Updated July 25, 2023

Total Variable Cost Formula (Table of Contents)

What is the Total Variable Cost Formula?

The term “total variable cost” refers to that portion of the overall expense, related to the production of goods or services, that can change in direct proportion to the quantity of production.

In other words, the total variable cost comprises the cost of production that varies with the change in production and such costs primarily include direct labor cost, cost of raw material and variable manufacturing overhead. The formula for total variable cost can be derived by adding direct labor cost, cost of raw material and variable manufacturing overhead. Mathematically, it is represented as,

Examples of Total Variable Cost Formula (With Excel Template)

Let’s take an example to understand the calculation of Total Variable Cost Formula in a better manner.

Total Variable Cost Formula – Example #1

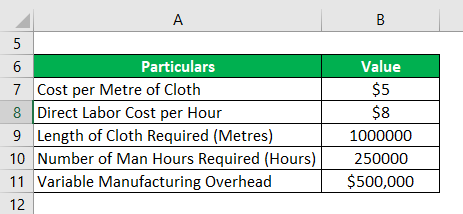

Let us take the example of a company named DHK Ltd. which engaged in the manufacturing suits in the state of California. The senior management wanted to review the interim production cost of the company. As such the chief accountant provided the following information that has been confirmed by the Finance Director of the company.

Calculate the total variable cost of production for the company based on the given information.

Solution:

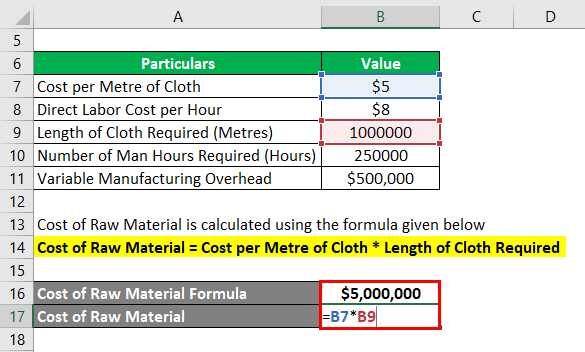

Cost of Raw Material is calculated using the formula given below

Cost of Raw Material = Cost per Metre of Cloth * Length of Cloth Required

- Cost of Raw Material = $5 per metre * 1,000,000 metre

- Cost of Raw Material = $5,000,000

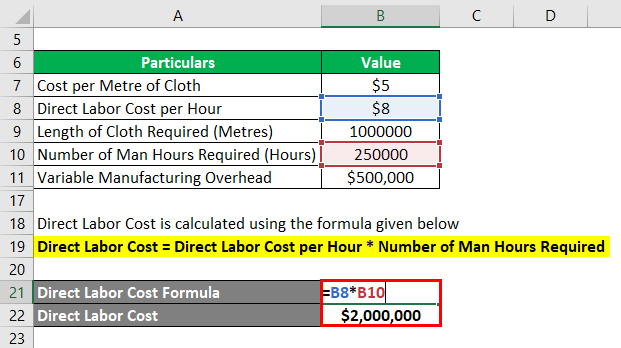

Direct Labor Cost is calculated using the formula given below

Direct Labor Cost = Direct Labor Cost per Hour * Number of Man Hours Required

- Direct Labor Cost = $8 per hour * 250,000 hours

- Direct Labor Cost = $2,000,000

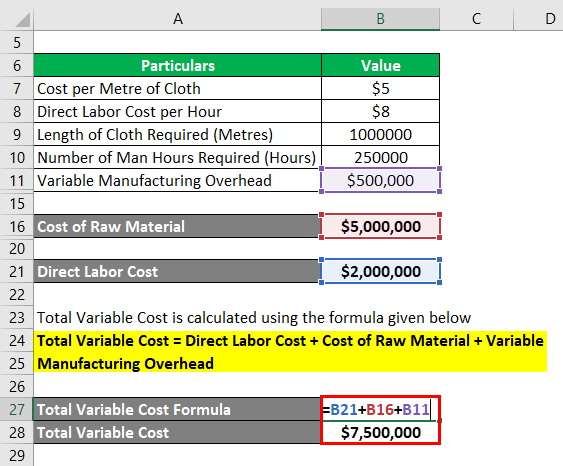

Total Variable Cost is calculated using the formula given below

Total Variable Cost = Direct Labor Cost + Cost of Raw Material + Variable Manufacturing Overhead

- Total Variable Cost = $2,000,000 + $5,000,000 + $500,000

- Total Variable Cost = $7,500,000

Therefore, the total variable cost of DHK Ltd. during the interim period remained $7,500,000.

Total Variable Cost Formula – Example #2

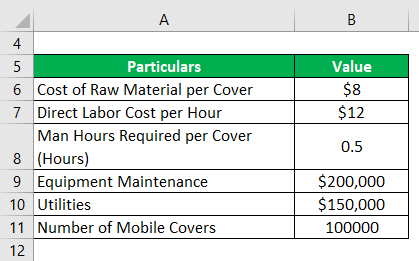

Let us take the example of ZSD Ltd. which is a manufacturer of mobile phone covers. Recently the company has received an order worth $2,000,000 for 100,000 mobile covers. As per the latest annual report, the following financial information is available,

Based on the given information, Calculate sure whether or not the order is a profitable proposition for the company.

Solution:

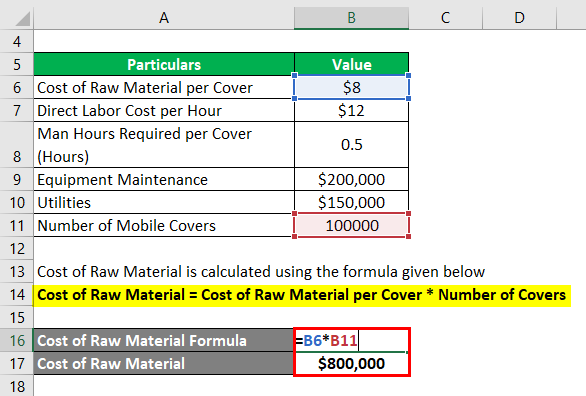

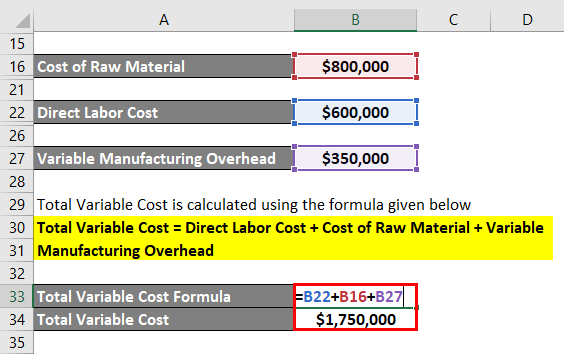

Cost of Raw Material is calculated using the formula given below

Cost of Raw Material = Cost of Raw Material per Cover * Number of Covers

- Cost of Raw Material = $8 * 100,000

- Cost of Raw Material = $800,000

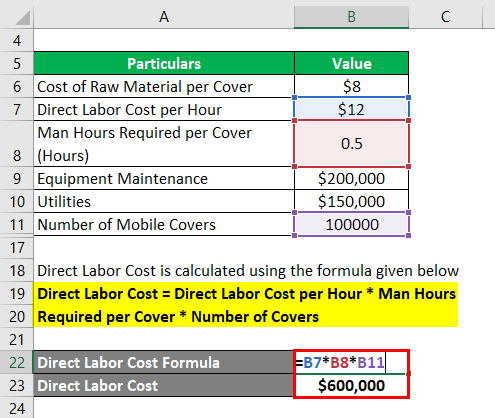

Direct Labor Cost is calculated using the formula given below

Direct Labor Cost = Direct Labor Cost per Hour * Man Hours Required per Cover * Number of Covers

- Direct Labor Cost = $12 per hour * 0.5 hours * 100,000

- Direct Labor Cost = $600,000

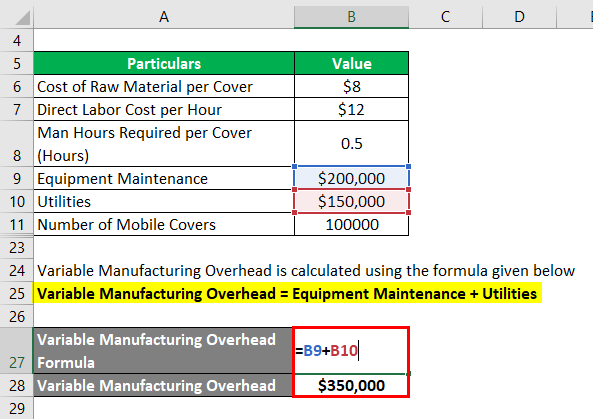

Variable Manufacturing Overhead is calculated using the formula given below

Variable Manufacturing Overhead = Equipment Maintenance + Utilities

- Variable Manufacturing Overhead = $200,000 + $150,000

- Variable Manufacturing Overhead = $350,000

Total Variable Cost is calculated using the formula given below

Total Variable Cost = Direct Labor Cost + Cost of Raw Material + Variable Manufacturing Overhead

- Total Variable Cost = $600,000 + $800,000 + $350,000

- Total Variable Cost = $1,750,000

Therefore, the total variable cost of production ($1,750,000) is lower than the contract size ($2,000,000) which means that ZSD Ltd. Can accept the order.

Explanation

The formula for total variable cost can be computed by using the following steps:

Step 1: Firstly, determine the direct labor cost that can be directly apportioned to the production level. The computation of direct labor cost involves certain factors like labor rate, level of expertise, and number of hours employed for production.

Step 2: Next, determine the cost of raw material required in the production process and its computation involves the type of material required, the amount of material used, and the rate.

Step 3: Next, determine the variable manufacturing overhead which is all the remaining variable costs that can be directly assigned to the production process.

Step 4: Finally, the formula for total variable cost can be derived by adding direct labor cost (step 1), cost of raw material (step 2) and variable manufacturing overhead (step 3) as shown below.

Total Variable Cost = Direct Labor Cost + Cost of Raw Material + Variable Manufacturing Overhead

Relevance and Use of Total Variable Cost Formula

It is important to understand the concept of total variable cost as it is usually by companies to determine the contribution margin of a product. Since fixed costs are a type of sunk cost, a company should make sure that any order that they execute should at least cover the total variable cost so that they generate some cash inflow.

Further, the total variable cost can also be applied to plan additional production units by improving efficiency or hiring contractual manpower in order to add to the bottom line of the company i.e. net income. It is essential to understand that since the total variable cost excludes fixed or absorption costs, profit will increase with volume if the additional revenue is higher than the incremental variable cost.

Total Variable Cost Formula Calculator

You can use the following Calculator

| Direct Labor Cost | |

| Cost of Raw Material | |

| Variable Manufacturing Overhead | |

| Total Variable Cost | |

| Total Variable Cost = | Direct Labor Cost + Cost of Raw Material + Variable Manufacturing Overhead | |

| 0 + 0 + 0 = | 0 |

Recommended Articles

This is a guide to Total Variable Cost Formula. Here we discuss how to calculate Total Variable Cost along with practical examples. We also provide a Total Variable Cost calculator with a downloadable Excel template. You may also look at the following articles to learn more –