Updated July 21, 2023

What is Times Interest Earned Ratio?

Times Interest Earned Ratio is also known as interest coverage ratio and it can be defined as a metric used for the purpose of calculating the ability of an organization is paying off all its short-term and long-term debt obligations it is calculated by dividing the company’s EBIT (or earnings before interest and taxes) by the interest expense.

Formula

The formula used for calculating is as follows:

Where,

EBIT stands for the earnings before interest and taxes which is the measure of the profit of the company after taking into consideration all the types of expenses and income that arise during the period except the expenses pertaining to the interest and the taxes. It can be calculated by adding the interest expenses and the tax expenses to the net income of the company.

Interest expense is the amount of expense pertaining to the interest that arises in the company when it raises the finances through the means of the debt or the capital leases. The number of Interest expenses can be found in the statement of income of the company.

Explanation

Times Interest Earned Ratio is the ratio between EBIT and interest expense. TIE is a type of solvency ratio that is used for determining the ability of an enterprise in taking care of its debt obligations. TIE is a very important and useful metric for users since it enables them to determine the solvency status of an organization

Examples of Times Interest Earned Ratio (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

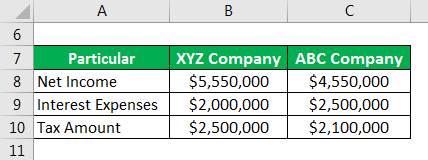

During a year the income statement of the XYZ Company showed the net income of $5,550,000. For the period, the interest expenses of the company are $2,000,000 and the tax amount is $2,500,000.During the same year, the income statement of the ABC Company showed a net income of $4,550,000. For the period, the interest expenses of the company are $2,500,000 and the tax amount is $2,000,000. Calculate the Times interest earned ratio of the two companies for the year using the information as given and analyze than which company has a better financial position.

Solution:

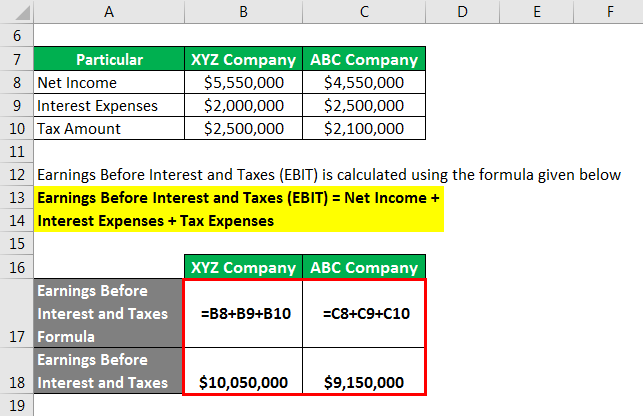

Earnings Before Interest and Taxes (EBIT) is calculated using the formula given below

Earnings Before Interest and Taxes (EBIT) = Net Income + Interest expenses + Tax Expenses

XYZ Company

- Earnings Before Interest and Taxes (EBIT) = $5,500,000 + $2,000,000 + $2,500,000

- Earnings Before Interest and Taxes (EBIT) = $10,050,000

ABC Company

- Earnings Before Interest and Taxes (EBIT) = $4,500,000 + $2,500,000 + $2,100,000

- Earnings Before Interest and Taxes (EBIT) = $9,150,000

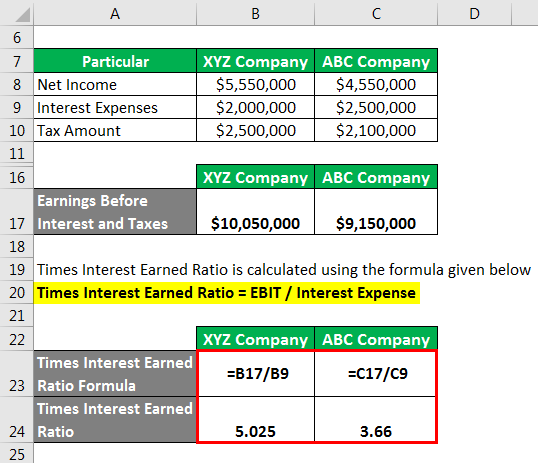

Times Interest Earned Ratio is calculated using the formula given below

Times Interest Earned Ratio = EBIT / Interest Expense

XYZ Company

- Times Interest Earned Ratio = $10,050,000 / $2,000,000

- Times Interest Earned Ratio = 5.025

ABC Company

- Times Interest Earned Ratio = $9,150,000 / $2,500,000

- Times Interest Earned Ratio = 3.66

Hence Times’ interest earned Ratio for XYZ Company is 5.025 times and ABC Company is 3.66 times. In this case, since times interest earned Ratio of XYZ Company is higher than the time’s interest earned ratio of ABC Company, it shows that the relative financial position of XYZ company is better than ABC company.

Use and Importance of Times Interest Earned Ratio

The significance of TIE is probable to a lot of extents. TIE ratio is used by users for a variety of purposes. With the TIE ratio, users can determine the capability of an organization is paying off all its debt obligations with the net income earned by the same. In other words, the ratio allows the users to evaluate and learn about the solvency and liquidity status of an enterprise. This is also of great use for users who are willing to make comparisons between two or more organizations with respect to their financial wellness.

Advantages and Disadvantages

Below are the advantages and disadvantages:

Advantages

Following are the advantages:

- The TIE ratio is easy to calculate.

- The TIE ratio indicates the solvency and liquidity of an organization.

- TIE ratio can be taken into use for measuring the current financial performance of an organization.

- TIE ratio can be taken into use for comparing the financial status of two or more entities.

Disadvantages

Following are the Disadvantages:

- TIE ratio only takes interest expenses into consideration and ignores principal payments. Sometimes, it may happen that principal payments are of a huge amount and can have a legitimate impact on the solvency status of an entity.

- TIE takes EBIT into consideration and sometimes, this value might not represent enough cash plowed by an enterprise. Due to this reason, the TIE ratio of higher value may not always mean that an entity has sufficient cash to settle off all its interest expenses.

Conclusion

Times Interest Earned Ratio can be calculated by taking EBIT as the numerator and Interest expense as a denominator and dividing the former by the latter. The formula is super easy to calculate and it can be totally used in learning the current financial well being of an organization. TIE is a very useful ratio. The users can take into their use in order to determine the actual financial performance of an organization and can also use the results in evaluating the current performance with the previous years’ performances.

Recommended Articles

This is a guide to the Times Interest Earned Ratio. Here we discuss how to calculate along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –