Typical Errors in Taxi Insurance: An Overview

A minimum level of insurance coverage is essential. A typical financial mistake is not having insurance or relying on low-quality quotes from taxi insurance near me searches. It is crucial to have sufficient insurance to meet your needs. Basic insurance protects your assets and finances in case of accidents or catastrophic events. However, the insurance process is complicated, and people often make mistakes. Typical errors in taxi insurance errors can lead to significant financial losses, so understanding these errors can help you make informed decisions and avoid costly outcomes.

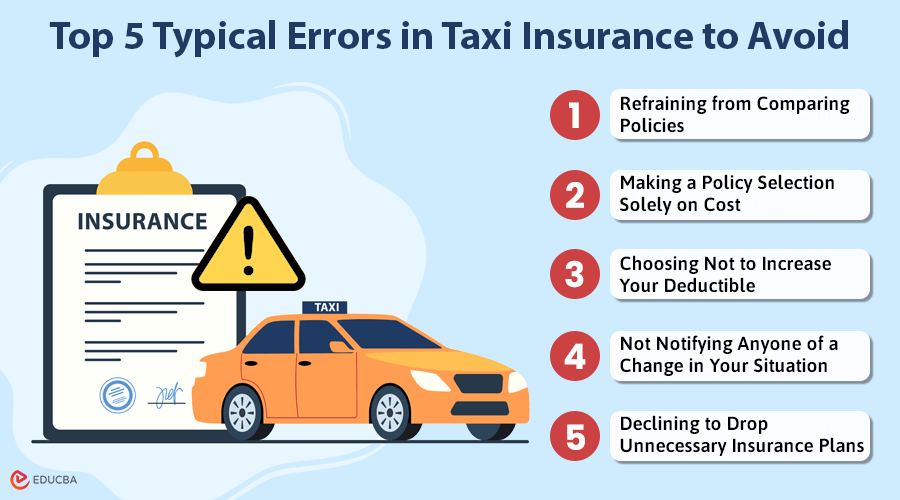

Top 5 Typical Errors in Taxi Insurance to Avoid

Regarding taxi insurance, making the wrong choices can lead to higher costs and insufficient coverage. To help you avoid these common mistakes, here are the top five errors to watch out for when selecting and managing your policy.

#1. Refraining from Comparing Policies

Getting a basic insurance policy at a reasonable price requires some research and is one of the standard taxi insurance mistakes. Performing this at least once every few years ensures you get the best deal. Changing to a different policy can help you save money, especially if you find better coverage or discounts.

- Policy Review Frequency: Compare insurance plans every two years. This quick and easy process can help keep your rates low.

- Check for Discounts: Consult with your insurance provider about savings that may apply based on your place of work, college, or other affiliations.

- Reliable Resources: Use tools like QuoteRadar to find dependable taxi insurance quotes and ensure you pay enough for sufficient coverage.

#2. Making a Policy Selection Solely on Cost

When shopping for private hire insurance, there is more to consider than just the premium. While a low-cost policy might seem appealing, it could lead to higher expenses in the long run due to other factors:

- Excess Costs: Policies with lower premiums often come with a higher excess. In case of an accident, you may end up paying significantly more out of pocket.

- Policy Conditions: Carefully review the contents of the policy to ensure you understand any attached conditions that might increase your costs.

#3. Choosing Not to Increase Your Deductible

You must pay your deductible before your insurance company covers the remaining expenses. Increasing your deductible can lower your monthly premium cost. However, ensuring sufficient funds are available to cover the deductible in case of an accident is crucial. Deductible amounts can vary depending on the type of coverage:

- Collision Insurance: To minimize out-of-pocket expenses for taxi repairs after an accident, consider opting for collision coverage with a smaller deductible.

- Comprehensive Insurance: For less frequent non-collision events such as theft or vandalism, you may choose comprehensive coverage with a higher deductible to save on premiums.

#4. Not Notifying Anyone of a Change in Your Situation

Your provider bases your insurance premiums on credit score, vehicle type, and driving record. Notify your provider of any changes to make sure they adjust your premium accurately.

- Traffic Violations: Inform your insurer of traffic tickets promptly, as they may increase your insurance premiums.

- Accidents: Notify your insurer after any accident, regardless of fault, to assess whether your premiums will be affected.

- Updated Driver: Inform your insurer if you add a new driver, as this may result in adjustments in your premiums.

#5. Declining to Drop Unnecessary Insurance Plans

Many people have unnecessary insurance, like rental taxi compensation or roadside assistance. If you do not use these services, consider canceling to save money on premiums.

- Repetition of Coverage: Compare your taxi insurance plan with any other insurance you may have, like coverage for rental cars or roadside assistance through your credit card or vehicle club.

- Changing Conditions: Re-evaluate the necessity of specific coverages as your lifestyle or number of taxis changes. For example, if you’ve upgraded your taxi and sold your previous one, gap insurance may no longer be necessary.

Final Thoughts

Avoiding typical errors in taxi insurance is essential for protecting your assets and minimizing financial risks. Regularly comparing policies, considering factors beyond cost, and adjusting deductibles can help you secure the best coverage. Additionally, notifying your insurer about changes in your situation and eliminating unnecessary plans can keep your premiums reasonable. Being proactive and informed can help you prevent costly mistakes and ensure you meet your needs with taxi insurance while offering sufficient protection against unexpected events.

Recommended Articles

We hope this article on typical errors in taxi insurance has been helpful. For more valuable insights on insurance-related topics, check out other recommended articles.