Definition of Business and Finance

Entrepreneurs are self-taught in most respects, but when it comes to managing business and finance, what counts is being prepared. Keeping up with receipts, invoices, and payments across the year and stable financial record keeping is easier said than done. If you have a small business that you want to nurture into a giant company, here are some crucial finance tips for you. So, read on to get the numbers right regarding financial management.

Get Better in Business and Finance

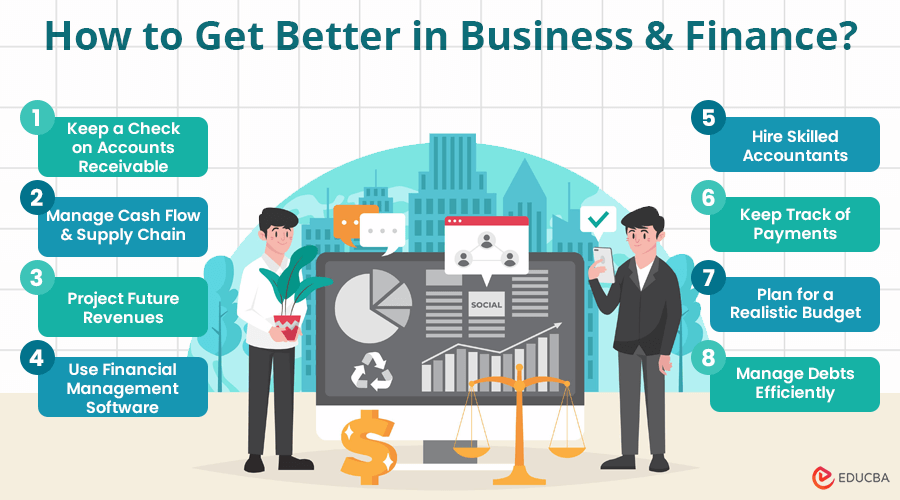

Below are mentioned 32 tips to get better in business and finance:

Use Cloud Technology to Weather the Storm

Switching from desktop software to cloud accounting solutions has many advantages, such as properly tracking your financial information annually.

Thanks to cloud computing, economic crises can be weathered well, and real-time insights into your finances can be accessed from anywhere.

This provides a huge efficiency boost for entrepreneurs of small businesses. Could accounting solutions also allow small business owners to scrutinize business and finance with the accountant?

Plan for a Better Tomorrow

Business issues need to be addressed daily, and finances require careful future planning. Those not looking into the crystal ball will fall behind the competition.

Spread Out the Tax Payments Net, Outsourced Finance Management

This is another good way to ensure you can get over the trouble of saving for quarterly estimated tax payments annually by choosing monthly payments instead.

Tax, therefore, becomes like another monthly operating expense. Reliable small business accounting falls outside the expertise of passionate entrepreneurs who mean well. Outsourcing technical and financial tasks is the best way forward in such cases.

Use the Past Financial Statements to Project Future Revenues

Expert CFOs recommend looking at the big picture regarding your company’s financial performance. Use past financial statements to project future revenue, expenses, and cash flow, and base your business decisions on this.

SaaS Financial Tools That Make Sense for Your Business

Using tools that work for your business is important. SaaS or Software as a service financial tools are a hot choice among small business owners who want to capture, analyze, and track financial data and understand their options to make informed decisions about the correct platform for their business. Using tools that capture only the required amount of information is vital.

Separate Business Expenses from Incidental Costs

If you are using business and finance for personal expenses and making a repayment, an account of this also needs to be maintained. Keep separate accounts for business and personal use, making tracking deductible expenses and crossover costs easier.

Hire Skilled Accountants

Tax laws are complicated, and you need allies for a beneficial business outcome. Intimate knowledge of taxation and tax laws in their jurisdiction makes accountants trusted professionals for the job. Calling in a pro has many benefits if you want more deductions and a penalty-free tax experience.

Organize your Business and Finance

Make sure to dedicate a regular weekly slot for sorting out your finances, whether with pen and paper or digital tools. Consider using accounting document management software to keep your financial records organized effectively. This habit will give you better insights into your business and help you make smarter decisions based on accurate information.

It will also ensure everything is organized when tax time approaches. Track your expenses if you want to be on a path to prosperity. You will also incentivize employees and check if you are within your budget by doing the math now rather than tackling numbers at the last minute.

Keep Track of Payments

Small businesses frequently operate without properly tracking customer invoices and payments, which costs them in the long run. Keeping proper records means being able to track your finances in one glance.

With admin tasks to take care of, an accounting snapshot is a handy tool for keeping a tight rein over business and finance. Navigate tricky financial waters and come sailing smoothly to the other side by clearly accounting for your payments.

Plan for a Realistic Budget Rather than Building Sandcastles in the Air

Budgets are essential to ensure your business gets off the ground and your feet firmly planted on solid terrain. A budget lays out what direction the business plan is moving in. It also indicates whether you must push harder or scale back your efforts.

Overspending is a Costly Mistake

A fancy company car or the latest Apple Mac are not necessary expenditures but only ways to create a shortfall that the business cash flow may not be able to handle.

So keep your expenses in check, or things can get out of hand. Lines of credit can be an increasingly dangerous path to tread on the road to growth and expansion. Learn to regulate your expenses and reinvest the rest towards the future financial health of your firm.

Complete Records are Important to Get the Big Picture

If our invoices, credit notes, bank statements, and financial documents are organized well, financial accounting will not be reduced to looking for missing pieces in a jigsaw puzzle.

Lost or inadequate records will be a massive problem for small organizations, especially in emergencies. Tools like an accurate online paystub generator can help streamline payroll records, ensuring you have accurate data on hand when needed.

Make sure you keep backups and accounting online in the cloud rather than having your head in the cloud when it comes to doing the math and keeping the score.

Manage Debts Efficiently

Managing debt effectively is crucial, and small businesses require clarity on the various business and finance options available, along with understanding the cost associated with each financial solution.

Lean Operation= Smooth Functioning

Once the money has been spent, fixed costs cannot be avoided, But running a lean operation rather than a flashy one can help to build the business rather than sapping available cash.

Keep costs to the minimum by avoiding capital expenditures as far as possible, and business success will be close at hand. It’s better to rein in costs when the economy is doing well than to tighten the belt when times get tough.

Expand at a Manageable Pace to Speed Up Growth

Employees can add to the business but to the cost factor as well. Consider expenses such as taxes, desks, furniture, computers, and indirect costs before you are set on a hiring spree.

Consider techniques like outsourcing globally to lower costs. Pay per task or hour and hire freelancers who cost less than full-time employees.

Keep a Check on Accounts Receivable

As the business expands, accounts receivable do not always keep pace. Make sure the average number of days for outstanding invoices doesn’t expand in time as your business grows. Avoid bad debts and the possibility of receivership by disciplined managing the business’s finances.

Access Capital in Here and Now to Encash in the Future

Consider drawing out capital to expand, buy another company or launch new products or services, refinance old debt, or establish a line of credit to weather a future rainy day.

Liquidity is one of the biggest presents you can gift your company in current times to tide over everything from daily business obligations to temporary cash shortages.

Employee Engagement is Essential

Engaging employees is a critical step forward in lowering turnover. It is also financially better to hire experts as consultants than hire for part-time positions. Moving further involves expanding expertise as well as a global footprint. For both, employee engagement is crucial.

Startups with Modest Beginnings End up Rich

Regardless of size, all businesses can only expand and grow if they start small. Gaining interest and feedback is a gradual process, and companies need to test new concepts in the market before launching their products. By using opportunities right now, you can cash out in the future.

When Times Get Tough, Cash is King

Consider every capital purchase requiring additional debt and see if the expenditure will generate the cash flow to make up for itself. Defer purchases that cannot pay their way through.

Budget Is The Perfect Financial RoadMap

On the path to prosperity, the budget is the financial roadmap that serves as a guide. Check the sources of capital growth and cash drains by tracking your expenses and budgeting.

Assess Your Financial Performance Objectively

Are you getting the top returns for your investment? Are nonbusiness assets also generating growth? Is the financial health of your company in pink or in red? Survival is only possible if you make objective assessments without any bias.

Be clear about the way your debt is structured. Look to generate a balance between short-term and long-term debt. Use long-term equity for business survival only.

Conduct In-Depth Financial Review

Prepare for a financial review with current investors, cash flows, balance sheets, etc. Assess and make provisions for the information needed. You must look beyond the tip of the iceberg if there are financial problems.

Lower the Risk, Higher the Benefits

Check your insurance coverage and increase deductibles to lower the premium. Review every item in the inventory list and eliminate coverage on low-risk items. You must also examine insurance policies for borrowing against cash surrender values at low rates.

Deal with Financial Problems At Once To Prevent Lasting Issues

You must take a proactive approach when an issue impacts cash flow. Discussing financial difficulties is important, and dealing with them even more so. Clarity of perspective is very important.

Little Knowledge is Dangerous, So Educate Yourself

Financial literacy is imperative to succeed in business and finance. This means knowing about cash flow, income, balance sheets, and shareholder equity statements.

The cash flow statement analyzes operating activities, financial and outflow, and investments. A balance sheet provides information on assets, liabilities, and shareholder’s equity.

Revenue earned within a specified period of time is reflected in the income statement. Shareholder’s equity refers to the composition of common and preferred shares.

Monitor and Assess Performance

You need to keep tabs on money movement when large amounts are involved. Assess financial performance with respect to past financial statements to project expenses, cash flow, and future revenue.

Be Clear About the Numbers

Ensure you do the math and know what it takes to run your business. Assess the true cost of products and services and track money moving in and out of your business to be clear about the expenses involved.

Unearth Hidden Costs

If you need to obtain a permit or get a license, the cost of managing your small business just shot up. Why? Quite simply because you have to factor in the cost of legal services, salary, return on investor capital, and capital for future expansion.

Add the cost of borrowing money, interest, and debt already accrued. Start thinking ahead after finding out how much your business is consuming.

Learn How to Manage Cash Flow and Supply Chain

Brush up on the basics and understand your cash inventories and how you manage the cash flow and the supply chain.

Know About The Marketplace

You must educate yourself about your marketplace and competitors to ascertain how the company fares in pricing, services, and goods. Assess the strengths and weaknesses and identify the opportunities to help you market your business better.

Go Hi-Tech, Use Financial Management Software

Software options can help you to track business and finance, file taxes, manage the budget, and maintain invoices. Utilizing financial management software can streamline these processes, ensuring accurate and efficient financial oversight.

Pricing your product or service is not just a test of your worth. The value of your business includes other factors, such as the competitive landscape and value brought to the business by customers.

The true worth of a business determines its prospects and influences its future.

Conclusion

Recommended Articles

Here are some articles to help you get more details about Business and Finance, so just go through the link.