Updated July 14, 2023

Definition of Swap in Finance

A swap in finance is an arrangement combined with a derivative contract between two parties, which results in an exchange of a stream of cash flows taking a notional principal amount as a base. Such instruments may be considered a portfolio of forwarding contracts designed for multiple times betting.

Explanation

- “Swap” means to exchange. In finance, parties use a swap as an exchange instrument to exchange cashflows.

- Consider you require funds with an interest rate that mimics the changes in the market interest rate, but the lender provides you with discounted fixed interest rate. In this case, the floating interest rate is costlier than the fixed interest rate. So, you search for another person in the market who needs a fixed interest rate & has been offered a floating interest rate by his lender.

- You can then agree with that other person, wherein he will pay you a fixed interest rate, and you will pay him the floating interest. This way, your effective cost is what you want to pay, i.e. “floating interest rate”.

- Swaps find wide applications in commodities markets, currency markets, deb-equity, and other domains, with no outer boundary.

- Swaps are famous in today’s finance regime due to their quick application and ease of operations.

Features of Swap in Finance

- At least two parties must enter into a swap, and the involvement of a third person as an intermediary allows for the possibility of more than two parties.

- Both parties will have similar exposure in the market.

- One of the parties has an absolute advantage in one market, which the other party does not have.

- In case of unequal exposures, the banks charge nominal fees to equal the exposure.

- The end result of the swap will be financial savings compared to normal operations for both entities. This happens in most cases.

- Each party must manage its debt issues and be exposed to funding costs. Each party wants to reduce its funding cost.

How Does It Work?

- In most cases, swaps entered into the financial world are generic or plain vanilla swaps. Here, there are two legs in the swap. One is floating, and the other is fixed. The principal amount would be notional, i.e. no exchange of actual principal amount between two parties.

- We will study the different types of swaps later in this topic. But basically, every swap starts with one party who wants a specific type of exposure that the lender cannot provide.

- Taking the base of an interest rate swap, one party applies for a business loan with a fixed interest rate. However, the lender offers only the floating interest rate, trading at a discount. Party One will accept the floating interest rate but must keep its exposure fixed.

- Say another party (i.e. party two) has taken a loan with a fixed rate of interest, but it has speculation that the interest rates in the future will reduce drastically. Thus it wants a floating interest rate.

- A banker identifies such demand and supply components, and an arrangement is made between the three parties to regulate the swap.

- Under this agreement, party one will pay a floating interest rate to its lender and a fixed interest rate to the banker, which the banker will pass on to party two. Further, party two will pay a fixed interest rate to its lender and a floating interest rate to the banker, which the banker will pass on to party one.

- Each party pays something and receives something in return so that the net cost is something that each party desires. A banker will charge a fixed commission to both parties.

- This way, a swap is arranged between two unknown parties.

Example of Swap in Finance

Say, Firm A & B wish to borrow 5 years of funds from the market:

|

Firms |

Fixed Market | Floating Market |

Preference |

| A | 8% | L + 2% | Floating |

| B | 10% | L + 1% | Fixed |

Show how a swap can be arranged to reduce each firm’s preferred funding cost.

Solution:

Step 1: Data

|

Firms |

Fixed Market | Floating Market |

Preference |

| A | 8% | L + 2% | Floating |

| B | 10% | L + 1% | Fixed |

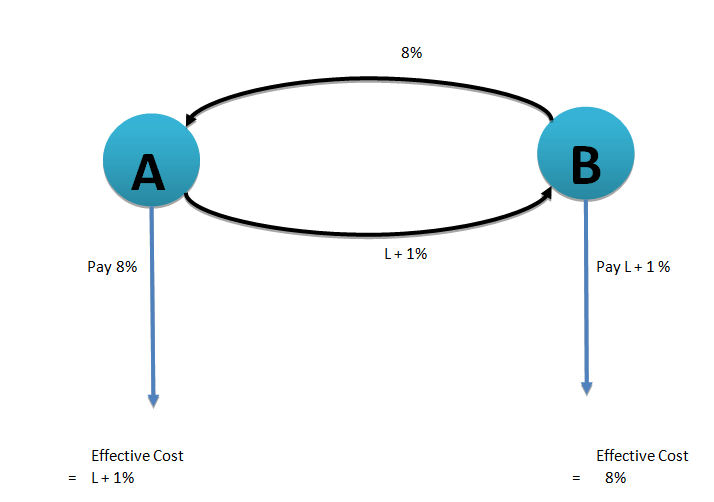

A enjoys an absolute advantage in a fixed market, while B enjoys an absolute advantage in a floating market. So, A should borrow fixed @ 8%, and B should borrow floating @ L+1%. They should then enter into a swap.

Green highlighted the desired funding requirement.

Explanation:

For Firm A,

It will pay 8% to the lender outside and recover 8 from Firm B. Thus, its effective cost is restricted to what it has paid to Firm B, i.e. L + 1% as agreed.

For Firm B,

It will pay L + 1% to the lender outside and recover the same from Firm A. Thus, its effective cost is restricted to what it has paid to Firm A, i.e. 8% as agreed.

Step 2: Presentation

Conclusion

| Firms | Desired | Actual | Gain |

| A | L + 2% | L + 1% | 1% |

| B | 10% | 8% | 2% |

Types of Swap in Finance

Once you understand the basic methodology of swaps, you can easily guess the working methodology of other swaps. Just focus on the legs in each swap.

- Interest rate swap: One leg is floating interest, while the other is fixed interest rate.

- Currency Swap: Both legs of the swap are in different currencies. It helps to hedge the position against currency fluctuations.

- Equity swap: Here, at least one of the legs is a return from an equity instrument. It may be exchanged with a return from bonds or portfolios, etc.

- Commodity swap: Here, at least one leg is based on commodity price, which can be exchanged with fixed or floating cash flows from another commodity.

- Credit Default Swap: It is famously called CDS, wherein the swap’s seller will reimburse the buyer with the face of the asset, which is defaulted along with the asset transfer.

- Total Return Swap: One leg is a total return from an asset, and the other is a fixed return from an index.

Valuation of Swap in Finance

- Swap is the exchange of a stream of cash flows, and thus its valuation is quite easy and sensible.

- One party in the swap wants to pay fixed, and the other wants to pay to float. Thus, the value of a swap for a fixed-payer is the difference between the present value of balance payments in a floating interest-paying instrument and the present value of balance payments in a fixed interest-paying instrument.

- The value of a swap for a floating payer is the difference between the present value of balance payments in a fixed interest-paying instrument and the present value of balance payments in a floating interest-paying instrument.

- However, the pricing of the swap is generally referred to as the “fixed rate of the swap”, and it is decided today such that the value of the swap is zero, i.e. the value of the fixed instrument equals the value of the floating instrument.

- One should note that the value of a floating coupon bond will be equal to the notional principal as of the date of settlement and will always be equal to the bond’s par value.

Uses of Swap in Finance

- Mainly, it is entered for interest rate swaps to reduce the cost of funding and obtain the desired funding method.

- It is used to exploit the comparative advantage in one market.

- Traders may use swaps in trading various financial instruments.

- It provides a sufficient hedge against unfavorable movements.

- Many broker houses and bankers use swaps to manage assets and liabilities.

Application of Swap in Finance

- Swaps have a wide range of applications, as explained in the various types of swaps. The outbound for the application of swaps is unlimited.

- Market participants primarily use it to hedge against various risks, such as currency rate fluctuations or interest rate fluctuations, which they can envisage.

- It provides easy access to different segments of different markets. Some of the markets in the financial world are not directly accessible to everyone.

- Swaps can also use in trading the Overnight Index Swaps (OLS), where the floating rate, i.e. MIBOR, is subject to daily compounding.

- Market participants may enter into double swaps to actively reduce the effective cost of funding. Here, a firm issues a hybrid instrument, i.e. an instrument that pays a fixed rate for certain years and a floating rate for another certain year. The firm’s objective is a fixed rate of funding throughout its tenure.

- Parties arrange two-party swaps to exploit comparative advantages and avoid the banker as an intermediary.

Conclusion

Financial markets extensively utilize swaps. It provides a hedge against a defined set of exposures. The parties in the swap get the desired type of funding costs, and it also saves on the desired funding cost. In rare circumstances, the swap results in a loss for both parties.

Recommended Articles

This is a guide to Swap in Finance. Here we also discuss the definition and how does it work? Along with types and examples. You may also have a look at the following articles to learn more –