Updated July 25, 2023

Tax Multiplier Formula (Table of Contents)

What is the Tax Multiplier Formula?

The term “tax multiplier” refers to the multiple which is the measure of the change witnessed in the Gross Domestic Product (GDP) of an economy due to changes in taxes introduced by its government.

To put it simply, this metric is mostly used by investors, economists and governments to study the impact of policy changes in taxation on the aggregate income level of a nation.

The tax multiplier can be expressed in two versions –

- Simple tax multiplier, where the change in taxes only impacts the consumption

- Complex tax multiplier, where the change in taxes impacts all the GDP components

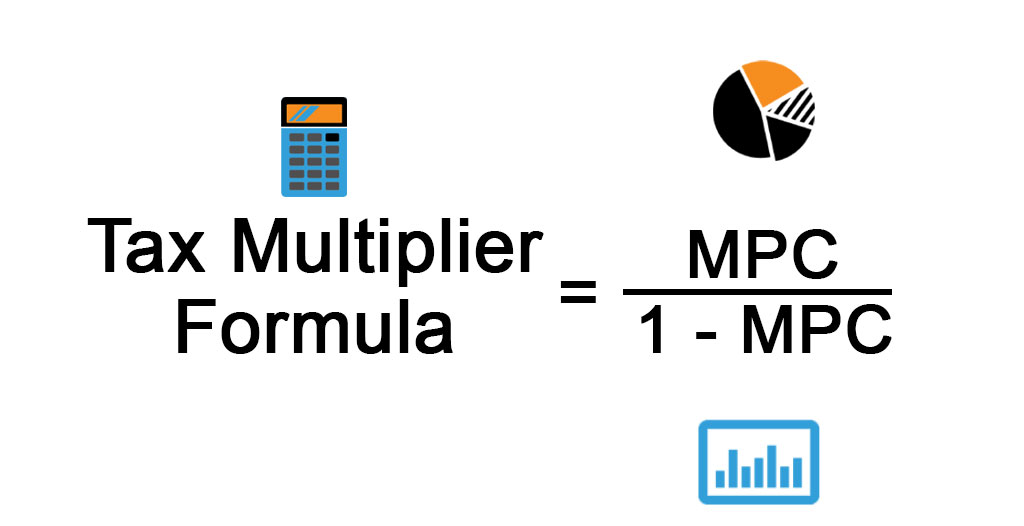

In this article, we will focus on the formula for a simple tax multiplier which is expressed as the negative marginal propensity to consume (MPC) divided by one minus MPC. Mathematically, it is represented as,

The reason for the negative sign is that the tax multiplier essentially measure is an increase in national income (ΔY) by a decrease in tax receipts (ΔT). Mathematically, it is represented as,

Examples of Tax Multiplier Formula (With Excel Template)

Let’s take an example to understand the calculation of the Tax Multiplier in a better manner.

Tax Multiplier Formula – Example #1

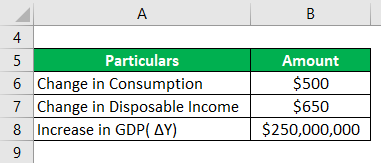

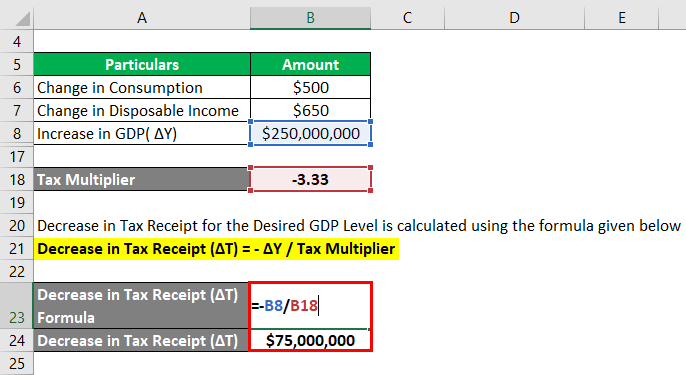

Let us take the example of a nation where the personal spending per capita increased by $500 as the disposable income increased by $650. Now, the government has decided to take steps to increase the GDP by $250 million in the current year. Suggest the tax policy which is required to achieve the desired GDP level.

Solution:

MPC (Marginal Propensity to Consume) is calculated using the formula given below

MPC = Change in Consumption / Change in Disposable Income

- MPC = $500 / $650

- MPC = 0.77

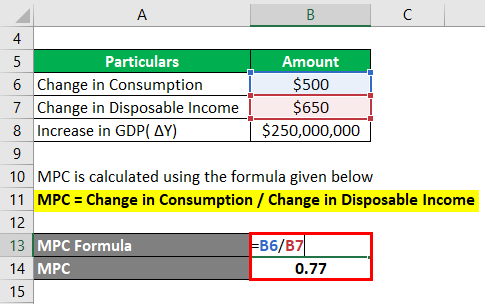

Tax Multiplier for the Economy is calculated using the formula given below

Tax Multiplier = – MPC / (1 – MPC)

- Tax Multiplier = – 0.77 / (1 – 0.77)

- Tax Multiplier = -3.33

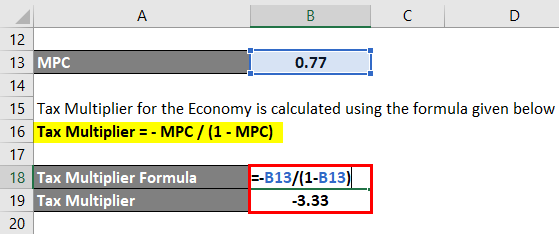

Decrease in Tax Receipt for the Desired GDP Level is calculated using the formula given below

Decrease in Tax Receipt (ΔT) = – ΔY / Tax Multiplier

- Decrease in Tax Receipt (ΔT) = – $250,000,000 / (-3.33)

- Decrease in Tax Receipt (ΔT) = $75,000,000

Therefore, the government need to reduce the tax receipts by $75.00 million in order to achieve the targeted GDP level.

Tax Multiplier Formula – Example #2

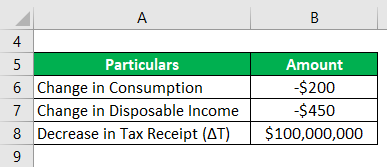

Let us take another example where personal consumption decreased by $200 due to a decrease in disposable income by $450. Now, the government wants to reduce the tax receipts by $100 million in order to relieve some pressure on disposable income. Calculate the increase in GDP due to the initiative taken by the government.

Solution:

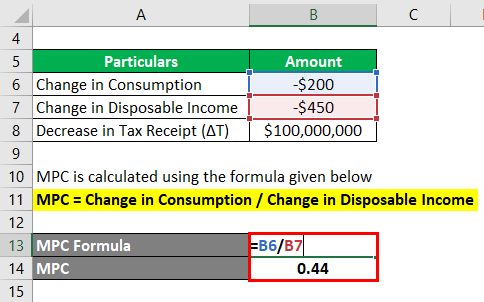

MPC ( Marginal Propensity to Consume) is calculated using the formula given below

MPC = Change in Consumption / Change in Disposable Income

- MPC = -$200 / (-$450)

- MPC = 0.44

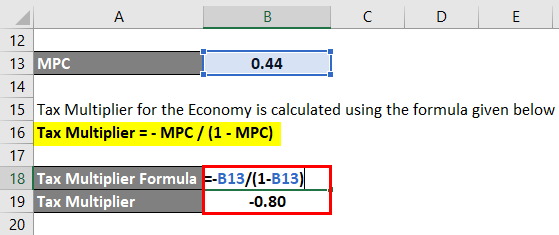

Tax Multiplier for the Economy is calculated using the formula given below

Tax Multiplier = – MPC / (1 – MPC)

- Tax Multiplier = – 0.44 / (1 – 0.44)

- Tax Multiplier = – 0.80

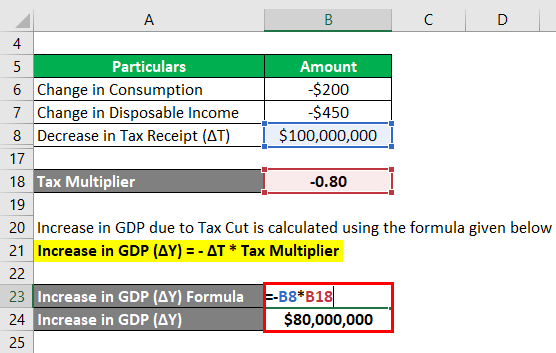

Increase in GDP due to Tax Cut is calculated using the formula given below

Increase in GDP (ΔY) = – ΔT * Tax Multiplier

- Increase in GDP (ΔY) = – $100,000,000 * (-0.8)

- Increase in GDP (ΔY) = $80,000,000

Therefore, given the tax cut by the government, the GDP is expected to increase by $80.00 million.

Explanation

The formula for tax multiplier can be derived by using the following steps:

Step 1: Firstly, determine the MPC, which the ratio of change in personal spending (consumption) as a response to changes in the disposable income level of the entire nation as a whole.

MPC = Change in Consumption / Change in Disposable Income

Step 2: Finally, the formula for tax multiplier is expressed as negative MPC divided by one minus MPC as shown below.

Tax Multiplier = – MPC / (1 – MPC)

Relevance and Use of Tax Multiplier Formula

It is an important concept from an economic point of view because taxes form an indispensable part of the economic system, both at micro and macro levels. So, it is interesting to understand how a government takes a decision on the changes in tax policy. Although tax multiplier is not the metric that goes into tax policymaking, it definitely influences the decision as it impacts the GDP of a nation. Inherently, when taxes go up the available disposable income decreases, which eventually negatively impacts consumption and that is what is captured by tax multiplier.

In this article, we have primarily discussed the simple tax multiplier, where the change in taxes only impacts consumption. However, in case the change in tax affects all the components of the GDP, then the complex tax multiplier formula has to be used as shown below.

Tax Multiplier = – MPC / [1 − (MPC × (1 − MPT) + MPI + MPG + MPM)]

where,

- MPC = Marginal Propensity to Consume

- MPT = Marginal Propensity to Tax

- MPI = Marginal Propensity to Invest

- MPG = Marginal Propensity of Government Expenditures

- MPM = Marginal Propensity to Import

Tax Multiplier Formula Calculator

You can use the following Tax Multiplier Formula Calculator

| MPC | |

| Tax Multiplier | |

| Tax Multiplier = |

| |||||||||

|

Recommended Articles

This is a guide to Tax Multiplier Formula. Here we discuss how to calculate tax multiplier along with practical examples. we also provide a tax multiplier calculator with a downloadable excel template. You may also look at the following articles to learn more –