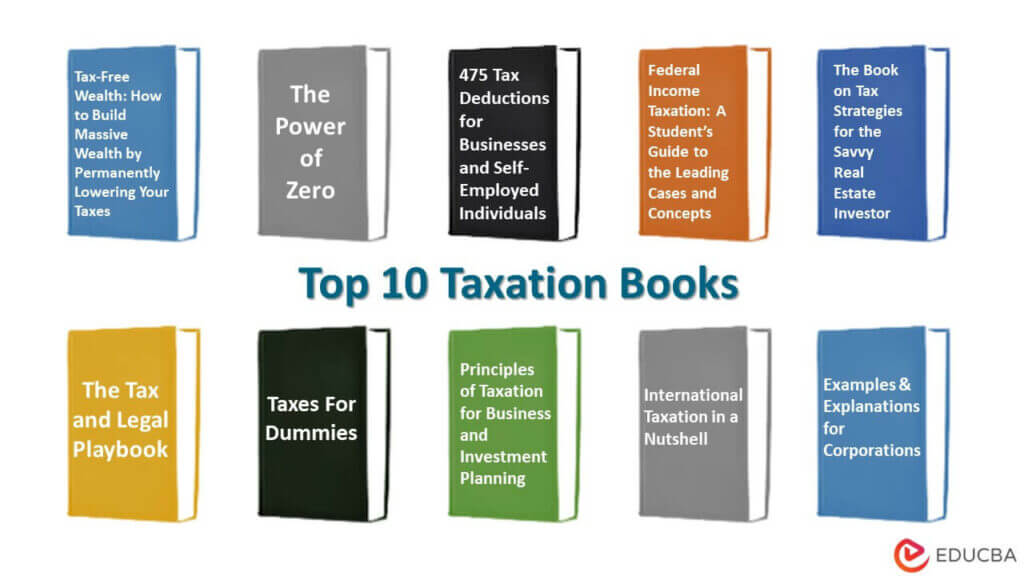

Best Books to Learn Taxation

Taxation is a system by which a government collects money from the public to fund its expenditure. Taxations are primarily for individuals and businesses. Taxation books provide in-depth knowledge of tax codes. The list of books offered here explains different ways to do your taxation. It helps you plan your taxes on time. It also shows how you can save on your taxes.

Here is a list of the top 10 taxation books:

| # | Books | Author | Published | Rating |

| 1 | Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes | Tom Wheelwright | 2018 | Amazon: 4.7 Goodreads: 4.26 |

| 2 | The Power of Zero | David McKnight | 2018 | Amazon: 4.7

Goodreads: 3.84 |

| 3 | 475 Tax Deductions for Businesses and Self-Employed Individuals | Bernard B. Kamoroff | 2019 | Amazon: 4.7

Goodreads: 4.13 |

| 4 | Federal Income Taxation: A Student’s Guide to the Leading Cases and Concepts | Marvin A. Chirelstein | 2009 | Amazon: 3.7

Goodreads: 3.45 |

| 5 | The Book on Tax Strategies for the Savvy Real Estate Investor | Amanda Han and Matthew MacFarland | 2016 | Amazon: 4.7

Goodreads: 4.42 |

| 6 | The Tax and Legal Playbook | Mark J Kohler | 2019 | Amazon: 4.7

Goodreads: 4.29 |

| 7 | Taxes For Dummies | Eric Tyson, Margaret Atkins Munro, and David J. Silverman | 2021 | Amazon: 4.6

Goodreads: 3.33 |

| 8 | Principles of Taxation for Business and Investment Planning | Sally Jones, Shelley Rhoades-Catanach, and Sandra Callaghan | 2019 | Amazon: 3.8

Goodreads: 3.30 |

| 9 | International Taxation in a Nutshell | Mindy Herzfeld | 2019 | Amazon: 4.6

Goodreads: 4.55 |

| 10 | Examples & Explanations for Corporations | Alan R. Palmiter | 2021 | Amazon: 4.7

Goodreads: 3. 51 |

Given below are the reviews and key points from the top 10 taxation books listed above:

Book #1 Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

Author: Tom Wheelwright

Buy this book here.

Review:

The book analyzes the US’s winners and losers of three major tax reforms. It explains the correct approach for claiming government incentives to lower taxes. The author provides helpful tips that readers can apply in their particular situations to take advantage of tax incentives.

Key Points:

- This book can help readers from both within and outside the US to become aware of tax incentives offered by the government.

- The book explains how to apply government incentives to lower taxes in different situations.

- The author explains which sectors of the US economy enjoy the highest tax incentives and are accordingly good for business.

- The author uses his experience analyzing the previous major revisions in US tax law to provide simple tips to readers for tax planning.

Book #2 The Power of Zero

Author: David McKnight

Buy this book here.

Review:

The author provides a detailed step-by-step guide to reaching the 0% tax bracket by retirement. The book emphasizes that due to the rising taxes, taxpayers need to understand how much of their retirement savings will not be subject to taxation. It should also help readers build multiple streams of tax-free income.

Key Points:

- This book explains how to apply government incentives to lower taxes in different situations.

- The book provides a detailed guide to transforming retirement by saving in tax-efficient investment schemes.

- It explains how quickly people should shift money to the tax-free bracket.

Book #3 475 Tax Deductions for Businesses and Self-Employed Individuals

Author: Bernard B. Kamoroff

Buy this book here.

Review:

This book provides detailed guidance on tax deductions that are available to taxpayers. It also illustrates where to claim the tax deductions in the return of income. Businesses and self-employed taxpayers can use this book to ensure they don’t miss out on claiming tax deductions and paying higher taxes.

Key Points:

- This book is a comprehensive guide on tax deductions that businesses and self-employed individuals can claim.

- This book guides readers on how to get to the lowest tax bracket by the time of retirement.

- The author highlights some of the tax deductions generally unknown to taxpayers.

- Apart from taxpayers, this book can be used as a ready reckoner by tax professionals to check tax deductions that may be available to their clients.

Book #4 Federal Income Taxation: A Student’s Guide to the Leading Cases and Concepts

Author: Marvin A. Chirelstein

Buy this book here.

Review:

The book provides an overview of the formulation of Federal Income Taxation in the United States. The deductions made through federal income tax are as per the principles of capitalism, where a certain percentage of tax is through collections from the wealthy 20% of Americans. This book defines the key elements of the Pareto Principle in Economics and how international taxation affects the indicators of income and employment. Audiences from an Economics background can use this book to understand the hierarchy of income slabs through a social lens.

Key Points:

- This book is a comprehensive guide on Income, Savings rate, Deductions, and the definition of the Pareto Principle that aims to segregate Wealthy Americans into 20% of the league to extract the benefits of federal income tax.

- The tax theory concerning employment and inflation and how interest rates affect the taxation indicators are highlighted well in the book.

- It explains consumption tax while concentrating on present income tax. It differentiates between those at the end of the book.

Book #5 The Book on Tax Strategies for the Savvy Real Estate Investor

Author: Amanda Han and Matthew MacFarland

Buy this book here.

Review:

The authors describe the relationship between real estate and taxes in an informative yet easy-to-read style. It also advises on documentation requirements that are key to avoiding tax audits from the tax authorities.

Key Points:

- In this book, the authors explain the tax benefits every real estate investor should know.

- The authors list questions every real estate investor should ask their CPA.

- The book also includes tax strategies for financing, managing, and transacting in real estate.

Book #6 The Tax and Legal Playbook

Author: Mark J Kohler

Buy this book here.

Review:

The author provides a detailed analysis of the tax and legal structure in this book. Small business owners must follow it to optimize their taxes. In addition, readers also get valuable insights into estate and retirement planning.

Key Points:

- This book uses real-world case studies to solve common tax issues for small businesses.

- This book simplifies the eligibility conditions required to be fulfilled by small businesses to claim tax deductions.

- New and seasoned entrepreneurs should find this book a helpful guide for planning taxes.

Book #7 Taxes For Dummies

Author: Eric Tyson, Margaret Atkins Munro, and David J. Silverman

Buy this book here.

Review:

This book is a helpful guide for readers with a limited understanding of taxation. It simplifies the procedure of filing a return of income with the tax authorities. Income tax filings are an essential aspect of showing income status. While government employees must recognize their actual income status, private entities adjust their income status by highlighting the low-income slab leading to less-than-expected return filings. This book describes how we can avoid it by imposing legal charges.

Key Points:

- It is a helpful book for readers who want to understand taxation basics.

- It helps readers make the most of tax deductions and credits before filing a return of income.

- This book helps readers to understand the taxation laws like US federal income tax, including maternity taxes and benefits, and how offsprings are an investment for the taxation system as a whole.

Book #8 Principles of Taxation for Business and Investment Planning

Author: Sally Jones, Shelley Rhoades-Catanach, and Sandra Callaghan

Buy this book here.

Review:

This book provides a comprehensive explanation of the Tax structure, how Tax bases are a significant indicator in affecting fiscal policy and monetary policy, and how repo rate and reverse repo rates take an inflationary adjustment in response to changes in base tax slabs. The shift of demand and supply in tax planning, investment in the business, and declaring investments to reduce the tax slabs are well-described in this book. Overall, it is a must-read book for enthusiasts trying to understand the primary taxonomy of the business.

Key Points:

- This book covers the tax system, the jurisdiction affecting federal laws, and how tax slabs affect middle-class Americans.

- It also talks about the effects of demand & supply and how shifts in demand will cause cost-push inflation.

- It explains how central banks can act as a measure to raise interest rates and simultaneously change the expected inflation rate to curb tax inflation.

Book #9 International Taxation in a Nutshell

Author: Mindy Herzfeld

Buy this book here.

Review:

It is a helpful book for students and professionals who want to understand the basics of international taxation. The author explains how tax planning strategies adopted by multinational corporations lead to revenue leakage for governments.

Key Points:

- This book provides some gripping details about the sudden rise and eventual fall of the American hedge fund Long-Term Capital Management.

- The author analyzes the interaction between the latest global tax developments and US tax law.

Book #10 Examples & Explanations for Corporations

Author: Alan R. Palmiter

Buy this book here.

Review:

The author provides a thematic coverage of the taxation of companies, partnerships, and agencies. Using real-world fact patterns should help readers link theoretical concepts with their practical application.

Key Points:

- This book adopts an informal and reader-friendly approach to explain the taxation of corporations.

- This book is a comprehensive guide to practical tax issues faced by corporations.

- It also contains a commentary on the latest tax rulings, which helps readers understand the areas of taxation that are prone to litigation.

Recommended Books

This article lists the top 10 taxation books to help you with your taxes. To know more, read the following books,