Target Audience for Accounts Receivable Financing: Overview

Accounts receivable (AR) financing is a financial strategy that enables businesses to convert outstanding invoices into immediate cash flow. This solution is ideal for businesses that need consistent cash flow to manage day-to-day operations, fuel growth, or navigate seasonal changes. By partnering with a financing provider, businesses can reduce delays in receiving payments and ensure smoother operations while having the financial flexibility to capitalize on growth opportunities. Understanding the target audience for accounts receivable financing is key to determining if this solution aligns with your business’s needs.

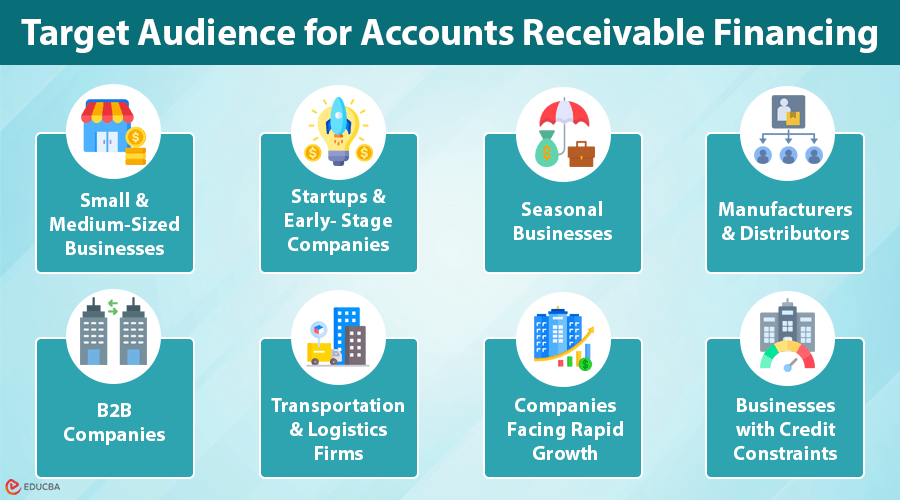

Target Audience for Accounts Receivable Financing

Here are the target audience for accounts receivable financing:

#1. Small and Medium-Sized Businesses (SMBs)

Small and medium-sized businesses often struggle to cover payroll, inventory, and other expenses because they have limited cash reserves. AR financing provides SMBs a solution to bridge cash flow gaps without incurring long-term debt.

Benefits for SMBs:

- Access to immediate cash for reinvestment.

- Ability to fulfill larger orders and expand operations.

- Avoidance of delays caused by 30, 60, or 90-day payment terms.

AR financing can be transformative for SMBs striving for growth but hindered by payment delays.

#2. Startups and Early-Stage Companies

Startups often struggle to get traditional loans because they lack credit history or collateral. AR financing leverages unpaid invoices as assets, providing startups quick access to working capital.

How AR Financing Helps Startups:

- Covers essential expenses like marketing, hiring, and product development.

- Offers financial stability without diluting equity.

- Avoids the burden of long-term debt.

This option helps startups establish themselves in competitive markets while maintaining flexibility.

#3. Seasonal Businesses

Seasonal businesses, such as retailers, event planners, and agricultural companies, often experience uneven cash flow throughout the year. AR financing ensures liquidity during off-peak periods by converting unpaid invoices into cash.

Advantages for Seasonal Businesses:

- Covers operational costs during slow periods.

- Ensures preparedness for upcoming peak seasons.

- Smooth’s cash flow fluctuations year-round.

Leveraging AR financing allows seasonal businesses to operate confidently, even during downtime.

#4. Manufacturers and Distributors

Manufacturers and distributors frequently deal with large orders and extended payment terms. AR financing ensures they have the liquidity needed to keep operations running smoothly.

Key Benefits for Manufacturers and Distributors:

- Funds for purchasing raw materials and paying suppliers.

- Ability to meet production deadlines and manage large contracts.

- Support for scaling operations to meet growing demand.

This financing option keeps manufacturers competitive and operationally efficient.

#5. B2B Companies

Businesses operating in the B2B space often encounter delayed payments due to lengthy invoice terms of 30 to 90 days. AR financing unlocks cash tied up in these unpaid invoices.

Why B2B Companies Need AR Financing:

- Provides working capital to sustain daily operations.

- Supports growth initiatives without waiting for client payments.

- Reduces cash flow challenges caused by delayed settlements.

B2B companies can use this solution to maintain financial health and capitalize on new opportunities.

#6. Transportation and Logistics Firms

Transportation and logistics firms face immediate fuel, maintenance, and payroll expenses while waiting weeks or months for client payments. AR financing offers quick access to much-needed funds.

Benefits for Transportation and Logistics Firms:

- Ensures that you meet operational needs on time.

- Helps maintain fleet efficiency and reliability.

- Provides financial flexibility in a competitive industry.

With AR financing, these firms can focus on delivering results without cash flow interruptions.

#7. Companies Facing Rapid Growth

Rapidly growing businesses often require additional capital to scale operations, hire staff, and invest in infrastructure. Delayed client payments, however, can slow their momentum.

How AR Financing Supports Growth:

- Provides steady cash flow to seize new opportunities.

- Prevents missed chances due to cash flow constraints.

- Helps businesses maintain their competitive edge.

AR financing allows growing companies to sustain their upward trajectory without delay.

#8. Businesses with Credit Constraints

Companies with poor credit scores or limited borrowing history may find traditional loans inaccessible. AR financing focuses on the creditworthiness of its clients rather than the business itself.

Why AR Financing Works for Credit-Constrained Businesses:

- Offers quick access to working capital.

- Does not require strong credit scores or collateral.

- Provides a financial lifeline to businesses needing immediate liquidity.

This makes AR financing an ideal option for businesses facing credit challenges.

Final Thoughts

Accounts receivable financing is a useful solution for businesses facing cash flow challenges. Turning unpaid invoices into quick cash helps businesses pay expenses, settle supplier bills, and fund growth. The target audience for accounts receivable financing includes small and medium-sized businesses, startups, seasonal companies, and those experiencing rapid growth or credit constraints. If your business needs financial flexibility, consider partnering with a provider like Epoch Financial to unlock the potential of your unpaid invoices and keep operations running smoothly.

Recommended Articles

We hope this guide on the target audience for accounts receivable financing has been helpful. Check out these recommended articles for more insights on improving cash flow and scaling your business.