Top Advantages and Disadvantages of Online Health Insurance

Are you planning to buy health insurance online?

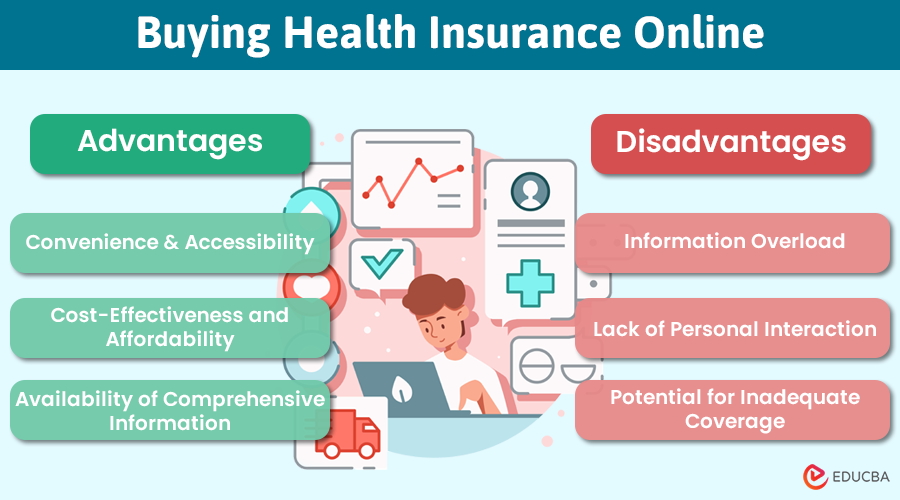

Buying health insurance online is becoming increasingly popular. The convenience allows internet users to explore and purchase health insurance policies right from the comfort of their homes. However, as with any activity, you must consider the advantages and disadvantages of online health insurance.

In this blog, we will help you make an informed decision by explaining the plus and minus of buying health insurance online.

Advantages of Buying Health Insurance Online

1. Convenience & Accessibility

One of the greatest benefits of online health insurance is the convenience and ease of buying it. You can look at different policies and compare prices from the comfort of your home or office. Whether at home, at work, or even on the move, all you need is a stable internet connection to access a wide array of health insurance options. It means you can buy health insurance online any time of your day, making it a perfect choice for busy people who want to handle their insurance needs in a hassle-free manner.

2. Cost-Effectiveness & Affordability

Buying health insurance online can be much more affordable for many reasons. Firstly, since everything is done digitally, There are savings that could get passed on to customers, in the form of special offers. Being able to browse multiple options online means you may likely find budget-friendly options with great deals online.

3. Availability of Comprehensive Information

The internet is full of information on a wide range of topics, and health insurance is no exception. When you get an online health insurance, you have immediate access to almost all the details and information including policy descriptions, accident insurance policy, customer reviews, expert articles and blogs, etc. This vast and detailed information will help you understand the details of different plans and help you make a smarter decision.

Disadvantages of Buying Health Insurance Online

1. Information Overload

Although the internet is a great place to learn, explore, and buy health insurance online, the abundance of available information can overwhelm and confuse some people. With so many plans and offers available on different websites, even online shoppers who prefer to buy everything online may find it hard to understand it all.

Without the guidance of an expert, you might struggle to clearly understand the specifics of each plan such as an accident insurance policy and determine which one best suits your needs. This abundance of information can make the decision-making process more easier.

2. Lack of Personal Interaction

Another downside of buying health insurance online is the lack of personal, face-to-face interaction with an insurance agent or branch service team who can guide you. While most individuals are used to digitisation, there are still many people who prefer the in-person guidance, support, and reassurance, provided by a knowledgeable professional when going through the complexities of health insurance.

3. Potential for Inadequate Coverage

One challenge of buying health insurance is going ahead without checking for coverage and not knowing whether to add on options. While some plans in India offer limited accident coverage, it is often not enough. To be fully protected, you will likely need to get a separate personal accident insurance policy. When buying online, it is important to research sufficiently so you can pick the right plans.

Final Thoughts

Buying health insurance online offers convenience and hassle-free processes, allowing you to compare plans and access extensive information easily. However, it is important to thoroughly analyze both pros and cons before making a decision. An additional note or tip is to always buy health insurance from a reputable provider like Chola MS and thoroughly understand policy terms and conditions before finalizing your decision.

Recommended Articles

We hope you see these advantages and disadvantages of online health insurance before making a decision. Here are EDUCBA’s other articles on insurance.