Updated July 31, 2023

Time Value of Money Formula (Table of Contents)

- Time Value of Money Formula

- Examples of Time Value of Money Formula (With Excel Template)

- Time Value of Money Formula Calculator

Time Value of Money Formula

The time value of money is a very important concept for each individual and for making important business decisions. Companies will consider the time value of money while deciding whether to acquire new business equipment or to invest in new product development or facilities and establishing the credit terms for selling their services or products.

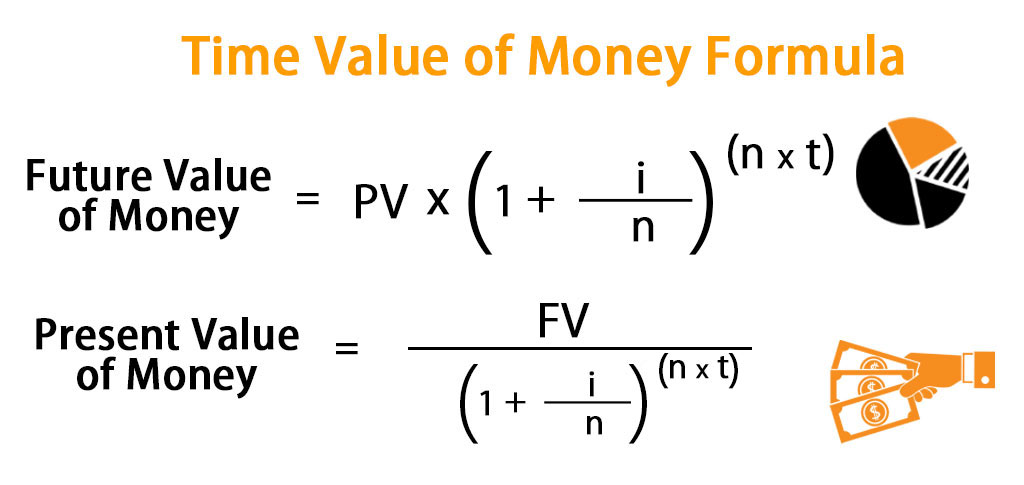

There are two aspects of the time value of money the first one is the future value of money, and the second one is the present value of money. In the future, the future value of money will represent the worth of money invested today. Conversely, the present value of money will indicate the current value of an amount that will be received or paid in the future.

The formula to calculate the future value of money allows comparison with the present value of the money:

Where,

- FV = Future Value of Money

- PV = Present Value of Money

- i = Rate of interest

- t = number of years

- n = number of compounding periods per year

Examples of Time Value of Money Formula (With Excel Template)

Let’s take an example to understand the calculation of the Time Value of Money formula in a better manner.

Example #1

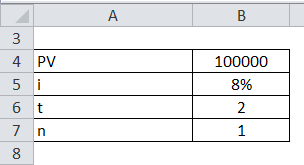

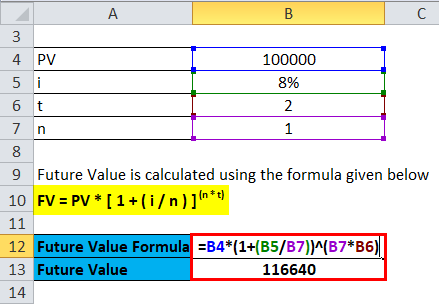

Let us Assume that a sum of money, say $100,000 is invested for two years at 8% interest. What will be the future value of the sum invested?

Solution:

The formula to calculate Future Value is as below:

FV = PV * [ 1 + ( i / n ) ] (n * t)

- FV = 100,000 * [ 1 + ( 8% / 1 ) ] ( 1 * 2 )

- FV = 116,640

Example #2

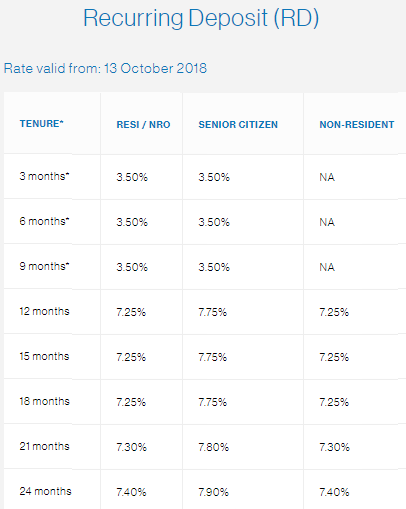

Below is the extract from the standard chartered bank deposit rate (recurring deposit) available for various periods. Now let’s assume that you decide to invest $100,000, say for period of 6 months, then what is the value you would expect to receive?

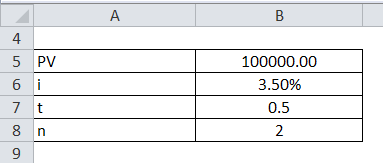

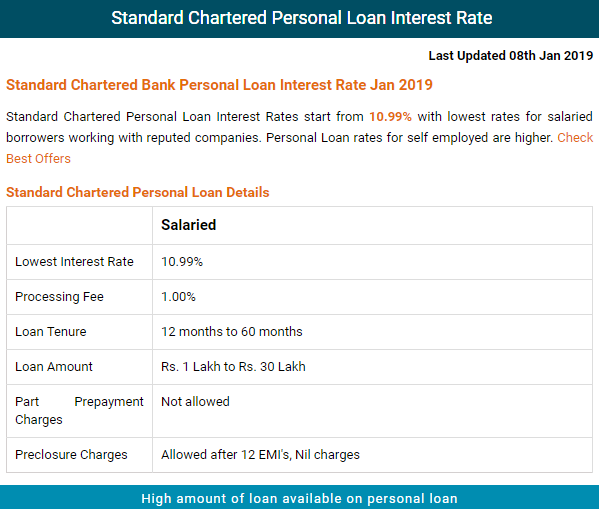

Let’s now try to calculate the future value of money:

Here, PV is $100,000, the Rate of interest for 6 months applicable is 3.50% p.a., the number of years is 0.5 (1/2), and the number of compounding per period will be 2.

The formula to calculate Future Value is as below:

FV = PV * [ 1 + ( i / n ) ] (n * t)

- FV = 100,000 * [ 1 + ( 3.50% / 2 ) ] ( 2 * 0.5 )

- FV = 1,01,750

Example #3

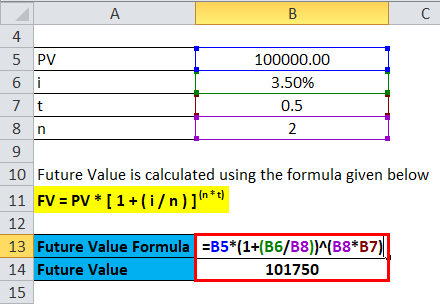

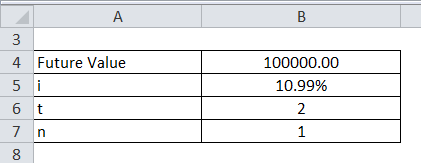

Below is again an extract of loan details from a standard chartered bank where the bank will lend, say 100,000 to its client at a rate of interest 10.99% and say the term is 2 years.

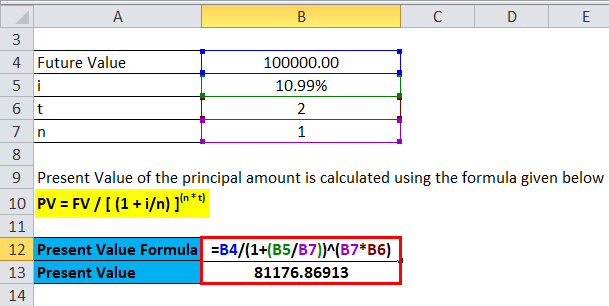

In this case, the bank will calculate the present value of the principal only, that is, the present value of the money which the bank would receive in the future.

Here the FV is 100,000, i is 10.99%, t is 2 years, and n is 1 year.

The formula to calculate the Present Value of the principal amount is as below:

PV = FV / [ (1 + i/n) ](n * t)

- PV = 100,000 / [ (1+10.99/1)](2*1)

- PV = 81,176.86913

Explanation

The Time Value of Money concept will indicate that the money earned today will be more valuable than its fair value or intrinsic value in the future. This will be due to its earning capacity, which will be the potential of the given amount. The time Value of Money (i.e. TVM) can also be called Discounted present value. Money deposited in the savings bank account will earn a certain interest rate as it must compensate for keeping the amount of money invested by a client and away from them at the current period. Therefore, if any bank holder deposits $200 in the bank account, then the customer will expect to receive more than $200 after 1 year.

Relevance and Uses

The time value of money is a wider concept and can also be related to purchasing power and inflation. Consider both factors along with the rate of return that investing the amount of money may realize.

Why is this factor so much important? The reason is inflation constantly erodes the value of money and, henceforth, the purchasing power of the money. This can be best exemplified by the value or the prices of commodities such as food or gas. Let’s say. For example, you were given a certificate for $150 of free gasoline in 1991. Then you could have purchased a lot more gallons of gasoline than you could have in hand if you were given $150 of free gas a decade, i.e., 10 years later.

The time value of money formula can be used in many financial decision-making:

- Capital budgeting

- Valuation of companies

- Loan amount and EMI calculation

- Annuity Calculation

- Insurance premium calculation

Time Value of Money Formula Calculator

You can use the following Time Value of Money Calculator.

| PV | |

| i | |

| n | |

| t | |

| Future Value of Money = | |

| Future Value of Money = | PV * (1 + (i / n))(n * t) | |

| 0 * (1 + (0 / 0))(0 * 0) = | 0 |

Recommended Articles

This has been a guide to the Time Value of Money formula. Here we discuss How to Calculate the Time Value of Money using FV Formula and practical examples. We also provide a Time Value of Money Calculator with a downloadable excel template. You may also look at the following articles to learn more –