What are Finance Certifications?

Professional finance certifications are specialized credentials that demonstrate expertise and knowledge in various aspects of finance. Professional organizations and institutions typically award these certifications after candidates complete a rigorous course of study and pass an exam.

These certifications can enhance a professional’s credibility, demonstrate their commitment to continuing education and professional development, and increase their job opportunities and earning potential.

Listed below are some advantages of finance certifications:

- They help individuals to perform better and strive toward excellence

- They improve the market value of a professional, thus increasing their visibility for recruiters

- Higher qualifications and credentials mean more job security

- Individuals with such finance certifications can expect up to 15% higher remuneration than the current market average.

Each finance certification is specific to the kind of role a financer needs to play in an organization. The duration and assessment method also varies from one program to the other.

Finance Certifications

1. CFA® – Chartered Financial Analyst

About the Certification

Chartered Financial Analyst certification is awarded to finance professionals, specifically by the CFA Institute. When a student completes a program of three different exams, they get the designation of a Chartered Financial Analyst.

This certification has three levels:

- CFA Level 1

- CFA Level 2

- CFA Level 3

To become a Chartered Financial Analyst, the finance professional has to meet the following requirements:

- Should complete the three levels of examinations of the CFA program

- Should have four years of prior work experience in the finance industry

- Should have a membership in the CFA institute

- And lastly, they should adhere to all the codes of ethics and standards of professional conduct of the CFA Institute.

Below are the topics that are an integral part of this exam:

- Financial Reporting

- Economics

- Financial Analysis

- Ethics

- Corporate Financing

- Fixed Income Investments

- Alternative Investments

- Equity Investments

- Portfolio Management

CFA Course Structure

To complete the certification of CFA, the finance professional must complete a course of three different levels. The three levels comprise various subjects or topics related to finances, mathematics, and accounting.

So, let us move ahead and understand the course structure and other relevant essentials of CFA Level 1.

CFA Level 1

The CFA level 1 examination divides into two sessions of 135 minutes of 90 multiple-choice questions per session.

| CFA Level 1 Exam | Session 1 | Session 2 | Total |

| Duration | 2 hours 15 minutes | 2 hours 15 minutes | 4 hours 30 minutes |

| Number of Questions | 90 | 90 | 180 |

| Exam Topics | Ethical and professional standards, economics, financial reporting, mathematical methodologies, financial analysis | Fixed incomes investments, alternative investments, corporate financing, equities, portfolio management | – |

Syllabus for CFA Level 1

| Subjects in CFA Level 1 | Percentage Weightage | Topics covered |

| Ethics | 15% | Global Investment Performance Standards Standard of Professional Conduct |

| Fixed Income Analysis | 11% |

Fixed Income Markets Fixed Income Securities Introduction to Fixed Income Valuation |

| Financial Reporting Analysis | 15% |

Drafting Balance sheet Financial Reporting Mechanics and Standards |

| Equity Investment | 11% | Market Efficiency

Security Market Indices Market Organization and Structure |

| Economics | 10% |

Firm and Market Structure Demand and Supply Analysis Aggregate Output, Prices, Economic Growth |

|

Portfolio Management, and Wealth Planning |

6% | Basics of Portfolio Planning and

Construction |

| Alternative Investment | 6% | Mutual funds Real estate |

| Derivatives | 6% | Derivative Markets and Instruments |

| Quantitative Analysis | 10% |

Discounted Cash Flow Applications Time Value of Money Statistical Concepts and Market Returns |

| Corporate Financing | 10% |

Cost of Capital Capital Budgeting |

CFA Level 1 Fees

|

Particulars |

Fees (INR) |

Fess (USD) |

| Enrollment fee for CFA Level 1 | Rs. 33,722 | $450 |

| Early registration fee | Rs. 52,456 | $700 |

| Standard registration fee | Rs. 74,938 | $1000 |

Eligibility for CFA Level 1

The finance candidate should meet the below requirements before qualifying for CFA Level 1:

- The candidate should either be in the final year of their graduation or should have completed their undergraduate degree.

- The candidate should have at least four years of work experience in any finance-related organization.

- They ask the candidate to submit more than two reference letters from some established or reputed financial professionals.

Exam Details

The CFA Level 1 examination tests the candidate’s knowledge and understanding of financial investment and its various techniques.

Below are the details of the CFA Level 1 exam:

| Structure of the CFA Level 1 Exam | 180 multiple-choice Questions |

|

Length of the exam |

Two Sessions: 1. Morning Session- 90 questions in 2 hr 15 minutes 2. Afternoon Session- 90 questions in 2 hr 15 minutes |

| Result declaration | Within 60 days of the examination |

| Rate of Level 1 Completion | 41% |

CFA Level 2

Once you clear the CFA Level 1, the candidates can pay for CFA Level 2. At this level, the motive is to test the candidate’s knowledge in several real-life scenarios of finance companies.

Below are the topics that you need to focus on while preparing for CFA Level 2:

- Investment Tools

- Professional and Ethical Standards

- Asset Classes

- Portfolio Management and Wealth Planning

Syllabus of Cfa Level 2

| Subjects | Percentage Weightage |

| Financial and Reporting Analysis | 10-15% |

| Corporate Finance | 5-10% |

| Ethical and Professional Standards | 10-15% |

| Quantitative Methods | 5-10% |

| Portfolio Management | 5-15% |

| Economics | 5-10% |

| Alternative Investments | 5-10% |

| Equity Investments | 10-15% |

| Derivative Investments | 5-10% |

| Fixed Income | 10-15% |

CFA Level 2 Fees

| Particulars | Fees (INR) | Fees (USD) |

| Early registration fee | Rs. 52,800 | $700 |

| Standard registration fee | Rs. 72,000 | $1000 |

Eligibility for CFA Level 2

The finance candidate should meet the below requirements before qualifying for CFA Level 2:

- The candidate should have completed the CFA Level 1

- The candidate must be a bachelor’s degree holder in finance from a recognized university

- The candidate should have at least four years of work experience in any finance-related organization

Exam Details

A candidate must pass the CFA Level 1 to be eligible to apply for CFA Level 2 exam. The candidates get size hours to finish the CFA Level 2 exam. The enrollment fee for this level varies every other year.

| Mode of CFA Level 2 examination | Online Computer-based examination |

| Language of exam | English |

| Number of questions | 44-45 item set questions/ session (Tentative) |

| Number of sessions | There are 2 sessions of 2 hours and 12 minutes each. |

| Type of questions | Vignette-based multiple-choice questions |

| Result declaration | Within 60 days of the examination |

CFA Level 3

CFA Level 3 is ultimately a different game than the previous two levels. It requires an enormous level of preparation.

The critical knowledge areas of CFA Level 3 are:

- Chapter 1-2: Ethics & Professional Standards

- Chapter 3: Behavioral Finance

- Chapter 4-5: Private Wealth Management

- Chapter 6: Portfolio Management for Institutional Investors

- Chapter 7: Application of Economic Analysis to Portfolio Management

- Chapter 8: Asset Allocation and Related Decisions in Portfolio Management

- Chapter 9: Asset Allocation and Related Decisions in Portfolio Management (2)

- Chapter 10: Fixed-Income Portfolio Management

- Chapter 11: Fixed-Income Portfolio Management (2)

- Chapter 12: Equity Portfolio Management

- Chapter 13: Alternative Investments

- Chapter 14: Risk Management

- Chapter 15: Risk Management Applications of Derivatives

- Chapter 16: Trading, Monitoring, and Rebalancing

- Chapter 17: Performance Evaluation

- Chapter 18: Global Investment Performance Standards

- Chapter 19: Portfolio Management

CFA Level 3 Syllabus

| Subjects | Marks Weightage |

| Ethical and Professional Standards | 10-15% |

| Fixed Income |

15-20% |

| Derivatives | 5-10% |

| Economics | 5-10% |

| Portfolio Management and Wealth Planning | 35-40% |

| Financial Reporting and Analysis | 5-10% |

| Equity Investments | 10-15% |

| Corporate Finance | 5-10% |

| Quantitative Methods | 10-15% |

| Alternative Investments | 5-10% |

CFA Level 3 Fees

| Particulars | Fess (INR) | Fees (USD) |

| Early registration fee | Rs. 52,800 | $700 |

| Standard registration fee | Rs. 72,000 | $1000 |

Eligibility Criteria for CFA Level 3

The candidate must complete CFA Level 1 and CFA Level 2 examinations.

- A bachelor’s degree in finance from a recognized university is a must.

- The candidate should have at least four years of work experience in any finance-related organization.

Exam Details

| Key areas covered | Ethics, Alternative Investments, Derivatives, Equity Investments, Fixed Income, Portfolio Management & Wealth Planning |

| Requirement | The CFA Level 3 is a full-day examination of six hours |

| CFA Level 3 exam dates | CFA® Level 3 is conducted only twice yearly, in May and August |

| Type of questions | A mix of Essay and MCQ |

| The number of questions | The exam consists of two sessions, with 11 item sets. Each item set typically contains six multiple-choice questions and 2 to 4 constructed-response (essay) questions. Therefore, the total number of questions in the CFA Level 3 exam is typically between 48 and 60, depending on the number of constructed-response questions in each item set |

| Passing rate | 54% |

| Result declaration | It is usually out within 90 days of the completion of the examination |

| Recommended preparation hours for CFA Level 3 | CFA Institute recommends studying for at least 300 hours to prepare for CFA Level 3 |

| What’s next? | Once you clear this CFA Level 3 examination, you will be entitled to CFA Charter by the CFA Institute. |

Career in CFA

Getting CFA certification helps you get higher annual salaries than other finance professionals. So when you do this certification, below are the potential career prospects available for you in the finance industry:

|

Career Prospects |

Job Title |

| Wealth Management | Wealth Manager |

| Financial Advisor | |

| Investment Banking | Investment Banker |

| Equity Research Analyst | |

| Private Equity | Associate |

| Private Equity Manager | |

| Asset Management | Asset Manager |

| Investment Management | Portfolio Manager |

| Research Analyst | |

| Investment Strategist | |

| Chief Investment Officer (CIO) | |

| Hedge Funds | Manager |

Jobs Roles and Responsibilities of CFA Analysts

| Job Role | Job description and responsibilities | Average Salary |

| Wealth Manager/Finance Advisor |

|

$50,000 – $300,000 per year |

| Investment Banker |

|

$100,000 – $300,000 annually |

| Private Equity Associate/Manager |

|

$100,000 – $500,000+ per year |

| Asset Manager |

|

$100,000 – $200,000 per year |

| Portfolio Manager |

|

$125,000 – $200,000 per year |

| Research Analysts |

|

$80,000 – $150,000 per year |

| The Chief Investment Officer (CIO) |

|

$200,000 – $500,000+ per year |

| Investment Strategist |

|

$125,000 – $250,000 per year |

| Hedge Funds Manager |

|

$200,000 – $1,000,000+ per year |

2. CPA – Certified Public Accountant

About the Certification

Certified Public Accountant certification is for accounting professionals recognized by the AICPA – American Institute of Certified Public Accountants. This certification is a valued and recognized certification in marketing because of its potential can work in several industries:

- Government

- Non-profit organizations

- Public accounting industries

- Corporate financing.

The CPA examination includes four sections:

- Business Environment and Concepts (BEC)

- Financial Accounting and Reporting (FAR)

- Auditing and Attestation (AUD)

- Regulation (REG)

To become a Certified Public Accountant, the finance professional has to meet the following requirements:

- The applicants should have a bachelor’s degree in the accounting field.

- The applicants should have a prior work experience of at least two years in public accounting.

CPA Course Structure

The CPA examination is the most challenging exam in the world. Below are some of the essential points a candidate should know before going for the CPA examination:

- The CPA examination is an online computer-based examination held only four times a year, in March, June, September, and December.

- To become a licensed CPA, you must clear all four sections of the CPA examination.

- A candidate must complete all four sections within 18 months, with at least a minimum score of 75 in each area.

- The examination includes multiple-choice questions, written communication tasks, and task-based simulations.

CPA Syllabus

In the CPA course, there are a few specializations offered to the candidate, which are:

- Human Resources

- Sales & Marketing

- International Business

- Finance

- Financial Planning & Analysis

- Auditing & Control

|

Subjects |

Topics covered |

| Business Environment and Concepts (BEC) |

|

| Financial Accounting and Reporting (FAR) |

|

| Auditing and Attestations (AUD) |

|

| Regulations (REG) |

|

Fee for CPA Exam

|

Particulars |

Fees (INR) |

Fees (USD) |

| Business Environment and Concepts (BEC) | The total for all four sections is Rs. 73,000 | $356.55 |

| Financial Accounting and Reporting (FAR) | The total for all four sections is Rs. 73,000 | $356.55 |

| Auditing and Attestation (AUD) | The total for all four sections is Rs. 73,000 | $356.55 |

| Regulation (REG) | The total for all four sections is Rs. 73,000 | $356.55 |

| Evaluation fee | Rs. 23,000 | – |

| Application fee | Rs. 14,600 | – |

Eligibility for CPA Exam

The finance candidate should meet the below requirements before qualifying for the CPA examination:

- The candidate should have graduation done in accounting and finance, such as BCom, BBA, MCom, and MBA.

Or

- The candidate should be a member of any one of the following:

- The ICAI – Institute of Chartered Accountants of India

- ICSI – Institute of Company Secretaries of India

- ICMAI – Institute of Cost Accountants of India

- The candidate should have completed 150 hours of the CPA course semester

- The candidate should have a work experience of at least two years in any accounting industry.

CPA Exam Details

The 16 hours four, sections examination’s main motive is to test the knowledge and skills of the CPA candidate.

|

Examination section |

Course Details |

Time Duration |

| Exam 1 | Auditing and Attestation (AUD) | 4 hours |

| Exam 2 | Financial Accounting and Reporting (FAR) | 4 hours |

| Exam 3 | Regulation (REG) | 4 hours |

| Exam 4 | Business Environment and Concepts (BEC) | 4 hours |

CPA Career Prospects

If you have a good interest in and knowledge of accounting, then CPA is the best option to enroll in. Along with the ability of a Chartered Accountant (CA), a CPA also includes knowledge of GAAP (Generally Accepted Accounting Principles), IFRS (International Financial Reporting Standards), GAAS (Generally Accepted Accounting Standards), etc.

| Career Prospects |

| Public Accountant |

| Tax Accountant |

| Internal Auditor |

| Financial Analyst |

| Corporate Accountant |

| Forensic Accountant |

Jobs Roles and Responsibilities of CPA Accountants

As per the data from the U.S. Bureau of Labor Statistics in May 2020, below are the details of job roles, their responsibilities, and their respective average salaries for CPA Accountants:

|

Job Role |

Job Description and Responsibilities |

Average Salary |

| Public Accountant |

|

$80,110 per year |

| Tax Accountant |

|

$80,050 per year |

| Internal Auditor |

|

$71,550 per year |

| Financial Analyst |

|

$83,660 per year |

| Corporate Accountant |

|

$80,210 per year |

3. FRM – Financial Risk Manager

About the Certification

The Global Association of Risk Professionals (GARP) offers a professional certification called FRM – Financial Risk Manager certification. The FRM – Financial Risk Manager certification illustrates a comprehensive understanding of the practices and risk management concepts used in the financial industries.

This certification is best for professionals with a thorough knowledge of risk management, such as traders, risk managers, auditors, regulators, and analysts. This certification has two levels:

- FRM Level 1

- FRM Level 2

To complete this FRM Financial Risk Manager certification, the candidate should pass both levels of the FRM Examination. It includes the following topics:

- Risk Management and Valuation

- Quantitative Analysis

- Financial Markets and Products

- The Current Issues in the Financial Market

FRM Course Structure

Candidates can complete the FRM examination in two parts; part 1 has four sections, and Part 2 has five individual sections. Below are some essential points a candidate should know before going for the FRM examination:

- Both levels have multiple-choice questions that candidates must complete in four hours for each group.

- A potential candidate must have at least two years of prior work experience in financial risk management.

- This examination is held three times yearly, in May, August, and November.

Topics and Weightage – FRM Level 1

|

Subjects |

Percentage Weightage |

| Foundations of Risk Management (FRM) | 20% |

| Quantitative Analysis (QA) | 20% |

| Financial Markets & Products (FMP) | 30% |

| Valuation & Risk Models (VRM) | 30% |

Topics and Weightage – FRM Level 2

|

Subjects |

Percentage Weightage |

| Market Risk Measurement & Management (MR) | 20% |

| Credit Risk Measurement & Management (C.R.) | 20% |

| Operation Risk & Resiliency (ORR) | 20% |

| Liquidity and Treasury Risk Measurement and Management (LTR) | 15% |

| Risk Management and Investment Management (I.M.) | 15% |

| Current Issues in Financial Markets (CI) | 10% |

FRM Fee

|

Particulars |

Fees (INR) |

Fees (USD) |

| Enrollment fee | Rs. 32,700 | $400 |

| Early registration fee | Rs. 45,000 | $550 |

| Standard registration fee | Rs. 61,500 | $750 |

Eligibility for FRM

The finance candidate should meet the below requirements before qualifying for the FRM examination:

- The candidate should be a graduate.

- The examinee should have two years of prior work experience in financial risk management.

FRM Exam Details

- The FRM examination is a two-part, online, computer-based examination.

- The time given is four hours for completing each part of the examination.

- It is a complex examination equivalent to a master’s degree.

- The test is free of negative markings.

- You will get the results via email within eight weeks of conducting the examination.

- The minimum passing score for FRM certification is 70%

FRM Level 1 Exam

| Examination format | Multiple choice questions |

| Number of questions | 100 |

| Passing score | 55-60% |

| Available examination time | May and November |

| Duration of examination | 4 hours |

FRM Level 2 Exam

| Examination format | Multiple choice questions |

| Number of questions | 80 |

| Passing score | 55-60% |

| Available examination time | May and November |

| Duration of examination | 4 hours |

FRM Career Prospects

Now that you know about the syllabus of the FRM certification, you should also understand the scope of designations you would be getting after completing this. Below is the list of jobs you get in FRM:

- Corporate Risk Manager

- Credit Risk Specialist

- Enterprise Risk Manager

- IT Risk Management Analyst

- Risk Manager

- Senior Operational Risk Manager

- Regulatory Risk Analyst

- Risk Analytics Client Consultant

- Market Risk Specialist

- I.T. Management Analyst

- Regulatory Risk Specialist

Jobs Roles and Responsibilities of FRM Managers

Below are the details of job roles, their responsibilities, and their respective average salaries for the FRM managers:

|

Job role |

Job description and responsibilities |

Average Salary |

| Credit Risk Manager |

|

$122,000 per year |

| Risk Manager |

|

$118,000 per year |

| The Investment Manager |

|

$135,000 per year |

| The Regulatory Compliance Manager |

|

$105,000 per year |

| Quantitative Analysts |

|

$120,000 per year |

4. CFP – Certified Financial Planner

About the Certification

Certified Financial Planner certification is best for financial planners or professionals. The Certified Financial Planner Board of Standards (CFP Board) of the United States organizes this examination.

This certification includes completing the following:

- Some college-level courses related to financial planning

- A comprehensive examination

- Several years of work experience in financial planning

- agreeing to abide by all the codes of ethics and professional responsibility given by the CFP Board

Once completing the CFP certification, the board instructs the professionals for various financial planning services like:

- Estate Planning

- Retirement Planning

- Investment Management and Planning

- Tax Planning

There are two ways to complete this CFP certification:

- The typical route

- Pathway for Challenge Status

The typical route is for candidates currently enrolled in a bachelor’s degree and wishing to apply for CFP.

And the pathway for challenge status is for the candidates who can clear the Advanced Financial Planning examination to earn their CFP certification. However, the candidate should have relevant working experience before sitting for the test.

CFP Course Structure

Certified Financial Planner certification includes completing five examinations designed upon six modules. The marking weightage for each module is 20%. Below is the list of modules in this course and the topics related to it:

|

Module |

Topics covered |

| Risk Analysis & Insurance Planning | Insurance and Risk Analysis, Planning for Clients’ Exposures to Mortality, Health, Disability, Property, Liability, etc. |

| Investment Planning | Investment Planning, Vehicles, and Strategies, Regulation of an Investment Advisor, Application to Clients, etc. |

| Introduction to Financial Planning | Financial Planning Process, Time Value of Money Applications, Personal Financial Statements, Client Interactions, Asset Acquisition, Education Planning, Risk Management, Investment Planning and Special Circumstances, Retirement Planning, etc. |

| Advanced Financial Planning | Constructing a comprehensive financial plan for the client. |

| Tax Planning & Estate Planning | Concepts that are relevant to the course. |

| Retirement Planning & Employee Benefits | Wealth Creation, Retirement Planning and Strategies for Clients, etc. |

Fee Structure

Typical Route

|

Particulars |

Fees (INR) |

| Registration Fees | Rs. 11,540, which is valid for one year |

| Fees for Examinations 1 to 4 | Rs. 4,130 for each examination per attempt |

| Fees for Examination 5 | Rs. 8,260 per attempt |

| CFPCM Certification Fees | Rs. 7,080 that has to be renewed annually |

Challenge Status Pathway

|

Mode of Enrollment |

Fees (INR) |

Description |

| FPSB India (Direct) | Rs. 29,955 | Registration fees (valid for one year), processing fees, certification & administration fees |

| Through Charter Members of FPSB India | Rs. 15,795 | Registration fees (valid for one year), administration and processing fees, initial CFP certification fees |

Eligibility for CFP

The candidate should meet the below requirements before qualifying for the CFP examination:

For the typical route:

- The candidate should have cleared the 12th board.

- The candidate should have already cleared the first five examinations of CFP covering all six modules.

For the challenge status pathway:

- The candidate should be an advanced level qualified such as C.A., ICWA, CFA, LLB, Ph.D., MPhil, or cleared the UPSC examination.

- The candidate should clear only the last examination of Advanced Financial Planning.

CFP Exam Details

The CFP examination is a two-hour examination with all multiple-choice questions. The table below explains the marks distribution for all the tests.

|

Type of questions |

The Total number of questions |

Total marks of the questions |

| One mark questions | 38 | 38 |

| Two marks questions | 15 | 30 |

| Three marks questions | 14 | 42 |

| Four marks questions | 10 | 40 |

| Total | 77 | 100 |

CFP Career Prospects

| Estate Planner |

| Insurance Advisor |

| Wealth Manager

Tax Advisor |

| Financial Planner |

| Financial Advisor |

Jobs Roles and Responsibilities of CFP Planners

Below are the details of job roles, their responsibilities, and their respective average salaries for the CFP Planners:

|

Job role |

Job description and responsibilities |

Average Salary |

| Financial Planner |

|

$75,000 – $100,000 |

| Financial Advisors |

|

$75,000 – $120,000 |

| Wealth Manager |

|

$100,000 – $150,000 |

| Tax Advisor |

|

$80,000 – $120,000 |

| The Insurance Advisor |

|

$70,000 – $100,000 |

| Estate Planner |

|

$125,000 – $200,000 |

5. CIMA – Chartered Institute of Management Accountants

About the Certification

Chartered Institute of Management Accountants certification is a professional certification for the accounting management field. This certification offers a way to become a CGMA – Chartered Global Management Accountant. It includes accounting management and related areas like finance, risk management, and business strategies.

The management of CIMA certification categorizes it into three different parts:

- The Certificate in Business Accounting

- The professional qualification

- The Strategic Professional

Each level focuses on various fundamentals, as explained below.

The Certificate in Business Accounting includes:

- Accounting Fundamentals

- Economy Management

- Ethics

The professional qualification includes:

- Advancement of Accounting Management

- A Business Strategy

- Financial Management

The Strategic Professional includes:

- Strategic decision making

CIMA Course Structure

The management divides the CIMA examination into four categories:

- Certificate Level

- Management Level

- Operational Level

- Strategic Level

CIMA Syllabus – Certificate Level

| Chapter | Topic covered |

| Chapter 1 | Fundamentals of Management Accounting |

| Chapter 2 | Fundamentals of Financial Accounting |

| Chapter 3 | Fundamentals of Business Mathematics |

| Chapter 4 | Fundamentals of Business Economics |

| Chapter 5 | Fundamentals of Ethics, Business Law, and Retirement Planning |

CIMA Syllabus – Operational Level

| Chapter | Topic covered |

| Chapter 1 | Enterprise Operations |

| Chapter 2 | Performance Operations |

| Chapter 3 | Financial Operations |

CIMA Syllabus – Management Level

| Chapter | Topic covered |

| Chapter 1 | Enterprise Management |

| Chapter 2 | Performance Management |

| Chapter 3 | Financial Management |

CIMA Syllabus – Strategic Level

| Chapter | Topic covered |

| Chapter 1 | Enterprise Strategy |

| Chapter 2 | Performance Strategy |

| Chapter 3 | Financial Strategy |

Fee Structure of CIMA

|

Particulars |

Fees (INR) |

| Registration fee | Rs. 7,700 |

| Annual subscription fee | Rs. 12,000 |

| Fee for Certificate level | Rs. 8,500 |

| Fee for operational level | Rs. 10,000 |

| Fee for management level | Rs. 11,500 |

| Fee for strategic level | Rs. 16,500 |

| Fee for the case study of the operational level | Rs. 18,000 |

| Fee for the case study of the management level | Rs. 18,000 |

| Fee for the case study of the strategic level | Rs. 25,500 |

Eligibility for CIMA

The candidate should meet the below requirements before qualifying for the CIMA examination:

- The student applying for the exam must have three years of work experience in financial services.

- The candidate should have a satisfactory record of ethical conduct in their company.

CIMA Exam Details

- The CIMA examination is five hours online, computer-based assessment.

- The management divides the examination into two parts: an objective test and a case study test.

- It consists of 140 multiple-choice questions.

- The candidate must pass a case study before moving to the next level.

|

Particulars |

Objective test |

Case study test |

| Each level examination | 3 | 1 |

| Time duration | 90 minutes | 180 minutes |

| Examination Frequency | The management conducts the exam daily at your nearest Pearson Center |

It can be conducted only four times a year: February, May, August, and November

|

| Result declaration | Immediately |

After one month after the completion of the case study

|

CIMA Career Prospects

Career prospects for the CIMA Accounts are:

- Finance Controller

- Management Accountant

- Management Consultant

- Chief Finance Officer

- Financial Director

- Internal Auditor

- Risk Manager

- Business Analyst

Jobs Roles and Responsibilities of CIMA Accountants

Below are the details of the job roles, their responsibilities, and their respective average salaries for the CIMA Accountants:

|

Job role |

Job description and responsibilities |

Average Salary |

| Financial Controller |

|

$80,000 to $150,000+ |

| Management Accountant |

|

$65,000 to $100,000+ |

| Management Consultant |

|

$85,000 to $150,000+ |

| Chief Financial Officer |

|

$200,000 to $500,000+ |

| Finance Director |

|

$120,000 to $200,000+ |

| Internal Auditor |

|

$70,000 to $100,000+ |

| Risk Manager |

|

$85,000 to $130,000+ |

| Business Analyst |

|

$65,000 to $95,000+ |

6. ACCA – Association of Chartered Certified Accountants

About the Certification

The Association of Chartered Certified Accountants (ACCA) is considered a professional body for accounts that further offers several certifications and qualifications related to finance and accounting. The exam lets the students learn knowledge and skills about finance and accounting. The topics covered in this certification are:

- Taxation

- Auditing

- Financial Reporting

- Assurance

- Corporate Accounting

- Management Accounting

- Business Law

Candidates must complete the Association of Chartered Certified Accountants certification in three levels:

- The Applied Knowledge Level

- The Applied Skills Level

- The Strategic Professional Level

Each level has its own set of examinations.

ACCA Course Structure

To complete the ACCA certification, the candidate must pass 13 ACCA essay tests and one online ethics module and gain three years of work experience in finance or accounting.

|

Level 1: Applied Knowledge Level |

Level 2: Applied Skills Level |

Level 3: Strategic Professional Level |

|

|

|

Fee Structure of ACCA (1900)

|

Particulars |

Fees (INR) |

| Applied knowledge (B.T., MA, F.A.) | Rs. 10,000 |

| Applied Skills (L.W.) | Rs. 11,000 |

| Applied skills (PM, TX, F.R., A.A., FM) | Rs. 12,300 |

| Strategic-level SBR and all advanced-level options | Rs. 15,400 |

| Strategic level SBL | Rs. 21,600 |

| Initial registration fee | Rs. 8,900 |

| Annual subscription fee | Rs. 11,200 |

Eligibility for ACCA

The candidate should meet the below requirements before qualifying for the ACCA examination:

- The candidate should be at least 18 years of age.

- The candidate should have completed their 12th standard education.

- The candidate should have scored 65% in mathematics and English in the 12th board examination.

- The candidate should have scored 50% in the rest of all the subjects in the 12th board examination.

ACCA Exam Details

The ACCA syllabus consists of 13 pages which divided into three categories:

- The Applied Knowledge Level (F1 – F3)

- The Applied Skills Level (F4 – F9)

- The Strategic Professional Level (P level)

Keys Used:

- Paper Based Examination (PBE)

- Computer Based Examination (CBE)

|

Examination level |

Examination syllabus |

Time duration |

| F1 | Governance, Risk, and Ethics (PBE / CBE) | 2 hours |

| F2 | Management Accounting (PBE / CBE) | 2 hours |

| F3 | Financial Accounting (PBE / CBE) | 2 hours |

| F4 | Corporate and Business Law (CBE) | 2 hours |

| F5 | Performance Management (PBE) | 3 hours |

| F6 | Taxation (PBE) | 3 hours |

| F7 | Financial Reporting (PBE) | 3 hours |

| F8 | Audit and Assurance (PBE) | 3 hours |

| F9 | Financial Management (PBE) | 3 hours |

| P1 | Governance, Risk, and Ethics (PBE) | 3 hours |

| P2 | Corporate Reporting (PBE) | 3 hours |

| P3 | Business Analysis (PBE) | 3 hours |

| P4 | Advanced Financial Management (PBE) | 3 hours |

| P5 | Advanced Performance Management (PBE) | 3 hours |

| P6 | Advanced Taxation (PBE) | 3 hours |

| P7 | Advanced Audit and Assurance (PBE) | 3 hours |

ACCA Career Prospects

Now that you know about the syllabus of the ACCA certification, you should also understand the scope of designations you would be getting after completing this. Below is the list of jobs you get in ACCA:

- Tax Accountant

- Management Accountant

- Financial Accountant

- External Auditor

- Internal Auditor

- Financial Analyst

Jobs Roles and Responsibilities of ACCA Accountants

Below are the details of job roles, their responsibilities, and their respective average salaries for the ACCA Accountants:

|

Job role |

Job description and responsibilities |

Average Salary |

| Tax Accountant |

|

$70,000 to $100,000 annually |

| Management Accountant |

|

$70,000 to $100,000 annually |

| Financial Accountant |

|

$65,000 to $90,000 annually |

| External Auditor |

|

$75,000 to $120,000 annually |

| Internal Auditor |

|

$65,000 to $85,000 annually |

| Financial Analyst |

|

$70,000 to $110,000 annually |

7. CAIA – Chartered Alternative Investment Analyst

About the Certification

Chartered Alternative Investment Analyst certifications are best for professionals seeking experience and knowledge in alternative investments. The CAIA Association, a global nonprofit organization, provides the certificate to the candidate.

CAIA is a globally recognized certification. It covers several strategies for alternative investments:

- Private Equity

- Hedge Funds

- Real Assets

- Structured Products

- Risk Management, and

This certification is fit for professionals coming from the following fields:

- Wealth Management

- Institutional Investing

- Private Banking

There are two levels in the CAIA course:

- Level 1 includes the fundamentals of alternative investments

- Level 2 contains fundamentals of risk and portfolio management.

Course Structure

The syllabus for CAIA mentioned below was recently updated in 2021 by the CAIA association.

CAIA Level 1 Syllabus

| Professional Standards and Ethics |

| Introduction to Alternative Investments |

| Real Assets |

| Hedge Funds |

| Private Equity |

| Structured Products |

| Risk and Portfolio Management |

CAIA Level 2 Syllabus

| Asset Allocation and Institutional Investors |

| Private Equity |

| Real Assets |

| Commodities |

| Hedge Funds and Managed Futures |

| Structured Products |

CAIA Fees

|

Particulars |

Early fees |

Standard fees |

| Enrollment fee | $400 | $400 |

| CAIA Level 1 examination fee | $1150 | $1250 |

| CAIA Level 2 examination fee | $1150 | $1250 |

CAIA Eligibility

The candidate should meet the below requirements before qualifying for the CAIA examination:

- The candidate should have an undergraduate degree from any field.

- The candidate should have a relevant interest in the alternative investments field.

CAIA Exam Details

- The management conducts the CAIA examinations twice yearly: late February, March, or September.

- The CAIA Level 1 examination includes 200 multiple-choice questions based on the subjects of Level 1.

- The CAIA Level 2 examination includes 100 questions, of which 70% are multiple-choice and the rest 30% are essay-type.

CAIA Level 1 Examination Structure

|

Subjects |

Percentage Weightage |

| Professional Standards and Ethics | 15 – 20% |

| Introduction to Alternative Investments | 20 – 25% |

| Real Assets | 10 – 20% |

| Hedge Funds | 10 – 20% |

| Private Equity | 5 – 10% |

| Structured Products | 10 – 15% |

| Risk and Portfolio Management | 5 – 10% |

CAIA Level 2 Examination Structure

|

Subjects |

Marks percentage of Multiple choice questions |

Marks percentage of essay-type questions |

| Asset Allocation and Institutional Investors | 8 – 12% | 0 – 10% |

| Private Equity | 11 – 15% | 0 – 10% |

| Real Assets | 13 – 17% | 0 – 10% |

| Commodities | 5 – 7% | 0 – 10% |

| Hedge Funds and Managed Futures | 18 – 22% | 0 – 10% |

| Structured Products | 5 – 7% | 0 – 10% |

CAIA Career Prospects

Below is the list of potential career prospects available for the candidates who pass their CAIA certification:

|

Career Prospects |

Job Titles |

|

Portfolio Management |

Portfolio Manager, Investment Manager, Fund Manager |

|

Risk Management |

Risk Manager, Risk Analyst, Risk Consultant |

|

Wealth Management |

Wealth Manager, Financial Advisor, Investment Advisor |

|

Investment Analysis |

Investment Analyst, Research Analyst, Due Diligence Analyst |

|

Commodity Trading |

Commodity Trader, Commodity Analyst, Commodity Risk Manager |

|

Private Equity |

Private Equity Associate, Private Equity Analyst, Investment Manager |

|

Hedge Funds |

Hedge Fund Analyst, Hedge Fund Manager, Investment Strategist |

|

Real Assets |

Real Estate Investment Manager, Infrastructure Investment Analyst, Natural Resources Investment Manager |

Jobs Roles and Responsibilities of CAIA Analysts

Below are the details of job roles, their responsibilities, and their respective average salaries for the CAIA Analysts:

|

Job Role |

Job Responsibilities |

Average Salary |

| Risk Manager |

|

$90,000 to $180,000+ annually |

| Real Estate Investment Manager |

|

$90,000 to $200,000+ annually |

| Portfolio Manager |

|

$120,000 to $250,000+ annually |

| Investment Analyst |

|

$80,000 to $150,000+ annually |

| Private Equity Associate |

|

$100,000 to $250,000+ annually |

| Hedge Fund Analyst |

|

$100,000 to $300,000+ annually |

8. ChFC – Chartered Financial Consultant

About the Certification

Chartered Financial Consultant certification is for professionals who have relevant experience of:

- Insurance

- Estate Planning

- Financial Planning

The American College of Financial Services. a non-profit educational institute from Pennsylvania, United States, gives this certification to eligible candidates. It involves eight courses covering all the major topics under financial planning. Therefore, a candidate must complete this certification for one to two years.

Once you complete this ChFC – Chartered Financial Consultant certification, you can get jobs as:

- Wealth Managers

- Insurance Agents

- Financial Planners

- Estate Planners

Course Structure

The ChFC course requires the candidates to complete the nine college-level courses listed below.

|

Syllabus |

| Estate Planning |

| Insurance Planning |

| Income Tax Planning |

| Retirement Planning |

| Financial Planning Process and Environment |

| Asset Protection Planning |

| Employee Benefits Planning |

| Investments |

| Applications of Comprehensive Financial Planning and Consulting |

Fee Structure of ChFC

|

Particulars |

Fees (USD) |

| Enrollment Fees | $200 |

| Course Fee | $350 $650 |

| Examination Fee | $100 – $325 |

| Annually Membership Fee | $145 |

Eligibility Criteria for ChFC

The candidate should meet the below requirements before qualifying for the ChFC examination:

- A bachelor’s or master’s degree is required for the position.

- The candidate should have. Three years of business experience within the last five years.

Exam Details

- In each examination, the candidate must score at least 70% marks.

- All eight examinations are for 2 hours each.

- The examination includes 100 multiple-choice questions on all the below topics:

- Fundamentals of Financial Planning

- Income Tax Planning

- Investments

- Capstone Course for ChFC

- Estate Planning

- Insurance Planning

- Financial Planning Applications

- Retirement Planning

ChFC Career Prospects

Now that you know about the syllabus of the ChFC certification, you should also understand the scope of designations you would be getting after completing this. Below is the career prospect for the ChFC certification course:

- Wealth Manager

- Financial Planner

- Financial Advisor

- Estate Planner

- Retirement Consultant

- Insurance Broker

Jobs Roles and Responsibilities of ChFC Consultants

Below are the details of job roles, their responsibilities, and their respective average salaries for the ChFC Consultants:

|

Job title |

Job Responsibilities |

Average Salary |

| Wealth Manager |

|

$102,090 annually |

| Financial Advisor |

|

$89,160 annually |

| Insurance Broker |

|

$52,180 annually |

| Estate Planners |

|

$100,910 annually |

| Retirements Consultant |

|

$67,550 annually |

9. CMA – Certified Management Accountant

About the Certification

Certified Management Accountant certification is a professional certification for candidates who are interested in the following fields:

- Financial Analysis

- Financial Planning

- Financial Control

- Decision Support

A global association gives this certification to finance professionals, the Institute of Management Accountants (IMA). It is specifically for candidates willing to take their careers forward in finance and accounting.

The CMA course provides sound knowledge and understanding of the below topics:

- Strategic Planning

- Financial Analysis

- Risk Management

- Financial Controls

The CMA certification is in two sections, and the first section includes the fundamentals of financial planning, analysis, and performance. At the same time, the second section, c, contains advanced information for strategic financial management. Both areas are for four hours. It is a computer-based examination.

CMA Course Structure

The CMA course is a three-level course that includes a total of 20 examinations:

- Foundation Level

- Intermediate Level

- The Final Level

CMA Subjects – Foundation Level

| Fundamentals of Accounting |

| Fundamentals of Business Mathematics and Statistics |

| Fundamentals of Law and Ethics |

| Fundamentals of Economics and Management |

CMA Subjects – Intermediate Level

| Company Accounts and Audit |

| Law, Ethics, and Governance |

| Financial Accounting |

| Cost and Management Accounting |

| Cost Accounting and Financial Management |

| Indirect Taxation |

| Operational Management Information System |

| Direct Taxation |

CMA Subjects – Final Level

| Advanced Financial Management |

| Tax Management and Practice |

| Business Strategy and Strategic Cost Management |

| Corporate Financial Reporting |

| Strategic Performance Management |

| Corporate Laws and Compliance |

| Financial Analysis and Business Valuation |

| Cost and Management Audit |

Fee Structure of CMA

|

Particulars |

Fees (INR) |

| Examination Fee for CMA Foundation Level | Rs. 4,000 |

| Examination Fee for CMA Intermediate Level | Rs. 20,000 |

| Examination Fee for CMA Final Level | Rs. 17,000 |

CMA Eligibility Criteria

The eligibility criteria for the CMA certification are different for its three levels, as described below:

For CMA Foundation level:

- The candidate should have completed the 12th standard board.

For CMA Intermediate level:

- The candidate should have completed the 12th standard board.

- The candidate should have completed the foundation-level examination.

For CMA Final level:

- The candidate should have completed the 12th standard board.

- The candidate should have completed the foundation and intermediate-level examinations.

CMA Exam Details

- The CMA examination is computer-based.

- There are two parts of this examination, which are for four hours each.

- The candidate has to score at least 360 marks in each examination to pass.

- The candidates receive their results immediately after conducting it.

CMA Part 1 Exam

|

Subject |

Percentage Weightage |

| External Financial Reporting Decisions | 15% |

| Budgeting, Forecasting, and Planning | 20% |

| Performance Management | 20% |

| Cost Management | 15% |

| Internal Controls | 15% |

| Technology and Analytics | 15% |

CMA Part 2 Exam

|

Subject |

Percentage Weightage |

| Financial Statements Analysis | 20% |

| Corporate Finance | 20% |

| Decision Analysis | 25% |

| Risk Management | 10% |

| Investment Decisions | 10% |

| Professional Ethics | 15% |

CMA Career Prospects

Below are the career prospects after completing this CMA certification:

- Financial Analyst

- Financial Director

- Chief Financial Officer

- Cost Accountant

- Senior Accountant

Jobs Roles and Responsibilities of CMA Accountants

Below are the details of job roles, their responsibilities, and their respective average salaries for the CMA Accountants:

|

Job Role |

Job Responsibilities |

Average Salary |

| Financial Analyst |

|

$80,000 to $120,000 annually |

| Financial Controller |

|

$110,000 to $160,000 annually |

| Chief Financial Officer |

|

$200,000 to $400,000 annually |

| A Cost Accountant |

|

$70,000 to $120,000 annually |

| Management Accountants |

|

$70,000 to $120,000 annually |

10. CMFC – Chartered Mutual Fund Counsellor

About the Certification

Chartered Mutual Fund Counsellor certification is for finance professionals interested in investment products and mutual funds. The College for Financial Planning offers this certification to the candidates. It covers several topics:

- Mutual Funds

- Portfolio Construction

- Risk Management

- Investment Strategies

CMFC certification includes six modules covering all the above topics. It is a must certification for the mutual fund and financial services industry.

Course Structure

CMFC is a comprehensive course covering the six modules a candidate must complete in ten weeks.

|

Module |

Syllabus |

| Module 1 | Introduction to Mutual Funds and the Investment Industry, Mutual Fund Structure and Operation, and Regulatory Environment |

| Module 2 | Asset Allocation and Modern Portfolio Theory, Mutual Fund Selection and Analysis, and Retirement Planning |

| Module 3 | Taxation of Mutual Funds, Estate Planning, Trusts, and Alternative Investments |

| Module 4 | Fixed-Income Securities and Mutual Funds, Equity Securities and Mutual Funds, and Behavioral Finance |

| Module 5 | Exchange-Traded Funds (ETFs), Closed-End Funds, and Variable Annuities |

| Module 6 | Ethical Considerations for Financial Advisors, Managing Client Relationships, and Building and Managing a Mutual Fund Business |

Fee Structure of CMFC

|

Particulars |

Fees (USD) |

| Enrollment fee | $50 – $100 |

| Examination fee | $400 – $500 |

| Annual renewal fee | $75 – $100 |

Eligibility Criteria for CMFC

- The candidate should meet the below requirements before qualifying for the CMFC examination:

- The candidate should have a bachelor’s degree or a professional education like CFA, CPA, or CFP.

- The examinee must have at least one year of work experience in the finance industry.

CMFC Exam Details

|

Type of questions |

Multiple choice questions |

| Number of questions | 140 |

| Time duration | 2 hours and 45 minutes |

| Passing score | 70% |

CMFC Career Prospect

Now that you know about the syllabus of the CMFC certification, you should also understand the scope of designations you would be getting after completing this. Below is the list of jobs you get in CMFC:

- Wealth Manager

- Portfolio Manager

- Investment Advisor

- Financial Advisor

Jobs Roles and Responsibilities of CMFC Counsellors

Below are the details of job roles, their responsibilities, and their respective average salaries for the CMFC Counsellors:

|

Job Title |

Job Responsibilities |

Average Salary |

| Wealth Manager |

|

$87,850 annually |

| Portfolio Manager |

|

$121,750 annually |

| Investment Advisor |

|

$94,450 annually |

| Financial Advisor |

|

$89,160 annually |

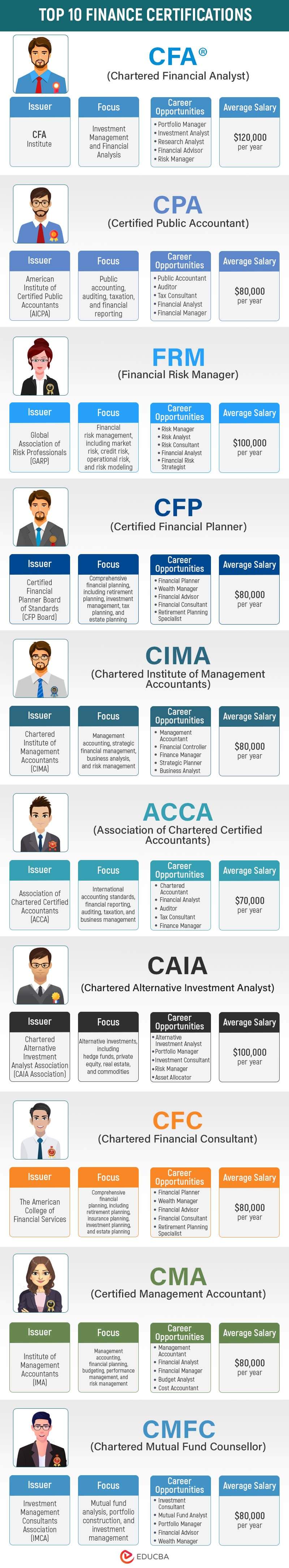

Finance Certification Infographic

Conclusion

Having additional qualifications and knowledge about a particular area of finance can work wonders for your career. It widens the horizons, opens new possibilities for you, and attracts prospective employers. Financial professionals gain authority and proper knowledge about a particular area of finance and keep professionals well-informed in their respective fields. It proves your dedication and trustworthiness and your commitment to ethical conduct.

The best part about enrolling for these finance certifications is that you can continue to work full time and devote complete attention to your work while procuring them, as they are either part-time studies or offer online resources and even exams. Most employers also encourage employees to pursue additional finance certifications. Hence, they offer cooperation at work and provide monetary support to pursue these courses.

Recommended Articles

Here are some further articles to learn more: