Updated November 6, 2023

Difference Between Stocks vs Mutual Funds

To describe the ownership certificates of any given company, a general term is used to describe Stocks, while the ownership certificates of a particular company are referred to as shares. Stocks invest in companies listed on a particular stock exchange. When someone says that they own mutual funds, it means that they have invested their money in a pool of funds collected from various investors. This pool of funds is invested according to stated investment objectives. Investors hold a proportionate share of the fund in the mutual fund. New investors come in, and old investors can exit at prices related to net asset value per unit.

In simple terms, when we refer to owning more than one share in a company or a few companies, we generally use the term “stocks”. This is because “stocks” typically refer to a portfolio of shares. On the stock markets, mutual funds are traded as equity or debt mutual funds.

Stocks

Whenever a company plans to raise capital, it can issue stocks or try to borrow some money. Those who own stocks in a public company may be referred to as stockholders, stakeholders, and shareholders, and in reality, all three terms are correct. They are the securities that represent a part of ownership in the corporation. When an investor buys a company’s stock, that person is not lending the company money but buying a percentage of ownership. In exchange for purchasing supplies in a given company, stockholders have a claim on the part of its earnings and assets.

Some stores pay monthly, quarterly, or annual dividends, a portion of the issuing company’s earnings. Investing in stocks can be profitable in two regards. Not only do you stand a chance to receive dividends, but if the company whose stock you own performs well and its stock price goes up, you could make money by selling that stock for a price higher than what you paid.

Mutual Funds

Mutual funds are the best financial product ever designed; for small investors, mutual funds can be open-ended or close-ended. In an open-ended fund, the sale and repurchase of units happen continuously, at NAV-related prices, from the fund itself. The corpus of open-ended funds, therefore, changes every day. A close-ended fund offers units for sale only in the IPO. Usually, close-ended funds trade at a discount to NAV. Investors wanting to buy or sell units must do so in the stock markets. Mutual fund Various product categories are possible: equity, debt, hybrid, commodity, real estate, exchange-traded funds, and fund of funds.

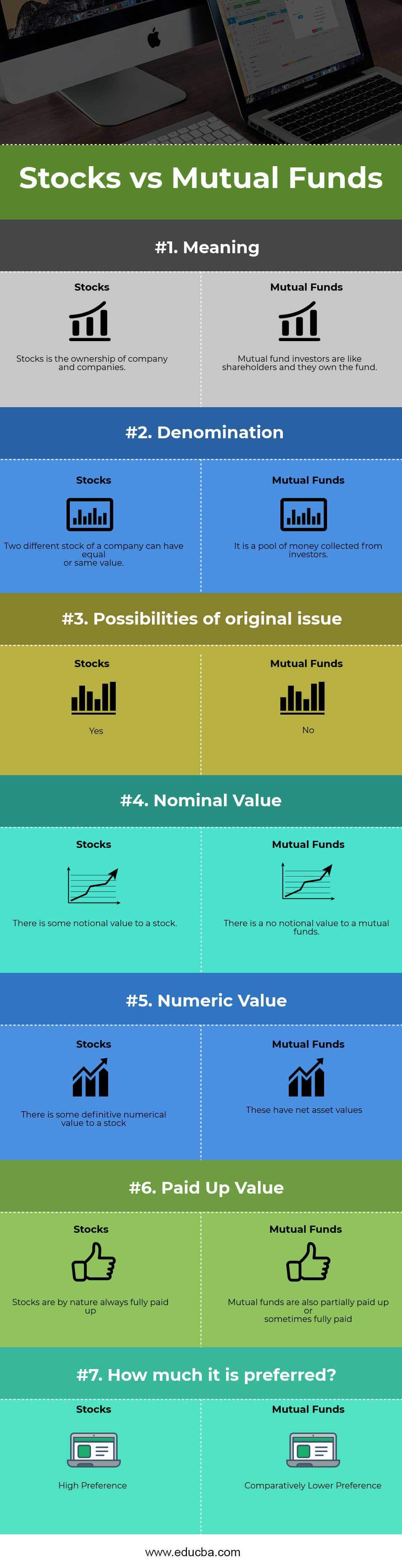

Head To Head Comparison Between Stocks vs Mutual Funds (Infographics)

Below is the top 7 difference between Stocks and Mutual Funds:

Key Differences Between Stocks vs Mutual Funds

As you can see, there are many differences between Stocks and Mutual Funds. Let’s look at the top difference between Stocks and Mutual Funds –

- Stocks are the collection of shares of multiple companies or are a collection of shares of a single company.

- Mutual funds money is invested in marketable securities according to the investment objective.

- A stock is a collection of claims. Mutual Funds are a collection of money.

- Stocks are risky as market sentiments and global news can impact the stock market instantly.

- Strong mutual funds provide broad, risk-controlled exposure to the market’s sectors without watering down their managers’ best ideas amid hundreds of picks.

- Mutual Funds represent the diversified portfolio of companies, while stock is a simple aggregation of Mutual Funds in a company.

- Mutual funds may not outperform the index, but stocks do.

- Companies issue Mutual Funds. It is known as an equity mutual fund when the Mutual Funds invest in equity funds while stocks are equities.

- For instance, let’s say Mr. James has bought funds for JP Morgan; in this case, we will say Mutual Funds can have many companies under the fund’s asset allocation. On the other hand, if Mr. James has ownership of certificates from several different companies as well, One could claim that Mr. Anderson has certificates of stocks and not shares.

Head To Head Comparison Between Stocks vs Mutual Funds

Below is the topmost comparison between Stocks vs Mutual Funds:

| The basis Of Comparison | Stocks | Mutual Funds |

| Meaning | Stocks are the ownership of a company and companies | Mutual fund investors are like shareholders, and they own the fund |

| Denomination | Two different stocks of a company can have equal or the same value. | It is a pool of money collected from investors. |

| Possibilities of the original issue | Yes | No |

| Nominal Value | There is some notional value to a stock | There is no notional value to mutual funds |

| Numeric Value | There is some definitive numerical value to a stock | These have net asset values |

| Paid-Up Value | Stocks are by nature always fully paid up | Investors partially pay up or fully pay mutual funds. |

| Preference level | High Preference | Comparatively Lower Preference |

Conclusion

Stocks vs. Mutual Funds are both important on their terms. And they both Stocks vs. Mutual Funds help determine the ownership in the company or companies and invest in companies as owners or as asset allocation, respectively.

Mutual funds Investors hold a proportionate share of the fund in the mutual fund. When we calculate quantity for different companies, it can be wholly called stock. New investors come in, and old investors can exit at prices related to net asset value per unit.

Investors can benefit from mutual funds due to several advantages, such as portfolio diversification, professional management, reduction in risk, lower transaction costs, liquidity, convenience, and flexibility.

One of the primary benefits of investing in the stock market is the chance to grow your money, i.e., investment Gains. The stock market tends to rise in value, though the prices of individual stocks rise and fall daily over time. Investments in stable companies that can grow more care to make more profits for investors.

Can an investor use both Stocks vs. Mutual Funds? The answer is yes; both Stocks vs. Mutual Funds have been discussed with their respective meanings and usage, along with the difference between Stocks and. Mutual Funds in this article.

Recommended Articles

This has guided the top differences between Stocks and Mutual Funds. Here we also discuss the key differences between stocks vs. Mutual funds with infographics and a comparison table. You may also have a look at the following stores vs. Mutual Funds articles to learn more-