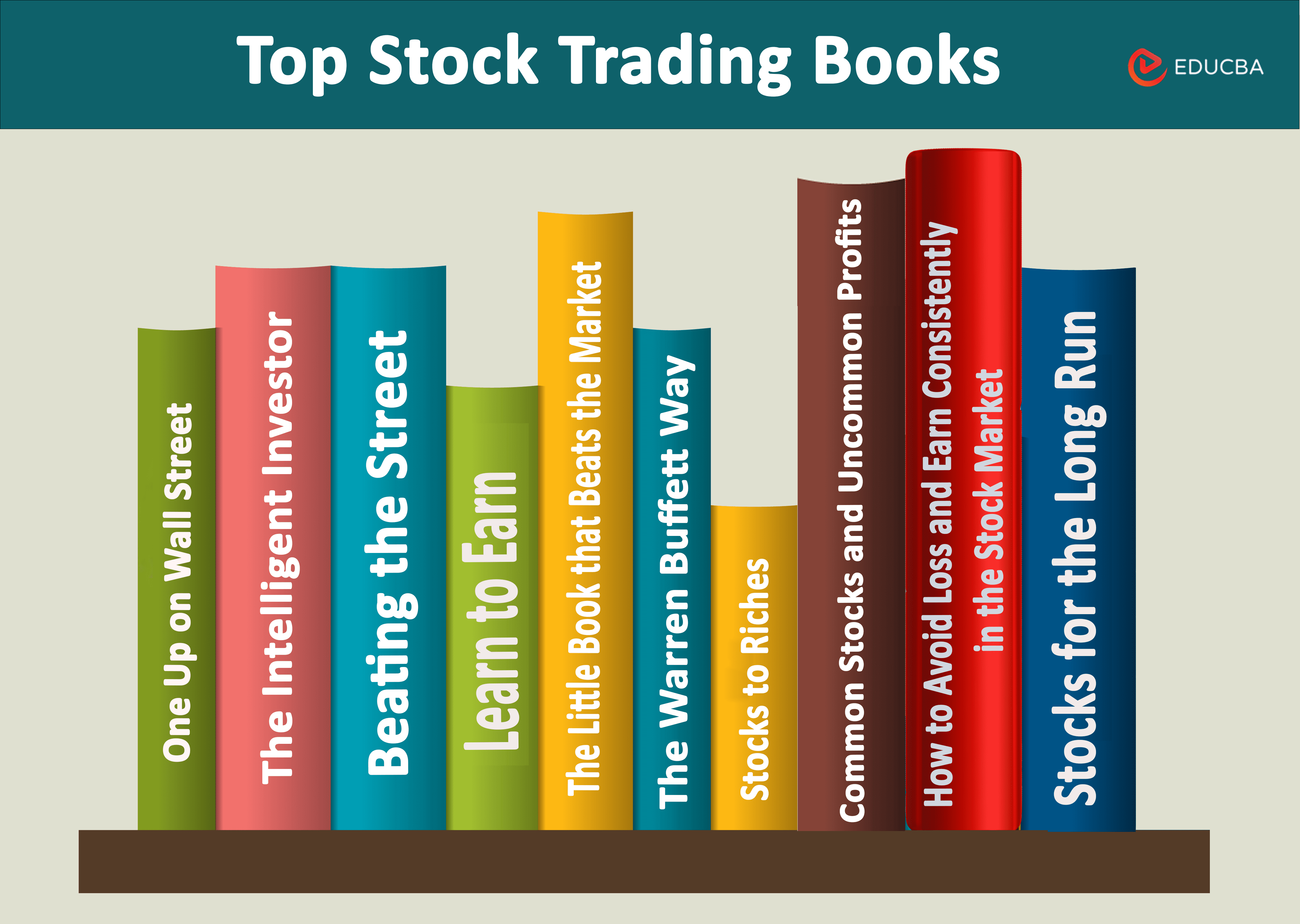

Stock Trading Books – Introduction

Trading in stocks means purchasing and selling a company’s stocks to make profits. However, it is not as simple as it sounds; it carries the danger of huge losses. It means traders must learn about the stock market, analyze trends, monitor price movement, etc., to make a successful trade. Therefore, these stock trading books are crucial for anyone who wants to make substantial profits from trading in stocks.

These 10 stock trading books will help everyone, whether a beginner or someone who has been in the field for a while.

| # | Stock Trading Books | Author | Originally Published | Rating |

| 1. | One Up on Wall Street | Peter Lynch | 1989 | Amazon: 4.5 Goodreads: 4.3 |

| 2. | The Intelligent Investor | Benjamin Graham | 1949 | Amazon: 4.5 Goodreads: 4.25 |

| 3. | Beating the Street | Peter Lynch | 1993 | Amazon: 4.4 Goodreads: 4.09 |

| 4. | Common Stocks and Uncommon Profits | Philip Fisher | 1957 | Amazon: 4.3 Goodreads: 4.13 |

| 5. | The Little Book that Beats the Market | Joel Greenblatt | 2006 | Amazon: 4.4 Goodreads: 4.05 |

| 6. | The Warren Buffett Way | Robert Hagstrom | 1994 | Amazon: 4.4 Goodreads: 4.17 |

| 7. | Stocks to Riches | Parag Parikh | 2005 | Amazon: 4.3 Goodreads: 4 |

| 8. | Learn to Earn | Peter Lynch & John Rothchild | 1995 | Amazon: 4.4 Goodreads: 4.04 |

| 9. | How to Avoid Loss and Earn Consistently in the Stock Market | Prasenjit Paul | 2015 | Amazon: 4.4 Goodreads: 4.39 |

| 10. | Stocks for the Long Run | Jeremy Siegel | 1994 | Amazon: 4.6 Goodreads: 4.12 |

Let us now review each of the stock trading or technical analysis books in detail so that you can find the one that fits your needs.

Book #1: One Up On Wall Street

Author: Peter Lynch

Get the book here.

Review:

This book encourages new investors to trust their instincts and take advantage of their own unique perspectives while picking strokes to invest in. The author, Peter Lynch, a highly successful investor, shares his insights and strategies in an accessible manner, dividing the book into three sections: Preparing to Invest, Picking Winners, and The Long-Term View. It is an excellent resource for people who are new to investing.

Key Points:

- The author argues that new investors can outperform professionals by thinking independently and avoiding the usual trading mentality.

- The book categorizes stocks into six types: Slow Growers, Stalwarts, and Fast Growers.

- The book explains the concept of “Multi Baggers,” stocks that multiply in value over time.

- Lynch advises investors to focus on the long term, maintaining a diversified portfolio of three to ten stocks.

- The book also emphasizes that selling decisions should be based on changes in a company’s fundamentals rather than stock prices.

Book #2: The Intelligent Investor

Author: Benjamin Graham

Get the book here.

Review:

Are you a new investor looking for a guide to navigate the complexities of stock markets? Then, “The Intelligent Investor” by Benjamin Graham is the book you should read. The book offers a comprehensive guide to concepts and methods of stock analysis. This book is ideal for those looking to enhance their investment portfolio.

Key Points:

- The author mentions that analyzing investments for the long term is important for protecting yourself from losses.

- The book advises investors to choose stocks based on their fundamental value, not popularity or short-term trends.

- The book also warns against blindly trusting market fluctuations, represented as “Mr. Market,” and encourages investors to follow a strict investment formula.

- Successful investing means skillfully handling risk and understanding that getting rid of all risks is impossible.

Book #3: Beating the Street

Author: Peter Lynch

Get the book here.

Review:

As we read from the book, we can see how Peter Lynch’s investment philosophy aligns with principles like personal experience, patience, and focus. As per the author, focusing on real businesses, analyzing long-term fundamentals, and disciplined decision-making can go a long way. Both Warren Buffet and Peter Lynch emphasize the importance of individual stock research, patience, and avoiding macroeconomic predictions.

Key Points:

- The book teaches you that to make successful investment decisions, you need to understand consumer preferences, such as popular retail choices.

- The author states that to be successful in stock trading, you need to have patience and focus on long-term investments.

- While he offers his method and specific stock examples, he cautions that discipline, research, and understanding a company’s long-term potential are crucial.

- The book also mentions that following advice after analyzing macroeconomic factors may not be as useful.

Book #4: Common Stocks and Uncommon Profits

Author: Philip Fisher

Get the book here.

Review:

Investing in stocks requires self-control and a rational mindset. This book by Philip Fisher provides insights for investors striving for consistent, long-term wealth growth. The author helps us learn about the basics of the market and then offers us lessons on how to invest. It is a valuable guide for investors wanting to make smart decisions.

Key Points:

- The book talks about the scuttlebutt method and various analysis techniques to evaluate potential investments.

- The author teaches us the trick to making profits and how to make smart investment decisions.

- The book states that we must embrace a long-term perspective, focusing on the future rather than succumbing to short-term market sentiment.

- The author also highlights Warren Buffett’s mantra and approaches.

Book #5: The Little Book That Beats the Market

Author: Joel Greenblatt

Get the book here.

Review:

Investing is a challenging journey, and Joel Greenblatt, using his years of experience, helps us learn the crucial principles from his book. It is a comprehensive guide for investors, emphasizing the value of self-reliance and discipline. The book is an excellent teacher for both new and existing investors.

Key Points:

- The author states that we should take advantage of the fact that the stock market offers opportunities to buy stocks below their intrinsic value or sell them for more than they are worth.

- The author introduces the Magic Formula as a systematic approach to identifying quality companies at bargain prices.

- He also mentions that successful investing happens over the long term, and short-term market fluctuations can be misleading.

- The book teaches that using various measures of value, such as low P/B, P/E, P/FCF, P/S, and P/dividend, can lead to success.

Book #6: The Warren Buffett Way

Author: Robert Hagstrom

Get the book here.

Review:

The author presents a compelling narrative of Buffett’s early investment lessons and his journey to becoming a financial legend in this book. The book delves into Buffett’s extraordinary strategic decisions and skills that propelled him to a net worth exceeding $100 billion. It shows us how challenging conventional investment wisdom helped Warren Buffet win the stock market.

Key Points:

- The book gives us an insight into Warren Buffet’s early years and how and where he learned the stock trading secrets.

- The author also talks about Buffett’s investment philosophy.

- It explores various aspects of Warren Buffet’s life to help us understand how he formed his current strategies.

- The author states that despite market theories like the Efficient Market Hypothesis, Buffett’s success is attributed to skill rather than chance, showcasing his ability to consistently beat the market.

Book #7: Stocks to Riches

Author: Parag Parikh

Get the book here.

Review:

This book is a simple yet comprehensive guide covering the fundamental concepts of stock markets. From investing strategies to psychological aspects, the book offers valuable insights for both novice and experienced investors. In simple and relatable language, “Stocks to Riches” provides a wealth of knowledge, making it a valuable resource for anyone navigating the complex world of stock markets.

Key Points:

- The book emphasizes that diligent research, global awareness, and emotional resilience are key to achieving superior returns in the stock market.

- Addressing loss aversion, the author provides relatable examples and a checklist to help readers avoid falling prey to the sunk cost fallacy.

- The book explores the strategy of segregating gains and integrating losses, offering valuable insights into optimizing investments.

- The chapter on mental accounting highlights relatable examples, emphasizing the importance of treating money objectively and not assigning emotional value based on its source.

Book #8: Learn to Earn

Author: Peter Lynch & John Rothchild

Get the book here.

Review:

Another famous book by Peter Lynch, “Learn to Earn,” covers how individuals can actively engage with the corporate world surrounding them. The author connects the daily experiences we have with corporate products. It also clarifies corporate terminology and provides insights into the legal aspects of incorporation. It is best for those interested in understanding the distinction between private and public companies or young investors eager to grasp the fundamentals of investing.

Key Points:

- The author distinguishes between private and public companies, highlighting the inclusive nature of stock ownership.

- The book paints a relatable picture of daily life, unfolding the opportunity to transform this involvement into active participation.

- Delving into the concept of corporations, the book demystifies the term and its Latin origin, “corpus” (meaning “body”).

- The book promotes investing as something that brings people together, regardless of differences like gender, ethnicity, or education level.

Book #9: How to Avoid Loss and Earn Consistently in the Stock Market

Author: Prasenjit Paul

Get the book here.

Review:

This book gives practical advice on stock market strategies. It outlines key indicators to avoid high-risk stocks. The author offers valuable insights to enhance returns and minimize losses. “How to avoid loss and earn consistently in the stock market” stands out for its simplicity. The book receives a top rating for its language, relevance, and applicability to beginners and intermediate investors.

Key Points:

- The book’s language is beginner-friendly, making it suitable for a wide audience, including professionals seeking a quick recap.

- It presents a set of rules for investing, focusing on fundamental values over short-term trends.

- The author equips readers with checklists to streamline stock selection, buy/sell decisions, and risk avoidance.

- He also stresses the significance of having an exit strategy, guiding investors on when to sell stocks.

Book #10: Stocks for the Long Run

Author: Jeremy Siegel

Get the book here.

Review:

This last book in the list of stock trading books is a wonderful resource for investors seeking to understand the potential of stocks. The author emphasizes the value of patience, a global investment perspective, and a focus on long-term fundamentals. This book is especially for those interested in stock markets and wealth generation.

Key Points:

- The author states that defining risks will help you choose stocks more efficiently.

- He also breaks the myth that high-growth sectors or countries guarantee the highest returns.

- The book argues that investing in global companies can open doors to diverse opportunities.

- Moreover, analyzing dividends and sources of shareholder value can also give you important insight into a company’s performance.

Recommended Books

We hope you found this EDUCBA guide on the top 10 stock trading books helpful. Check the following recommendations for similar articles,