Updated July 27, 2023

Total Expense Ratio Formula (Table of Contents)

What is the Total Expense Ratio Formula?

Total expense ratio is extensively used in the Mutual Fund industry which correlates between total costs of a Mutual Fund organization required for its operations in respect with the Total Fund managed by the organization.

In other words, expenses related to Research, Distribution, Commissions and administrative expenses which are directly operational in nature are taken into consideration. The general psychology which drives this particular ratio is that the higher the ratio, the lower the return. The rising operating cost for any kind of business is considered as lower efficiency by that particular business.

Formula For TER is represented as:

Where, costs of funds include all management fees, trading expenses, research fees, and legal fees along with auditor’s fees and marketing and distribution expenses, etc.

Examples of Total Expense Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Total Expense Ratio in a better manner.

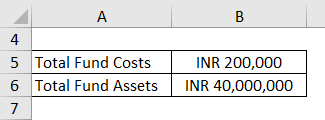

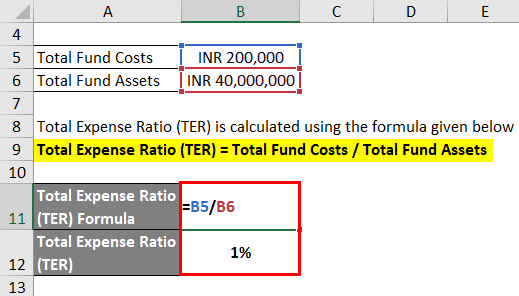

Suppose Firm A is managing INR 4 Crore AUM and it has an annual expense of INR 2 lacs and the fund has given a return of INR 12.5 Crore (12.5%) annually. Calculate the Total Expense Ratio.

Total Expense Ratio (TER) is calculated using the formula given below

Total Expense Ratio (TER) = Total Fund Costs / Total Fund Assets

- Total Expense Ratio (TER) = INR 2,00,000 / INR 4,00,00,000

- Total Expense Ratio (TER) = 1%

Suppose firm X has AUM of INR 300 crore and has a return on investment of -10% and the expense ratio is 0.5%. Thus we observe that the expense ratio is lower in percentage terms compared to the first example. So one might have an opinion that firm X is a better choice for investment in compared to firm A. But in practice, we have noticed that firm X has given a 10% negative return that is INR 30 crore losses on the capital of INR 300 crore. So, if the total expense of the fund is added back then the total loss comes to INR 3.5 crore which is a loss of 10.5% on an investment of INR 300 Crore for the clients.

Thus in the above two examples, the first one seems to be the right option for an investor considering that in both cases the investor has the same appetite for risk.

Explanation of TER Formula

- Total Funds is the overall Asset managed by the company on behalf of its clients. AUM is the summation of total assets invested by their clients in Mutual Funds or Fund managing.

- Total costs as a percentage of the total invested amount are calculated by each and every Fund house as it helps to determine the operational efficiency of that particular firm or an organization with respect to its peers. Thus, the fund house with the lower operational expense and higher return would be in focus for the Investors depending upon the investor’s risk appetite.

- In most cases, the total costs are being deducted from the profit generated from that fund. Thus, the Net Profit = Total Return from the Fund – Total Expense (direct and indirect).

- Certain operational and indirect expenses which are charged twice are not included depending on the type of Assets class the Investment firm or mutual fund house is catering to. Expenses such as stockbroker fees, securities transfer taxes, advisory fees, etc might be incurred more than one time.

Relevance and Use of TER Formula

- Total return and total expense are calculated on the AUM individually and the Net returned is derived after deducting the TER from Total Return.

- In the case of the big players within the mutual fund industry, one can segregate between an average performer and an excellent performance by means of the total expense ratio. This is one of the controls that I had written on capital that would suggest a lower expense ratio after a stipulated time period. So if a point is not performing well the return will be comparatively less and the ratio would be higher in comparison with the fund having a higher return.

- TER also helps a mutual fund to determine its weakness in terms of cost control. In many cases, a mutual fund manager might have expertise in the fundamentals of the companies in which the pool funds have been invested. But there may be a contradiction regarding the earning performance of the companies and their price movements. Show the management has to balance in between fundamentals and as well as the price chart of the companies. This is because the evaluation of a good mutual fund scheme is based upon early or quarterly returns.

- In the case of balanced funds, the rate of return in most cases can be negative as a certain part of the fund is invested in debt or liquid funds. So apparently the funds are less risky than 100% equity-based funds. There might be a difference between the little from both of these funds. In this case, the ratio will not work properly as the risk-bearing capacity of the clients is different.

- In the current scenario, SEBI has instructed all the mutual fund companies to lower and their commissions and distribution expenses so that the total expense ratio becomes less compared to earlier schemes. In the modern environment because of the increasing demand for mutual fund schemes, the AUM has increased substantially resulting in a lower total expense ratio because the cost of commissions and distributions along with research costs has remained the same. So percentage-wise the total expense ratio has lowered. Thus it gives a brief idea that in spite of a lower total expense ratio one cannot guarantee the quality of a particular scheme in the mutual fund segment.

Conclusion

Apparently, the Total Ratio used to be one of the ways of evaluating a particular scheme, but with the intervention of SEBI, the TER has decreased substantially because of lower costs and higher AUM. Thus, the parameter of evaluation has to change on the basis of peer group analysis. As all the Schemes primarily the Equity-based one would reflect a lower Total Expense Ratio.

TER Formula Calculator

You can use the following TER Calculator

| Total Fund Costs | |

| Total Fund Assets | |

| Total Expense Ratio (TER) | |

| Total Expense Ratio (TER) | = |

|

|

Recommended Articles

This is a guide to the Total Expense Ratio Formula. Here we discuss How to Calculate the Total Expense Ratio along with practical examples. We also provide a TER Calculator with a downloadable excel template. You may also look at the following articles to learn more –