Updated July 11, 2023

What is the Total Debt Service Ratio?

For financial institutions and lenders, the term “total debt service ratio” refers to the financial metric that helps them in assessing the debt servicing ability of an individual based on the individual’s gross income, debt repayment obligations (such as mortgage payments), and other associated expenses (such as property tax, home insurance, etc.).

Formula

The formula is an aggregate of all annual debt repayment obligations and other related expenses divided by the gross income. Mathematically, it is represented below,

Examples of Total Debt Service Ratio (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

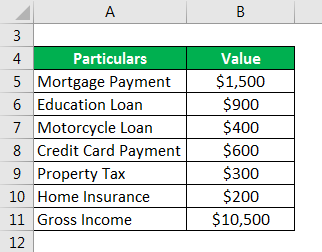

Let us take the example of David to illustrate the computation of the total debt service ratio. In this case, David has a gross monthly income of $10,500, along with the following monthly payments:

Solution:

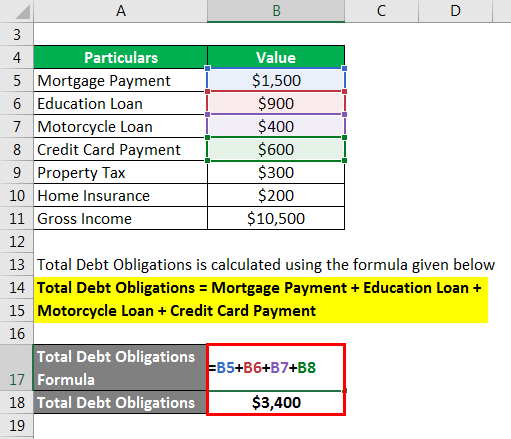

Total Debt Obligations calculate using the formula given below

Total Debt Obligations = Mortgage Payment + Education Loan + Motorcycle Loan + Credit Card Payment

- Total Debt Obligations = $1,500 + $900 + $400 + $600

- Total Debt Obligations = $3,400

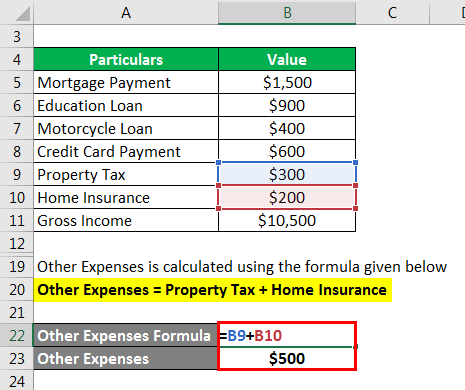

Other Expenses calculate using the formula given below

Other Expenses = Property Tax + Home Insurance

- Other Expenses = $300 + $200

- Other Expenses = $500

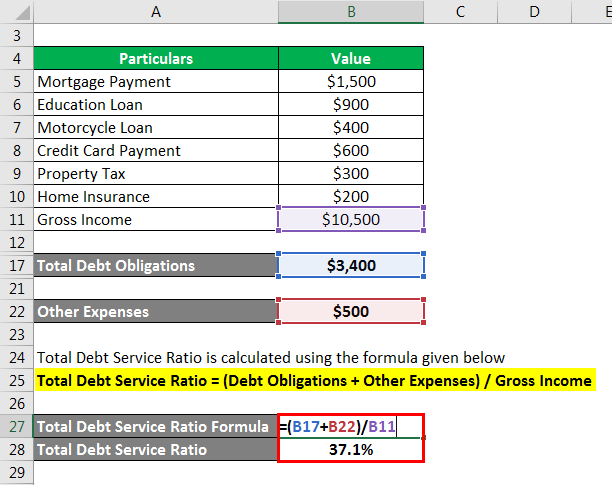

It calculate using the formula given below

Total Debt Service Ratio = (Debt Obligations + Other Expenses) / Gross Income

- Total Debt Service Ratio = ($3,400 + $500) / $10,500

- Total Debt Service Ratio = 37.1%

Therefore, based on the given information, it can be seen that David’s debt service ratio is 37.1% which is in the acceptable range.

Example #2

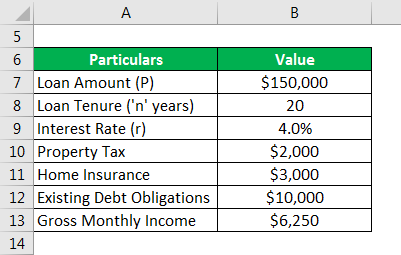

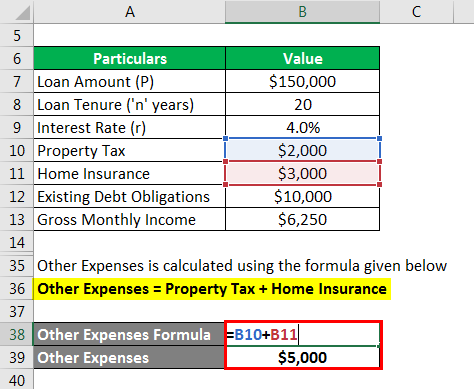

Let us take the example of John Doe, who has recently applied for a home loan on a $200,000 house. He made a down payment of 25%, i.e., $50,000, which means he needs a further $150,000. He plans to take a 20-year fixed-rate loan at 4.0%. Further, he would have to pay another $2,000 for property taxes and $3,000 for home insurance. Currently, John has existing debt repayment obligations of $10,000 a year. Determine John’s debt service ratio if his gross monthly income is $6,250.

Solution:

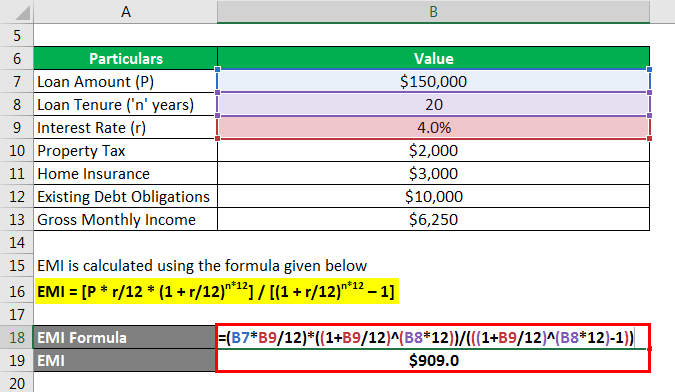

EMI calculate using the formula given below

EMI = [P * r/12 * (1 + r/12)n*12] / [(1 + r/12)n*12 – 1]

- EMI = [$150,000 * 4%/12 * (1 + 4%/12)20*12] / [(1 + 4%/12)20*12 – 1]

- EMI = $908.97 ~ $909

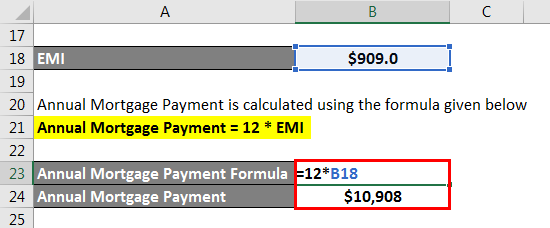

Annual Mortgage Payment calculate using the formula given below

Annual Mortgage Payment = 12 * EMI

- Annual Mortgage Payment = 12 * $909

- Annual Mortgage Payment = $10,908

Gross Income calculate using the formula given below

Gross Income = 12 * Gross Monthly Income

- Gross Income = 12 * $6,250

- Gross Income = $75,000

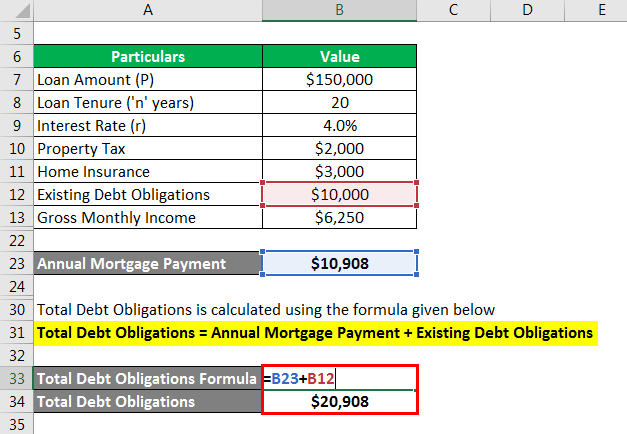

Total Debt Obligations calculate using the formula given below

Total Debt Obligations = Annual Mortgage Payment + Existing Debt Obligations

- Total Debt Obligations = $10,908 + $10,000

- Total Debt Obligations = $20,908

Other Expenses calculate using the formula given below

Other Expenses = Property Tax + Home Insurance

- Other Expenses = $2,000 + $3,000

- Other Expenses = $5,000

It calculate using the formula given below

Total Debt Service Ratio = (Debt Obligations + Other Expenses) / Gross Income

- Total Debt Service Ratio = ($20,908 + $5,000) / $75,000

- Total Debt Service Ratio = 34.5%

Therefore, if John’s home loan gets approved, his debt service ratio is expected to be 34.5%, which is acceptable.

Advantages and Disadvantages

Some of the major advantages and disadvantages of the same are as follows:

Advantages

- It is considered a good indicator of an individual’s liquidity position and helps assess their debt servicing ability. In addition, it can be used to identify any potential defaults.

- Lenders predominantly use this debt measure for decision-making, which is easy to understand and explain. In addition, one doesn’t require any higher education degree to interpret this metric.

- The metric focuses on debt repayment obligations and considers other expenses to ascertain an individual’s debt servicing capability.

Disadvantages

- The metric has no well-defined benchmark for what level of coverage can be considered comfortable. Consequently, it is exposed to the subjectivity or discretion of the bank’s management. For instance, most lenders don’t approve loans if the ratio is above 43%, with many even rejecting the loan proposal if the ratio is above 36%. However, smaller lenders even disburse loans for individuals with a ratio north of 43%.

- The ratio entirely focuses on the individual’s gross income and doesn’t consider their ability to infuse funds in case of a shortfall of gross income. For example, some individuals might not generate adequate cash inflow every month but hold an adequate amount of assets that can be liquidated in case of a liquidity shortfall.

Conclusion

So, it can be seen that this is for individuals as the debt service coverage ratio for companies and firms. Banks and other lenders use a very important debt metric to decide whether or not to approve a loan to an individual. Typically, the lower the ratio value, the better it is for the borrower.

Recommended Articles

This is a guide to the Total Debt Service Ratio. Here we discuss how to calculate, along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –