Updated November 28, 2023

Table of Contents

What is the Total Cost Formula?

The total cost formula calculates the total cost that the company spends to produce products. It includes both fixed and variable costs.

Businesses use this formula to find out how much it costs to produce one unit of the product. This way, they can decide the ideal selling price for the product and make profits. There are a few formulas we can use to calculate the total cost. They all mean the same, but the way we calculate them differs.

1. Simple Formula

Total Cost = Total Fixed Costs + Total Variable Cost

Here,

- Fixed Costs: These costs stay constant regardless of the number of units a company produces. It includes costs like rent, equipment cost, salaries, etc. Companies must pay these costs even if the business is not doing well.

- Variable Costs: These costs can change depending on the quantity of a product the company produces. They depend on raw materials required, labor, packaging, etc.

Now, let’s consider the below example to calculate the total cost.

Download the Excel template here:

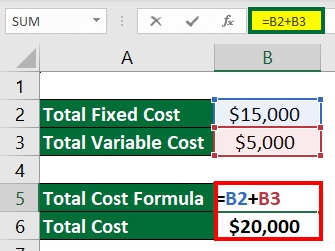

Example #1:

Suppose FlavorFusion, a food company, produces beverages. Their total fixed cost is $15,000, and the total variable cost is $5000. Let us calculate the total cost for the company.

Solution:

Total Cost = Total Fixed Cost + Total Variable Cost

= $15,000 + $5000

= $20,000

2. Advanced Formula

Total Cost = Total Fixed Costs + (Average Variable Cost x Total Units)

Here,

- Average Variable Cost: It is the cost to produce one unit of a specific product.

- Total Units: It is the total number of units the company makes of a particular product.

When to use it?

You can use the advanced formula when you don’t know the total variable costs. Here, you have to replace the total variable cost with the average variable cost multiplied by the total units produced.

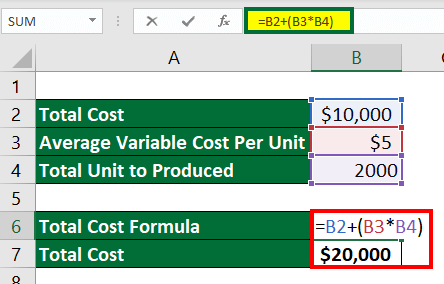

Example #2:

UltraSpeed Ltd. is a company that manufactures automotive components. As per the accounts department, the company’s total fixed cost is $10,000 monthly. If the average variable cost per unit is $5, calculate the total cost to produce 2,000 units monthly.

Solution:

Let’s calculate the total cost to produce 2000 units using the below formula:

Total Cost = Total Fixed Cost + (Average Variable Cost Per Unit x Total Units)

= $10,000 + ($5 x 2,000)

= $20,000

Thus, the total cost to produce 2000 units in a month is $20,000.

In this example, the total cost is directly proportional to the number of units produced, i.e., if the production number of units increases, the cost also increases.

3. Average Total Cost Formula

Average Total Cost Per Unit Formula = Total Cost / Total Units

When to use it?

Suppose you want to find out the cost to produce each unit of a product. Then, you can use the average total cost per unit formula, which calculates the total cost per unit.

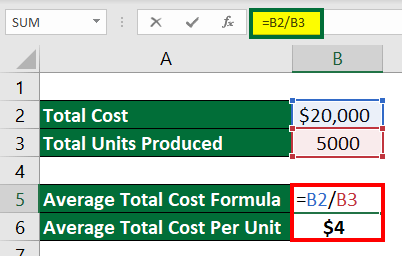

Example #3:

QualityCraft manufacturing company spends a total cost of $20,000 to produce $5000 units of Smart LED in a month. Let us find the average cost per unit for producing each piece of the product.

Solution:

Let’s calculate the average total cost per unit using the following formula.

Average Total Cost Per Unit = Total Cost / Total Units

= $20,000 /$5000

= $4

How to Calculate Total Cost? (Simple Steps)

Remember these simple steps if you ever get confused about which formula to use when calculating the total costs.

- Find total fixed costs.

- Then find the variable cost for producing a single unit.

- Find the total units produced by the company.

- Multiplying the total units produced and the variable cost per unit to obtain the total variable cost.

- Finally, calculate the total cost by adding the total fixed and total variable costs.

Total Cost Formula Calculator

Use the following calculators to calculate the total cost.

| Total Fixed Cost | |

| Average Variable Cost Per Unit | |

| Quantity of Units Produced | |

| Total Cost | |

| Total Cost = | Total Fixed Cost + Average Variable Cost Per Unit * Quantity of Units Produced |

| 0 + 0 * 0 = |

Things to Remember

- Do not leave out any costs associated with a project; otherwise, you may get incorrect results.

- Properly differentiate between which are fixed costs and which are variable costs.

- Also, consider indirect costs like overhead and marketing to find the accurate total costs.

Frequently Asked Questions (FAQs)

Q1. Explain the formula for the total costs in the EOQ.

Answer: The Economic Order Quantity (EOQ) helps businesses determine the exact number of products they must produce to maintain their inventory supply. By calculating the total cost in EOQ, companies can know how to minimize their inventory costs.

Total Cost = Purchase Cost + Ordering Cost + Holding Cost

- Purchase cost is the cost of purchasing the products from suppliers.

- Ordering cost is the cost of fulfilling an order, like packaging and shipping.

- Holding cost is the cost of storing the products as inventory.

Q2. What are the benefits of calculating the total cost in business?

Answer: Businesses can use the total cost to make accurate budgets. They can also use it to plan production and sales costs to make profits. In addition, companies can set the right price for their product to cover all their expenses.

Q3. What are the real-life applications of the total cost?

Answer: Many people and organizations use the total cost for different purposes. Using this formula, manufacturers set product prices, contractors create budgets and timelines for construction projects, and medical professionals decide how much to charge for medical services.

Q4. Differentiate between the total vs. average vs. marginal cost formula.

Answer: The difference between the total, average, and marginal cost formulas is as follows:

- Total Cost: It determines the total cost of producing products.

Formula: Total Cost = Total Fixed Cost + Total Variable Cost

- Average Cost: It calculates the average cost of producing a single unit or product.

Formula: Average Cost = Total Cost / Total Units

- Marginal Cost: It is the additional cost to the total cost for producing one more additional unit.

Formula: Change in Total Cost / Change in Total Quantity

Recommended Articles

This article gives a detailed explanation of the total cost formula along with a calculator. We discuss calculating the total cost using practical examples with a downloadable Excel template. You can visit the following links to read related articles: