Updated September 22, 2023

Top Line Definition

The gross revenue reported at the very top of an income statement is popularly called the top line. It represents a company’s initial revenue or sales before subtracting any expenses. It can be either gross revenue or net sales.

A growing top line is often seen as a positive signal as it indicates that the company’s products or services are gaining more market acceptance. Also, when it increases, it can potentially lead to increased profitability.

Table of Contents

Key Highlights

- The top line on the income statement is the initial calculation of a company’s revenue or sales.

- It is very important as it reflects the company’s ability to generate revenue and indicates its growth from one period to the next.

- The bottom line comes at the end of the income statement, indicating the profit after deducting all the expenses from the top line.

Examples in Income Statement

Example #1: Apple Inc.

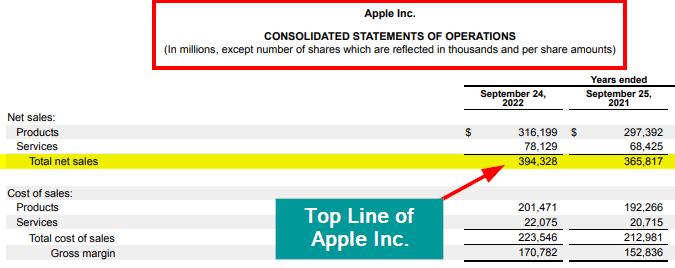

The following example is of Apple Inc.’s income statement. It demonstrates how Apple presents its top line as “Total Net Sales.” We can see that the revenue (total net sales) for 2022 and 2021 was 394,328 and 365,817 (in Thousands), respectively.

(Image source: Apple Annual Report 2022)

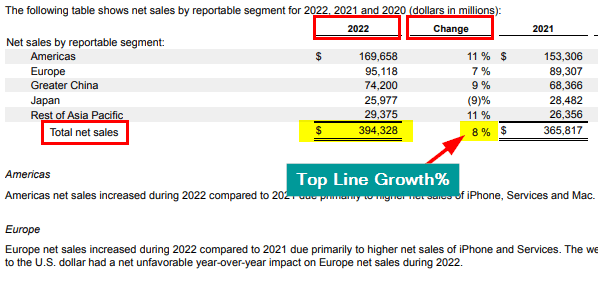

Furthermore, within the Notes section of Apple’s 10-K report, we can find information about the company’s revenue categorized by different segments and how much it increased or decreased compared to the previous year.

As we can see in the image above, in 2022, Apple Inc. recorded revenue growth of 8%, driven by an increase in sales across America, Europe, China, etc. It posted a top line of $394.3 billion – up from the previous year’s (2021) value of $365.8 billion.

Example #2: Meta Platforms Inc.

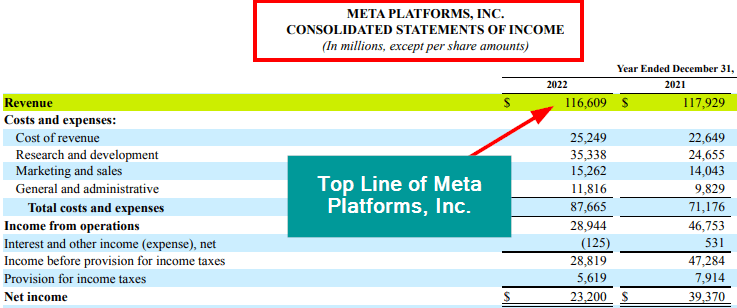

In Meta Platform’s income statement, we can see that the top line is revenue. The company has directly reported its total revenue without any calculations. We can see that Meta’s revenue for 2022 is $116,609 million.

(Image source: Meta Annual Report 2022)

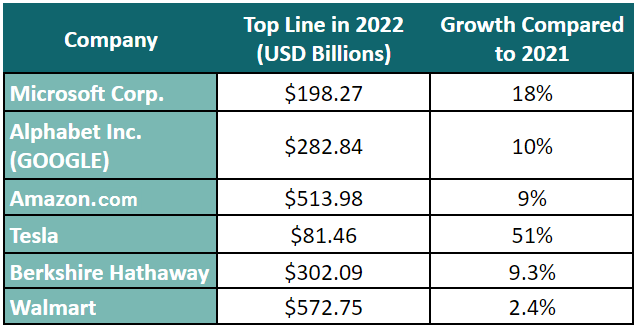

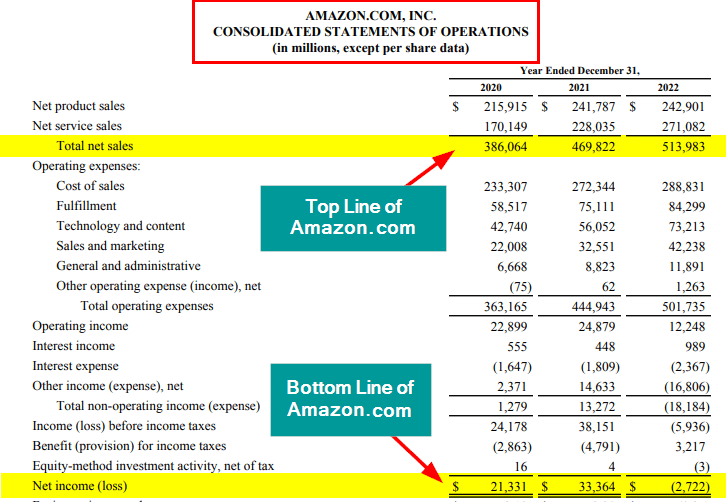

Top Line Growth for Major Companies

The top line of major companies for 2022 was as follows:

Formula

Let us now look at its formula to understand how companies compute it. It fundamentally depends on two metrics – volume and price, as shown below.

How to Calculate?

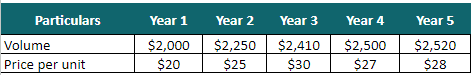

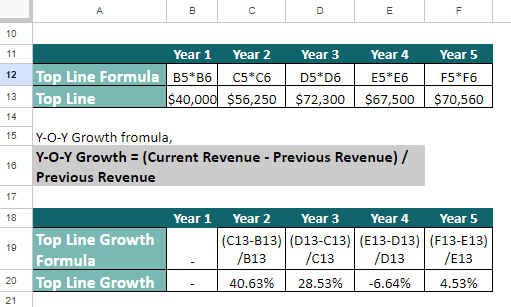

Suppose we have a company’s price and volume forecast for five years. Let us calculate its top line.

Given:

Solution:

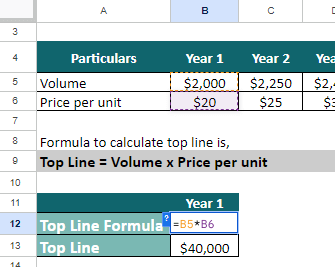

Let us use the formula to calculate the top line for the first year.

Top line = Volume x Price per unit

=$2,000 x $20 = $40,000

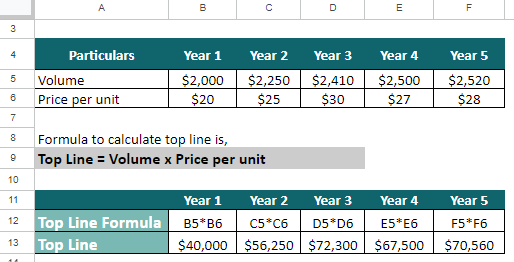

Similarly, let us calculate for the rest of the 4 years.

Now, based on the calculated top lines, let us find the Y-O-Y growth.

How to Evaluate?

Industry Comparison:

- Always evaluate this growth on a relative basis, i.e., compare your growth with your industrial peers.

- For instance, if you have a 12% growth while the peer companies are growing at 20%, then you have relatively lower growth.

Segment Analysis:

- Compare the company each segment’s revenue with the previous year to see which segments are underperforming or overperforming.

- You can break down the revenue into different segments, such as products, services, geographic regions, or customer types.

Reasons for Increase

Typically, stakeholders and analysts are interested in a company’s top-line growth, which refers to the growth in sales. This financial metric can either be evaluated on a Q-o-Q (quarter-on-quarter) basis or a Y-o-Y (year-on-year) basis. Here are 3 reasons for the increase in a company’s

Increased Volume:

- Growth driven by rising volumes can be either due to expanding operations/ business or acquiring new companies.

- Growth because of rising volume is usually witnessed in sectors like FMCG.

Increased Prices:

- Growth due to a price increase happens when the industry players have the pricing power because there are a limited number of players in the sector.

- Typically, it occurs in sectors like steel and cement, where volume growth doesn’t happen that easily because of high upfront capex requirements.

Here are a few other differences between the bottom and the top line.

| Basis | Top Line | Bottom Line |

| Definition | It is the gross figure of the revenue earned during the given period. | It is the net income after deducting all costs for the company in a given period. |

| Present in Income Statement | It is reported at the very top of the income statement. | It is present at the end, bottom of the income statement. |

| Calculation | Volume x Price Per Unit | Total Revenue – Total Expenses |

| Represents | Total incoming money | Total profit generated |

| Importance | It indicates the firm’s ability to generate sales. | It signifies the company’s profitability and efficiency in business aspects. |

Frequently Asked Questions (FAQs)

Q1. How can a company grow its top line?

Answer: A company can pursue the following strategies to grow its top line:

- Launch a new ad campaign to attract new customers

- Launch a new product to generate additional revenue

- Exercise its pricing power to increase the prices

- Acquire another company.

Q2. Can top and bottom line growth diverge?

Answer: Sometimes, a company’s top and bottom lines may offer contrasting views of its business. The top line may be strong because of healthy revenue growth. However, the bottom line could decline if the company’s production process is inefficient or the raw material costs are rising faster than the revenue growth.

Q3. What is the significance of the top line?

Answer: It is a very important figure in a company’s financial reporting as it indicates how much revenue it has generated in a specified period. Essentially, it reflects the demand for the company’s products.

The movement in the top line indicates what course of action a company needs to pursue in the future. If it is growing at a decent rate, then the company is already doing a great job, and they just need to continue what they are doing. Suppose it is declining or not growing at the desired rate. In that case, the company needs to make certain adjustments, such as changing its marketing strategy, improving product quality, re-thinking pricing, or working on the customer’s overall experience.

Recommended Articles

This is a comprehensive article on what top line means in accounting. With detailed Excel and income statement examples, we have also explained its growth and how to evaluate it. For more such articles, refer to the following recommendations,