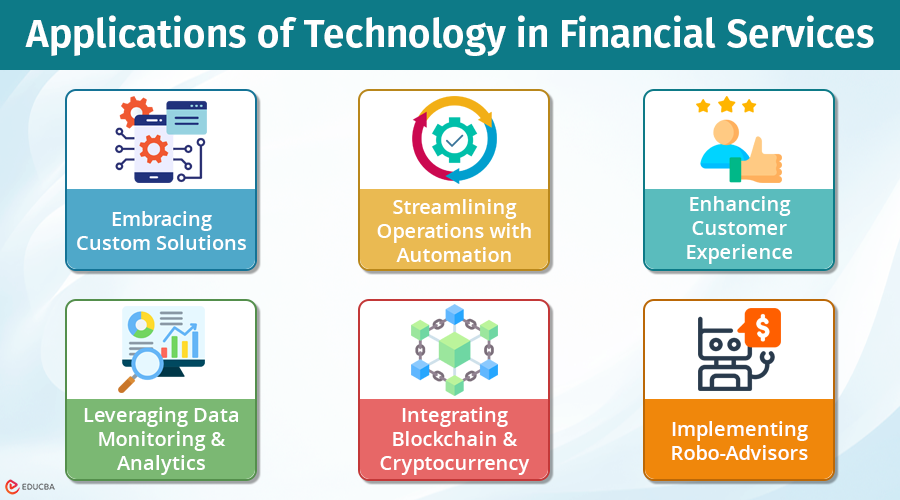

Technology and Financial Services: How is IT Revolutionizing the Financial Services Sector?

Information technology is significantly transforming the financial services sector. This shift is reshaping how financial institutions operate, interact with customers, and manage their operations. The impact has been significant, driving improvements in online customer service, efficiency, and speed of service. Here are the various applications and benefits of integrating technology and financial services.

#1. Embracing Custom Solutions

To stay competitive and address unique business challenges, financial institutions are increasingly investing in Custom Software Development Dallas. Tailor-made solutions offer several advantages:

- Enhanced Efficiency: Custom software meets specific operational needs, leading to streamlined processes and reduced manual effort.

- Scalability: As financial institutions grow, custom solutions can accommodate new functionalities and increased workloads.

- Better Integration: Custom software seamlessly integrates with existing systems, ensuring a cohesive IT ecosystem.

#2. Streamlining Operations with Automation

Financial Process Automation is another crucial area in which technology is making an impact. Automated processes are transforming how firm manage financial transactions and operations:

- Reduced Errors: Automation minimizes human error by standardizing processes and ensuring consistent data entry.

- Increased Speed: Automated systems accelerate transaction processing and other financial operations, enhancing overall efficiency.

- Cost Savings: Automation also lowers operational costs and frees up resources for other critical tasks.

- Ensures Compliance: It helps automate compliance processes, ensuring adherence to the ever-evolving regulatory landscape.

#3. Enhancing Customer Experience

IT advancements are not only improving internal processes but also enhancing customer interactions:

- Personalized Services: Custom software enables financial institutions to personalize products and services as per customer data and preferences.

- Faster Transactions: Automation and modern IT systems enable quicker processing times, providing a smoother experience for customers.

- Better Security: Advanced IT solutions enhance security measures, protecting sensitive financial data and instilling confidence in customers.

#4. Leveraging Data Monitoring & Analytics

- Real-time Monitoring: Advanced monitoring systems enable real-time tracking of transactions and activities, facilitating quicker response to potential regulatory breaches.

- Predictive Analysis: Financial institutions are leveraging data analytics to predict trends and customer behaviors, which helps them make informed decisions.

- Risk Management: AI-driven models help in assessing risks more accurately and efficiently, leading to better risk management.

#5. Identity Verification with Biometric Authentication

- Streamlined Onboarding: Identity verification technologies streamline the customer onboarding process by quickly and securely verifying customer identities.

- Regulatory Compliance: These technologies help financial institutions comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations more efficiently.

- Preventing Fraud: Authentication methods, such as fingerprint and facial recognition allow financial institutions to deal with the risk of fraud and unauthorized access.

#6. Integrating Blockchain and Cryptocurrency

- Secure Transactions: Blockchain offers a secure way of recording transactions, which enhances transparency and reduces fraud.

- New Asset Class: The integration of cryptocurrencies as a new asset class offers customers more investment options and diversifies their portfolios.

#7. Implementing Robo-Advisors

- Cost-Effective Investment Advice: Robo-advisors provide automated, algorithm-driven financial planning services, making investment advice more accessible and affordable to a broader audience.

- Portfolio Optimization: They use sophisticated algorithms to optimize investment portfolios, ensuring that customers receive personalized and effective investment strategies.

Final Thoughts

The future of financial services depends heavily on ongoing IT advancements. Financial institutions will succeed as the industry evolves. As technology progresses, the financial sector will likely undergo even more significant changes, creating an exciting era for businesses and customers alike.

Recommended Articles

We hope you found this article on integration of technology and financial services helpful. Check out these other similar articles.