Updated July 27, 2023

Taxable Income Formula (Table of Contents)

What is Taxable Income Formula?

This article will talk about the Taxable Income Formula, and Here we learn the calculation of Taxable Income along with the various important Examples.

Taxable Income is the amount of income that is liable to tax. It means how much income an individual or company owes to the government in the current tax year. Gross Income or Adjusted Gross Income or Net Income is an individual’s income from the employer before any deductions or taxes.

Post deduction is the net income. In India, a person’s income that crosses the maximum amount limit is collected as Income tax based on the rate set by the Indian income tax department. It is based on the Individual Resident Status of the taxpayer too. Indian Income does always have a tax liability. Foreign Income also comes under tax liability for Residents but not for non-residents. Income can be divided into two categories.

1. Earned Income

Earned Income includes Salaries, Provident fund contributions, fees, pensions, gratuities, tips, bonuses, etc.

2. Unearned Income

Unearned Income includes rent, alimony, interests, royalties, dividends, etc. Simply we can divide the Income like below.

- a) From Salary

- b) From Fixed Assets like properties.

- c) From Business or Profession

- d) From Share Markets or investment Gains

- e) From Other Resources, if any

Now the Gross Income is additional of all the above, whatever is applicable.

Income tax can be calculated using a simple formula. It is purely based on the income tax slabs it falls under.

The formula For Taxable Income is as below:

Examples of Taxable Income Formula (With Excel Template)

Let’s take an example to understand the calculation of Taxable Income in a better manner.

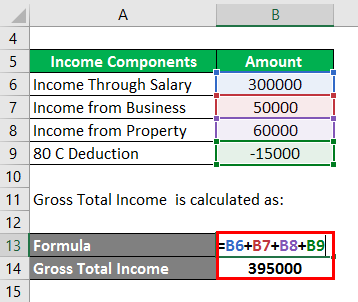

Taxable Income Formula – Example #1

Reena has income from Salary, Business, and Property. She gets a Total Income salary of Rs.3L post all possible deductions/ exemptions. And Income from a fashion boutique is Rs.50000 after all exemptions. And Property Rent of Rs.60000. She invested in 80c for 15000. Hence claimed for 80 C.

Solution:

The calculation of Gross Total Income:

- Gross Total Income = 300000+50000+60000 – 15000

- Gross Total Income = 395000

The formula to calculate Total Taxable Income is as below:

Total Taxable Income = Gross Total Income – Deductions / Exemptions allowed from Income

- Total Taxable Income = 395000 – 0

- Total Taxable Income = 395000

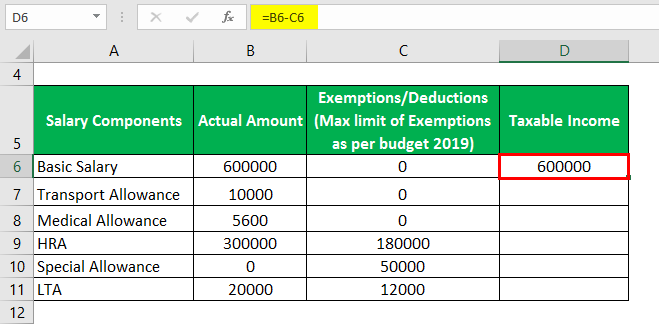

Taxable Income Formula – Example #2

The income tax calculation for the Salaried

Income From salary is the summation of Basic Salary, House Rent Allowance, Special Allowance, Transport Allowance, Other If any. Some Parts of the salary are tax exempted, such as phone bills, Leave travel allowance. In addition, the Standard deduction of 50000 is there in the Budget 2019.

Veera lives in Bangalore and gets a basic Salary of Rs.600000 a month. HRA of Rs.300000, Transport Allowances of Rs.10000, and medical allowances of Rs.5600. Telephone Bills of Rs.20000 Annually. Veera pays Rent of Rs.20000. Below is how the taxable income from salary is calculated.

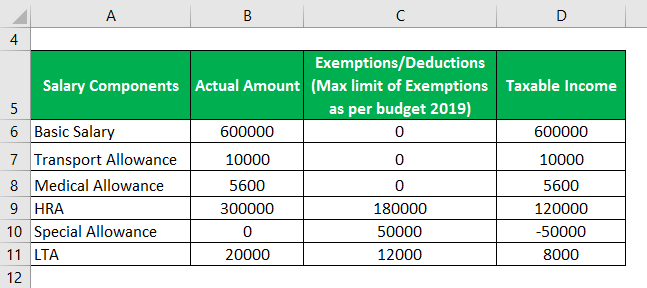

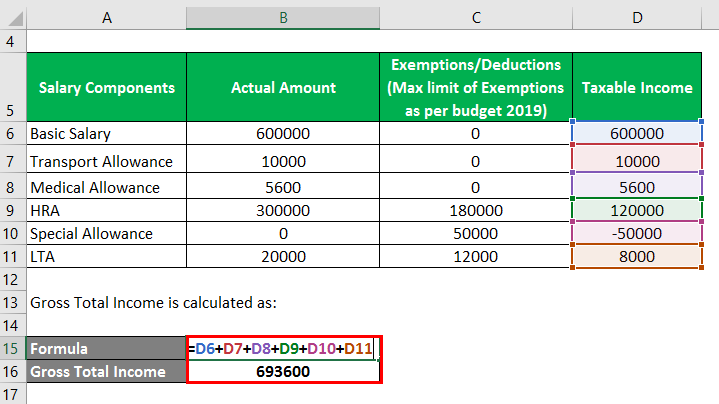

The calculation of Taxable income is as below:

Similarly, we call for other values

The calculation of Gross Total Income is as below:

- Gross Total Income = 600000 + 10000 + 5600 + 120000 – 50000 + 8000

- Gross Total Income = 693600

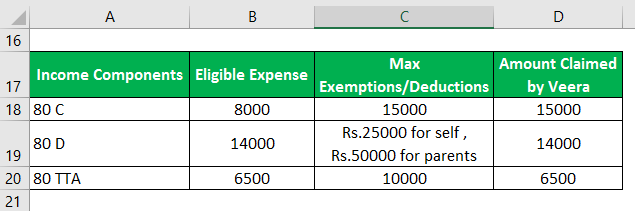

Veera has income from interest from the savings account of Rs.6500 annually. Neha has invested under 80C to save some tax Edelweiss Tokio Life Insurance premium of Rs.8000. Medical insurance paid Rs.14000. Veera Can claim the following Deductions.

Income from Other Sources:

Veera has income from other sources of Rs.40000 annually.

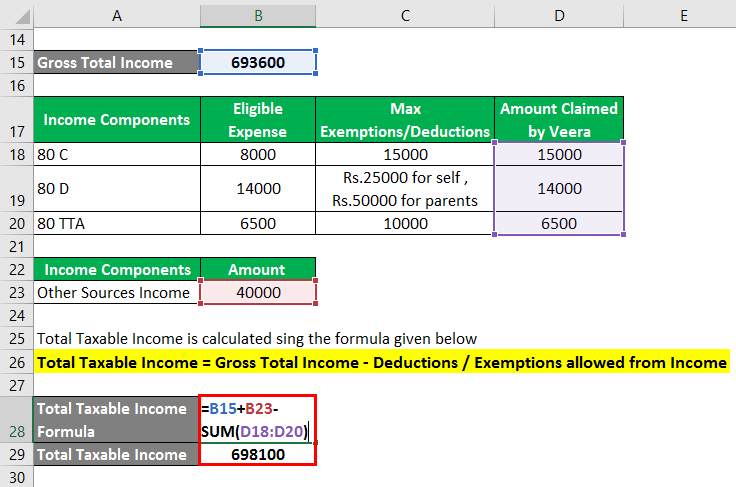

The formula to calculate Total Taxable Income is as below:

Total Taxable Income = Gross Total Income – Deductions / Exemptions allowed from Income

- Total Taxable Income = 693600 + 40000 – (15000 + 14000 + 6500)

- Total Taxable Income = 733600 – 35500

- Total Taxable Income = 698100

Explanation

Here is the step-by-step approach for calculating Taxable Income.

Step 1: Gross Income- Gross Income is an individual’s income from the employer or company before any deductions or taxes. So it will be an additional of all income that a person/company would have possibly got through a) salary or b)property or c) business or d) capital gains, or e) other resources.

Gross Total Income = a+b+c+d+e

Step 2: Deductions or Exemptions-The exemption or Deduction value has to be deducted from the gross income. Certain allowances are fully taxable or partly taxable, or fully exempted taxable allowances.

Fully-Taxable – Some fully Taxable allowances are Overtime Allowance, Servant Allowance, and Dearness Allowance.

Partly Taxable – Examples of Partly Taxable are House Rent Allowance, Travel Allowance, Uniform Allowance, and Children’s Education Allowances.

Fully Exempted Taxable – Some of the Fully Exempted Allowances are Allowances of High Court & Supreme Court Judges, Foreign Allowances. Based on the Category a particular allowance falls under, it is deducted from the gross income.

Step 3: Net Income or Taxable Income: The income amount which is deducted from the suitable allowances is Net Income.

Step 4: After finding the net income, based on which Income range slabs the amount comes from, the Taxes are calculated. One can refer to the above income tax slab table for this.

Total Taxable Income or Net Income = Gross Total Income – Deductions / Exemptions allowed from Income

Relevance and Uses of Taxable Income Formula

Mainly The Taxable Income is used to find the tax we must pay to Government as an individual or Company. The taxes are mainly used for raising the revenue of the government and other purposes as well. So it is mainly for Public Finance. When the overall monetary status of a country is compared with other countries, the revenue is considered. Taxes of its citizens hold the main place in it.

Taxable Income Formula Calculator

You can use the following Taxable Income Formula Calculator

| Gross Total Income | |

| Deductions | |

| Total taxable Income | |

| Total taxable Income = | Gross Total Income – Deductions |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to Taxable Income Formula. Here we discuss how to calculate Taxable Income along with practical examples. We also provide a Taxable Income calculator with a downloadable Excel template. You may also look at the following articles to learn more –

- Formula for Internal Growth Rate

- Coverage Ratio Formula Excel Template

- Calculation of Effective Tax Rate

- Examples of Correlation Formula

- Gross Income Formula

- Capital Gain FormulaCalculator (Examples with Excel Template)

- Difference between Tax Shelter and Tax Evasion

- Tax Multiplier Formula with Examples