Best Books to Learn Technical Analysis

You can learn technical analysis from numerous publications that cover various topics, such as chart patterns, group psychology, building trading systems, and many more. Although, many published books offer obsolete or pointless information.

This list of the top 10 trading analysis books will help you better understand the topic and apply the method. They are suitable for students as well as professionals in this field.

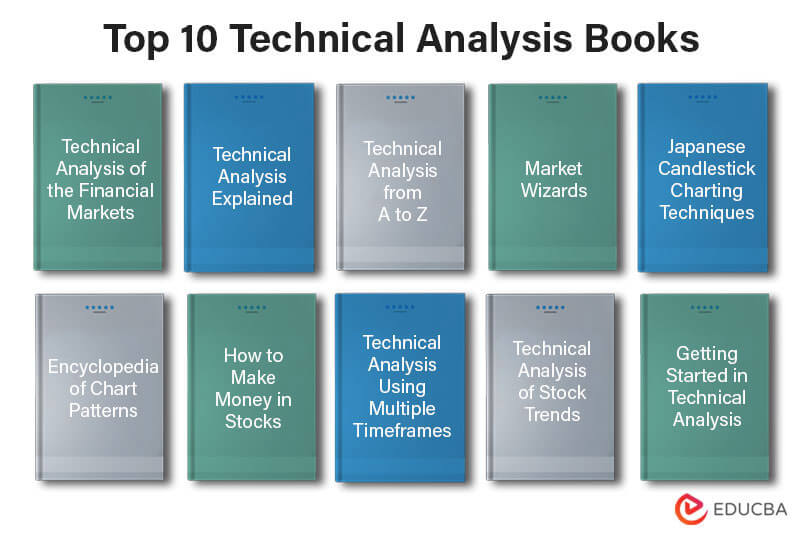

Here are 10 books’ names that have evolved into classics regarding learning how to trade.

|

# |

Books | Author | Published |

Rating |

| 1 | Technical Analysis of the Financial Markets | John Murphy | 1999 | Amazon: 4.7

Goodreads: 4.19 |

| 2 | Technical Analysis Explained | Martin J. Pring | 2014 | Amazon: 4.5

Goodreads: 4.05 |

| 3 | Technical Analysis from A to Z | Steven B. Achelis | 2013 | Amazon: 4.4

Goodreads: 3.63 |

| 4 | Market Wizards | Jack D. Schwage | 2012 | Amazon: 4.7

Goodreads: 4.25 |

| 5 | Japanese Candlestick Charting Techniques | Steve Nison | 2022 | Amazon: 4.0

Goodreads: 4.31 |

| 6 | Encyclopedia of Chart Patterns | Thomas Bulkowski | 2021 | Amazon: 4.5

Goodreads: 4.08 |

| 7 | How to Make Money in Stocks | William O’Neil | 2009 | Amazon: 4.5

Goodreads: 4.03 |

| 8 | Technical Analysis Using Multiple Timeframes | Brian Shannon | 2008 | Amazon: 4.7

Goodreads: 4.15 |

| 9 | Technical Analysis of Stock Trends | Robert D. Edwards and John Magee | 2021 | Amazon: 4.6

Goodreads: 4.16 |

| 10 | Getting Started in Technical Analysis | Jack Schwager | 1999 | Amazon: 4.5

Goodreads: 3.76 |

Let’s review each technical analysis book’s highlights, conclusions, and reviews in depth.

Book #1: Technical Analysis of the Financial Markets

Author: John Murphy

Get this book here.

Book Review:

This book explains the fundamental ideas and concepts that determine it and how they can be applied successfully in practical situations. This study aims to improve traders’ understanding of technical analysis and introduce them to cutting-edge technology tools. This is essential knowledge for all traders. The author covers inter-market linkages, stock rotation, candlestick charting, and other ideas. It helps understand the art and science of interpreting charts and technical indicators and making wise trading decisions.

Key Points:

- The book encompasses a broad range of technical analysis principles and explains complex concepts in a way that the typical reader quickly understands.

- It provides valuable details on technical indicators, chart patterns, and candlestick charting, emphasizing practical use.

- This book is a thorough reference work on technical analysis.

- One area of study in this book is the importance of technical analysis when dealing with complex F&O instruments, particularly futures markets.

Book #2: Technical Analysis Explained

Author: Martin J. Pring

Get this book here.

Book Review:

The author provides enlightening insights into the study of technical analysis as a useful and practical instrument for forecasting price changes. It teaches readers how to invest confidently in today’s more complex markets. This book puts a lot of emphasis on formulating and implementing effective strategies. It happens with the aid of sophisticated investment tools and procedures and an understanding of how investor psychology affects the markets.

Key Points:

- It covers nearly every facet of investing in today’s markets while emphasizing technical analysis as an effective investment strategy.

- The book thoroughly explains the operation and composition of current markets and the importance of cutting-edge investment tools.

- It also explains the approaches and the significance of technical analysis.

- Additionally, readers would benefit from learning to avoid letting their emotions cloud their judgment while making decisions.

Book #3: Technical Analysis from A to Z

Author: B Steven Achelis

Get this book here.

Book Review:

For those learning the fundamentals of technical analysis for the first time, this book is a good resource because it provides the ideas and vocabulary used in the first chapter in an approachable manner. The latter half of this work provides clear explanations of more than 100 technical indicators and a variety of widely utilized chart patterns. The author of this best-selling technical analysis book used a methodical strategy to explain each indication in this work and to illustrate it with appropriate real-world examples.

Key Points:

- It is an easy read for beginners looking to understand the fundamentals of technical analysis quickly.

- A newcomer can get started with assistance from knowledge of technical indicators and chart patterns in this book.

- It is a must-read for people who are new to technical analysis.

- It provides fundamental terms and principles for technical analysis as an introduction.

Book #4: Market Wizards

Author: Jack D. Schwage

Get this book here.

Book Review:

This book is a unique collection of interviews with prominent traders that provide priceless access to some of the brightest minds in the business. The fascinating success stories of traders in a league of their own provide novice and experienced traders with a wealth of knowledge about the complexities of the art of trading. They can help them improve their risk management abilities.

Key Points:

- The author interviewed Bruce Kovner, Marty Schwartz, Ed Seykota, Tom Baldwin, and other elite traders for this project.

- The book gives naturally curious people an insight into the greatest traders’ simple-to-follow secrets.

- They can even help regular traders acquire new strategies.

- The author has also developed a set of guiding principles for traders after extensive research and consideration of actual trader experiences.

Book #5: Japanese Candlestick Charting Techniques

Author: Steve Nison

Get this book here.

Book Review:

It is a highly regarded field publication credited with introducing Japanese candlestick charting methods to the West. It serves as an excellent primer on the history and fundamental ideas that underpin this strategy. Candlestick charting is now practically a requirement for any technical analysis course, and traders worldwide use it extensively. The author has also provided details on how this ground-breaking charting method can be combined with different technical instruments and utilized as a flexible analytical tool for market analysis.

Key Points:

- The book is an excellent introduction to candlestick charts for experts and beginners.

- It highlights the applicability, breadth, and complexity of technical analysis used in the day’s intricate markets.

- This book demonstrates how to use this technique with any other analytical instrument to confidently evaluate practically any market, including futures, for hedging and speculating.

- This method demonstrates the general applicability of its concepts by successfully being used to analyze futures markets, equities, speculation, and hedging.

Book #6: Encyclopedia of Chart Patterns

Author: Thomas Bulkowski

Get this book here.

Book Review:

This in-depth technical analysis book includes 23 new patterns and updated material to help readers trace pattern behavior in bull and bear markets. From this book’s ten event patterns, a trader can learn how to trade big events, such as quarterly earnings announcements, stock upgrades, and downgrades. Each chart pattern is thoroughly analyzed and addressed. It gives an overview of the pattern, talks about pattern behavior, performance rank, general identification criteria, and understanding chart pattern failures. It also explains how to prevent them.

Key Points:

- This technical analysis book covers chart patterns in depth and explains how to recognize, understand, and use chart patterns for trading.

- It helps everyone understand the behavior of chart patterns to trade more successfully in difficult market situations and manage risk appropriately.

- Additionally, the author covers how to reduce inherent risk and realistic chart pattern trading tactics.

- Relevant facts in the book help readers comprehend the behavior of chart patterns more clearly and develop their trading confidence.

Book #7: How to Make Money in Stocks

Author: William O’Neil

Get this book here.

Book Review:

Charting is only one topic covered in How to Make Money in Stocks. Furthermore, it emphasizes fundamentals like earnings, sales growth, management, and goods. It may be the best read for broad principles rather than strict regulations since it is a difficult book section. O’Neil encourages investors to overcome their first apprehension about investing in stocks that might have seen significant gains.

Key Points:

- The author explains how nothing can replace growth. Therefore, investors prefer to invest in growing businesses.

- Also, he says that objects have value. Hence, a company’s product should be cutting-edge and have room for expansion even if you don’t utilize it in your daily life.

- The book discusses why one must seek enterprising, visionary CEOs with workable, long-term growth strategies. It is crucial to avoid “carers” and “maintainers.”

- This book also says why buying equities while they’re down is typically not a good idea.

Book #8: Technical Analysis Using Multiple Timeframes

Author: Brian Shannon

Get this book here.

Book Review:

The book emphasizes the value of applying technical analysis to numerous time frames to identify transactions with the highest likelihood of success. Also, it covers themes like short selling, setting stop-loss orders, identifying price targets, and others. It also goes well beyond what its title suggests. The book includes instructions on how to identify and manage emotionally costly choices. It also shows sneaky techniques brokerage firms use to earn from your account with additional fees.

Key Points:

- The book tells readers to enter established trends with low risk and high-profit levels.

- It guides everyone on how to take advantage of cyclical capital flows in all markets.

- The author teaches how to estimate a trade’s potential profit.

- This book can be helpful to traders regardless of the method they employ. It has broad appeal among technical traders.

Book #9: Technical Analysis of Stock Trends

Authors: Robert D. Edwards and John Magee

Get this book here.

Book Review:

The hallmarks of this book are an analysis of chart patterns and an examination of the development of the Dow theory. It also discusses how to use a workable substitute. This 1948 publication, which focuses on vertical bar charts and emphasizes their value for market analysis, remains a key tool for chartists. The most recent edition of the work also has a ton of newly updated information on the subject. These include, among other ideas, the Leverage Space Portfolio Model and an enlarged version of pragmatic portfolio theory.

Key Points:

- It is the first book to develop a strategy for analyzing the predictable behavior of investors and markets was Technical Analysis of Stock Trends.

- The author has given special attention to vertical bar charts and how chartists might use them to their advantage in regular trading.

- The book is an excellent resource for beginning and seasoned chartists because it includes a wealth of information on chart pattern interpretation.

- It is up-to-date with the most recent theories, methods, and strategies to increase the work’s relevance in today’s marketplaces.

Book #10: Getting Started in Technical Analysis

Author: Jack Schwager

Get this book here.

Book Review:

This book covers crucial topics in technical analysis and is an excellent start for new traders. The book establishes trading systems, identifies entry and exit points, creates a trading strategy, and discusses technical indicators and chart patterns. These are all crucial parts of becoming a good trader.

Key Points:

- The book analyzes various charts like candlesticks, point-and-figure, bars, and close-only.

- This book covers trend-following, anti-trend, and pattern-identification trading systems.

- The author had a trading strategy set out, including trading ethics, market selection, risk management techniques, and creating a trading schedule.

- This book is a perfect destination for beginners traders because it covers all of the critical themes in technical analysis.

Recommended Books

We hope this top 10 Technical Analysis books article helps you. For more such books, EDUCBA recommends the following,