Advancements in Technologies in Finance Industry

In recent years, technology has become a crucial part of finance, revolutionizing different aspects of this sector, whether it is data quality, analytics, accounting, investing, or trading. This technology can transform the finance sector for companies and individuals using modern and advanced tools for shaping the present and future of finance. It includes artificial intelligence, blockchain, cloud computing, etc., so you can optimize your operational efficiencies, make better financial decisions, and gain higher profits.

Hence, when technology meets fiance, it is known as “fintech” or financial technology. It includes developments and innovations like mobile payments, cryptocurrencies, net banking, etc. The aim of using technology in the finance industry is to achieve faster transactions and improved security, convenience, and accessibility, among others. In this article, you will learn about the top technologies in finance industry.

Fintech Statistics:

- The Fintech as a Service Market may increase substantially from $310.5 billion in 2023 to $676.9 billion by 2028, with an expected CAGR growth of 16.9% during the forecast period.

- According to experts, the blockchain technology market will reach $1,235.71 billion by 2030.

- The market revenue of cryptocurrencies may reach $71.7 billion by 2028.

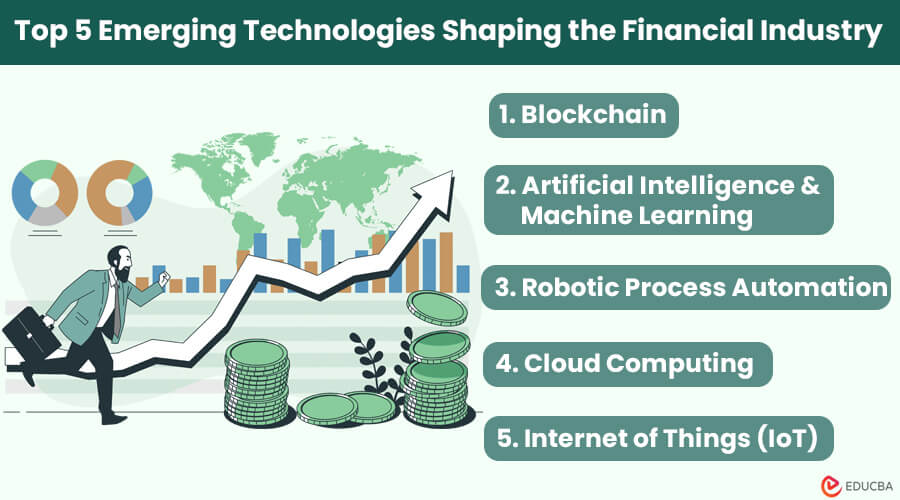

Top 5 Emerging Technologies in Finance Industry

Let us explore the top 5 emerging technologies in finance industry.

1. Blockchain Technology

Blockchain is a technology in the financial industry that uses DLT, i.e., distributed ledger technology, to record, share, and synchronize data. It stores data on an online ledger, continuously updating it in real-time across different locations and duplicating it on a network of computers. Advanced cryptography protects the data in a blockchain, making it secure and almost impossible to change. Since there is no single owner or any disturbance to the data, this technology promotes transparency and trust.

In addition, the finance industry uses blockchain technology to solve identity theft and cybersecurity issues. The transaction costs are low since there is no mediator or a centralized place to control the blockchain. This has made it popular for widespread adoption.

Uses:

- It is useful for processing international or foreign payments with low transaction fees.

- It supports assets such as tokenization for private equity funds, providing custody services, etc.

- Blockchain helps verify and manage user identity.

- It settles transactions efficiently and facilitates trading activities.

- It enables smart contracts for processing loans securely.

- Blockchain manages loan and KYC (know your customer) processes and tracks financial commodities for supply chain management.

2. Artificial Intelligence and Machine Learning

The fintech industry increasingly depends on Artificial Intelligence (AI) and Machine Learning (ML). It is because it makes life easier for both businesses and customers. These systems can improve business services, operate more efficiently, and improve customer experience.

Uses:

- Advanced AI chatbots help businesses provide 24/7 customer service, suggest products and services, and answer common queries without depending completely on human support teams.

- AI and ML systems can detect and prevent online fraud in real-time. These use advanced algorithms to analyze data patterns and detect unusual fraud activities. Businesses can also receive notifications or alerts and fix issues quickly, saving money and reputation.

- These AI and ML tools accurately predict future market data using historical and past data. This will help investors and traders make better financial decisions before any investments.

- AI and ML can determine an individual’s creditworthiness by analyzing data like their income, credit history, employment history, etc.

- These systems also help manage assets, personalize customer experiences, and more.

3. Robotic Process Automation (RPA)

The finance industry uses Robotic process automation (RPA) to automate operations using robotics, advanced algorithms, and software solutions. This technology enables finance automation, helping fintech companies to meet their growing demands and provide solutions quickly. It also helps them make better business decisions, reduces manual and repetitive work, and saves resources, effort, money, and time. As a result, businesses can focus on important tasks to achieve better results.

Besides making processes faster and more efficient, RPA decreases the risk of human errors so that businesses can succeed even during tough market conditions.

Uses:

- RPA is useful for processing payments and also automates routine and labor-intensive finance processes to save time and effort.

- RPA helps in accounting reconciliation tasks and detects fraudulent activities by analyzing data patterns.

- Also, RPA uses chatbots and other software-based robots at a large scale to handle customer queries and tasks.

- It allocates tasks and manages massive amounts of information by organizing and processing data efficiently.

- It reviews and adjusts work hours and helps manage inventory.

- Moreover, it helps in financial recording and reporting.

4. Cloud Computing

Cloud computing is a technology in the financial industry that can help fintech companies move towards digitization with ease. It provides flexible computing services and storage capacity while using fewer resources. Companies can also back up data, store it in the cloud system, and access it anywhere, anytime, enhancing convenience. Therefore, with data storage in the cloud, the company cannot lose its data during a natural disaster or any other unfortunate event.

Moreover, fintech companies can achieve better business agility and scalability by relying on the cloud. They can handle more customers and data with the help of cloud computing. They can also use modern, advanced software-as-a-service (SaaS) solutions to automate their task, improve security, build products and services, and so on.

Uses:

- Cloud banking (banking as a service) allows the processing and storing of financial data in several remote locations instead of just one computer.

- It helps build easy and user-friendly banking software for a better customer experience.

- It also ensures security with technologies like DevSecOps.

- It uses containers to handle multitasking on a single operating system (OS) instance to improve efficiency.

5. Internet of Things (IoT)

The finance industry is among the early adopters of the Internet of Things (IoT). IoT refers to real-world or physical objects using software, devices, sensors, and other systems over the internet. With the use of this IoT, companies can share data easily.

Uses:

- IoT provides real-time financial data for trading, investing in stocks, etc.

- It helps detect and prevent online fraud.

- It enables personalizing customer experiences based on their preferences and demographics.

- IoT helps in maintaining data security.

Challenges and Considerations

Some of the challenges with fintech and what you can do about it are as follows:

1. Data Security

Due to increasing cybersecurity issues, your data is always at risk.

2. Compliance Risks

Finance is a highly regulated sector; hence, you must meet compliance regulations applicable according to the jurisdiction.

Solution: To avoid compliance risk, you should keep track and stay informed of any updates in finance regulations, prepare regular audits, or possibly hire an experienced lawyer for guidance.

3. Tech Expertise

Many fintech companies lack the necessary technology and expertise to deal with financial issues.

Final Thoughts

Emerging technologies like AI, blockchain, IoT, RPA, and cloud computing are transforming the finance industry. Fintech companies, investors, traders, and other individuals can use these financial technologies to improve efficiency, productivity, and investment return.

Author

Stacy Dubovik (Financial Technology and Blockchain Researcher)

Stacy is an expert in large-scale digital transformation projects and has practical knowledge of the finance domain. She joined ScienceSoft in 2020. She frames ScienceSoft’s service offerings and technology, guiding corporate finance, BFSI, DeFi, and blockchain. She also works closely with developers, business analysts, and software architects to help create innovative solutions for clients. for clients. In addition, she continuously monitors customer expectations and new fintech trends in the BFSI market and blockchain products.

Recommended Articles

We hope this article on technologies in finance industry benefited you. To learn more, you can refer to the articles below.