Understanding Tactics in Personal Injury Claims

When you get injured and file a personal injury claim, you expect the insurance company to cover your medical bills, lost wages, and other damages. Unfortunately, the process is rarely as simple as it sounds. Insurance companies have a system, but their primary goal is to pay you as little as possible. If you are struggling with a claim, an Atlanta personal injury lawyer can help. This article breaks down the tactics in personal injury claims that insurers use to minimize payouts and how you can protect yourself.

Steps Insurance Companies Follow in Personal Injury Claims

Insurance companies do not just hand out checks. They investigate, evaluate, and negotiate. Some cases settle quickly, while others drag on for months. Knowing their process helps you anticipate their moves and counter their strategies.

Step 1: Assigning a Claims Adjuster

Once you file a claim, the insurance company assigns a claims adjuster. They investigate the accident and determine how much or if they should pay.

- They review accident reports, medical records, and witness statements.

- They may contact you for more details about the accident.

- They might sound friendly, but their goal is to save the company money.

Step 2: Investigating the Claim

The insurance company does not take your word for it; they conduct their investigation.

- They may visit the accident scene, review photos, or talk to witnesses.

- They analyze medical records to check for pre-existing conditions.

- If they find inconsistencies or delays in treatment, they use them against you.

Step 3: Reviewing Medical Records and Expenses

Your medical records are essential in determining the value of your claim. Insurance companies thoroughly scrutinize them.

- If you delayed treatment, they might argue your injuries were not serious.

- They question treatment costs and may reject “expensive” procedures.

- They may send your records to their doctors, who often downplay injuries.

Step 4: Determining Liability and Claim Value

The insurance company assesses fault before deciding how much to pay.

- If their policyholder is responsible, they estimate damages.

- If they believe you share the blame, they reduce your settlement.

- If there is uncertainty, they may deny the claim entirely.

Step 5: Making a Settlement Offer

Once they determine a claim value, they make an initial offer. But is it fair?

- The first offer is often much lower than what you deserve.

- They may pressure you into accepting by saying it is the best they can do.

- If you push back, they may delay, hoping you will settle for less.

Step 6: Negotiating the Settlement

Negotiation can take weeks or months. Here is what happens:

- You (or your lawyer) present evidence and counter their offer.

- They return with a slightly higher—but still low—offer.

- This back-and-forth continues until both parties agree.

Step 7: Finalizing the Settlement

Once both sides agree, the insurance company issues payment—but there is a catch.

- They require you to sign a release of liability form.

- This document prevents you from seeking more money later.

- If your injuries worsen, you cannot ask for additional compensation.

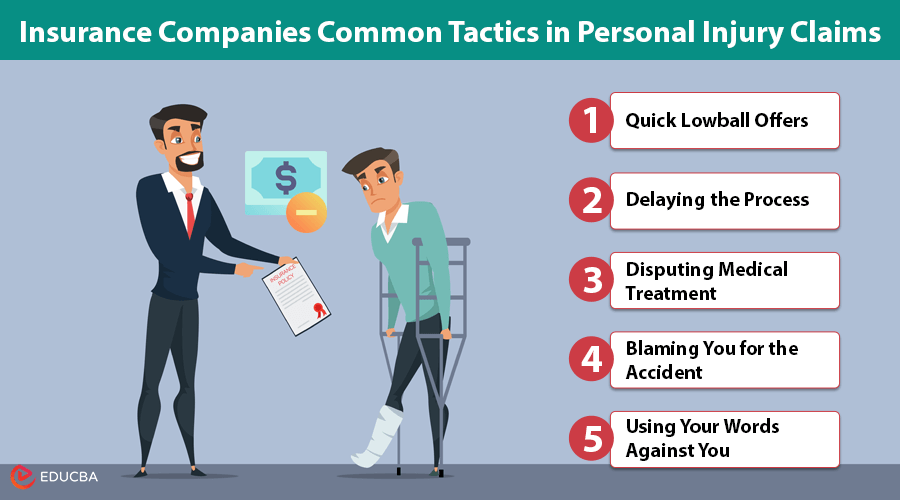

Insurance Companies Common Tactics in Personal Injury Claims

Insurance companies follow a process but use specific tactics to pay you less. Here are some of the most common strategies they use:

- Quick Lowball Offers: They offer a small settlement early on, hoping you will accept without negotiating.

- Delaying the Process: They drag out the claim to wear you down and force you to accept a lower settlement.

- Disputing Medical Treatment: They challenge the necessity or cost of your medical treatment to lower your claim’s value.

- Blaming You for the Accident: They argue that you were at fault, reducing their liability and settlement payout.

- Using Your Words Against You: Anything you say during conversations or interviews can be twisted to minimize your claim.

How to Protect Yourself from Insurance Company Tactics

Although you cannot prevent insurance companies from using these tactics, you can take measures to protect yourself:

- Seek medical attention immediately: Prompt medical treatment is essential in proving the severity of your injuries.

- Do not give recorded statements: Anything you say can work against you, so avoid recorded statements unless your lawyer is present.

- Keep detailed records: Keep a record of everything relevant to the accident and your injuries, such as correspondence, medical bills, and receipts.

- Reject the first offer: The first offer is often too low. Do not accept it without evaluating the true value of your claim.

- Talk to a lawyer – An experienced personal injury lawyer can guide you through the process and help you get the settlement you deserve.

Final Thoughts

If you are injured, do not let the insurance company take advantage of you. Understanding tactics in personal injury claims is key to protecting your rights. Seek advice from a lawyer who will advocate for your rights and ensure you get the compensation you are entitled to.

Recommended Articles

We hope this guide on tactics in personal injury claims helps you navigate the legal process effectively. Check out these recommended articles for more tips and strategies to strengthen your claim and secure the compensation you deserve.