Updated July 5, 2023

What is Trade Discount?

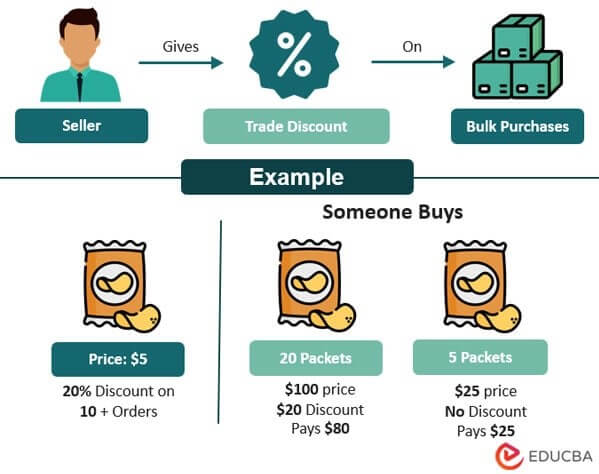

Trade discount is the amount of discount a product seller gives on the list price of a product to its buyers. The party who offers the discount is the manufacturer/wholesaler, and the other party who avails the discount is the retailer/wholesaler.

The list price is generally present in the catalog of the manufacturer. Moreover, the manufacturer gives this discount usually when the buyer purchases the product in bulk.

Giving these discounts builds good business relationships between buyers and sellers. As none of the parties record this discount anywhere in the books of accounts, the discount amount largely depends on the parties’ mutual understanding and business relations. Market forces of a competitive environment in the industry might also be a factor in deciding the discount rate.

How Does Trade Discount Work?

Trade discount is a pricing strategy manufacturers/wholesalers use to incentivize bulk purchases by their customers (retailers and resellers). The discount is a percentage deduction from the list price of a product that the seller grants when the buyer purchases a large quantity. The idea is that the more products a customer buys, the greater the discount they will receive, encouraging them to buy even more products in the future.

For example, if a retailer purchases 100 units of a product with a list price of $10 each and receives a 20% discount, the retailer will pay $800 instead of $1,000.

Formula

We can calculate it by multiplying the list price by the discount rate.

- Discount Rate is the discount percentage that the seller offers on their products.

- The list Price is the price in the catalog at which the seller initially decides to sell a product.

How to Calculate the Trade Discount?

Step #1: Find the List Price of The Product

Ascertain the selling price of the product as per the seller’s product catalog.

Example: The catalog price of a woolen scarf is $25.

Step #2: Establish the Discount Rate for the Product

The seller must decide on a discount rate for the buyer depending on the purchase amount, its relationship with the buyer, market competition, etc.

Example: The seller gives a 10% discount on purchasing 100 scarves.

Step #3: Determine the Trade Discount

Multiply the discount rate and the product’s list price to find out the value of the discount.

Example: The list price of 100 scarves will be $2,500. If we multiply with the discount rate of 10%, it will give a discount value of $250.

Step #4: Calculate the Net Price

Subtract the discount value from the list price to arrive at the product’s final selling price.

Example: The seller sells the 100 woolen scarves at $2,250 ($2,500 – $250), initially priced at $2500.

Examples

We have added a few examples below to easily understand the calculation.

Example #1

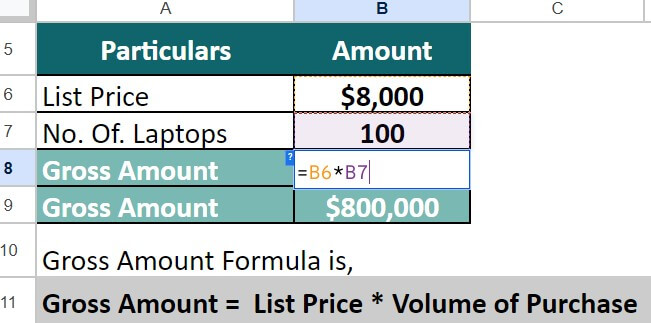

A wholesaler purchases 100 laptops from a manufacturer. The list price of each laptop is $8,000. The discount by the manufacturer to the wholesaler is 15%. Compute the gross amount, discount amount, and net amount.

Solution:

Step #1: To calculate the gross amount, multiply the list price by the number of laptops purchased:

Gross Amount = $8,000 × 100 = $800,000

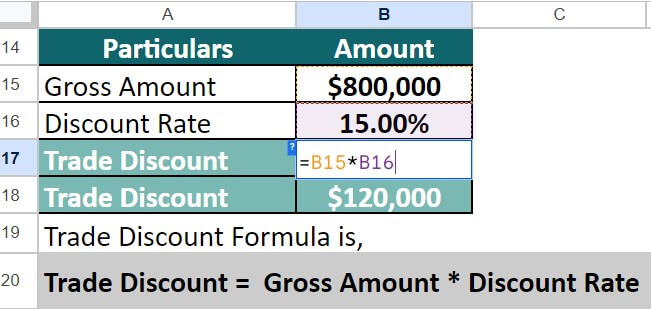

Step #2: We compute the discount amount for 100 units by multiplying the gross amount with the percentage of discount:

Trade Discount = $800,000 × 15% = $120,000

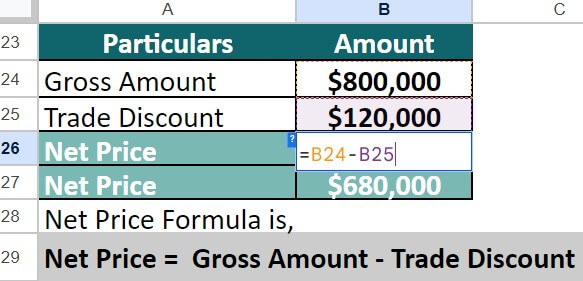

Step #3: Let us calculate the net price that the buyer must pay for the 100 laptops. For that, subtract the discount from the gross amount:

Net Price = $800,000 – $120,000 = $680,000

The total amount the wholesaler will pay the manufacturer is $680,000 after a discount of $120,000 on $800,000.

Example #2

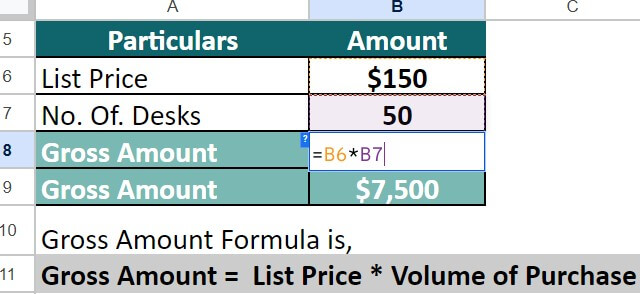

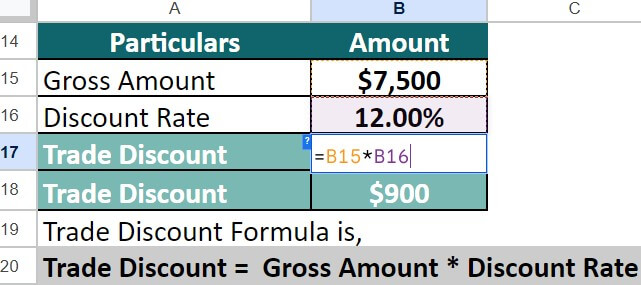

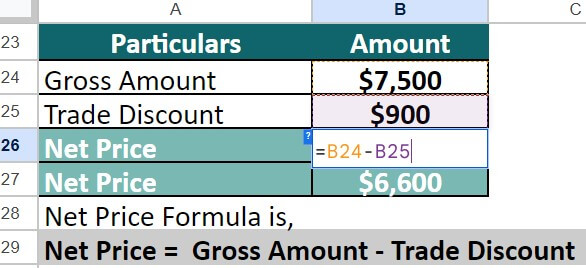

Carl&Co purchases 50 desks for the company’s new office. They receive a discount rate of 12%. Calculate the trade discount and the net price Carl&Co pays if the desk’s list price is $150.

Solution:

Step #1: First, let us calculate the total amount of the purchase by multiplying the list price by the number of desks:

Gross Amount = $150 × 50 = $7,500

Step #2: To calculate the discount, we multiply the discount rate by the gross amount:

Trade Discount = $7,500 × 12% = $900

Step #3: The net price is the difference between the gross amount and the discount:

Net Price = $7,500 – $900 = $6,600

Carl&Co pays $6,600 for 50 desks after receiving a discount of $900.

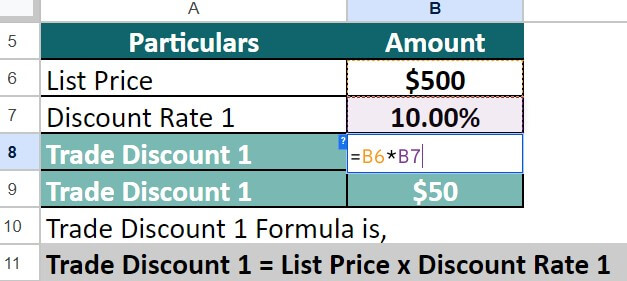

Example #3: Trade Discount Series

It is when the seller offers a series of discounts on the product. Here, we calculate the discount as many times as many discounts the seller is giving.

ABC Ltd. has a discount series of 10%/2%, where a discount of 10% is if a buyer purchases $300 and above, and a discount of 2% is if the buyer makes the payment within 7 days.

Calculate the discount if the buyer buys products worth $500 and pays within 7 days.

Solution:

Step #1: Let us calculate the first discount amount by multiplying the price and first discount rate:

Trade Discount 1 = List Price x Discount Rate 1

= $500 * 10% = $50

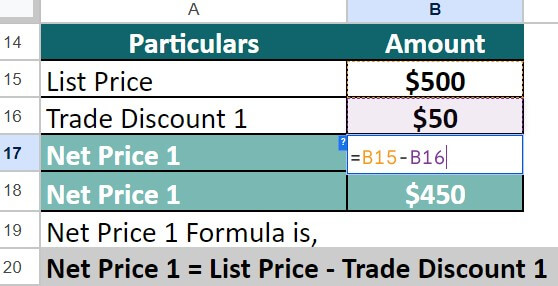

Step #2: Let us calculate the net price 1 by subtracting the discount from the list price:

Net Price 1 = List Price – Trade Discount 1

= $500 – $50 = $450

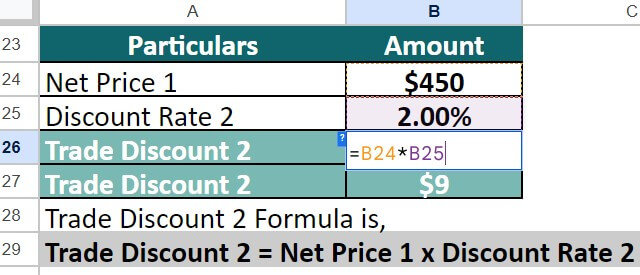

Step #3: Let us calculate the second discount amount by multiplying the net price 1 and discount rate 2:

Trade Discount 2 = Net Price 1 x Discount Rate 2

= $450 * 2% = $9

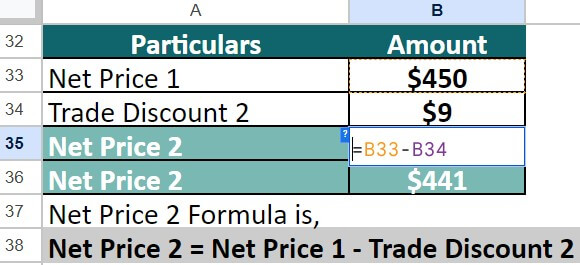

Step #4: Let us calculate the final net price by subtracting the trade discount 2 from the net price 1:

Net Price 2 = Net Price 1 – Trade Discount 2

= $450 – $9 = $441

The total discount the buyer gets is $59 ($50 + $9), and the final purchase price is $441.

Accounting for Trade Discount

It is essential to note that businesses do not create a new “trade discount account” to post the transaction in the books of accounts. It is neither recorded in the books of accounts of the manufacturer nor the wholesaler/retailer.

The seller deducts the discount from the list price and then records the final selling price to book the sale/purchase of goods in the books of the manufacturer/wholesaler.

Example:

The list price of an article is $2,000. Suppose a manufacturer sells the product to a wholesaler, at a 20% discount, at a net cost of $1,600. The manufacturer and wholesaler will record this sale/purchase in their books of accounts by $1,600 (discounted amount) instead of $2,000 (gross amount).

There will be no entry for the amount of discount granted by the manufacturer to a wholesaler in the books of accounts of both parties.

Journal Entry for Trade Discount

Neither the buyer nor the seller records the discount amount in the books of accounts. They only record the transaction of sale/purchase in the accounts of both parties.

Example:

Assume the discounted amount is $1,600

1. The seller debits the amount in the wholesaler/retailer account and credits it to the sales account.

Books of Manufacturer

| Particulars | Debit | Credit |

| Wholesaler/Retailer Account | $1,600 | |

| To Sales Account | $1,600 |

2. The buyer debits the purchase account and credits the manufacturer’s account.

Books of Retailer/Wholesaler

| Particulars | Debit | Credit |

| Purchase Account | $1,600 | |

| To Manufacturer Account | $1,600 |

Trade Vs. Cash Discount

| Particulars | Trade Discount | Cash Discount |

| Definition | It is the discount that sellers offer buyers who purchase larger quantities of products. | It is the discount that customers get when they make early payments (before the due date). |

| Purpose | The seller aims to make higher sales volume by offering this discount. | The aim is to receive instant or sooner payment from the customer for whatever they purchase. |

| Accounting | It has no separate mention in the journal entry. | This discount appears on the seller’s debit section and the buyer’s credit section. |

| Calculation | The seller deducts the amount from the list price. | The seller subtracts the amount from the invoice value (after removing the trade discount). |

| Time Allowance | It applies at the time of purchase. | It applies at the time of payment. |

| Consideration | It depends on the quantity of purchase. | It depends on the time of payment. |

| Rate | It is fixed under all circumstances. | It varies with time and mode of payment. |

| Transaction mode | It applies to credit and cash transactions. | It only applies to cash transactions. |

| Beneficiaries | It applies to all buyers who are resellers (wholesalers, retailers). | It applies to the end customers. |

| Also Known As | We also call it a functional discount. | We also call it a sales discount. |

Advantages and Disadvantages

| Advantages | Disadvantages |

| It increases the sales quantities, thereby increasing sales revenue, which helps cover manufacturing costs. | In the long run, it may result in a decrease in profits for the seller. |

| It prevents overstocking as manufacturers sell the goods in bulk. It promotes the goodwill of the manufacturer. | Small discounts may add up to form massive amounts, which would result in a decrease in profitability. |

Trade Discount Calculator

Use the following calculator for Trade Discount Calculations:

| List Price | |

| Discount Rate | |

| Trade Discount | |

| Net Price | |

| Trade Discount | (List Price * Discount Rate) |

| = | (0 * 0 ) = 0 |

| Net Price | (List Price - Trade Discount) |

| = | (0 - 0 ) = 0 |

Frequently Asked Questions (FAQs)

Q1. Explain the purpose of the trade discount.

Answer: The primary purpose of trade discounts is for businesses to increase their sales volume and profitability by effectively selling their inventories. When a manufacturer provides a good discount on a bulk product, the retailer buys additional products than they initially planned. It leads the manufacturer to sell more goods than before. Moreover, it also establishes a long-term business relationship and maintains customer satisfaction.

Q2. What is the importance of a trade discount?

Answer: The trade discount benefits manufacturers as well as retailers/wholesalers. From the manufacturer’s point of view, it boosts the sales volume resulting in more profitability. They can also avoid stocking inventory by selling goods in bulk quantities.

On the other hand, retailers/wholesalers enjoy a good margin on goods. They can further pass on the discounts to ultimate customers through cash discounts which help develop their goodwill among the clients.

Q3. Is a trade discount a debit or a credit?

Answer: The trade discount is neither debit nor credit because it isn’t recorded in the accounting books.

Recommended Articles

This is an EDUCBA guide to Trade Discount. We have also discussed the introduction to accounting for the trade discount and its advantages and disadvantages. You may refer to the following articles to learn more –