Updated July 18, 2023

Definition of Tax Fraud

Tax fraud (also known as tax evasion) is an illegal activity wherein a few categories of taxpayers do not pay their tax liabilities by way of falsely claiming expenses, misreporting their incomes, misrepresentation of facts or suppressing facts, or providing false evidence with the only intention to avoid payment of tax to the government.

Explanation

- Tax fraud means tax evasion. It means if you earn something, you do not intend to pay your country’s government. Let’s understand why paying taxes is essential.

- The government of any country is responsible for every citizen of the country, its defense, its cash flow, its growth, its infrastructure & many other things. It needs to ensure the availability of basic essential facilities for every country resident. Basic essential facilities such as hospitals, transportation, food supplies for the poor, infrastructure, etc. For expenditure on such necessities, it needs funds. Thus, the most significant government source is tax revenue (direct and indirect).

- Using such tax revenues, the government can ensure the facilities. The government also needs to fund the research & development within the country, its defense equipment & defense army. Countries are in the process of discovering vaccines for COVID-19. Such research work requires fund flow. The government provides the same. So, at least the taxpayer’s money comes around him.

- That’s the reason why we pay taxes. So, now you may understand that tax frauds are conducted by those inhuman beings who do not care for their country & its people.

- Tax fraud refers to misrepresentation of facts, suppression of facts, falsely claiming the expenditure, not offering any income to tax, etc.

- IRS has specified the following as tax frauds:

- False claim for exemptions or deductions

- Failure to withhold tax when asked for

- Kickbacks

- Failure to payment of tax, even if liable

- Organized Crime

- Unreported income

- Alteration of document

Example of Tax Fraud

We can make a classic real-life example of Walter Anderson. The details are as under:

- Anderson started his career in the telecommunication sector as a salesman at MCI Communications in 1979. He invested $ 100,000 in the foundation of Mid-Atlantic Telecom in 1948. He founded Esprit Telecom Plc (in London) in 1992 & sold the venture in 1999 by earning a huge capital return. In 1988, he founded International Space University, providing a multicultural & multidisciplinary graduation course for space studies. He promoted the commercial development of many space programs to resolve many challenges of the planet.

- The United States Government investigated Mr. Anderson’s businesses through the years 2002 to 2005. He was alleged of hiding wealth in foreign countries.

- He was thus charged for tax evasions of around $ 364 million. He was arrested on February 26, 2005, at Dulles International Airport & sentenced to imprisonment for 6 years. He was also asked to pay restitution amount to the government.

- He was released on December 28, 2012.

Types of Tax Fraud

|

Types of Tax Frauds |

Explanation |

| Under-reporting of Income |

|

| Misrepresentation of figures |

|

| Claiming deductions even if you are not eligible |

|

How to Report Tax Fraud?

- IRS maintains the confidentiality of the person reporting the tax cases. Hence, no status or progress update is provided by IRS.

- It has enlisted the types of fraud to be treated as tax fraud.

- IRS insists on sending a formal letter with the following minimum details:

- Name of the person or business for whom you are reporting

- Address of the person or business for whom you are reporting

- Social security number or Employer identification number for tracing the person or business.

- A brief description of the fraud.

- How did you become aware of the fraud or the way you obtained the information?

- Years of suspected tax fraud.

- The estimated amount of unreported income.

- Your name, address & contact number.

- IRS also gives rewards for reporting fraudulent activities. The relevant persons need to claim the reward by submitting form 211.

Tax Fraud Penalties

| Particulars | Explanation |

| Civil or Criminal Penalties |

|

| Fines |

|

| Imprisonment |

|

| Cost of Prosecution |

|

| Payment of tax amount |

|

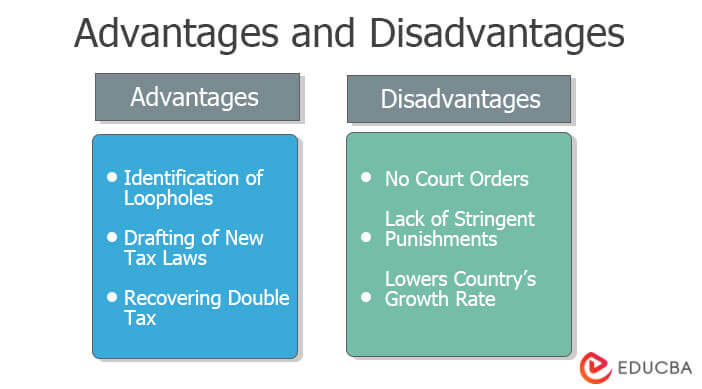

Advantages and Disadvantages

Following are some of the advantages and disadvantages to learn.

Advantages

- Tax fraud cases enable the identification of existing loopholes in the tax laws & their provisions. It certainly identifies the action points to be taken by the government not to let such cases arise in the future.

- Fraud cases enable stricter drafting of new tax laws by the government in future years.

- The government in any way recovers the double tax not received in fraud cases. Thus, revenue doubles.

Disadvantages

- The biggest disadvantage is that no court orders the death penalty for fraud cases. This, in some way, motivates potential tax fraud persons.

- More & more tax frauds are the result of a lack of stringent punishments.

- The government should disable the convicted person from doing business in future years.

- Another biggest disadvantage is that it lowered the country’s growth rate.

- It strongly demotivates the honest taxpayers of the country.

Conclusion

The basic question that arises is, “who is responsible for the occurrence of tax frauds?” the answer is “everyone in the loop. Every person from the drafting of tax law to personally witnessing the fraud is responsible.” the lawmaker is responsible for the weak drafting of provisions. He is also responsible if he does not amend the provisions quickly with retrospective effect. Corrupt officers of government are at the center of this fraud. The auditors of the fraudulent companies did not raise red flags for the fraudulent events. everyone in the loop is held responsible. tax frauds are the result of loopholes in tax provisions & weak tax collection system of the country.

Recommended Articles

This is a guide to Tax Fraud. Here we also discuss the definition and how to report tax fraud? along with advantages and disadvantages. You may also have a look at the following articles to learn more –