Best Books to Learn Structured Finance

Structured finance is an intricate form of financing designed to solve large corporations’ financial issues that traditional forms of financing cannot solve.

This list of the best-structured finance books helps everyone better understand the subject. A firm hold on structured finance can ultimately help one’s career and business.

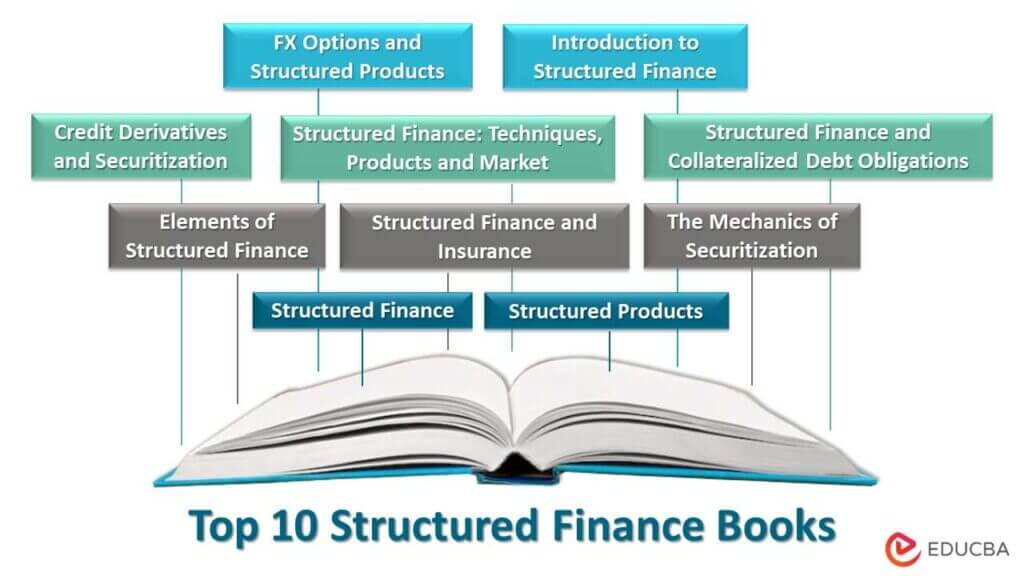

Here we have the list of the top 10 structured finance books:

|

# |

Book | Author | Published |

Rating |

| 1 | Structured Finance | Charles-Henri Larreur | 2022 | Amazon: 4.8

Goodreads: 5.00 |

| 2 | Structured Finance: Techniques, Products and Market | Stefano Caselli and Stefano Gatti | 2017 | Amazon: 4.5

Goodreads: 3.00 |

| 3 | Introduction to Structured Finance | Frank Fabozzi, Henry Davis, and Moorad Choudhry | 2006 | Amazon: 4.7

Goodreads: 3.73 |

| 4 | Structured Finance and Collateralized Debt Obligations | Janet Tavakoli | 2019 | Amazon: 3.7

Goodreads: 4.00 |

| 5 | Elements of Structured Finance | Ann Rutledge and Sylvain Raynes | 2010 | Amazon: 3.5

Goodreads: 5.00 |

| 6 | The Mechanics of Securitization | Moorad Choudhry | 2013 | Amazon: 4.5

Goodreads: 4.07 |

| 7 | Credit Derivatives and Securitization | Janet Tavakoli | 2022 | Amazon: 3.3

Goodreads: 3.97 |

| 8 | Structured Products | Roberto Knop | 2002 | Amazon: 4.6

Goodreads: 4.33 |

| 9 | Structured Finance and Insurance | Christopher Culp | 2006 | Amazon: 4.4

Goodreads: 4.11 |

| 10 | FX Options and Structured Products | Uwe Wystup | 2017 | Amazon: 5.0

Goodreads: 4.38 |

Given below are the reviews and key takeaways from the top 10 structured finance books listed above:

Book #1: Structured Finance

Author: Charles-Henri Larreur

Buy this book here.

Review:

The basic rationale adopted by the author in this book is that structured finance transactions are not set up to directly finance a company but rather a specific asset or a portfolio of clearly defined assets. This book provides a detailed introduction to asset-based lending and non-recourse financing techniques. The author also comprehensively analyzes leveraged buyouts, project finance, asset finance, and securitization techniques.

Key Points:

- This book will help readers understand the main techniques of structured finance through numerous case studies and practical examples.

- This book briefly introduces leveraged buyouts, project finance, asset finance, and securitization.

- It also helps understand the global context and the regulatory framework structured finance operates.

Book #2: Structured Finance: Techniques, Products, and Market

Author: Stefano Caselli and Stefano Gatti

Buy this book here.

Review:

This book extensively covers asset securitization, structured leasing transactions, project finance, and leveraged acquisitions. It covers both the technical and regulatory implications of structured finance. The authors provide insights into various segments of the structured finance business. Particularly, it gives information regarding market trends, deal characteristics, and deal structuring.

Key Points:

- The book highlights the best market practices for undertaking structured finance transactions.

- Readers of this book will gain an understanding of the novel areas of intervention. These include public-private partnerships and non-performing loans in the resolution of bank restructuring.

- This book clearly explains the common characteristics of structured finance transactions.

Book #3: Introduction to Structured Finance

Author: Frank Fabozzi, Henry Davis, and Moorad Choudhry

Buy this book here.

Review:

This book begins with a thought-provoking case study on how Enron affected the boundaries of structured finance. It is a good book to understand the instruments and techniques used in structured finance, such as derivatives, securitization, and special-purpose vehicles.

Key Points:

- This book states that a large part of structured finance in today’s markets involves securitization.

- Learning about structured finance’s basic concepts, instruments, techniques, and benefits is a good book.

- The author also clarifies the use of interest rate derivatives in securitization transactions.

Book #4: Structured Finance and Collateralized Debt Obligations

Author: Janet Tavakoli

Buy this book here.

Review:

This book is a wealth of practical information on securitization, derivatives, and global systemic risk. The author also explains the issues surrounding credit products like collateralized debt obligations, corporate bonds, and mortgage-backed securities.

Key Points:

- This book will help readers understand the flaws of some structured finance products and how they are used to commit fraud.

- It helps understand everything about collateralized debt obligations and flawed structured finance products that led to the subprime crisis.

- The author also explains how corporations can use structured finance to lower funding costs.

Book #5: Elements of Structured Finance

Author: Ann Rutledge and Sylvain Raynes

Buy this book here.

Review:

The author covers fundamental concepts related to structured finance and securitization in school and workplace contexts. It also covers advanced structured analysis topics such as data analysis, Markov chains, recovery modeling, and valuation of structured securities.

Key Points:

- This book is useful for students, academics, analysts, investors, and asset management companies.

- This book captures the fundamentals of structured finance that should be useful for new and experienced investors.

- It covers various concepts related to structured finance in simple language.

Book #6: The Mechanics of Securitization

Author: Moorad Choudhry

Buy this book here.

Review:

Securitization is said to be the core of structured finance. Securitization has been used for a long time. However, a lack of information exists on how it is structured and closed successfully.

Key Points:

- This book is a good step-by-step practical guide to structuring and closing asset–backed security transactions.

- In this book, the author explains how banks implement and closed securitization transactions in the post-subprime period.

- The author provides much-needed insights on how to list and close deals in this book.

Book #7: Credit Derivatives and Securitization

Author: Janet Tavakoli

Buy this book here.

Review:

The author explains the amplification of the flaws in collateralized debt obligations during the subprime crisis by the leverage and opacity of credit derivatives technology used to transfer risk. This book delves into the principles and processes of the credit derivatives market using only the fundamental rules of investment theory.

Key Points:

- This book introduces new insights on how to avoid being on the wrong side of credit derivatives transactions.

- This book also provides examples of market windfalls achieved through credit derivatives during the global financial crisis 2008.

- It also talks about the economic crash caused by the global reaction to the COVID-19 pandemic and its aftermath.

Book #8: Structured Products

Author: Roberto Knop

Buy this book here.

Review:

This book adopts a practical approach to explain the main structured products developed over the past few years by considering each product’s risks, valuation, and key elements.

Key Points:

- The author explains the 10 golden rules of structured products through in-depth research and analysis.

- This book takes a practical approach to explain the main structured products used in financial markets.

- This book also covers in detail the fixed-income structures and equity-indexed structures.

Book #9: Structured Finance and Insurance

Author: Christopher Culp

Buy this book here.

Review:

The alternative risk transfer market enables corporations to manage and transfer risk without traditional insurance. This book explores the development of new and innovative structured finance products for transferring risk, including structured notes, collateralized debt obligations, and contingent capital.

Key Points:

- This book examines structured finance as an alternative to traditional risk transfer.

- It explains the theory and practice of risk transfer through structured finance and insurance.

- Chapters written by leading experts make this book a must-read for those who want to understand alternative risk transfer.

Book #10: FX Options and Structured Products

Author: Uwe Wystup

Buy this book here.

Review:

This book explains traded deals with corresponding motivations explaining why the structures have been traded. The author also covers examples of deals that traded and led to dramatic losses.

Key Points:

- The book contains numerous examples, which are good practice material and support further learning and reflection.

- This book provides a road map for investors willing to invest in beyond-vanilla options strategies.

- It has an entire chapter devoted to hedge accounting, where a typical structured FX forward is examined in a case study.

Recommended Books

This article reviews the top 10 structured finance books for your learning. To know more, read the following books,